After Earnings, Is AT&T Stock a Buy, a Sell, or Fairly Valued?

As the company faces slowing growth and lead sheathing issues, here’s what we think of AT&T stock.

AT&T T released its second-quarter earnings report on July 26, 2023, before the markets opened. Here’s Morningstar’s take on AT&T’s earnings and stock.

Key Morningstar Metrics for AT&T

- Fair Value Estimate: $23

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

What We Thought of AT&T’s Q2 Earnings

- Slowing growth: Looking at the industry’s second-quarter results, we think earnings have lined up pretty closely with expectations. AT&T has seen growth slow. Management telegraphed this at a series of conferences in May and June, based on the loss of a government contract and the immediate impact of new rate plans from T-Mobile and Verizon. We think there’s more going on with AT&T, and that it needs to revamp some of its rate plans to better appeal to certain customer segments. However, this is a challenge of tactics and not long-term competitive positioning.

- Toxic lead cables: This issue was widely discussed for both AT&T and Verizon. Management talked about the investigations it has undertaken at sites mentioned in the media, and said the firm is going through corporate records to make sure it has located all lead-sheathed cables in its network. It appears that records are spottiest for the old MCI business. MCI acquired the Western Union telegraph network in the 1970s, but I suspect this network is far smaller than the core telephone network. AT&T was firm in stating that lead was used extensively in U.S. infrastructure during the first half of the 20th century and that handling it properly has long been part of the company’s protocols for workers and unions.

- Plans for lead removal: We have trimmed our fair value estimate for AT&T slightly to $23 per share, primarily to account for its potential need to increase capital spending (all else equal) to respond to the lead issue. We believe the approach we’ve taken is appropriately conservative, given the uncertainty around this matter. We assume the firm will ramp up its removal and remediation efforts over the next couple of years, reaching $1 billion, with spending continuing for the foreseeable future at a consistent but manageable pace.

