Communication Services: Cable’s Broadband Dominance Isn’t as Strong as It Once Was

Our favorite stocks in this sector include Comcast, Disney, and Alphabet.

In August, we cut our economic moat rating for Comcast CMCSA to narrow from wide. The firm’s core broadband business continues to generate modest growth, despite recent competitive pressure from fixed wireless providers, especially T-Mobile TMUS and Verizon Communications VZ. While profitability remains solid, returns on invested capital have drifted lower as customer penetration among the homes and businesses in Comcast’s network passes. We expect penetration will continue to lower as wireless chips away at the market. T-Mobile recently indicated that it believes its network will be able to serve 12 million broadband customers by the end of 2028, up from 5.5 million today.

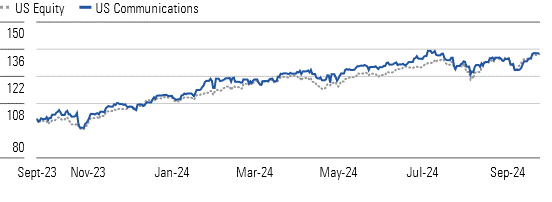

Communication Stocks Have Kept Up With Market Thanks to Meta's Performance

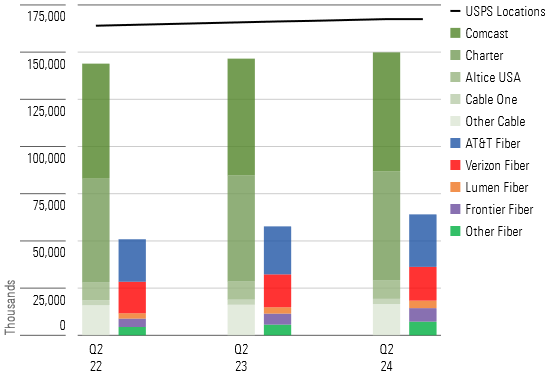

We also expect fiber network investment (the primary competitor to cable) will remain elevated for several years. Verizon announced plans to buy Frontier Communications FYBR to add to its fiber network, likely indicating a growing appetite to expand further. AT&T T continues to build new fiber networks while partnering with private firms to expand its reach. T-Mobile has also partnered with several firms to offer fiber-based broadband in pockets of the United States. We expect Comcast will continue to generate solid cash flow for the foreseeable future. However, our confidence has diminished in returns remaining well ahead of the firm’s cost of capital beyond the next decade (which is required to earn a wide moat rating).

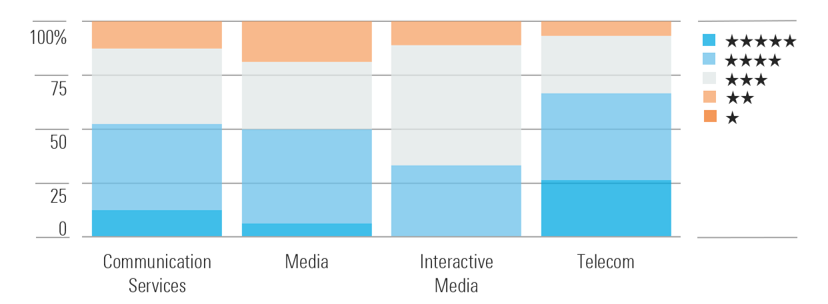

Valuations Have Risen Across the Sector, but We Still See Opportunities

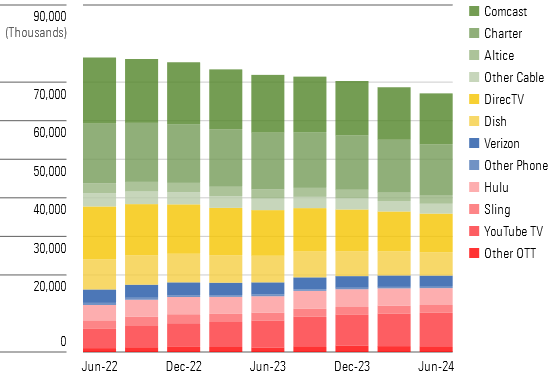

The continued struggles of the traditional media business also factored into our moat change for Comcast. Profitability at NBC Universal has deteriorated along with the decline in pay TV customers in the US. Comcast has doubled down on the television business, with large losses continuing at Peacock, its streaming service.

Homes and Business Locations Passed; Fiber Is Steadily Expanding

Peacock likely received a big revenue and subscriber bump from the Olympics this summer, but our confidence in the very long term has diminished. Most recently, the firm agreed to a high-cost rights agreement with the NBA, despite the uncertain outlook for the future revenue potential of the television business. Our moat downgrades earlier this year for traditional media firms like Warner Bros. Discovery WBD, Paramount PARA, and Fox FOX reflect our waning confidence that the industry will collectively find a solution to persistent cord-cutting.

US Pay TV Subscribers: Traditional Distributors Need Help from Content Owners

Top Communication Services Sector Picks

The Walt Disney Company

- Fair Value Estimate: $115.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

Disney DIS sold off after fiscal third-quarter earnings on disappointing results in its experiences segment, which has been extraordinarily strong. However, the market overlooked several points of encouraging improvement in the media business. Most notably, the streaming business has turned to profitability, and ESPN has been stronger than we expected as it fights the decline in traditional television. We believe Disney’s media business looks healthier now. We expect experiences to remain strong in the long term due to the firm’s unique intellectual property and forthcoming capacity expansion.

Alphabet

- Fair Value Estimate: $209.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

We believe investors are overly pessimistic about antitrust concerns for Alphabet GOOGL/GOOG, as well as its competitive positioning in AI. On antitrust issues, we think the worst-case scenario—a breakup of the firm—is highly unlikely, and that the company will be able to navigate remedies without materially damaging its core business. We also see Alphabet as one of three credible leaders in public cloud, and think it is well-positioned to benefit from surging interest in generative AI. We believe Alphabet’s Gemini model, along with the variety of products it powers (including a chatbot and productivity tools), can go toe to toe with solutions from other industry leaders.

Comcast

- Fair Value Estimate: $54.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

While Charter Communications CHTR and Altice ATUS trade at bigger discounts to our fair value estimate than Comcast, differences in debt leverage account for these gaps. Thus, we would still favor Comcast for its stronger balance sheet. We expect Comcast’s network will enable it to maintain the size of its broadband customer base over time while a rational competitive environment allows broadband prices to rise. The cable companies, including Comcast, will need to increase network spending in the coming years to keep pace with the phone companies’ fiber network capabilities but we expect cable cash flow to grow modestly over the coming years. In our view, the NBCUniversal business isn’t as strong, but it remains an important media asset.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)