Retailers in the Bargain Bin

Sales were soft in the most recent quarter, but we see brighter days ahead.

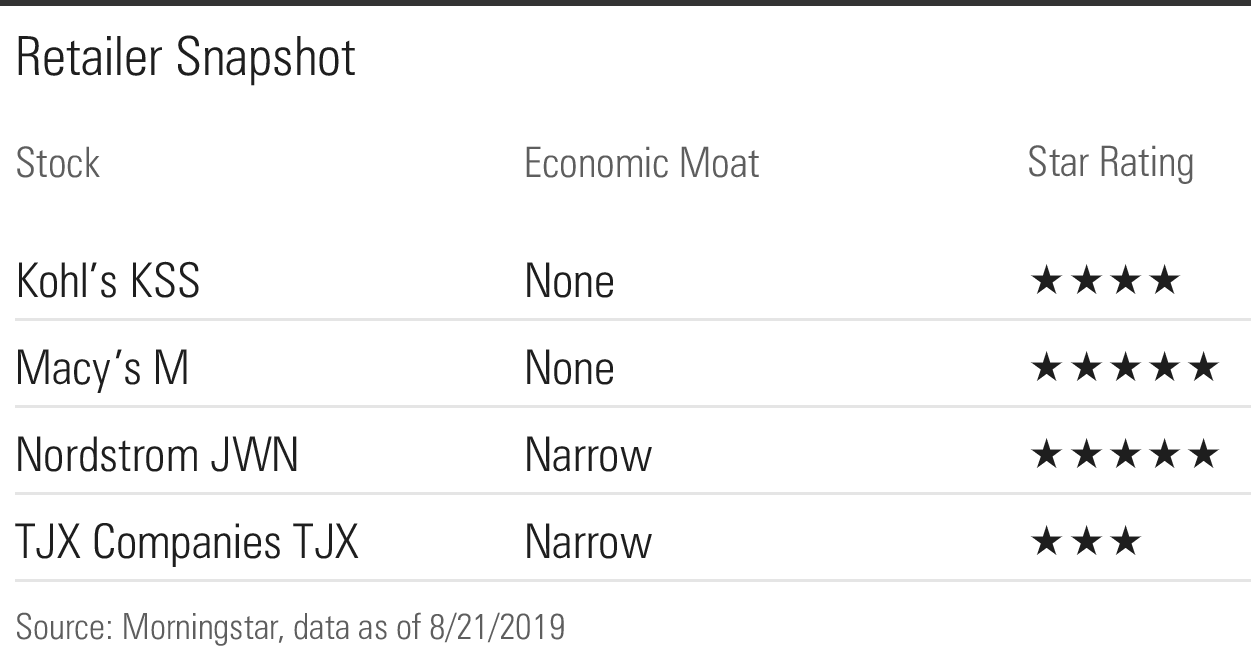

Sluggish sales has been the theme for retailers reporting second-quarter results, but we think the market isn’t giving enough credit for future improvement. Nordstrom, Macy’s, and Kohl’s all trade well below what we think they’re worth.

Retailer Snapshot

Nordstrom's Full-Line Sales Disappoint, but Expenses Contained Nordstrom JWN joined other North American department stores in reporting weak sales for the second quarter. The narrow-moat company's 6.5% sales decline in its full-price segment missed our forecast of a 4.0% decline despite July's annual Anniversary Sale. Nordstrom's sales were affected by sellouts of some popular items and slow sales of others. We think many retailers resorted to significant markdowns to move slow-selling inventory (especially women's apparel) in the second quarter. Nordstrom's off-price business reported a 1.9% sales decline for the quarter. While this result matched our forecast, it is nonetheless disappointing considering the segment's history of growth. Nordstrom scaled back on flash sales in the quarter, a key driver of traffic for the off-price business, but intends to increase their frequency in the second half of the year.

Despite the full-price sales miss, Nordstrom’s earnings per share of $0.90 in the quarter beat our estimate of $0.77 on good expense control. The company reported selling, general, and administrative expense at 31.2% of sales, 70 basis points better than our forecast. Nordstrom reported improved economics from its Anniversary Sale despite the soft sales. We think the company’s inventory, down 6.4% year over year, is in good shape heading into 2019’s second half, but we are cautious on customer traffic trends. Thus, we do not expect to change our fair value estimate despite the quarter’s EPS outperformance, which led the shares to jump after the announcement. We view Nordstrom, still down sharply year to date, as attractive.

