What's Saudi Aramco Worth?

Assessing the valuation and competitive position of this oil giant.

Saudi Aramco, Saudi Arabia’s state-owned oil company, is set to begin trading on the Riyadh stock exchange on Dec. 11. Exclusive rights to produce from nearly all the oil and natural gas reservoirs in the Kingdom of Saudi Arabia gives Aramco access to some of the lowest-cost oil and natural gas reserves globally, bestowing it with an overwhelming cost advantage and earning it a wide moat and stable trend rating, in our view. Our discounted cash flow model values Aramco at $1.4 trillion, or SAR 26 per share, implying a yield of 5.4%, below the initial offer price of $1.7 trillion, or SAR 32 per share.

Saudi Aramco has no close peers, given its size, structure, and cost advantage. With hydrocarbon production of 13.6 million barrels of oil equivalent per day in 2018, 10.3 mmboe/d of which was crude oil, it dwarfs every other public oil and gas company, even including peer national oil companies--those that are largely government owned and typically have preferential access to their country’s resources. Only Russian gas giant Gazprom comes close, but it lacks the oil production.

Though Aramco’s relative size and government ownership make a comparison with other national oil companies attractive, it’s not entirely applicable. National oil companies typically have poor reputations for inefficiency and capital allocation because they are often used for domestic employment or as a vehicle for policy as opposed to maximizing efficiency or making the most value-accretive decisions. While the Saudi government takes its share of economic rents from Aramco through royalties, taxes, and dividends, minority shareholders should take comfort in knowing Aramco is a well-run oil company. As opposed to many national oil companies, which are viewed as a domestic jobs program, Aramco’s employment levels are comparable with smaller international oil companies. If we assume that all of Aramco’s 76,000 employees are in the upstream segment (they’re not), then Aramco’s production per employee is still comparable with that of international oil companies.

Aramco has a large downstream operation as well. Its 3.1 mmb/d of net refining capacity makes it the world’s fourth-largest refiner. It also operates 16.7 million metric tons of chemical manufacturing capacity. However, while downstream (refining and chemical) earnings constituted 38% of net earnings for comparable international oil companies in 2018, Aramco’s downstream contributed less than 2% of EBIT. While Aramco is technically an integrated operation with a relatively large downstream footprint, its upstream activities drive its earnings and value.

However, a key element of Aramco’s strategy is to increase its downstream footprint to ensure markets for its hydrocarbon production. In March, it announced an agreement to acquire a 70% equity interest in SABIC, a Saudi-based chemical manufacturing company, for $69.1 billion (a reasonable 7.2 times 2018 EBITDA). In 2018, SABIC’s total production was 75.2 million metric tons, placing it among the top five global chemical companies. The deal is expected to close in the first half of 2020. In addition, Aramco agreed to acquire a 17% interest in Hyundai Oilbank from Heavy Industries Holdings for SAR 4.7 billion ($1.25 billion) giving it an interest in a 650 thousand b/d refinery in South Korea. The deal is expected to close in the first half of 2020. Aramco also has a nonbinding agreement with Reliance Industries of India to purchase a 20% interest in its chemical division. We expect additional deals to expand Aramco’s downstream business throughout high-growth demand centers in Asia. However, even accounting for the SABIC deal, we estimate downstream EBIT will constitute only 8% of total EBIT in 2023.

Minority Investors, Know Your Place Given its majority government ownership, comparing Saudi Aramco with other national oil companies is most appropriate for the purposes of awarding a stewardship rating. While Aramco will have all the governance trappings of an international oil company, including a board of directors with independent members, minority investors should have no illusions about who is in control: The majority shareholder is the government of Saudi Arabia. We have not historically associated government ownership with poor stewardship. In fact, most of the majority government-owned international oil companies and national oil companies we cover earn a Standard stewardship rating. Only Petrobras earns a Poor rating, and that is a result of government influence, which resulted in years of poor capital-allocation decisions that destroyed returns. Aramco's strong returns do not seem to indicate that the government's majority ownership has resulted in value destruction, and thus we award a Standard stewardship rating.

