Innovation Supports Growth at Big Pharma/Big Biotech Companies

Moats and returns on invested capital look stable for companies with a solid list of pipeline drugs.

Most Big Pharma and Big Biotech companies in our coverage support wide moats as a result of their ability to generate new drugs to replace mature ones losing patent protection.

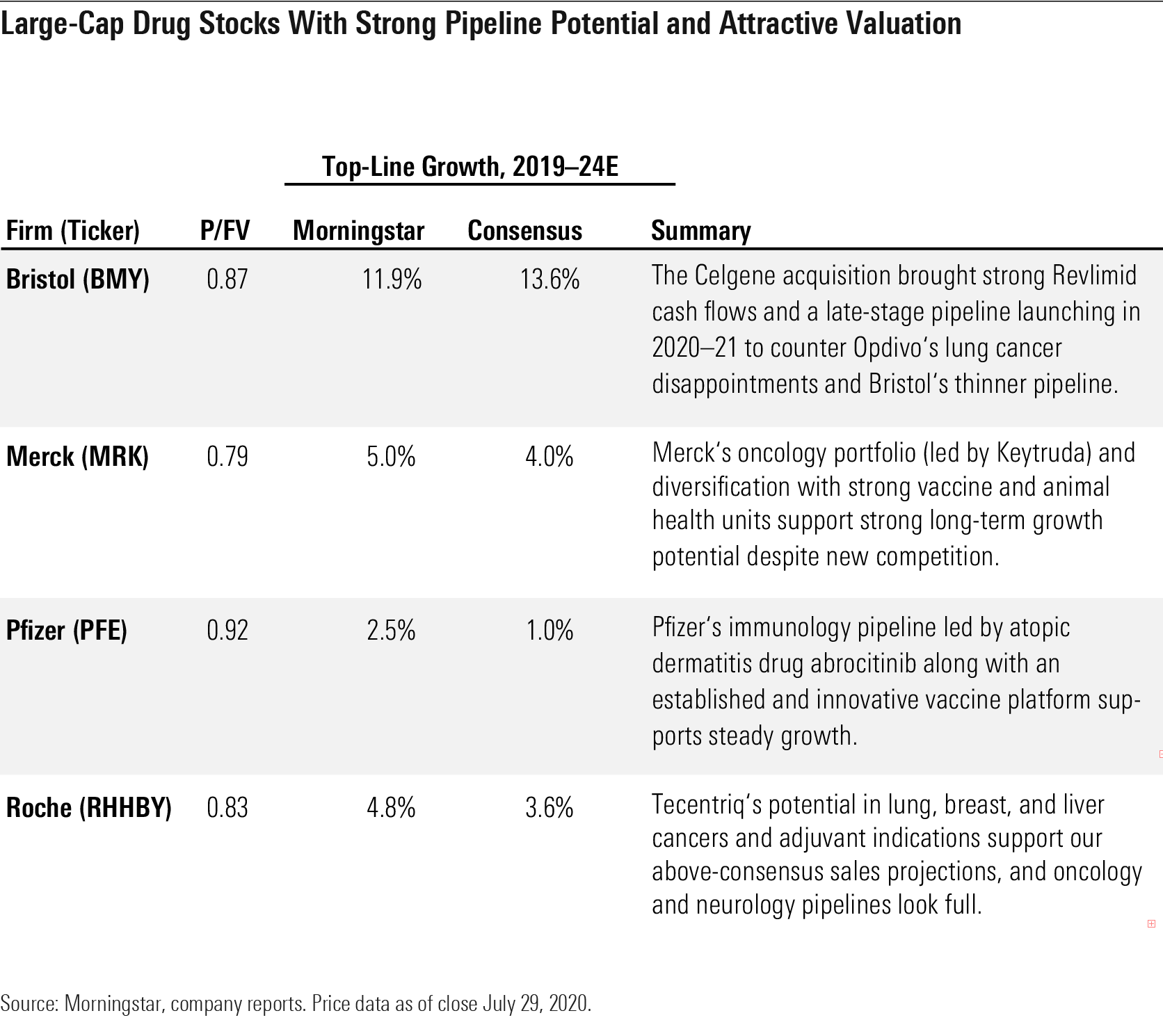

We project 4.7% annual average sales growth through 2024 (similar to consensus) for the 18 moatiest pharma and biotech names we cover, as innovation more than counters generic/biosimilar and branded competitive threats. Overlaying our growth analysis with valuation, we see underappreciated areas.

