Where Are the Opportunities in P&C Insurers?

Moats and management make the difference.

In our view, property and casualty insurance is at its heart a commodity industry in which it’s difficult to achieve sustainable excess returns. But some insurers clearly stand out, and the relatively wide spread of price/book multiples suggests a fairly large difference in franchise quality across the industry. We think having a grasp on the strength of a company’s competitive advantage and potential long-term returns is a necessary first step to gauge whether current market multiples reflect a proper valuation.

Commercial insurance economic moats (Chubb CB, Travelers TRV, and W.R. Berkley WRB) are based primarily on specialization, and personal lines moats are built on scale (Geico BRK.A/BRK.B and Progressive PGR). We believe the quality of management is of roughly equal importance to that of the moat, given the inherent fragility of insurance operations. Underwriting prowess, in our opinion, is the key differentiator, and only two companies (Progressive and W.R. Berkley) benefit from both a narrow moat and exemplary capital allocation, marking them as the highest-quality names we cover. We think generalist investors sometimes misunderstand which metrics to focus on. Our regression analysis supports the idea that it is overall profitability, not pricing or catastrophe losses, that drives P&C insurance stock returns.

To this end, we are optimistic about the outlook for commercial insurer profitability, as recent price increases seem to be more than sufficient to combat negative trends in terms of investment income and social inflation. We are skeptical, however, that the coming years will fully match the last hard market in terms of the magnitude or duration of excess returns, as the industry remains well capitalized. Still, with book multiples for the group roughly in line with historical averages, we think there could be some opportunities.

Personal auto has enjoyed very attractive returns recently, thanks to price increases and a pandemic-induced reduction in miles driven. But we expect mean reversion over time and are cautious on the space, given that current market multiples seem to be more in line with recently elevated returns than our long-term expectations.

P&C Moats Are Rare, but Strong Franchises Do Exist

We focus on underwriting profitability to separate quality companies in the sector. We think insurance companies that can consistently achieve relatively strong underwriting profitability are investors’ best long-term bets.

The commercial sector of P&C insurance is highly fragmented, with the top 10 carriers in the United States controlling only a little over a third of the market. There has been a trend toward deconsolidation over the last 20 years, suggesting that scale is not an operative source of advantage.

In our view, the primary way for a P&C insurer to give itself a competitive edge is to focus on the least commodified areas of the insurance market. The term specialty line is often used in the P&C insurance industry to describe this type of line. We would classify specialty as any line with unique risks that requires extensive experience to underwrite effectively. We think Chubb, Travelers, and W.R. Berkley have developed narrow moats through specialization.

In contrast to commercial lines, the personal sector is much more concentrated, and the market share of the leading carriers has increased modestly over time. However, if we look closer, we can see that this consolidation has been driven entirely by two players in auto lines: Geico and Progressive. These two companies increased their market share in personal auto insurance from 10% in 2000 to 27% by 2020.

Geico and Progressive are the two leading players in the direct channel and arguably have the strongest moats in the insurance industry. The economics of the agent and direct channels differ in a material way. Customer acquisition costs become more fixed for carriers in the direct channel, which has opened the opportunity for a scale advantage for Geico and Progressive that is both easier to execute and self-sustaining than one based on specialization.

Progressive was the clear leader in introducing telematics in the space, but at this point, almost every major carrier has telematics offerings. The one laggard has been Geico. However, looking at the two companies against industry averages, it appears that telematics is not so much Progressive’s gain as Geico’s loss. It’s not clear that Progressive’s underwriting performance relative to industry averages has materially improved in recent years. On the other hand, there does appear to be a clear negative trend for Geico.

Another advantage Progressive has had in recent years is its move toward bundling. In 2015, it acquired homeowners insurer ARX. On a stand-alone basis, this business is not particularly attractive. However, the addition of bundling has allowed Progressive to move upmarket and reignite growth in its agent channel auto business, which is much more profitable. We think Progressive has simply been better positioned and managed in recent years and has outperformed Geico in terms of underwriting profitability and growth.

Underwriting Is the Key Capital Allocation Consideration

Insurers tend to keep strong balance sheets because of regulatory pressure and the fact that maintaining a strong credit rating is somewhat necessary for the business. Credit rating considerations would likely come into play at capital levels above the regulatory requirement. As such, we don’t tend to see balance sheet strength as a significant point of differentiation when to comes to capital allocation.