Even so, investors should be cognizant of three areas of government involvement (beyond a progressive royalty scheme). First, the government has historically relied on Aramco to complete domestic infrastructure projects that fall outside the purview of oil and gas production. While the government changed its laws in 2017 to ensure that future projects are done on a commercial basis, the risk is that Aramco will be not fully compensated for these projects or that resources will be diverted from hydrocarbon production. Second, the government requires Aramco to sell some products domestically below market or regulated prices. In 2017 the government implemented an equalization method to reimburse Aramco for lost revenue on these products. There is the risk that this mechanism could change, resulting in lost revenue.

Finally, the government controls the maximum amount of oil Aramco may produce. As a result, Aramco is at the mercy of decisions that the government might make as part of OPEC to reduce production. As the largest producer of the cartel, Aramco is likely to bear the brunt of those decisions. At the same time, the government requires Aramco to maintain MSC, or the average maximum number of barrels per day of crude oil that can be produced for one year during any future planning period that is spare capacity, to accommodate necessary rapid changes in production volumes. These volumes represent operating costs and capital investment that the company might not be able to necessarily use, harming returns. The current MSC is 12.0 mmb/d.

Wide Moat With a Stable Trend Through its exclusive rights to produce from nearly all the oil and natural gas reservoirs within the Kingdom of Saudi Arabia, Saudi Aramco has access to some of the lowest-cost oil and natural gas reserves in the world, giving it an overwhelming cost advantage and earning it a wide economic moat, in our view. Its current concession, which replaced the original concession in late 2017, is for 40 years with an extension of 20 years to be granted in the 30th year of the concession, assuming the company meets certain terms. Beyond then, the concession may be extended by another 40 years in the 60th year of the concession. The initial 40-year term of the concession, not to mention the combined potential term of 100 years, far surpasses the 20-year hurdle necessary to earn a wide moat rating. Further, as the government will remain the majority owner of Aramco throughout the term of the concession, we have a high level of confidence that the company will meet the requirements to keep the concession in place for the full initial term at a minimum and in all likelihood receive both extensions.

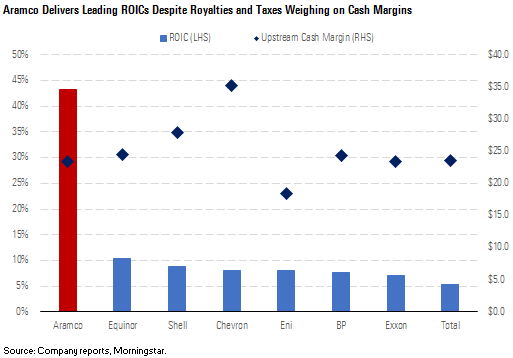

Saudi Aramco’s cost advantage is evident in its low operating and development costs as well as high returns on capital, all of which compare very favorably with publicly listed integrated oil and gas companies. In 2018, Saudi Aramco’s lifting costs and development costs were $2.80/boe and $4.70/boe, respectively, both well below the average of $7.80/boe and $14.60/boe, respectively, reported by a comparable group of integrated oils.

Admittedly, this excludes a burdensome royalty and high tax rate; including that, Aramco realized a cash margin of $23/boe in 2018 compared with $25/boe for the peer group. However, the much lower capital intensity resulted in higher companywide returns on invested capital of 43% compared with an average of 7% for the peer group.

One other element of its cost advantage that could become increasingly important is its relatively low emissions intensity. Aramco reported an upstream emissions intensity of 10.2 kilograms/boe in 2018, much lower than the 26.4 kg/boe average of the integrated oil peer group.

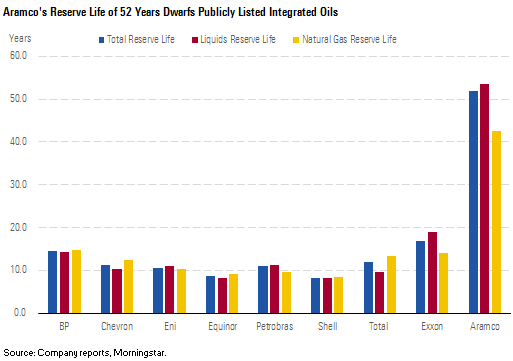

We expect this cost advantage to persist for two more decades at least, supporting a wide moat rating. Saudi Aramco produces from 498 reservoirs in 136 onshore and offshore fields throughout the country that have favorable geologic formations, leading to low costs. Aramco manages its reservoirs to maximize recovery as opposed to volumes. As such, it produces well below what it could theoretically do, given the size of its resource base. The result is an oil equivalent reserve life of 52 years compared with 9-17 years for its peers, leaving it with decades of low-cost production.