- The market underappreciates Roche's RHHBY strong position in immuno-oncology. We expect Tecentriq's approval in a range of cancers--including first-line non-small-cell lung cancer, small-cell lung cancer, triple-negative breast cancer, and hepatocellular carcinoma and upcoming data in adjuvant indications--to drive 2024 sales of $11.3 billion ($6.4 billion consensus).

- Our above-consensus view of immuno-oncology supports Bristol-Myers Squibb's BMY Opdivo, and the Celgene acquisition gives access to strong cash flows through 2022, several potential blockbusters launching by 2021, and dozens of early-stage partnerships.

- Merck's MRK Keytruda franchise is poised to continue to dominate in the largest lung cancer market, with multiple growth opportunities in earlier-stage disease and new indications. The company's vaccine business (led by Gardasil) and animal health divisions also provide attractive growth.

- Pfizer's PFE emerging immunology pipeline should bring several new drugs to the market with competitive profiles, led by abrocitinib in atopic dermatitis. Strong vaccine development in pneumococcal disease, C. difficile, and respiratory syncytial virus should support additional growth.

Large-Cap Drug Stocks With Strong Pipeline Potential and Attractive Valuation

In the COVID-19 pipeline, key drivers include Gilead Sciences' GILD antiviral remdesivir, multiple vaccines, and targeted antibodies. While these products support our moat ratings indirectly (greater appreciation of innovation and reduced risk of severe price cuts), we don't see significant sales from COVID-19 products, given not-for-profit strategies at vaccine makers like AstraZeneca AZN and Johnson & Johnson JNJ.

Among treatments, remdesivir and Regeneron’s REGN REGN-COV2 are in our models, but among vaccines, we only model Pfizer and BioNTech's BNTX vaccine, BNT162b2, given recent contracts and a for-profit strategy.