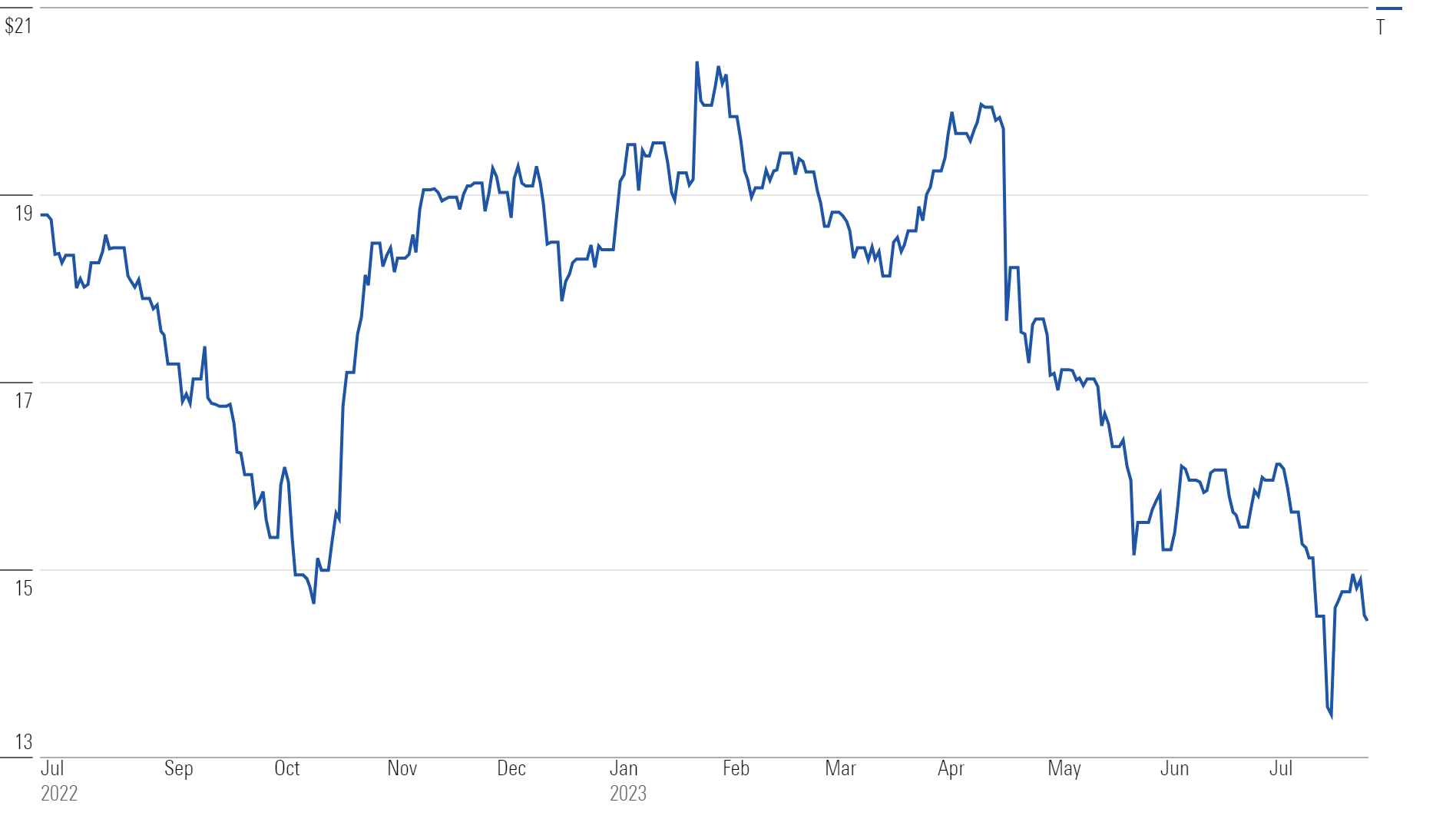

AT&T Stock Price

Fair Value Estimate for AT&T

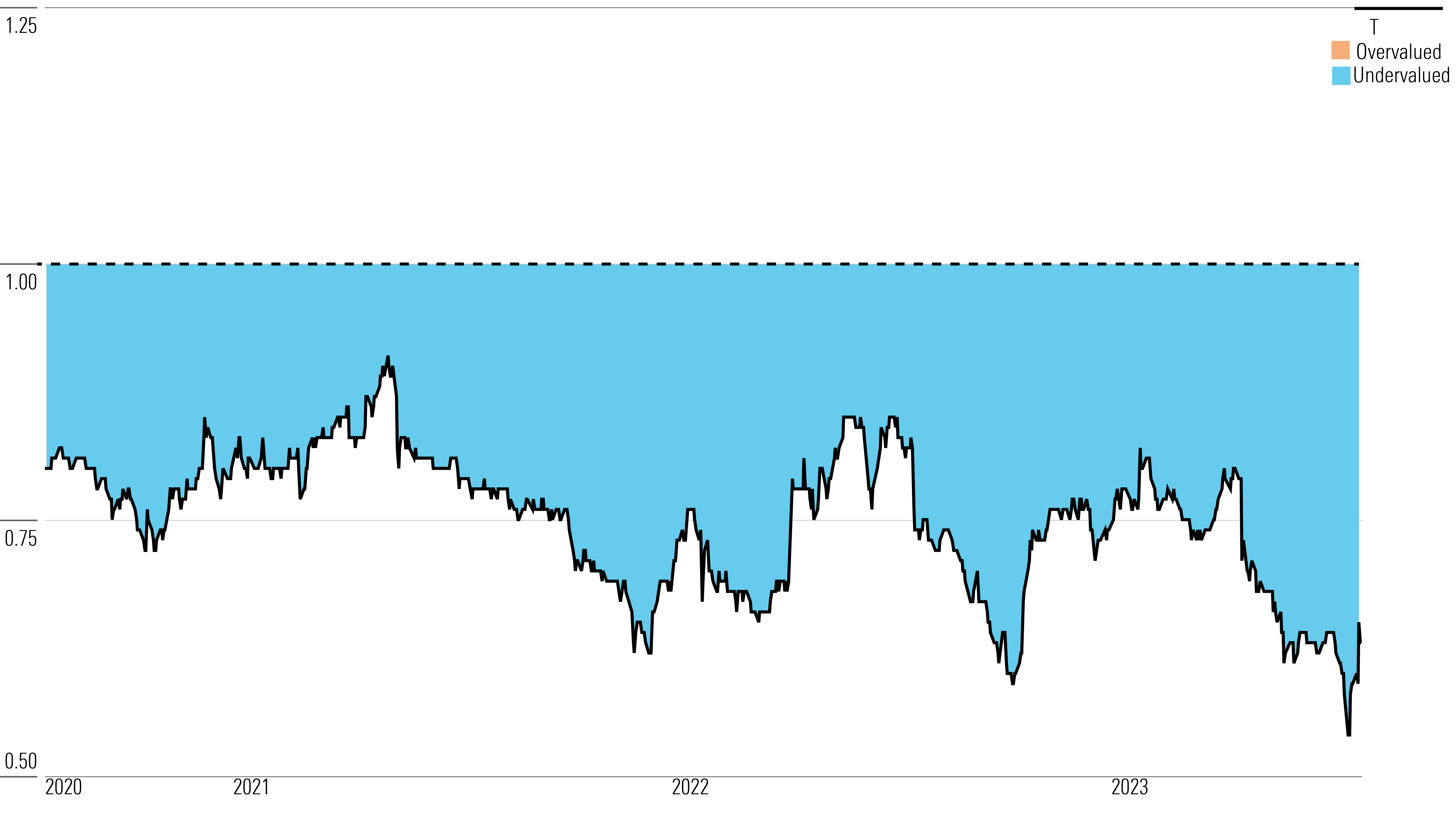

With its 5-star rating, we believe AT&T stock is undervalued compared with our long-term fair value estimate.