With limited M&A activity, capital return levels are fairly high. Insurance is a fully mature, balance-sheet-driven industry, and insurers tend to actively return significant amounts of capital, within the limitations imposed by having to maintain a solid capital base. So we don’t see shareholder distributions as a major point of differentiation, either.

We see investment efficacy as the primary capital allocation factor to consider. We view investment efficacy primarily through the lens of underwriting discipline, and we assess that based on three factors: appropriate conservatism, pricing discipline, and innovation. In our view, Progressive and W.R. Berkley stand out, with Progressive’s edge primarily coming from innovation and W.R. Berkley’s from pricing discipline.

Because of Berkshire Hathaway’s success, we think many are drawn to insurers that attempt to generate alpha on the investment side. But we generally believe that an equity-heavy investment approach is more risk-tolerant than value-creative. Within our coverage, two companies, Markel MKL and Fairfax FFH, fit this bill. We think Markel tends to be more commonly viewed as a mini Berkshire. Markel co-CEO Tom Gayner has been an adept investor, beating the market by 260 basis points, on average, over the past 10 years. However, we think it is important to separate asset allocation choices and investing prowess. We don’t think investors should pay any premium for the former. Gayner’s alpha has only increased book value growth by 1% per year, on average.

Additionally, we would caution against comparing Berkshire’s investment approach with any other insurer, as Berkshire is an outlier in terms of its capital structure. If we compare Markel with other insurers, we can see that its heavy allocation to equities does appear to raise its risk profile. It is a matter of opinion whether Markel is too risk-tolerant or other insurers are too risk-averse, but Markel’s approach certainly generates some additional risk relative to peers.

What Actually Drives Insurance Stocks?

The most common misconception among generalist investors, in our view, is that the pricing cycle drives P&C insurance stocks (in short, that investors should buy insurers when pricing is improving and sell when pricing is declining). But we think pricing is the lever that the industry uses to adjust to changes in other factors. Therefore, we think an industry thesis based solely on the direction of pricing is incomplete. To test this, we regressed year-over-year changes in commercial P&C pricing (using data from the Council of Insurance Agents & Brokers) against the average return for the commercial P&C insurers in our peer group. The results of our regression support our view. While it shows a reasonable R squared, the relationship is not statistically significant.

We think investors should look at the direction of overall profitability, which we see as the key driver of stock returns over time. If we regress stock returns with changes in net income, we see a much clearer relationship. Pricing is clearly a component in profitability over time, but it is only one component. We think investors need to also consider other factors such as changes in claims levels and investment income. The results of our regressions support the idea that overall profitability is the key factor, as the relationship is both statistically significant and shows a relatively strong R squared.

Things Are Looking Up for Commercial Insurers

Price increases have greatly accelerated since the start of 2019, and that momentum carried through 2020. More recently, price increases have started to level off, but even without any further improvement, the pricing picture has improved dramatically. The industry has not seen pricing increases at recent levels since 2003, which demonstrates how long cycles can run.

In our view, disciplined insurers have the most upside to an improved pricing environment. For instance, W.R. Berkley generated returns on equity above 20% over multiple years during the last hard pricing market and has generally only generated modest excess returns since. That raises the question of whether insurers will repeat the performance of 2003-07. To do that, we need to look at the factors outside of pricing that affect profitability.

- Insurers have generally had to reinvest in lower-yield instruments over the past couple of decades, and that remains the case today. However, the yield pressure today doesn't appear especially bad relative to the range over the past two decades, and it's certainly not worse than it was in 2003. As such, we don't see lower interest rates as a particular headwind at the moment or a major obstacle to replicating the high returns in the last hard market period.

- Another issue is inflation. When it comes to general inflation, expectations have picked up considerably as the pandemic has started to wind down, but it remains within the historical range and doesn't appear to be significantly above the levels during the last hard market. We don't see overall inflation as a major obstacle, but it could be a bit of a drag on returns.