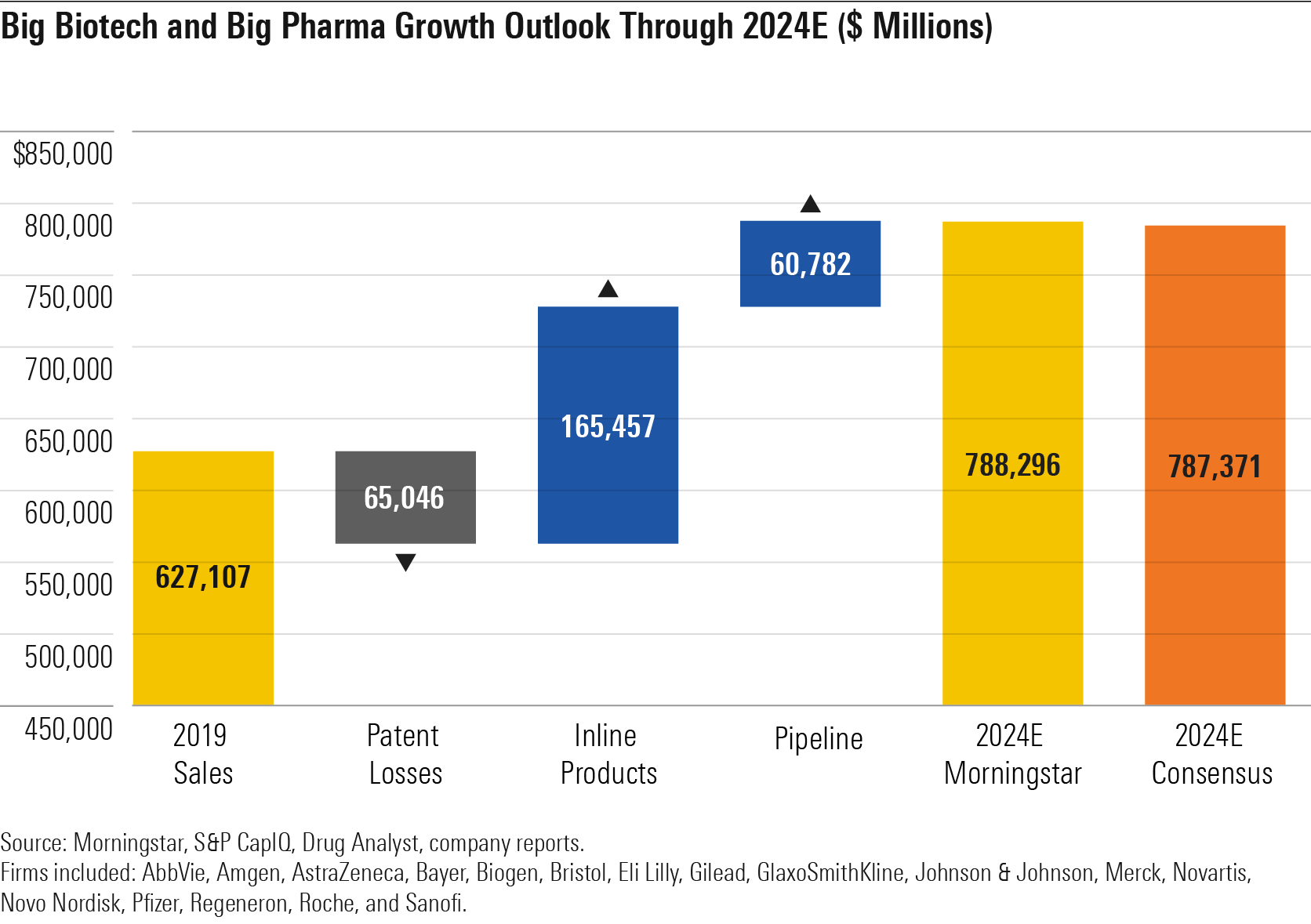

Five-Year Outlook: Big Biotech and Pharma Companies' Pipelines Offset Patent Losses and Reinforce Moats Innovation is the central building block for the strong economic moats in the drug and biotechnology industry, supporting drug pricing power and launch trajectories. However, drug sales fall significantly following patent expirations, making the continuous cycle of new drugs essential to the industry's economic moats.

In looking at the entire large-cap drug and biotech industries, we expect steady innovation to drive 5% annual sales growth over the next five years, similar to consensus expectations.

We divide the outlook for large biotech and pharma companies into three segments: in-line products (approved drugs with generic/biosimilar threats after 2024), products losing exclusivity through 2024, and pipeline drugs (approvals in 2020 and beyond). The bulk of this growth is from in-line products that are generally established on the market and at the peak of their growth-generating potential.

However, the five-year outlook for pipeline growth is stronger than our last update from January 2019, representing almost 300 basis points more as a percentage of total 2024 sales.

Big Biotech and Big Pharma Growth Outlook Through 2024E ($ Million)

Large-Cap Pharma Companies Can Preserve Moats With Focus or Diversification U.S. payer consolidation and the rising prominence of value-based assessments from the Institute for Clinical and Economic Review have constrained pharma and biotech companies' ability to price high and pass through annual U.S. price increases, and pending executive branch rules and potential legislation are weighing on valuations.

Given the pricing pressure overhang, companies need higher levels of innovation in their pipelines to justify pricing and prevent pharmacy benefit managers from using competition to drag prices down. Slight dosing advantages and minor improvements in efficacy in crowded therapeutic areas will not support the innovation needed for pricing power, as was the case in the 1990s and early 2000s.

In areas like respiratory disease (asthma) and diabetes (insulin), next-generation drugs have lacked the differentiation to support the price increases and deepen competitive advantages.

We think large-cap pharma companies are adapting to the changing payer landscape and preserving their narrow and wide economic moats, as the majority of pipeline drugs are focused in critical care areas and represent significant advancements over current treatment options. Regulatory groups are increasingly willing to approve such drugs on limited phase 2 data, and pharma companies are pushing drug-development speeds to shorten the pathways to increasingly competitive marketplaces.

More novel drugs can mean more development risk, but most large-cap pharma companies are in a position to preserve their competitive advantages. We see two different strategies:

- increase the diversification of drug development by bringing in divisions such as animal health, consumer health, and vaccines, which tend to be more stable, or

- increase investment focus on innovation in areas with strong pricing power, particularly in therapeutic areas that are a core focus of expertise for a given company. AbbVie ABBV diversified into aesthetics with its acquisition of Allergan, while Bristol solidified its oncology and immunology focus with its acquisition of Celgene.

From a moat perspective, diversification is important either across different industries or different drugs. A high dependence on one drug tends to weaken a company’s moat; competitive threats, an emergence of an unknown side effect, or a patent loss can impair the cash flows from the drug, hurting the company’s ability to reinvest in developing the next generation of drugs.