Our $23 fair value estimate assumes modest revenue growth and expanding margins over the next few years due to investments in its wireless and fiber network. The estimate implies an enterprise value of 7.5 times the 2023 EBITDA estimate and an 8% free cash flow yield. AT&T is expected to slowly gain market share over the next few years in the wireless segment, with postpaid revenue per phone customer modestly growing. Wireless service revenue is anticipated to increase by 3% annually on average through 2027, with wireless EBITDA margins holding in the low 40s.

The consumer broadband business is predicted to deliver steadily improving growth as the fiber network buildout matures, leading to an opportunity to sharply increase margins over the next five years. The enterprise service business will gradually return to growth and profitability with cost-cutting balances staying steady along with the loss of higher-margin legacy services.

Consolidated revenue is projected to grow 2%-3% annually, while consolidated EBITDA is expected to grow slightly faster, in the 3%-4% range. AT&T is anticipated to steadily increase free cash flow due to lower capital spending and declining debt leverage in spite of higher cash taxes and a declining contribution from DirecTV.

Read more about AT&T’s fair value estimate.

AT&T Price/Fair Value Ratio

Economic Moat Rating

AT&T’s wireless services are its most important business segment, and returns on capital have declined in recent years due to heavy investments in wireless spectrum and infrastructure. Despite this, we still expect the wireless segment’s returns to remain ahead of AT&T’s cost of capital. AT&T, Verizon, and T-Mobile dominate the U.S. wireless market, collectively serving nearly 90% of retail postpaid and prepaid phone customers. The industry’s scale advantage and high costs of maintaining nationwide coverage limit significant competition and aggressive customer poaching. The carriers have pledged substantial capital returns to shareholders, and they are not likely to disrupt the current pricing structure significantly.

AT&T’s fixed-line enterprise services segment holds a solid competitive position in providing complex communications services to business customers with diverse needs, earning returns on invested capital of around 10%-15%. However, the consumer fixed-line services segment lacks a competitive advantage, with inferior networks compared to cable competitors, resulting in returns on capital estimated to be around 5%. AT&T is also improving its competitive position against cable providers by aggressively expanding its fiber-to-the-premises network.

Read more about AT&T’s moat rating.

Risk and Uncertainty

AT&T’s Morningstar Uncertainty Rating remains at Medium due to potential liabilities associated with lead-sheathed cabling, leading to expected volatility for investors. The primary uncertainties facing AT&T are regulation and technological advancements. Regulation may intervene if AT&T’s services are insufficient or overpriced, especially in response to weak competition, potentially impacting its wireless and broadband services, which are considered crucial for social inclusion in employment and education. Moreover, AT&T is responsible for providing fixed-line phone services to millions of homes, including rural areas, which might require additional investments even with insufficient economic returns.

Regulators control the wireless spectrum flow, creating scarcity and forcing carriers to pay high prices for licenses. Spectrum policies have been used globally to promote competition, a strategy the U.S. might adopt. On the technology front, evolving wireless standards may lead to more efficient spectrum usage and reduced deployment costs, allowing new firms to enter the market. Cable companies are also exploring opportunities to leverage existing networks for limited wireless coverage, potentially increasing competition. There’s a slight chance that wireless technology advancements could eliminate the need for AT&T’s fixed-line networks, impacting the returns on its fiber investments.

Read more about AT&T’s risk and uncertainty.

T Bulls Say

- Following a period of investment, AT&T will hold a nationwide 5G wireless network with deep spectrum behind it and a fiber network capable of reaching nearly one-fourth of the United States.

- AT&T has the scale to remain a strong wireless competitor over the long term. With three dominant carriers, industry pricing should be more rational going forward.

- Combining wireless and fixed-line networks with new technologies and deep expertise makes AT&T a force in enterprise services.

T Bears Say

- The cost of maintaining dominance in the wireless industry by controlling spectrum has been exceptionally high over the years. AT&T has spent $40 billion over the past three years for licenses with few prospects for incremental revenue.

- Advancing technology will eventually swamp AT&T’s wireless business, enabling a host of firms to enter the market, further commoditizing this service.

- AT&T’s massive debt load will catch up with it. The firm carries far higher leverage than it historically has had, and its dividend payout remains high. Lead liabilities could be an additional burden.

This article was compiled by Saaketh Tirumala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)