Are Independent Refiners Still Competitive?

Despite a difficult market, their advantages are intact.

The refining market remains in recovery following what is likely to be the trough in refined product demand in the second quarter. Demand has begun to recover, although the future pace is in question as infections continue to spread, potentially slowing the economic recovery. As such, refiners will probably have to maintain utilization discipline through at least the remainder of the year, with most management teams not expecting a return to average inventory levels until the middle of next year. Investors should expect poor earnings until then as margins are likely to remain weak. However, predicting short-term margin and crude differential movements is a waste of time. Given the unpredictability of near-term macro conditions, we think the more important question for investors is: Will refiners retain their long-term advantages, or will there be any post-pandemic structural changes that negate them? We don’t think the latter will happen, but all competitive positions aren’t equal.

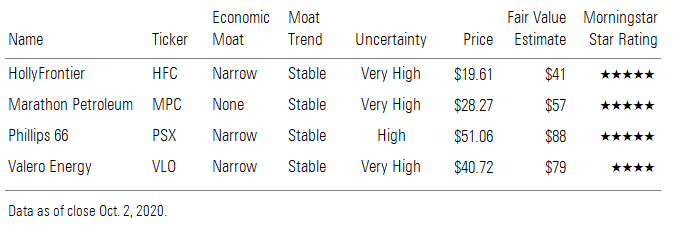

Given that all refiners appear relatively cheap, we’d lean toward quality, which means we prefer Valero Energy VLO. A rising tide of improved product demand, lower inventory levels, and higher margins will lift all boats, but as a pure-play refiner with the highest-quality assets, Valero stands to benefit while offering protection if the difficult environment persists longer than expected.

Market Is Recovering, but Likely Has a Way to Go A recovery in refined product demand is slowly underway. Both gasoline and distillate have shown more progress than jet fuel, although their initial declines were less severe. During the month of July, weekly gasoline and distillate demand was about 10% lower than the same period in 2019, which jet fuel demand was about 45% lower. While the year-over-year decline in demand is a negative for refiners, the recovery for gasoline and distillate is a positive. Although jet fuel continues to languish, it makes up only about 10% of U.S. refiner yields, while gasoline and distillate combined make up 75%.

The recovery in demand has allowed refiners to increase capacity utilization, most recently running over 80% compared with trough levels of 68% earlier. Additional gains in the near term might be difficult, however. Based on management guidance, the refiners we cover (HollyFrontier HFC, Marathon Petroleum MPC, Phillips 66 PSX, and Valero) will only run at about 78% of capacity on average during the third quarter, implying stabilization, not improvement. Management commentary during second-quarter conference calls also implied that a return to normalized inventory levels might not occur until the middle of next year at the earliest, which will probably prevent further utilization gains in the interim. Additionally, utilization typically falls during the end of the third quarter because of a seasonal decline in demand. This year is unlikely to be any different.

The recovery in inventories has been uneven. Gasoline inventories remain above average levels but have improved, particularly on a demand-adjusted basis (days of supply), as absolute levels have fallen while demand has improved. Distillate inventories have not shown similar improvement. Inventory in absolute terms as well as on a demand-adjusted basis remains well above historical levels. Jet fuel will likely continue to be mixed into the distillate pool as long as air travel demand is weak, which will inflate inventories.

Margin improvement has proved more elusive. While gasoline margins have improved sharply off April lows, they have stabilized at relatively low levels since. Given the inventory overhang as well as low utilization levels (potential inventory), margins are unlikely to mount a bigger comeback without a meaningful increase in demand. Gasoline margins had been relatively weak for several years before the pandemic as overproduction due to strong distillate margins and wide crude spreads spurred overproduction of gasoline. Now, however, distillate margins--which had largely driven refiners’ profits--are weak as well. Similar to gasoline, those margins are unlikely to improve without demand recovery in distillate as well as jet fuel.

Are U.S. Refiners' Competitive Advantages Intact? While we monitor the underlying fundamentals of the refining market closely, predicting near-term movements of product margins and crude spreads, the key profitability indicators, is nearly impossible and certainly beyond our abilities. We can, however, look beyond the current situation to determine if U.S. refiners' competitive advantages are intact. After doing so, we think they are, leaving our economic moat ratings unchanged.

Refiners’ moats stem from a cost advantage relative to global peers that is based on three things: refinery complexity, access to discount crude, particularly domestic light tight oil, and low-cost natural gas.