Most wide-moat companies do not depend on a single drug for a significant share of revenue; large drug companies that rely on a single drug--AbbVie (Humira) and Regeneron (Eylea)--hold narrow moat ratings despite excess economic returns. For pharma and biotech companies that are diversified across divisions, moats can be supported in several ways, including brand power (consumer, animal health), cost advantages (vaccines, animal health), and switching costs (animal health).

R&D Productivity Looks Largely Stable for Pharma and Biotech Companies, Offsetting Patent Losses The strong moats of the large drug and biotech companies look secure, with pipelines strong enough to offset patent losses. The industry will continue to face major patent losses; while the current landscape seems increasingly favorable for patent extensions, the eventuality of generic or biosimilar competition is certain.

Pipeline drug development is less certain, with failures happening constantly. Nevertheless, the portfolio strategy of developing several new drugs supports the strong likelihood that next-generation drugs will reach the market. Further, the shift toward developing drugs in areas of unmet medical need (rather than slight advancements in well-treated areas) suggests stronger pricing power for new drugs, a trend seen over the recent years, especially in cancer and rare-disease areas.

Based on our aggregate outlook for the large drug and biotech companies, we expect returns on invested capital to exceed weighted average costs of capital over the long term. While ROICs over the past five years haven’t matched the very high ROICs of the early 2000s, the massive damage of the industry patent cliff in 2012-14 appears to have subsided, and the outlook looks largely stable.

Further, while we don’t view another major patent cliff emerging because of more dispersed patent losses for the group, several very important patent losses will occur over the next five years, including Humira and Revlimid (agreements with generic/biosimilar competitors should spread out the damage for these drugs over several years based on royalty agreements and different competitive timing by geographic regions).

We do see a mild decline in ROICs in the later years of our projections. Some of this decline is due to the lost visibility of new pipeline drugs that should emerge in five to seven years but are currently in early-stage development with very little published clinical data. Overall, the spread of over 700 basis points between projected ROICs and WACCs looks secure to support our moat ratings.

