Consumer Defensives: Despite Angst, Thirsty Investors Have Names to Pursue

Estee Lauder, Kraft Heinz, and Dollar General are our top consumer defensive stocks.

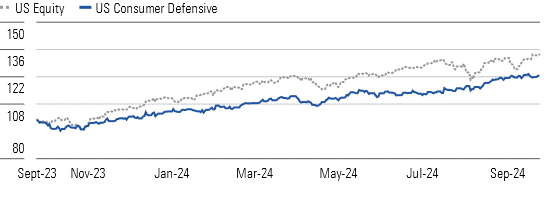

The Morningstar US Consumer Defensive Index significantly outpaced the broader market in the third quarter. The median stock in the sector trades at just a 1% discount to our fair value estimate, although the market-weighted price to fair value trades at a much higher premium.

Consumer Defensive Stocks Continued To Climb Higher in Q3

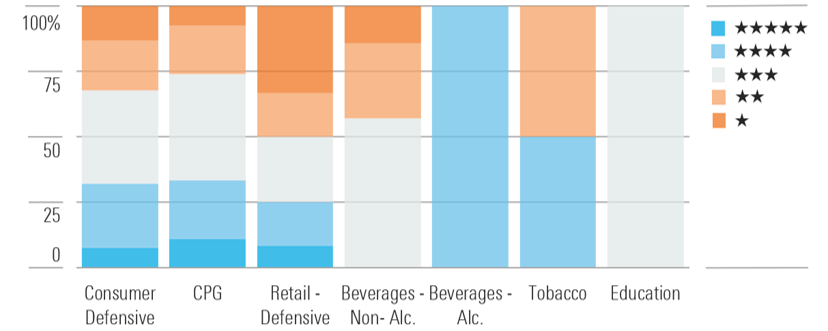

Nonetheless, we see attractive investment opportunities, with over 30% of our coverage trading in 4- or 5-star territory. We see alcoholic beverages as particularly undervalued, with the average stock trading 19% below our intrinsic valuations. We posit that investors remain cautious due to ongoing financial constraints facing consumers, which could intensify competitive pressures.

The Time Is Ripe to Tap Into Alcoholic Beverage Discounts

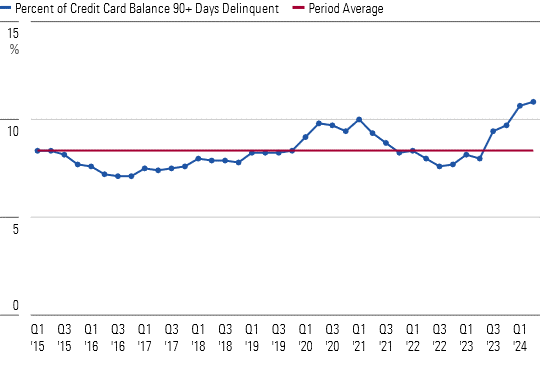

As personal savings have declined, we surmise consumers have increasingly turned to credit cards to bridge the gap. However, many are now struggling to manage mounting debt loads. As of the end of the second quarter, 10.9% of credit card balances were over 90 days delinquent, marking a 10-year high relative to the 8.4% average rate seen since early 2015. In this environment, we expect consumers to alter their spending habits, with increasing favor for lower-priced private-label products. This will likely be more pronounced in categories where innovation fails to align with evolving consumer trends.

In this context, we assess the level of spending as a percentage of sales allocated to research, development, and marketing to incite demand, which we view positively versus outsize promotional spending to buoy near-term volumes. We think moaty players are best equipped to withstand short-term market share declines and invest to strengthen their standing with retailers and consumers in the long term.

Rising Credit Card Delinquencies Reveal Growing Financial Strain

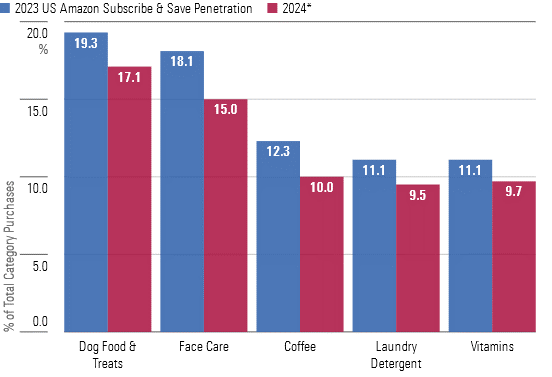

Amid these fluctuating dynamics, we’ve also seen a shift in online purchase patterns. While e-commerce adoption has surged in the last few years, with many consumers integrating platforms like Amazon into their shopping routines—including using subscriptions for consistent deliveries of essential, daily-use products—we’re starting to see consumers employ more discretion.

In this vein, Amazon users scaled back on subscriptions in 2024, likely opting to shop in-store or explore other channels to secure the best deals and lengthening intervals between purchases. With the continued bifurcation in shopping patterns, we believe operators must ensure their products are available in the channels where and when consumers are shopping.

Cost-Conscious Consumers Cut Subscription Purchases to Conserve Cash

Top Consumer Defensive Sector Picks

Estee Lauder

- Fair Value Estimate: $176.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

We believe Estee Lauder’s EL shares are attractive, trading around a 50% discount to our fair value estimate. Although a slow travel retail recovery in China has impaired demand and margins, we’re optimistic about the firm’s long-term prospects. Its brand investments and solid execution will help bring margins back to historical levels while ensuring its standing (underpinned by category-leading brands and preferred vendor status) remains in place. Further, we believe Estee is poised to benefit from secular premiumization trends across developed and emerging markets.

Kraft Heinz Company

- Fair Value Estimate: $57.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

At a nearly 40% discount to our fair value estimate and a 4%-5% dividend yield, we think Kraft Heinz KHC is attractive. We suspect investors are skeptical it will shun a material volume contraction in a tough economy (higher inflation and lackluster consumer spending) and amid intense competition (increased promotions by other brands and private label) after recent price hikes. However, we hold a favorable view on the firm’s efforts to unearth cost savings to support brand spending (research, development, and marketing), which should help drive top-line growth in the longer term.

Dollar General

- Fair Value Estimate: $130.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

We view narrow-moat Dollar General’s shares as significantly undervalued, trading at a 35% discount to our intrinsic valuation. While the company continues to be negatively affected by weak spending capacity from its core low-income customer base, we attribute this to a reduction in federal aid, as management estimates that more than half of its sales come from shoppers with a household income of less than $35,000. In this context, we still consider the retailer’s competitive advantage intact, as impressive store density and distribution scale allow Dollar General to serve rural towns more cost-effectively than its peers.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)