How ESG Risk Affects Pharma and Biotech Moats and Valuations

Morningstar and Sustainalytics offer complementary methodologies.

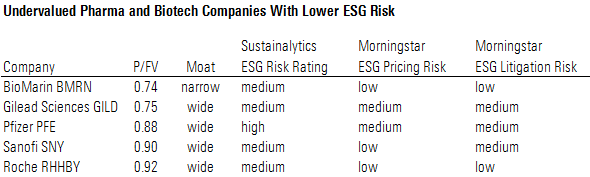

When we incorporated environmental, social, and governance factors into our valuation analysis for Big Pharma and Big Biotech at Morningstar, we focused on material ESG issues, or MEIs, in the social realm, where we think these companies are exposed to the most ESG risk. Sustainalytics' business ethics, product governance, and access to basic services MEIs stood out as the key issues that could affect valuations for our top 18 Big Pharma and Big Biotech names under coverage at Morningstar. After analyzing pricing strategies, ethics-related inquiries, and product safety-related litigation at each of these companies, we have modified our models to include annual litigation expenses in our base-case forecasts and additional U.S. pricing reform-related sales hits in our bear-case forecasts. We've tied the magnitude of these headwinds to each company's U.S. exposure (which boosts litigation and pricing risk), reliance on price increases, U.S. price discrepancies versus other developed markets, and exposure to medicines targeting chronic, less severe diseases (which we see as more exposed to litigation costs). Our ESG analysis provides a comprehensive evaluation that supports our mostly wide economic moat ratings for the industry. Overall, Morningstar sees undervalued names Roche RHHBY and BioMarin Pharmaceutical BMRN as having the lowest exposure to ESG-related risks. We also like Gilead Sciences GILD, Sanofi SNY, and Pfizer PFE on both valuation and ESG risk. Johnson & Johnson JNJ and Eli Lilly LLY look the least compelling to us, based on litigation risk and valuation, while AbbVie ABBV and Biogen BIIB look undervalued despite high pricing risk.

Undervalued Pharma and Biotech Companies With Lower ESG Risk

Morningstar and Sustainalytics (44% owned by Morningstar) are collaborating to broaden and deepen our ESG analysis. Our first healthcare-focused ESG report centers on the pharmaceutical and biotech industries, where U.S. pricing reform has created a significant overhang on valuations. We see realistic reform measures as manageable, and our top 18 pharma and biotech names traded at an 8% discount on average to our fair value estimates at the start of 2020.

Sustainalytics offers a comprehensive, industry-based approach to ESG risk, the starting point of our analysis. Morningstar has concluded that valuation-affecting ESG risk for branded drug companies centers on pricing risk (largely U.S.) and litigation risk (largely product safety-related). We've adjusted our valuations and scenario analyses for these risks, with significant fair value estimate adjustments for litigation risk to Bayer BAYRY and Lilly and the largest bear-case scenario adjustments for pricing risk to AbbVie and Biogen.

Our moat ratings for these 18 companies are mostly tied to the strength of their intangible assets over the next 15-20 years, which we see as heavily linked to industry research and development productivity and continued innovation as patents on older medicines expire. Although we think disruptive U.S. pricing reform (tying U.S. prices to international prices) could reduce U.S. branded drug spending by 24%, we only include a 25% probability of this occurring in a bear case. We see reforms like price inflation caps and structural changes to Medicare Part D discounting, included in the Senate's PDPRA bill, as more likely and much more manageable, and we estimate a combined 5% hit to U.S. branded drug sales from these measures in our bear case, resulting in no moat impact.

Roche and BioMarin Have Lowest ESG Risk Under Morningstar's Analysis Overall, Morningstar sees the lowest exposure to ESG-related risks at Roche and BioMarin, and both names stand out as undervalued. Roche's diagnostics diversification, global pricing strategies, and focus on severe diseases lower pricing and litigation risk. In addition, Roche's current U.S. biosimilar pressure (included in our base case) already factors in much of the potential headwind from international benchmark pricing, which could be tested in Medicare Part B. BioMarin's global pricing strategy for its rare-disease drugs as well as the serious nature of these conditions limits future pricing and litigation risk, despite high price tags, and Medicare exposure is minimal.