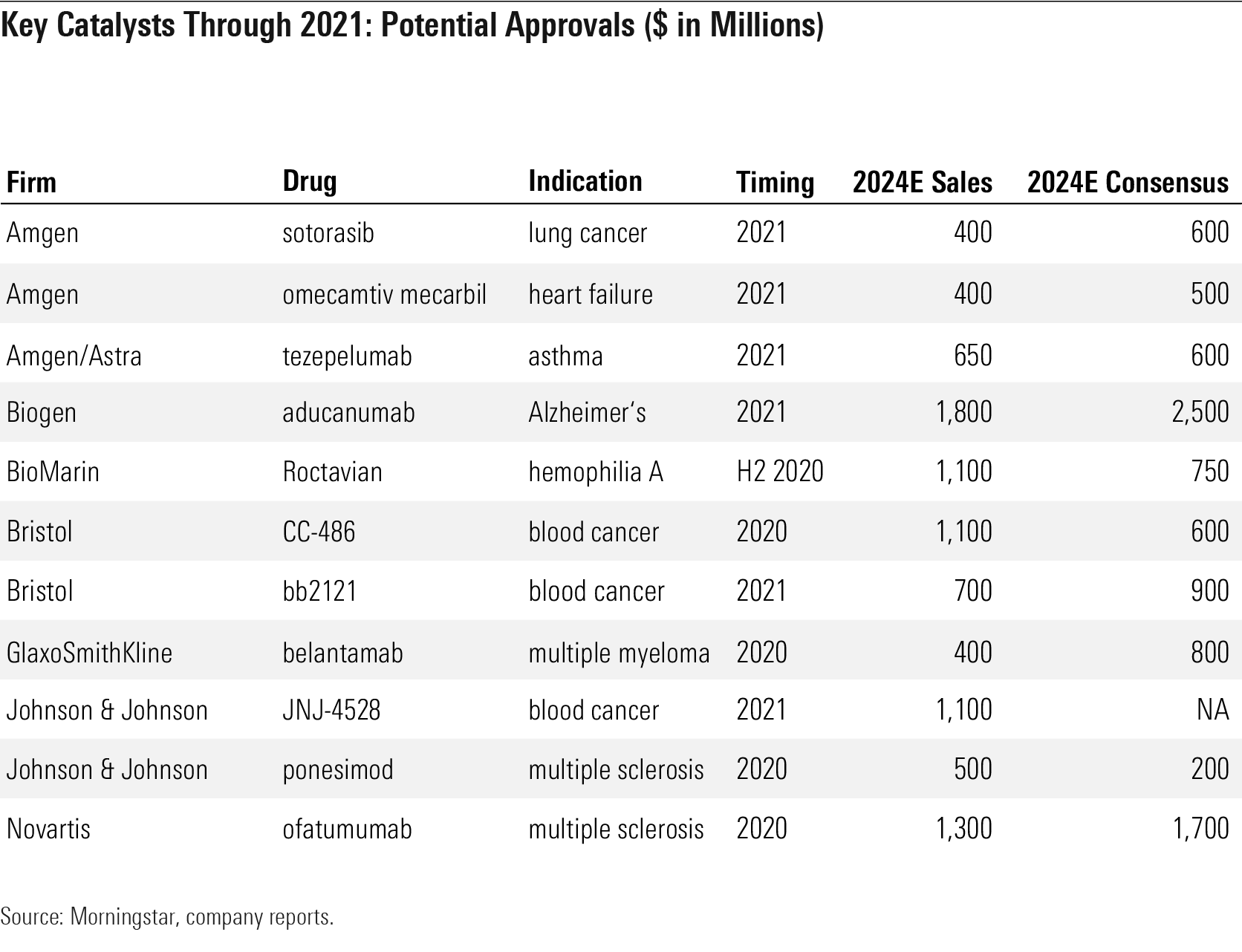

Key Catalysts Through 2021: Amgen and Bristol's Pipeline Drugs Could Launch in the Next Year Big Pharma and Big Biotech companies' stock prices tend to move significantly with clinical data and drug approvals. While Morningstar and market forecasts probability-weight future events, the actual outcome is often a catalyst for share movement as estimates change and uncertainty around those estimates declines. We see a healthy number of catalysts through the end of 2021 in a variety of indications, supporting pipeline productivity and economic moats.

We see several important events for Amgen AMGN and Bristol through 2021, in particular. Amgen could see key data in late 2020 and approvals in 2021 for three key therapies: sotorasib (lung cancer), omecamtiv mecarbil (heart failure), and tezepelumab (asthma). Bristol is in a position to see several approvals stemming from its 2019 acquisition of Celgene, following on the heels of the recent approval of Zeposia (ozanimod) in multiple sclerosis.

Through 2021, we expect approval of three key blood cancer therapies: CC-486 and CAR-T therapies liso-cel and bb2121. Bristol will see competition in blood cancer from rivals including Johnson & Johnson’s JNJ-4528 (estimated 2021 approval) and Glaxo’s GSK belantamab (estimated 2020 approval), and in multiple sclerosis from J&J’s ponesimod (estimated 2020 approval) and Novartis’ NVS ofatumumab (estimated 2020 approval).

Biogen BIIB is also at a critical point for its aducanumab program, which was filed with the Food and Drug Administration in July 2020 and should receive an FDA decision in 2021; while we only model a 40% probability of approval, we do model a 20% probability of approval of Roche’s similar drug gantenerumab (phase 3 data expected in 2021) and see efficacy of Novo Nordisk’s NVO GLP-1 therapies as a wild card (liraglutide data expected in 2020).

Novo Nordisk and Eli Lilly LLY will continue to face off in the GLP-1 market, as Novo Nordisk hopes to produce high-dose Ozempic data to match recent strong data for high-dose Trulicity, and both pharma companies look to improve on this with combination regimens (Eli Lilly’s GIP/GLP tirzepatide should have data in 2020-21).

BioMarin BMRN is also at a critical point in its rare-disease pipeline, with hemophilia A gene therapy Roctavian and achondroplasia therapy vosoritide poised for launches over the next year.

Oncology and immunology remain two key areas for new data. In oncology, we will see some of the first key data in adjuvant lung indications come through for PD-1/PD-L1 antibodies, including Astra’s Imfinzi (estimated 2021), Merck’s Keytruda (estimated 2021), and Roche’s Tecentriq (estimated 2021-22). In immunology, AbbVie looks poised to expand its approval for JAK inhibitor Rinvoq as Gilead’s filgotinib (arthritis), Pfizer’s abrocitinib (atopic dermatitis), and Roche’s etrolizumab (ulcerative colitis) could enter the market. There is also more head-to-head data coming in this space, with Rinvoq data versus Dupixent expected in early 2021 in atopic dermatitis, Stelara data versus Humira in Crohn’s coming in 2020, and Bristol’s BMS-986165 versus Otezla in psoriasis expected in late 2020.

