Managed Care Organizations: Investment Opportunities and Risks Ahead of the Election

Near-term regulatory risks in US healthcare could benefit long-term investors.

As the election approaches, managed care organizations face significant regulatory risks associated with US healthcare spending that could damper industry profitability.

Fortunately for investors in managed care organizations, we think the near-term regulatory risks of this election cycle look manageable, despite current pockets of weakness in Medicare Advantage, Medicaid, and pharmacy benefit management.

Some of these near-term regulatory risks are even creating opportunities for long-term MCO investors.

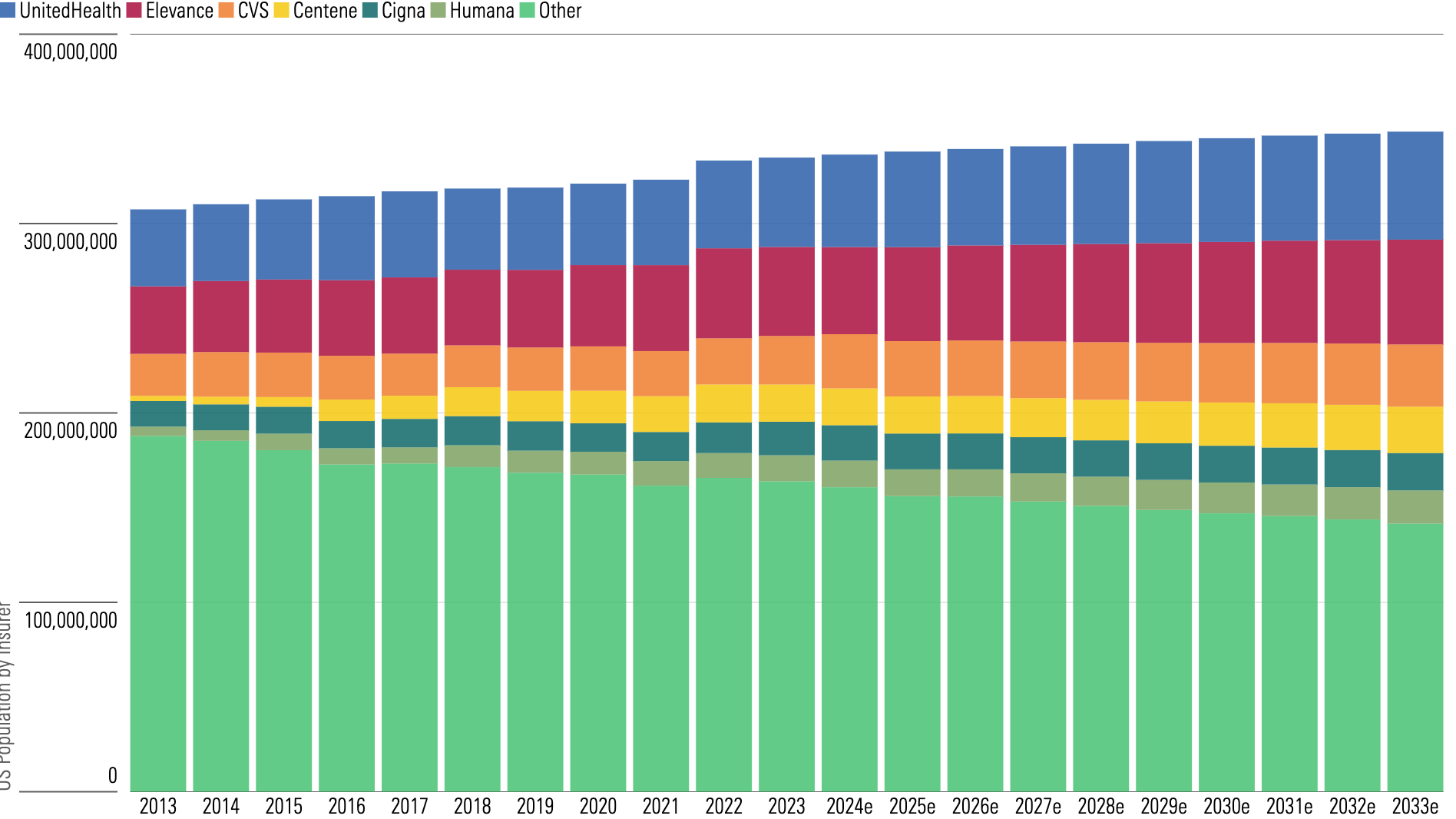

We keep our moat ratings at narrow for the six publicly traded MCOs that we cover, which insure over half of the US. That includes Humana HUM, Centene CNC, CVS CVS, Elevance ELV, UnitedHealth UNH, and Cigna CI.