Other companies, including Sanofi and Gilead, perform well on ESG measures and look undervalued. Gilead's limited U.S. price increases for its HIV portfolio have helped the company avoid massive price discrepancies with other markets. Sanofi's diversified business and rare-disease portfolio limit exposure to U.S. pricing reform. Pfizer also performs well, but exposure to Medicare Part D oncology therapies (expensive medicines that also generally see significant price increases) gives exposure to potential U.S. pricing reform.

J&J and Lilly look the least compelling to us, based on litigation risk and valuation, while AbbVie and Biogen look undervalued despite high pricing risk. J&J and Lilly both have portfolios focused on chronic, less severe diseases, a history of significant litigation expenses, and fully valued portfolios and pipelines. Biogen's multiple sclerosis portfolio and AbbVie's immunology therapies have built up the largest U.S. price discrepancies versus other developed markets, and both have high U.S. exposure; however, current valuations don't appear to give enough credit to their newer products and pipelines.

ESG issues can have significant impacts on our valuation or fair value uncertainty ratings when isolated. In our first healthcare ESG report, we're focusing on branded biotech and pharmaceutical companies, which have been at the center of controversy over high prices and product safety issues as well as blurred ethical lines relating to areas like intellectual property extension, delayed generic entry, and collusion.

Partnering with Sustainalytics and using Sustainalytics' terminology for material ESG issues, we see three MEIs significantly affecting our valuation of branded drug companies, all of which fit under the social branch of ESG: business ethics, product governance, and access to basic services. Sustainalytics generally incorporates a broader view of these MEIs that includes issues that are likely to affect our valuation as well as more ethical considerations. We've narrowed our approach to focus on areas that directly hit our valuation. Because Morningstar's definitions differ slightly, we're using the term "pricing risk" instead of "access to basic services," and we're blending business ethics and product governance into a "litigation risk" metric.

No Moat Rating Changes Following ESG Analysis As a group, our Big Pharma and Big Biotech coverage has roughly 44% of sales from U.S. branded drugs, or roughly 60% of total branded drug sales from the United States. Big Pharma and Big Biotech companies under our coverage generally fall into two categories: those with a focus on branded drugs, making the U.S. a 50%-plus share of sales, or companies with multiple business units like diagnostics, over-the-counter drugs, and generics that diversify business and lower the percentage of sales from U.S. branded drugs. In addition, some companies have higher price discrepancies that further increase the proportion of sales in the U.S. (like Amgen and AbbVie's immunology franchises or Biogen's multiple sclerosis franchise), and some have much higher market penetration in the U.S. (like Gilead's HIV business). Regeneron's REGN U.S. exposure is a factor of its Bayer collaboration on Eylea, as virtually all of the company's product sales tie to the U.S. geography for Eylea sales. While this exposure can change with time, companies with higher U.S. exposure tend to have higher pricing risk.

Not only are prices generally higher in the U.S., but industry dynamics like pharmacy benefit manager consolidation and payer/PBM mergers are giving companies tougher negotiating partners as they fight for the best formulary access. Due to higher U.S. prices, companies are even more sensitive to U.S. sales than their sales exposure indicates; although they do not disclose the percentage of profits coming from the U.S., the Brookings Institution estimates that the U.S. is 64%-78% of drug industry profits. Also, possible U.S. regulatory changes on drug pricing are coming into focus.

Focusing on product and ethical liabilities, higher U.S. exposure also tends to mean higher litigation risk. Drugs can create side effects that can lead to increased warnings on labels, product recalls, and major litigation, especially in the U.S.

However, even the companies with the highest ESG-related risks on pricing and litigation had no moat rating changes following our analysis. For example, Biogen is the only company to which we assigned a severe risk rating on price discrepancies, largely because of its exposure to U.S. sales of multiple sclerosis drugs. In our bear-case scenario for Biogen, we now assume a 25% hit to U.S. drug prices, in addition to other stock-specific pipeline and margin risks that were already included in our bear-case scenario. Even with this adjustment, Biogen's returns on invested capital stay north of its 7% cost of capital.

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)