Key catalysts Through 2021: Potential Approvals ($ in Million)

Key Catalysts Through 2021: Clinical Data ($ in Millions)

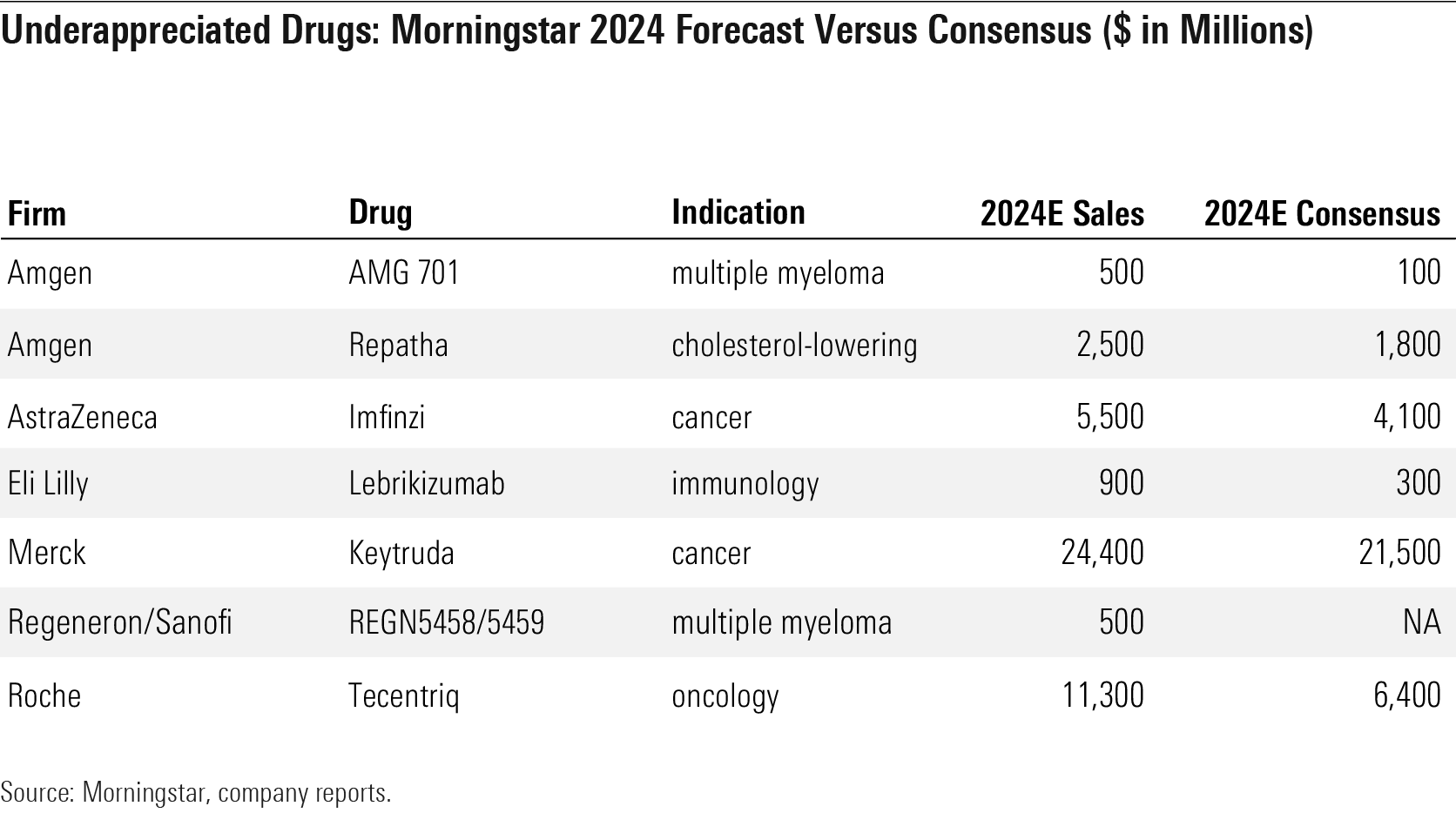

Where We Differ: Pipeline Drugs in Immunology and Oncology Underappreciated When stacked against consensus, our forecasts tend to favor newer oncology and immunology programs over aging products facing potential branded or generic competition, which we think supports research and development productivity and economic moats for companies with healthy new product portfolios and/or solid pipelines.