4 Headwinds Facing the Managed Care Organization Industry

Given their competitively advantaged plan offerings, the MCOs that we cover look likely to continue expanding their coverage of the US population during the next 10 years, even amid headwinds.

The main industry headwinds that we see look likely to ease in the intermediate term:

- Renewed Medicaid eligibility redeterminations that are cutting into that population and creating a mismatch of rates and acuity in the remaining population should largely ease by the end of 2024.

- Medicare Advantage plan growth may be constrained through 2026 because of recent regulatory actions. Still, we think that Medicare Advantage growth will likely be stronger than other plan types for the next decade owing to demographic trends, increasing popularity versus traditional Medicare, and ongoing rate increases.

- Pharmacy benefit managers face regulatory scrutiny for their lack of transparency, but even if spread and rebate-related pricing is eliminated, we expect the PBMs to switch most clients over to fee-based arrangements to largely offset that potential headwind.

- Election cycles can create volatility in MCO shares, but if mixed control of the federal government continues, then MCOs will likely enjoy a relatively benign policy environment in the near term.

We expect the six main companies to cover 59% of the population by 2033, up from 51% in 2023, as they continue to grow their membership bases by 2% (compared with less than 1% expected US population growth) on solid expansion in Medicare, individual exchange, and employer plans.

Top-Tier MCOs Look Likely to Continue Gaining Market Share in the Medical Insurance Industry and Grow Membership at 2% CAGR

How to Position Your Investment Portfolio Before the 2024 Election

Managed Care Organizations Hold Narrow Moats but Face Longer-Term Policy Risk

Still, while some of these narrow-moat companies are stronger than others, none appear able to escape the policy risk that this industry faces.

Specifically, we believe that the MCOs we cover will generate economic profits for at least the next 10 years, but the potential for regulatory pressure on industry profitability reduces our confidence about the wide-moat time frame of 20 years.

Our Best Idea in the industry is Humana, which continues to face uncertainty around its intermediate-term profit trajectory in the highly regulated Medicare Advantage market.

Medicaid and individual plan leader Centene also looks undervalued, while CVS’ problems in Medicare Advantage and PBM transparency concerns keep its shares deeply discounted. Cigna, Elevance, and UnitedHealth shares look fairly valued.

| Company | Ticker | Market Cap $ in Billions | Moat Rating | Capital Allocation Rating | Uncertainty Rating | Star Rating | Fair Value (as of Sept. 19, 2024) | Price/Fair Value (as of Sept. 19, 2024) |

|---|---|---|---|---|---|---|---|---|

| UnitedHealth | UNH | 532 | Narrow | Exemplary | Medium | 3 stars | $550 | 0.95 |

| Elevance Health | ELV | 125 | Narrow | Standard | Medium | 3 stars | $550 | 0.98 |