Given the relatively poor performance in its limited reported operating history, we are not willing to assign a moat to Aramco’s downstream operation at this time. IPO prospectus documents only included three years of historical performance, an insufficient amount of time to judge how Aramco’s assets perform throughout the cycle. Furthermore, the downstream segment registered large losses in 2016.

Additionally, Aramco’s refining assets do not appear to hold many competitive advantages. Its in-country, fully owned refineries, which constitute over half its refining capacity, are geared toward processing Saudi-produced crude but have a relatively low complexity rating of 7.3 (4.9 for its wholly owned and 9.6 for its affiliates). This results in a high yield of low-value fuel oil (17% in 2018). Its international refineries are better positioned with a complexity of 9.8 and lower fuel oil yield. Positively for Aramco, its distillate (diesel, jet fuel) yield is high at 48%. The complexity of its total portfolio of 8.3 falls below the 9.4 average of its peers. With relatively low complexity, Aramco does not have the ability to process lower-quality, cheaper heavy crudes without sacrificing higher-quality light product. It also does not have access to discounted light crude as its supply of locally sourced light crude is purchased at market prices based on global benchmarks.

Aramco is continually investing in its refineries, however, and we suspect there might be some cost advantage to being in proximity to low-cost, abundant oil and natural gas supplies. As such, with a longer operating history available, a narrow moat rating might be warranted.

SABIC also has a limited reporting history available, but we suspect it earns a narrow moat rating based on an average return on equity of 15% for the past five years, according to PitchBook. Although it manufactures products globally, only its Middle East and U.S. facilities likely have a cost advantage. Typically, we view chemical manufacturing sites in the Middle East and North America (primarily the Gulf Coast) as having access to low-cost chemical feedstock while Asia and particularly Europe represent higher-cost regions. Nonetheless, SABIC and the downstream business’ relatively small contribution to earnings do not deter us from awarding the company a wide moat.

Oil and gas producers’ moat trend typically rests on relative ability to replace reserves. In this regard, we do not anticipate Saudi Aramco will see any material improvement or degradation in its ability to replace reserves necessary to maintain production levels or the quality of those new reserves, earning it a stable moat trend rating. Aramco’s very long reserve life means it does not have same challenge of replacing reserves that other integrated oils do. Given the size of its reserve base and management of reservoirs to maximize recovery as opposed to production levels, Saudi Aramco should be able to maintain its cost position for decades to come. It reports that 80% of its reserves are less than 40% depleted while 80% of its reserves have a recovery factory between 41% and 80%. As such, it should continue drawing on existing fields for years to come, leveraging existing infrastructure and keeping development costs low. Furthermore, it has historically expanded its reserve base without any evidence of deterioration in economics. In 2018, it reported a three-year reserve replacement ratio of 104% of total reserves and 127% for oil. Given the abundance of low-cost resources in Saudi Arabia and Aramco’s continued exclusive right to produce them, we expect the company to maintain its cost advantage.

While Aramco is continually investing in and upgrading its refining and chemical facilities, we do not expect any material change in the cost position those facilities currently hold. Although investment in upgrading capacity can improve a refiner’s cost position, it is typically expensive, and any increase in earnings is concurrent with an increase in capital; thus improvement in returns is limited. Additionally, such upgrades are available to any refiner willing to spend the capital. Improvements in operating costs are unlikely to materially improve a company’s cost position either. However, a longer operating history as well as more disclosure might warrant a moat upgrade if we gain greater confidence in Aramco’s downstream business’ ability to deliver steady profits and excess returns. Although the company plans to add more chemical processing capacity in low-cost regions such as the Gulf Coast, we don’t expect any movement along the cost curve of its existing assets that would warrant a positive or negative trend rating.

What's Aramco Worth? Performing a valuation analysis using comparisons with publicly traded international oil companies and national oil companies proves difficult, given the uniqueness of Aramco that we've detailed. As a result, using the range of trading multiples for international and national oil companies to capture the full range of possible valuations the market might assign results in a very wide range for Aramco's equity values.