Oncology is one of the key areas where our estimates differ from consensus; we are generally more bullish than consensus in this market. In immuno-oncology, we think the potential for newer PD-1/PD-L1 therapies to grow new markets has been underappreciated, including Astra’s Imfinzi (earlier-stage lung cancer) and Roche’s Tecentriq (lung cancer, breast cancer, and liver cancer). Merck’s leading drug Keytruda also looks undervalued, as the market is still underestimating the overall opportunity for future growth. Keytruda should gain approvals in earlier-stage lung cancer and expand share, particularly internationally, over the next few years.

In multiple myeloma specifically, we see more potential for bispecific antibodies targeting B-cell maturation antigen (such as Amgen’s AMG 701 and Regeneron/Sanofi’s SNY REGN5458/5459) than consensus does, and less potential for Glaxo’s antibody-drug conjugate belantamab (which should be earlier to market, but with weaker efficacy).

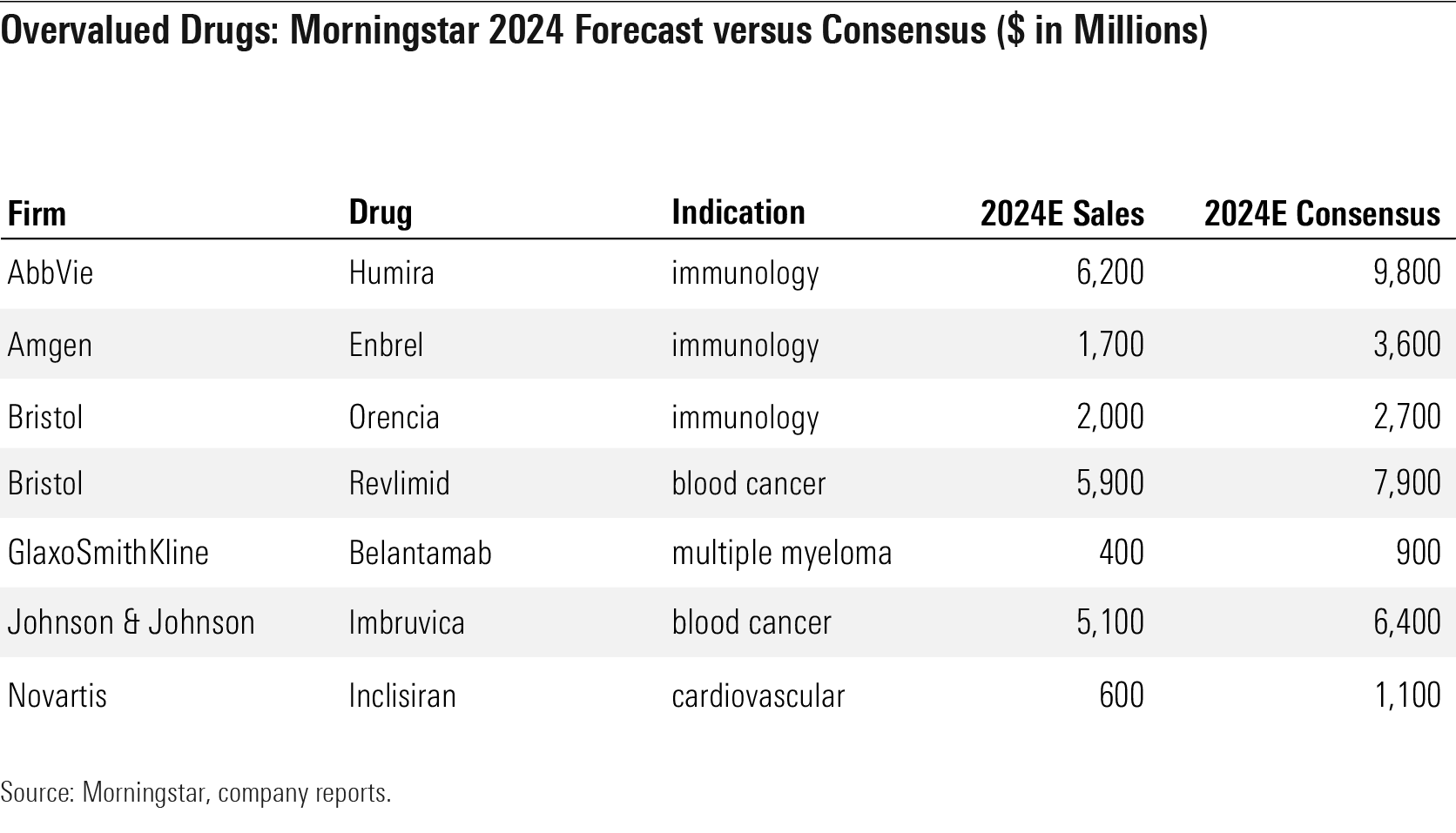

Two established drugs in oncology look overvalued, as we expect faster generic erosion for Bristol’s Revlimid and steeper competition for J&J/AbbVie’s Imbruvica than consensus.

We see a similar theme in immunology, with several undervalued newer drugs and a handful of older therapies that should fade more rapidly than consensus predicts.

For example, JAK inhibitors like AbbVie’s Rinvoq and Pfizer’s abrocitinib, as well as Eli Lilly’s lebrikizumab, look strong in atopic dermatitis, and we expect them to take some share from Dupixent’s dominant position. Gilead’s filgotinib has significant potential in arthritis due to its strong safety profile, and Eli Lilly’s Taltz also looks undervalued.

However, we assume steeper declines for AbbVie’s Humira, Amgen’s Enbrel, and Bristol’s Orencia as new competition and biosimilars hit the market over the next few years.

In cholesterol-lowering, we still see significant potential for Amgen to expand its Repatha franchise, which looks undervalued, and slower potential for inclisiran, which looks overvalued, to gain share, as we await long-term survival data.

Underappreciated Drugs: Morningstar 2024 Forecast Versus Consensus ($ in Million)

Overvalued Drugs: Morningstar 2024 Forecast Versus Consensus ($ in Millions)

M&A Most Likely to Focus on Midsize Deals at Biotech and Pharma Companies Among the major acquisitions of the past 20 years, the key motivations for acquiring companies have been cutting costs, adding growth, and replenishing pipelines. Motives around diversification have sent mixed signals, with AbbVie looking for diversification in Allergan versus the many divestments from Big Pharma, including animal health, consumer health, and noncore therapeutic areas. This gives us less clarity on how companies want to position themselves through corporate actions.