We think Nordstrom’s digital and local initiatives show promise. In Los Angeles, its biggest market, Nordstrom reports that local shoppers spend 2.5 times as much as others and are more likely to use buy online/pick up in store services. Nordstrom reported 4% digital growth (to 30% of total sales) in the second quarter despite an overall sales decline of 5%.

We do not expect Nordstrom’s long-awaited, 300,000-square-foot women’s store in Manhattan to have a major impact on 2019 results. Opening Oct. 24, it will contribute to holiday sales, but we think that initial marketing costs will be significant and that it will take some time for the store to build a customer base. Also, we think the New York retail market is being hurt by weaker international tourism. Macy’s Bloomingdale’s chain is among the retailers that have been affected by this issue.

We believe the Nordstrom family and the board manage the company for the long term. However, we do have some concern that outside shareholders could be at a disadvantage. Recent media reports suggest the Nordstrom family may wish to increase its stake in the company; the family owns about 31% of Nordstrom and reportedly wants to boost its stake beyond 50%. It has been widely reported that the family attempted to buy the entire company for $50 per share in 2018 but was rebuffed by the board. If the Nordstroms do attempt to increase their stake, they could use their personal wealth or issue debt for share buybacks or a tender offer. As the stock trades well below our fair value estimate, we buybacks would be beneficial for shareholders. Given the turmoil in the department store space, however, we think it would be risky to take on unnecessary debt. It is likely that Nordstrom’s board would need to approve any deal that places significant new debt on the balance sheet.

Slow Customer Traffic and Product Markdowns Plague Macy's Macy's M share price dropped after the company reported second-quarter results and reduced its outlook for the rest of the year. We view the shares as attractive at current levels and believe the retailer won't cut its current annual dividend of $1.51, which is yielding 9.7%. As we forecast Macy's 2019 free cash flow at more than $1 billion, we think the no-moat company's annual dividend cost of less than $500 million is manageable.

Macy’s 0.2% growth in comparable sales on an owned basis in the second quarter came in below our forecast of 0.5%. Moreover, the company relied on significant discounting and promotions to sell slow-moving apparel, including private-label women’s activewear. This pressured the gross margin, which at 38.8% missed our forecast of 39.8% and represented a year-over-year decline of 160 basis points. We think the gross margin was negatively affected by both markdowns and e-commerce fulfillment costs. While Macy’s believes its inventory is in better shape headed into the fall season, it reduced its 2019 midpoint earnings per share outlook by more than 6%, suggesting a lack of momentum and lowered expectations for second-half operating income.

We think Macy’s operates too many stores that have too much selling space. It owns hundreds of stores in struggling malls, many of which may close. Macy’s, like J.C. Penney and other department stores, continues to struggle with declining customer traffic due to competition from outlet stores, e-commerce, discount stores, and branded stores operated by vendors. According to data from the U.S. Census and others, department store sales in the United States have steadily declined since 2000. However, Macy’s has not announced another round of store closings and appears hesitant to do so. While the company owns potentially valuable real estate, its monetization efforts have stalled and were just $7 million in the second quarter.

We view Macy’s efforts to respond to competitive threats as promising but inadequate. We think its plans may improve sales at its leading 150 stores (which compose about 50% of total in-store sales), but we do not think they can bring customers to its hundreds of weaker stores in lower-tier malls. Among Macy’s efforts, it is expanding its Growth50 remodeling plan, improving its mobile e-commerce capabilities, expanding its vendor direct offerings, and continuing to open off-price Backstage stores. We view the last strategy as mostly defensive. Macy’s has opened 47 Backstage stores so far this year, bringing its total number to more than 200. While the company reports mid-single-digit comparable sales growth at Backstage stores open more than 12 months, we do not believe they are drawing traffic to the Macy’s stores that house them. Macy’s reported double-digit e-commerce growth in the second quarter, suggesting a decline in sales within its physical stores. Moreover, the company reported a 3% decline in average unit retail in the second quarter. We think the lower prices of Backstage items are hurting Macy’s pricing and gross margins and not driving significant incremental sales.

