Basic Materials: Despite Index Rise, We See Multiple Long-Term Opportunities

In this sector, our favored stocks are Albemarle, Dow, and FMC.

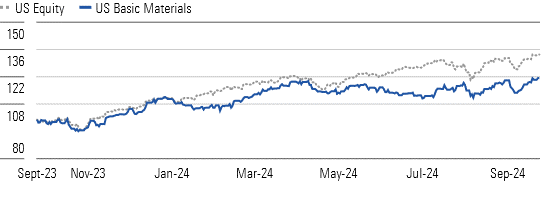

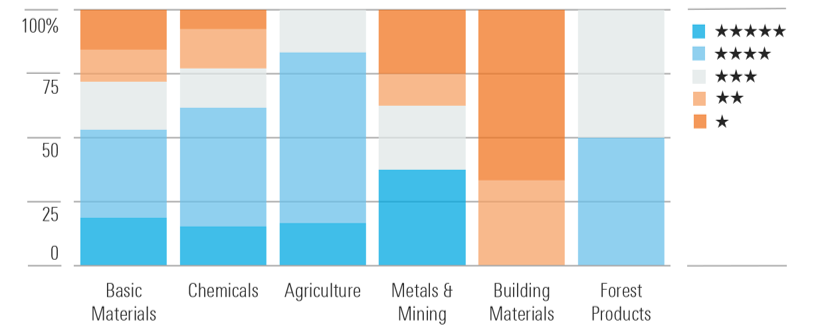

The Morningstar US Basic Materials Index significantly outperformed the broader market during the third quarter. In chemicals, we attribute the rise to normalizing demand following inventory destocking in 2023 and early 2024. However, we still see opportunities across the sector, with over 50% of the stocks trading in 4- or 5-star territory.

The Basic Materials Index Outperformed During Q3 as Demand Returned

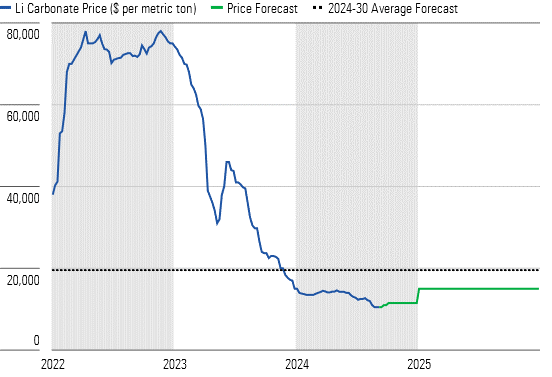

Lithium prices are at a multi-year low, as supply grew faster than demand in 2023 and through the first three quarters of 2024. However, demand is still growing from higher global electric vehicle sales and the buildout of utility-scale batteries used in energy storage systems. Over the long term, we forecast lithium demand to grow over 2.5 times by 2030 from 2023. In the near term, we forecast higher average prices in 2025 versus current levels of $10,500 per metric ton, as supply cuts will move the market closer to balance. Over the medium term, we expect prices to average $20,000 per metric ton, which reflects the marginal cost of production. For low-cost lithium producers, higher prices will drive substantial profit growth in the coming years.

Over Half of Basic Materials Stocks Trade in 5-Star or 4-Star Territory

Crop protection sales fell 18% in 2023, driven by inventory destocking among farmers, farm retailers, and distributors. The decline was due to the unwinding of excess inventory built up during the covid-19 pandemic amid supply-chain fears. However, farmer demand for premium crop protection chemicals remains strong, as these products help minimize crop yield loss due to weeds, insects, and fungi. As inventory destocking was largely completed by the end of the first half of 2024, we expect a strong profit rebound in the second half and 2025.

Lithium Prices Are at Cyclically Low Levels, but We See Prices Rising in 2025

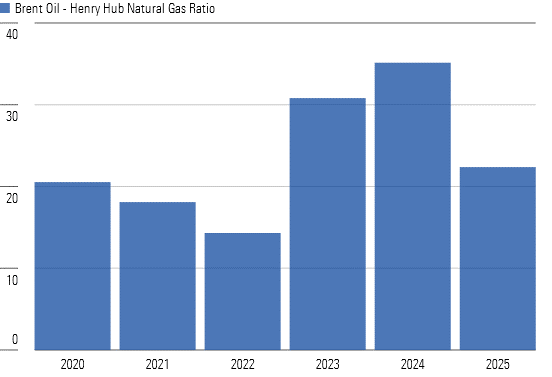

Commodity chemical producers largely saw profits decline in 2023, due to weak end-market demand. However, with demand gradually returning, we see a favorable profit environment, as we expect volume growth in the fourth quarter of 2024 into 2025. Additionally, US producers benefit from a favorable Brent oil to US natural gas spread, as commodity chemical prices are generally based on marginal cost producers that use Brent-oil-based naphtha feedstock. With a spread above 20, we see a favorable profit environment.

US Chemical Producers Should See a Favorable Cost/Price Environment

Top Basic Materials Sector Picks

Albemarle

- Fair Value Estimate: $225.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

Albemarle ALB is our top pick to play strong lithium demand and rising prices from growing EV adoption. The stock trades at less than 60% of our $225 fair value estimate. Albemarle’s main business is lithium, which generated roughly 90% of profits in 2023. The company produces lithium from two of the lowest-cost resources globally, creating the cost advantage that underpins our narrow moat rating. Albemarle’s low-cost position and solid balance sheet should allow the company to withstand the lithium price downturn. We point to rising lithium prices as a catalyst for shares.

FMC

- Fair Value Estimate: $110.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Our top pick to invest in crop chemicals demand recovery is FMC FMC, a crop protection pure-play company. The stock trades at a little more than 55% of our $110 fair value estimate. While it saw a great profit fall versus its more diversified crop input peers, we expect the firm will see a stronger rebound in the second half of 2024 into 2025. The market is also concerned about the industry recovery and FMC’s patent expiration risk of its diamide products, which currently generate around 50% of profits. However, as the company develops new premium products from its strong research and development pipeline, we forecast FMC will see solid long-term profit growth.

Dow

- Fair Value Estimate: $72.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Dow DOW is our top pick to invest in a profit recovery and favorable environment for US commodity chemical producers. Around 75% of Dow’s production capacity is in North America, creating the cost advantage that underpins our narrow moat rating. The firm benefits when there is a more favorable spread between Brent oil and US natural gas, as US natural gas is its largest input, while the prices for many of its products are based on Brent-oil-based naphtha. We point to a volume recovery in the fourth quarter of 2024 into 2025 and favorable unit economics driving profit recovery as a catalyst for shares.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)