However, we think more-focused strategies are likely to dominate in M&A philosophy over the next few years. Value creation was rarely achieved in the large deals of the past decades; these acquisitions tended to capture most of management efforts, leaving less focus on innovation.

As a result, we expect most deals to focus on smaller companies that can be tucked into operations more easily with a focus on innovative new drugs. However, the most important factor in all acquisitions is price, which tends to be higher for the smaller companies as acquisition premiums are placed on valuations. Therefore, we still expect companies to make larger acquisitions, like Bristol’s acquisition of Celgene to gain innovative pipeline drugs.

Also, we see several companies that have had healthy share price performance, allowing them to issue shares to pay for larger deals if necessary. Amgen, Astra, and Regeneron are prime examples of pharma and biotech companies that will potentially leverage stock price gains in a larger acquisition.

Among large-cap targets, we think Regeneron looks appealing, given its strong bispecific antibody pipeline in oncology and recently reduced investment from longtime partner Sanofi. Among smaller-cap targets, we think several oncology targets could be logical additions for their large-cap partners in combination therapy, like Seattle Genetics SGEN (Bristol’s Opdivo with Adcetris in Hodgkin’s lymphoma), Nektar NKTR (Bristol’s Opdivo with bempegaldesleukin in multiple cancers), and Exelixis EXEL (Roche’s Tecentriq with cabozantinib in multiple cancers). We also see RNA-focused companies like Moderna MRNA (Merck collaboration) and BioNTech (Pfizer and Roche collaborations) being logical targets, as technology is currently being validated with SARS-CoV-2 vaccines in clinical testing at a much more rapid pace than expected.

Alexion ALXN has been under pressure to pursue a sale from key investors, and Gilead and Roche (both focused on building immunology exposure) could be logical buyers, although we see this as less likely than some other potential deals. Momenta MNTA also looks particularly appealing as one of the leaders in the FcRn antibody market, which could serve multiple autoimmune markets; Amgen, Gilead, Regeneron, or Roche could all be interested in its pipeline of drugs.

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)