Checkup for Healthcare Moats

We downgraded these three stocks, but they’re still undervalued.

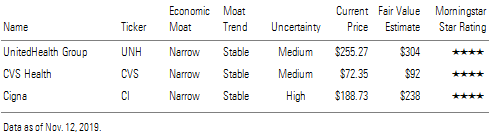

We have taken a fresh look at U.S. health insurers and pharmacy benefit managers UnitedHealth Group UNH, CVS Health CVS, and Cigna CI. We continue to view their stocks as undervalued. However, after reviewing the competitive dynamics and ongoing debate about these players' long-term roles in the U.S. health system, we reduced our economic moat rating for UnitedHealth to narrow from wide and cut our moat trend ratings for CVS and Cigna to stable from positive. All of these companies now have narrow moats and stable moat trends.

The U.S. health system continues to put significant financial pressure on many U.S. citizens, and we think medical insurers and pharmacy benefit managers will remain key targets of regulators looking to improve the U.S. healthcare system. These organizations may continue to face significant event risk that could cut into profitability eventually. While manageable changes to the status quo appear much more likely than extreme changes like a drastic "Medicare for All" scenario that eliminates private insurance in the intermediate term, the potential for ongoing pressure on profitability in a strained U.S. healthcare system acts as a fundamental constraint to our moat and moat trend ratings in this industry.

Specifically, we no longer feel confident enough to endorse a wide moat rating, which implies excess returns for at least the next 20 years, for UnitedHealth despite its unrivaled scale advantages in the U.S. health insurance industry. Similarly, we no longer view the potential synergies associated with the combination of CVS (retail and pharmacy benefit manager) and Aetna (insurance) and the combination of Cigna (insurance) and Express Scripts (pharmacy benefit manager) as compelling enough to offset the underlying constraints on industry players in addition to the return on invested capital-reducing valuations paid for these mergers. Therefore, we have cut our moat trend ratings to stable from positive for CVS and Cigna.

From a valuation perspective, all three players continue to trade below our fair value estimates, though. We believe the market is placing too much weight on an extreme Medicare for All scenario that eliminates private insurance. Admittedly, in a pure Medicare for All scenario where U.S. insurers have no place in the U.S. insurance market, these companies' U.S. medical and pharmacy benefit management operations could be in jeopardy. These businesses represent about 60% of CVS' operating profits, about two thirds of UnitedHealth's operating profits, and about 85% of Cigna's operating profits. However, we believe this scenario represents a very low-probability (5% or less) risk within our 10-year forecast period, as it would require significant shifts in control of the current federal government bodies, including a filibuster-proof Democratic majority position in the Senate and a new president from the far-left wing of the Democratic Party.

We view scenarios where these organizations provide medical and pharmaceutical benefits through employers and even government entities, such as Medicare Advantage and Medicaid managed-care plans, as much more likely than the extreme Medicare for All scenario where the private insurance industry no longer exists. In these more likely scenarios, we suspect there will be a place for private health insurers and related pharmacy benefit managers in the U.S. healthcare system for a relatively long period.

These more likely scenarios give us confidence in our base-case valuation scenarios. CVS and Cigna trade at a similar 21% discounts to our fair value estimates. CVS' shares are being offered at 10 times 2019 expected earnings, and we expect about 5% compound annual growth from CVS' earnings during the next five years, including an acceleration to the high single digits in the outer years of that period from roughly flat 2019 results. Cigna's stock recently traded at 11 times 2019 expected earnings with 11% compound annual earnings growth expected by us during the next five years. UnitedHealth trades at a 16% discount to our fair value estimate and 17 times 2019 expected earnings. We expect UnitedHealth to increase earnings per share by about 13% compounded annually during the next five years.

UnitedHealth Group, CVS Health, Cigna

/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)