Kohl's Still Struggling to Draw Shoppers, but Some Optimistic Signs Poor customer traffic continued to be an issue for Kohl's KSS in the second quarter. Same-store sales declined 2.9% in the quarter (following a 3.4% drop in the first quarter), falling short of our forecast of a 2.0% decline. Kohl's blamed May rain and other short-term issues on the shortfall. We think, though, that the no-moat company's large store base is the overriding issue, as it faces competition from e-commerce, discounters, specialty stores, and others.

Kohl’s slow sales translated into a soft gross margin of just 38.8% in the second quarter, 30 basis points below our forecast and a year-over-year drop of 80 basis points. We believe Kohl’s, like Macy’s and others, had to resort to discounting to move women’s apparel (women account for 70% of Kohl’s shoppers) and other merchandise in the quarter. Kohl’s also faces a negative impact on gross margins from increasing digital fulfillment costs. More positively for the company, sales picked up in the last six weeks of the second quarter (1% same-store growth) and into August. The company attributed the improvement to better weather, back-to-school shopping, and activewear. Adjusted earnings per share of $1.55 in the quarter beat our $1.54 thanks to expense control and increased share repurchases. We forecast Kohl’s same-store sales will improve in the second half of 2019 from the first half and do not expect to change our fair value estimate. We view Kohl’s, with a dividend yield of 5.7%, as attractive.

Kohl’s rolled out its returns program with Amazon to all locations in early July. We view this program as largely defensive and think the extra effort and cost are only worthwhile to Kohl’s if they lead to incremental sales within its stores. While Kohl’s claims that the program will contribute positively to operating income in 2019, it has provided minimal quantitative data on this thus far.

We think Kohl’s is showing progress with its plans for efficiency and growth. Its selling, general, and administrative expense at 30.4% of net sales in the second quarter beat our forecast of 31.0%. Kohl’s also showed progress with e-commerce in the quarter, reporting a midteens increase in digital sales, an improvement from the high-single-digit result in the first quarter. Kohl’s is investing to use its large store base to support its e-commerce. For example, it reported that 40% of its digital sales were fulfilled by its local stores in the second quarter. While we view this effort as useful for cost containment and speed, we do not think it fully offsets the additional fulfillment costs with e-commerce.

We think Kohl’s is doing well with activewear, and it has expanded floor space for the category in some of its best-performing stores. It has reported mid-single-digit growth from activewear, led by strong sales of Vans, Adidas, and other brands. Kohl’s has built about 75 Adidas shops within its stores and intends to roll out another 100 or so this fall. We view this strategy as sound as we believe the athleisure trend remains very strong in the United States.

TJX's Sluggish Sales Don't Damp Our Long-Term Outlook Although TJX's TJX U.S. comparable sales growth underwhelmed in the second quarter, we still believe the narrow-moat company is poised to capitalize on its store experience, value proposition to customers and vendors, and cost leverage. So while we plan to temper our near-term targets, our long-term forecast is intact for around 5% top-line growth against 11% pretax margins over the next decade.

TJX posted 2%, flat, 1%, and 6% quarterly comparable growth at its Marmaxx, HomeGoods, Canadian, and other international units, respectively (against our 3%, 2%, 1%, and 3% respective targets). Management reiterated its $2.56-$2.61 fiscal 2020 diluted earnings per share guidance; our pre-announcement $2.65 estimate is likely to sink slightly.

In an encouraging sign for the company, TJX’s pretax margin of 10.4% slid 20 basis points in the quarter as expected, despite softness in the United States, where HomeGoods (about 15% of overall revenue) saw flat comparable growth on the heels of lackluster 1% growth in the first quarter. Though HomeGoods turns inventory far more quickly than traditional sellers, management said lingering category missteps led to the ongoing challenges, as ordered but undelivered off-trend merchandise continues to arrive. We expect gradual recovery from the transitory issue, bolstered by leadership’s indications that third-quarter performance is improving, and we continue to see HomeGoods as a positive contributor to TJX’s brand mix. We foresee 2%-3% segment comparable growth long term.

Sales were somewhat slower than we expected at Marmaxx (roughly 60% of overall sales), but management cited traffic as the driver of performance and said it sees “phenomenal” product availability. While off-price chains continue to add stores, we still expect broader retail’s upheaval and customers’ mutable tastes to leave availability high as manufacturers struggle to match supply to demand.

/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)