| Cigna | CI | 99 | Narrow | Standard | Medium | 3 stars | $366 | 0.97 |

| CVS Health | CVS | 74 | Narrow | Standard | Medium | 5 stars | $93 | 0.63 |

| Humana | HUM | 38 | Narrow | Standard | Medium | 4 stars | $473 | 0.67 |

| Centene | CNC | 40 | Narrow | Standard | Medium | 4 stars | $92 | 0.83 |

Stock Market Sentiment Often Depends on US Healthcare Policy Initiatives

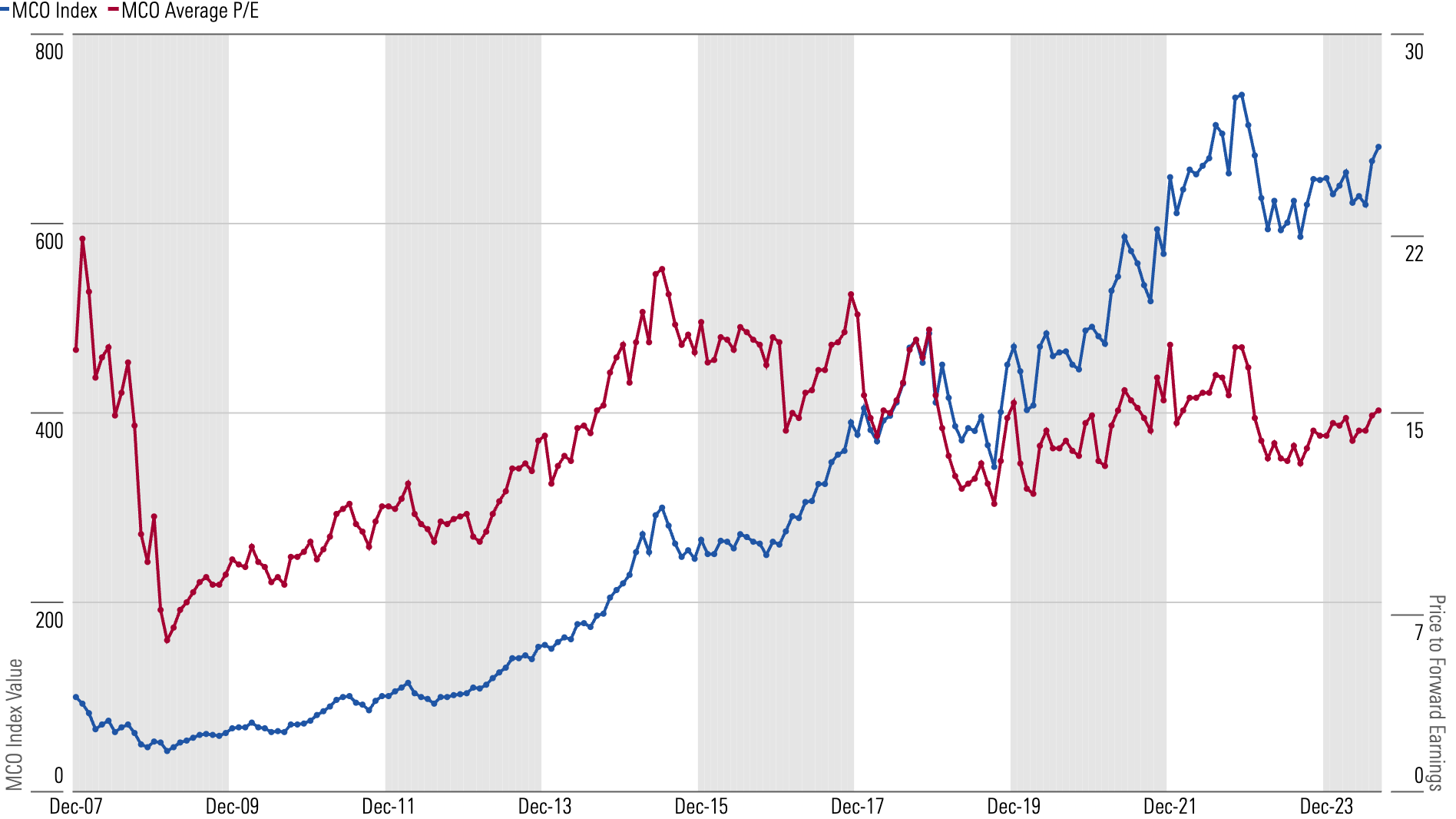

From 2008 to the end of August 2024, shares of the six MCOs collectively returned 11% compounded annually on 11% average earnings per share growth—but it was a bumpy ride for investors, especially in election years when Democrats were advancing.

For example, although the Affordable Care Act of 2010 wound up expanding the industry, the years leading up to its 2014 implementation were tough for MCO investors, similar to when Democrats considered a policy in the 2020 election primaries that would have eliminated private insurers.

MCOs Have Produced Strong Shareholder Returns, Despite Policy Risks That Pushed Down Shares and P/E Multiples in Some Election Cycles

The potential for major changes to the US healthcare system largely swings with control of the federal electable bodies. Risks could rise for MCO profits if the pendulum of control swings toward one party in the 2024 election. However, if mixed control of the federal government continues, then MCOs will likely enjoy a relatively benign policy environment in the near term.

One thing Republicans and Democrats appear to agree on, though, is that PBM transparency probably needs to increase, which creates a low-single-digit profit risk for the MCO industry, by our estimates.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PDHJPZBNVRCAFEQ2AHYHABU2AU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)