Industrials: Many Stocks Overvalued After Q3 Outperformance

Our top stocks in this sector are Chart Industries, Wesco, and CNH Industrial.

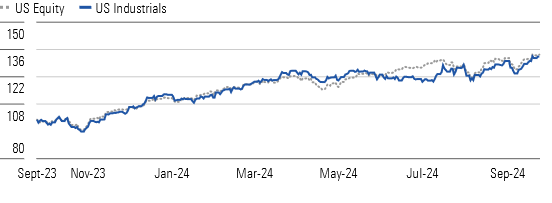

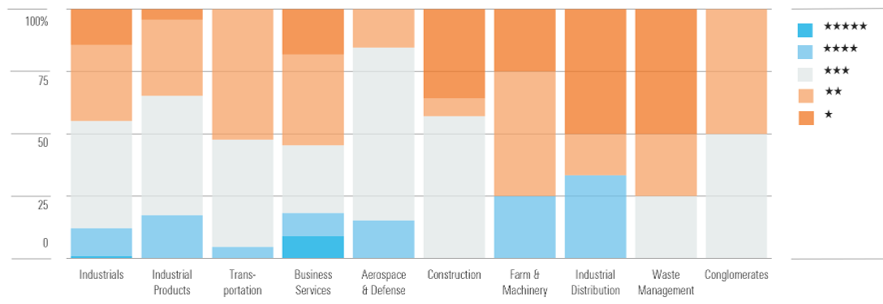

Industrials solidly outperformed the broader market during the third quarter but still lagged in the year to date. Notable outperformers for 2024 include the construction, waste management, and aerospace and defense industries. Conversely, industrial products, transportation and logistics, and farm and heavy construction machinery stocks were laggards.

Industrials Outperform in Q3 but Lag in the Year to Date

Many Industrial Stocks Overvalued, With Limited Opportunities

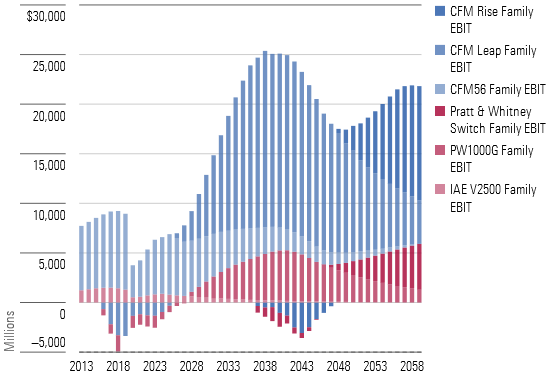

Within aerospace and defense, shares of commercial jet engine manufacturers GE Aerospace GE and RTX RTX have performed exceptionally well in 2024, thanks to their profit-generating aftermarket services. Returns on these competitively advantaged turbine engines are realized over multi-decade operating lifecycles only after heavily investing in the technology to meet requirements for future aircraft designs.

According to our newly developed financial model for engine lifecycles, we project the profit pool for narrow-body engines to peak at an aggregate of $25 billion by 2038, with the lion’s share to be collected by the CFM International joint venture between GE Aerospace and Safran. Two other commercial aerospace aftermarket-focused firms, Heico HEI and Transdigm Group TDG, have also enjoyed strong stock price appreciation this year. We believe delayed new aircraft deliveries from Boeing BA could extend the operation of aging aircraft, resulting in more aftermarket opportunities.

Morningstar Estimates for Narrow-Body Profit Pool

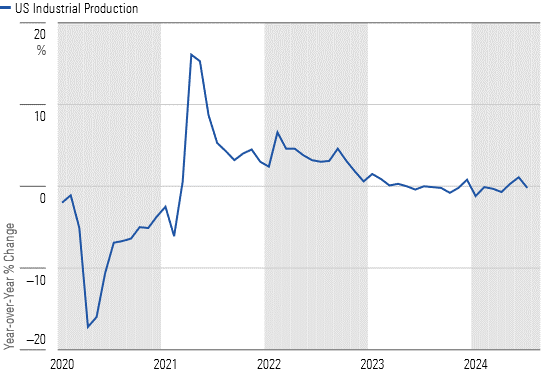

Despite US macroeconomic growth, the trucking industry endured a painful freight downturn for the better part of two years, driven by muted retailer inventory restocking and sluggish industrial end markets. The good news is that trucking industry demand conditions have probably bottomed. Assuming US real goods spending doesn’t roll over, we expect the return of TL and LTL demand growth for 2025.

HVAC system manufacturers are poised to benefit from secular trends in urbanization and an increased focus on energy-efficient building solutions. In our view, the outcome of the 2024 presidential election is a key consideration, as a Kamala Harris win would likely result in stricter climate-related policies, which could boost demand for more energy-efficient systems. But most of our HVAC coverage trades at significant premiums to our fair value estimates, due to overly optimistic expectations for long-term profit margins.

Sluggish Industrial End Markets Have Weighed on Trucking Demand

Top Industrials Sector Picks

Wesco International

- Fair Value Estimate: $197.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

Wesco WCC is an industrial distributor with three reportable segments: electrical and electronic solutions, communications and security solutions, and utility and broadband solutions. Shares sold off after second-quarter earnings fell short of market expectations amid inventory destocking and project delays, and they have not fully recovered. We are still confident in Wesco’s long-term prospects and think growth will return soon, driven by increased US infrastructure spending.

Chart Industries

- Fair Value Estimate: $200.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

Chart GTLS has pivoted to expanding its specialty portfolio of products into high-growth areas like hydrogen and liquefied natural gas. The firm made several attractive investments and joint ventures with key partners that let it increase the amount of in-house content it uses for larger projects, lowering costs and providing more control over delivery times. Still, Chart’s stock plummeted in early August after management cut 2024 guidance due to new order timing shifts. Nevertheless, new opportunities for data center awards are already inbound, with $40 million in wins during the second quarter for cooling solutions.

CNH Industrial

- Fair Value Estimate: $14.70

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

CNH CNH is a global heavy machinery manufacturer, with a range of products including agricultural and construction equipment. The company’s products are available through a robust dealer network, which includes over 3,600 dealer and distribution locations worldwide. Agriculture demand has been weak in 2024, as crop prices have not recovered since the middle of last year. However, we remain constructive in our outlook for CNH’s agriculture business, considering the favorable replacement environment and the incremental opportunity in precision agriculture.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)