Price/Book The price/book ratio typically can be a useful metric for valuing integrated oils as it removes issues with forward multiples, which rely on earnings estimates influenced by oil price assumptions and segment mix. Here, however, it's problematic. While the price/book multiple should theoretically be tied to return on equity, with a higher ROE resulting in a higher price/book, we find a weak relationship for international oil companies and no relationship for national oil companies.

Furthermore, as with most metrics, Aramco’s ROE is not comparable with its peers. Using the average trading range of price/book multiples of 1.0-1.5 times for international oil companies understates Aramco’s value, given the wide disparity in ROEs. Using national oil companies’ price/book range of 0.4-1.4 times probably overly discounts for political risk and operating inefficiencies not applicable to Aramco. As a result, the loose relationship between ROE and price/book makes it difficult to infer a price/book multiple for Aramco based on its higher ROEs. However, with an average ROE 4 times higher than the average of the peer group, Aramco’s price/book could arguably be upward of 6 times.

Free Cash Flow Yield and Dividend Yield The dividend is a key element of Aramco's investment appeal. The company plans to pay out $75 billion a year ($0.09375 per share quarterly, assuming 200 billion shares) in dividends from 2020 through 2024. Notably, the government will forgo its portion of the dividend to ensure that investors are paid the minimum amount in the event the board determines the dividend in any quarter to be less than $0.09375 per share. This is important because we see Aramco's free cash falling short of $75 billion through 2021 based on current oil price curves. The government's effective guarantee of the dividend then argues for a lower yield than what might be implied by its free cash flow coverage ratio. In this respect, Aramco's dividend payout policy is more like that of an international oil company, which is reticent to ever cut the dividend, than that of a national oil company, whose payouts tend to be more variable. Aramco is likely to offer a yield that is comparable with the approximately 5% average of international oil companies, despite having a lower coverage ratio.

Given the importance of free cash flow to supporting shareholder payouts, we’d expect a similar effect on Aramco’s free cash flow yield. In other words, given that Aramco’s total free cash flow is more than sufficient to cover minority shareholders’ dividend, the total amount of free cash flow is less relevant to them, minimizing the importance of free cash flow yield as a valuation tool.

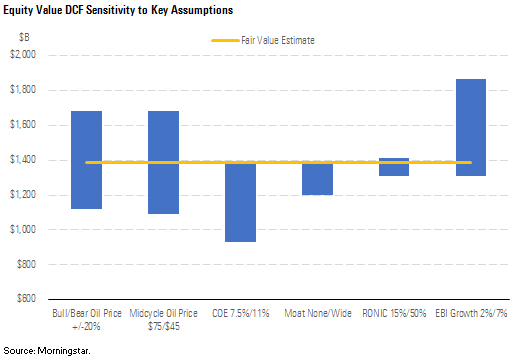

DCF Model's Implications for Valuation We overcome the issues with a multiple-based valuation by using a discounted cash flow-derived fair value estimate, which values Aramco at $1.5 trillion, or SAR 30.5 per share. This valuation implies a dividend yield of 4.6%.

Our DCF model uses Brent oil prices of $60 per barrel in 2020, $58 in 2021, $57 in 2022, and our long-term midcycle price assumption of $60 in 2023. We use a weighted average cost of capital of 8.4% based on a cost of equity of 7.5%, a 1% country risk premium, and a 5.8% cost of debt. Our wide moat rating means we use a 15-year stage 2 length with a return on new invested capital of 35% and an EBI growth rate of 3%.

Our model already incorporates rather favorable assumptions of a low cost of equity and a wide moat rating, which benefits valuation. Still, our valuation fails to reach the rumored targeted valuation of $2 trillion. To get to that level, we’d need to assume midcycle oil prices of $100, assuming all else equal in our model, well above our $60/barrel estimate

Unsurprisingly, higher oil prices result in a higher valuation. However, the effect weakens as oil prices rise, given a progressive royalty scheme. Beginning in 2020, royalties will increase from 15% at oil prices less than $70/barrel, to 45% up to $100/barrel, then 80% beyond that level. As a result, minority shareholders have limited exposure to oil price upside and a cap on valuation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)