- A bigger issue is social inflation, a term used to explain how claims costs could rise above general inflation, most commonly due to trends in litigation, such as an increase in the volume of litigation or the size of jury awards. There does appear to be a fairly strong consensus in the industry that social inflation has become a significant factor in recent years, and there does appear to be anecdotal evidence to support this view. For instance, a review by VerdictSearch showed a more than 300% increase in the frequency of verdicts of $20 million or more in 2019 compared with the annual average from 2001 to 2010. According to Cornerstone Research, the median securities class-action settlement declined a bit year over year in 2020 but remained 19% above the average from 2011 to 2019. Data also suggests a material increase in the volume of class action filings in recent years. While this paints a worrying trend and could blunt the positive impact of pricing increases, it does appear that pricing is winning the battle. Further, the hard market in 2003 was prompted in part by a bout of social inflation, suggesting that a similar trend at this point shouldn't be a deal breaker for strong profitability. Underlying combined ratios for our commercial insurance coverage have improved significantly since the start of 2019.

During the last hard market, the industry was working past losses that materially lowered its capital base. But despite the trials the industry has faced over the past few years, balance sheets look as strong as ever. In our view, this could limit the duration and the magnitude of excess returns from better pricing, as excess capacity is likely to lead to a faster return to more competitive pricing.

Despite the optimistic outlook for profitability, current market valuations for the commercial insurers in our coverage are roughly in line with historical averages, and there could be some opportunities across the rest of our coverage.

We’re Cautious on Personal Lines

Before the pandemic, personal auto insurers had struggled due to a confluence of factors. First, gas prices fell at the start of 2015, which led to an increase in miles driven. A bigger issue was that the multidecade trend toward safer driving had stalled. Fatalities and injuries per mile driven had both been cut roughly in half from 1990 to 2010. However, following 2010, the levels flattened or increased slightly. This has generally been attributed to a rise in distracted driving, but we believe that diminishing returns from new safety features in cars also played a role.

The net effect is that auto insurers saw a meaningful increase in claims losses starting in 2015. In 2013 and 2014, the average combined ratio for our auto insurer coverage was 95%. From 2015 to 2017, the average increased to 98%, but the industry was able to push through better pricing as a result. Better pricing ultimately overwhelmed the negative claims trend, and the industry in the last few years has been in something of a sweet spot. In 2018 and 2019, the combined ratio for our coverage averaged 93%, even better than the industry was experiencing before the pickup in claims.

For auto insurers, the pandemic was a significant positive, as it led to a dramatic decline in miles driven and in claims. The positive was partially offset by rebates offered by insurers in the early stages, but the net effect was a large improvement in underwriting profitability in 2020.

We have already seen a negative pricing response this year, and premiums have dropped about 3% since the start of 2021. We remained concerned that the industry could see further pricing pressure. It is important to note that state regulators generally have to approve pricing levels, and the abnormal levels of profitability the auto insurers have enjoyed could attract regulators’ attention. In our view, a reversion to more normal profitability is highly likely, although the exact timing is difficult to predict.

Current market valuations for the two companies in our coverage that draw most of their revenue from personal auto insurance, Allstate ALL and Progressive, are higher than historical averages. We think the market may be focusing too much on recent returns and prospects in the very near term, as the benefits from the pandemic will likely not disappear immediately. As a result, we are cautious on these names from a long-term perspective, given the prospect for declining profitability.

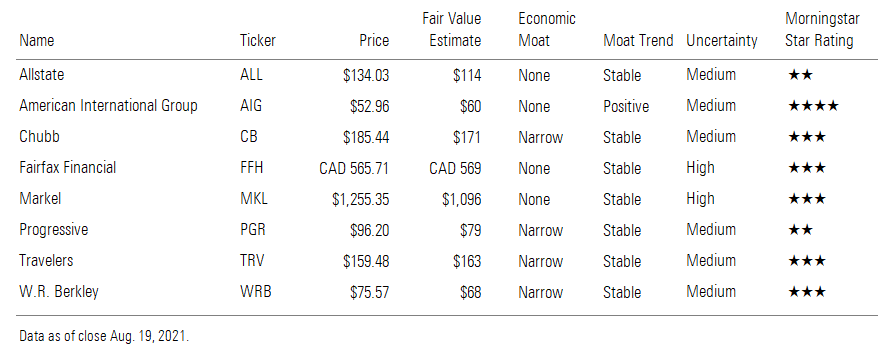

Allstate, American International Group, Chubb, FairTax Financial, etc. data

/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)