Pay-TV Troubles on Full View in Poor Start to 2020

Cord cutting is still an issue, but a subscriber death spiral remains unlikely.

The onset of lockdowns in March fueled demand for at-home entertainment, but not necessarily the kind that the U.S. pay-television industry delivers. Television customer losses were ugly in the first quarter. We don’t believe media investors should panic, though, as several factors have simultaneously conspired against traditional TV, in our view: the loss of live sports, the relative ease of switching off Internet-delivered services like YouTube TV, poorly timed pricing changes (especially at AT&T), and economic hardship resulting from the pandemic. We expect that the return of sports, in particular, and any improvement in the economic situation will help the industry.

Still, the recent resurgence in price increases--only partially reflecting steadily rising content costs--has given us pause. Our thesis that the industry would find creative ways to improve the price/value equation for consumers hasn’t materialized, and prospects have dimmed. We no longer believe the media industry has the wherewithal to fix its TV problems, as companies appear content to milk the business for cash while investing in their new streaming offerings.

With this backdrop in mind, we have taken another hard look at the confluence of industry statistics and demographic data to build a new forward-looking customer model. We no longer believe that the industry will succeed in delivering gradual customer losses and that the next five years will look similar to the past five years, in terms of aggregate decline. While this has a minimal impact on our view of traditional TV distributors (cable and satellite companies), which we have long believed face a harrowing future, we have had to reassess our forecast for the media companies that supply content to the industry.

- The first quarter was a dreadful start to the year for traditional pay-TV distributors, which lost about 1.8 million customers in aggregate. Online (over the top) distributors were little help in offsetting these losses. The cancellation of the NCAA basketball tournament and the shutdown of major sports leagues in March likely contributed to the weak quarter, especially among OTT customers.

- Still, the quarter highlights that pricing versus perceived value remains a sticking point for consumers. OTT providers like Hulu with Live TV and YouTube TV have increased prices more than 20% over the last year. Traditional distributors appear to have assumed that these price increases signal relaxed competition and have raised prices sharply, including a bevy of annoying fees that are little more than an attempt to hide the true price of service from customers in most cases.

- AT&T's pricing actions have likely damaged the industry. The company's promotional pricing and discounting efforts kept a large number of marginal subscribers "artificially" in the pay-TV ecosystem during 2016-18. Management's decision in late 2018 to prioritize profitability over holding on to TV customers--a misguided long-term strategy, in our view--has produced massive customer losses.

- In contrast, Dish is downplaying sports and allowing customers to drop local networks instead of paying a $12 monthly fee. Charter is now offering skinnier bundles and TV service without a set-top box. However, these efforts don't support a long-term healthy industry, and some distributors, like Verizon, are starting to give up rather than endlessly battle content suppliers.

- OTT services haven't flourished as we had expected. AT&T appears to have given up on OTT distribution, as the company has hamstrung its AT&T TV Now offering by raising prices and reducing the number of channels in its lowest-priced plans. The company's latest online service, AT&T TV, a thin-client IPTV solution, is overpriced, with the lowest plan at $93 per month.

- Hulu with Live TV and YouTube TV have moved to the forefront of the OTT business, but the price increases since each service launched in 2017 have stymied growth somewhat. We think YouTube TV may be adding too many secondary channels, particularly entertainment ones that are unlikely to attract consumers satisfied with streaming options like Netflix.

- Despite margin pressures at OTT distributors, we still firmly believe that price increases are ill-considered, since many subscribers are cord-shavers who left traditional distributors because of the increasing price of the bundle. A price increase to $60 or above for a basic OTT plan could push these cord-shavers to switch to another lower-priced service or to leave the pay-TV ecosystem altogether.

- Margin pressure from cable network affiliate fee growth will likely outweigh any benefit from the increased advertising revenue or channel tiering. Media companies continue to press for price increases even as major pay-TV networks like ESPN have increased prices rapidly over the majority of the last decade, despite losing millions of subscribers.

- The increased focus on broadcast retransmission and reverse compensation revenue also hurts the industry. Pay-TV customers will pay upward of $10 per month for broadcast content in 2020 that was free a decade ago and is still free over the air.

- It's clear to us that the major media players lack the will to radically reform the traditional TV bundle and have turned their efforts to the direct-to-consumer streaming model, at least for entertainment content. We no longer expect that the major owners of pay-TV networks will lower prices in the near future. The odds of a creative solution emerging that aligns the long-term interests of media companies and distributors look far longer to us today than even two years ago.

- This lack of will to reform the traditional bundle has led us to lower our expectations for pay-TV penetration and overall subscribers. We now project that pay-TV penetration will fall from 65% of households in 2020 to 55% in 2025 and that overall pay-TV subscribers will decline from 84 million in 2020 to 73 million in 2025.

- When examining the current makeup of pay-TV subscribers, we assume that the two strongest groups--households headed by older consumers and those containing sports fans--will continue to subscribe to the bundle. While streaming services like Netflix diminish the appeal of entertainment channels, live programming such as news and sports will keep a significant portion of households in the pay-TV ecosystem.

- Fox represents one of the purest plays on the importance of news and sports to the bundle. The company is well positioned to benefit from the increased focus on these two content areas.

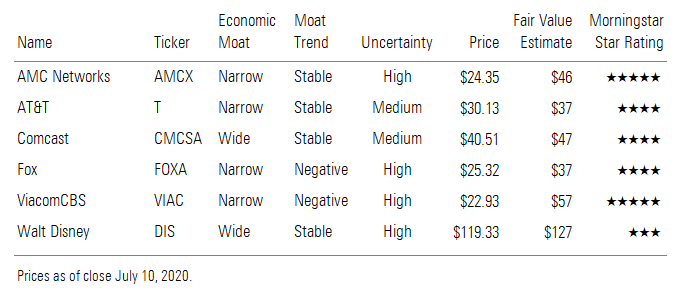

AMC Networks AT&T, Comcast, Fox, Viacom CBS, Walt Disney

This information was published June 29 as part of a Communications Services Observer, which is available to Morningstar’s institutional clients.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/s3.amazonaws.com/arc-authors/morningstar/fab4d3e1-7951-4575-a38d-fd2028ad4ae3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fab4d3e1-7951-4575-a38d-fd2028ad4ae3.jpg)