Retail REITS Still a Buying Opportunity

We think the market misunderstands the ramifications of e-commerce.

Many investors are concerned that the continued growth of e-commerce is a large, structural negative trend for brick-and-mortar retail. However, we believe the omnichannel strategy--e-commerce sales by traditional retailers--that is being increasingly pursued by most national retailers favors the high-quality portfolios owned by the retail real estate investment trusts. Of these, Simon Property Group SPG and Regency Centers REG are our top picks.

The retail REITs typically trade off on major retailers announcing store closures or reports of large e-commerce gains; the implication is that gains by e-commerce will negatively affect future sales and thus occupancy of the retail REITs. While many retailers are indeed closing stores, these are typically at lower-quality malls and shopping centers, which lack the demographics like population density that generate high foot traffic or average household income to lead to high average sales per ticket for tenants at the center. Stores in lower-quality properties are likely to be less profitable and therefore more likely to be targeted for closure when a retailer decides to reduce its physical footprint. A store closure at one of these centers can be devastating, as each closure draws fewer consumers to the other stores, which in turn lowers sales and increases the likelihood of additional store closures at the center. Given this relationship, many investors assume that consumers shifting sales online will only have a negative impact on the retail REITs.

However, the retail REITs have significantly increased the average quality of their portfolios over the past two decades, recycling the proceeds from the sale of older, lower-quality properties into acquiring newer, more productive centers. Retailers are more likely to retain these higher-productivity stores, as they have the necessary demographics to support high sales growth and thus store profitability. In fact, Class A retail has consistently outperformed all other retail segments each year over the past decade in terms of growth in sales per square foot, and we believe this trend will hold.

As retailers increasingly shift to an omnichannel strategy, maintaining these stores as places where consumers can buy online/pick up in store remains an essential part of their plans despite e-commerce’s increasing penetration of retail sales. Additionally, the brick-and-mortar store can be a showroom for the company’s products, provide marketing for its online storefront, and act as a place to return products that were purchased online.

While many malls and shopping centers will close as a direct result of increased e-commerce penetration, we think the portfolios of the retail REITs will remain vital to omnichannel retailers and the U.S. consumer in the decades to come. We see many mall REITs and shopping center REITs as undervalued by the market today, given the importance of these centers to the future of omnichannel retail.

Simon Property Group

Class A malls continue to outperform other forms of brick-and-mortar retail. Additionally, no-moat Simon recently acquired Class A mall competitor Taubman Centers, which should increase cash flows and provide more leverage when negotiating with tenants. The stock sold off significantly during the pandemic and has not fully recovered. Simon has long-term leases with tenants, so it should continue to receive rent even during the current crisis. While many weaker retailers may go bankrupt due to the lack of sales, we think Simon’s attractive portfolio will be able to quickly fill any vacancies. We believe that its mall portfolio will be less affected by store closures than other malls.

We continue to see major mall tenants closing stores, either through actively breaking leases or simply choosing not to renew when their leases expire. However, most of the stores closing are unprofitable as a result of a lack of foot traffic producing enough sales to support the store’s continued existence. This means that the closings are greatly weighted toward the lower end of the mall quality spectrum, as those malls are in less densely populated areas, draw lower-income shoppers, and have lower-quality tenants. Retailers, even struggling ones, are looking to keep their profitable stores in Class A malls that have the dynamics to produce high sales per square foot. We believe that Class A malls will produce flat to positive sales growth and outperform lower-quality malls.

Simon has recently invested significantly to acquire retailers declaring bankruptcy, including Forever 21, Lucky Brand, Brooks Brothers, and JC Penney in 2020. While many investors were initially worried about the riskiness of investing in these failing retail businesses, Simon’s 2021 guidance makes management’s moves look quite shrewd. While the company has not fully revealed its investment in these ventures, management noted that it has $330 million invested across all of its retail operations. The first investment in 2020 was in Forever 21, which Simon reported that it paid $67 million for its share. Despite purchasing Forever 21 in February 2020 at prepandemic prices and then seeing the business slow as a result of the pandemic, Simon managed to generate $30 million in EBITDA in 2020 from the investment. The company said it expects similar success with its other retail investments in 2021, issuing guidance of $260 million in EBITDA, which implies a 79% return on its $330 million investment within the first full year.

Additionally, the size of these investments represents only a fraction of operating cash flow, which was over $2 billion in 2020 despite the decline in operations the company experienced due to the pandemic. So as long as these investments don’t distract management from focusing on its huge portfolio, we are strongly in favor of Simon pursuing similar investments in 2021 as free cash flow and the balance sheet should allow it to take on the additional risk to pursue the potential of massive returns.

We also like that Simon has been able to translate e-commerce competition into tenants in recent years. More than 50 retailers that started exclusively online have opened physical stores to complement their online marketplace as they evolve to pursue an omnichannel strategy. The store openings are almost entirely in markets with dense populations and high average incomes and are in high-end retail locations like Class A malls with high foot traffic driven by other high-quality tenants. These companies are finding that physical retail stores are just as profitable as their online storefronts and are looking to expand their physical footprint. Simon is also experimenting with an e-retailer incubator in its malls, which should create more tenants over time. Having only opened in 2018, Simon has already had success translating one of the tenants into opening physical stores in multiple locations throughout its portfolio.

Regency Centers

Regency’s portfolio is filled with high-quality assets in population-dense, affluent markets. Over 80% of the no-moat company’s properties feature a grocery anchor, and grocery stores represent slightly more than 20% of annual base rent. Regency’s grocery anchors are strong draws to the centers, as they produce sales per square foot well above the national average and are very healthy, with low occupancy costs. Grocery has been one of the retail categories that has seen sales growth increase during the pandemic, driving consistent business to the rest of Regency’s portfolio, which should maintain high occupancies.

Beyond the pandemic, we like Regency’s portfolio, given that many tenants should be insulated from the impact of e-commerce. While online grocery shopping is rapidly growing, most purchases should still occur in a store, as consumers prefer to see produce and meat before buying to ensure quality and freshness. Additionally, even if groceries increasingly move to a buy online/pick up in store concept, traffic is still driven to the property even if consumers order online.

Meanwhile, service-oriented tenants like restaurants (20% of annual base rent), fitness/health centers, and pharmacies provide a product or service that requires a physical location. While some of these tenants were significantly hurt by the pandemic, there is no online alternative, and shoppers should eventually return to these stores as the vaccine rollout allows people to resume their prepandemic lifestyles. Even food delivery services that are becoming increasingly popular still pick up food directly from the restaurant. Therefore, the service- and grocery-oriented tenants of Regency’s portfolio should continue to see steady growth that isn’t affected by the growth of e-commerce.

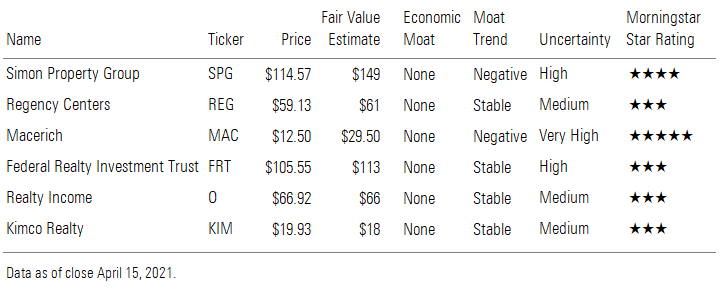

Simon Property Group, Regency Centers, Macerich, Federal Reality Investment trust, etc.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)