Complexity and Heavy Sour Crude Differentials Greater complexity allows a refiner to process a wider range of crudes. A refiner can purchase lower-quality crudes (heavy sour) for lower prices and convert them into equivalent amounts of clean product that refining light crude would otherwise produce. The difference in price between the lower-quality heavy sour crudes and higher-quality light crudes improves the refiner's realized margin. Complexity is not going away. Once installed in the refinery, it's there to stay. The bigger threat to complexity, in our view, is persistent narrow heavy sour differentials that diminish the advantage of holding complex facilities by reducing their margin potential and incurring higher processing costs without commensurate margin uplift.

While heavy sour differentials have narrowed lately as supply has fallen because of Venezuela and Mexico production declines, OPEC production quota reductions, and Canada production curtailments (lower-quality barrels are the first to be cut in the last two cases), we only view Venezuela and Mexico production as a long-term issue that is unlikely to materially reverse. As demand recovers over the next year, we expect OPEC to restore its volumes, which should mean greater availability of sour crudes, while the growth outlook for Canadian production is largely intact.

Domestic Light Tight Crude Differentials We also do not see long-term access to domestic light crude to be an issue, although differentials will probably be pressured in the near term. As producers cut back on production, volumes are no longer nearly close enough to fill up recently completed pipeline capacity. As a result, light crude differentials have narrowed since the beginning of the year.

We think the days of double-digit domestic spreads are long gone. After years of growing production and investment, our forecast suggests pipeline takeaway capacity will be sufficient to accommodate growing light tight oil production for the next five years at least. So, despite a return to light tight oil production growth, particularly in the Permian, this pipeline overcapacity should keep a lid on differentials and prevent the spikes to double-digit levels that we’ve seen in the recent past. Although theoretically a floor should be set at transportation cost to the Gulf Coast (approximately $4-$5 a barrel from Cushing and $3/bbl from Midland) we’ve seen spreads fall below that level at times. Forecasting near-term spreads is a fool’s errand, but over the long term, we’d expect spreads to trade around transportation levels, which would still provide U.S. refiners with a light crude cost advantage relative to global competitors.

At a time of narrower differentials, refiners’ complexity plays a role as well. Combined with an advantageous location, it means refiners hold greater crude availability and flexibility. So, when light crude spreads are narrow and relatively unattractive, refiners can process more heavy sour crude from foreign sources. Ultimately, feedstock flexibility is paramount in refining; thanks to their quality assets and varied sources of cost-advantaged crude, U.S. refiners have it more so than global peers.

Low Domestic Natural Gas Prices The decline in global natural gas prices due to the coronavirus pandemic has negated one of U.S. refiners' key advantages, as refiners who use natural gas around the world are on par. Natural gas is a critical input to the refining process as it can be used to heat the crude oil for cracking and in the upgrading process to produce hydrogen. Given the energy intensity of refining, lower natural gas prices can have a meaningful impact on operating costs. For example, Valero estimates that at 2019 prices, its natural gas costs are nearly half those of comparable European refiners ($0.79/bbl versus $4.81/bbl). Our past analysis suggests other U.S. refiners enjoy similar benefits. This also does not demonstrate the benefit versus refiners that rely on liquids-priced fuels to operate their refineries.

Granted, this advantage is diminished in the current price environment. However, at this point we do not see any structural changes to the industry or long-term impacts on global natural gas demand. Development of higher-cost liquefied natural gas facilities will still be needed to meet global gas demand. Those projects need higher prices, implying that global natural gas prices will rise to historical levels once demand recovers.

Narrow Moats Largely Intact Because we believe the underlying elements of refiners' cost advantage is intact, we are not revising most of our narrow moat ratings. The exception is Marathon Petroleum, whose moat rating we downgraded to none in the wake of the Andeavor deal. The addition of Andeavor's West Coast facilities diluted what was Marathon's previously midcontinent- and Gulf Coast-focused portfolio. The aforementioned competitive advantages are weaker on the West Coast, particularly California, and operating costs are higher. Additionally, incorporating Andeavor fully into our Marathon model resulted a very narrow excess returns spread. Taken together, we now have less confidence in Marathon's ability to earn excess returns 10 years from now.

We acknowledge that refiners will face increasing pressure as long-term gasoline demand wanes from electric vehicle adoption. However, our work suggests that the effect remains more than 10 years out, resulting in little impact on our moats. We will continue to monitor EVs’ penetration and impact on gasoline demand.

Combating Demand Decline With Renewable Diesel Although we estimate that a steep decline in gasoline demand remains more than a decade off, refiners are prudently taking steps to prepare for that day. One of those steps is to make the transition to renewable diesel. Although current producing and planned projects amount to only 100 thousand barrels a day compared with 8.9 million barrels a day of refining capacity, the transition remains in early days.

Valero is the only refiner currently producing renewable diesel. Through its Diamond Green Diesel joint venture, it produces 275 million gallons annually (gross) next to its St. Charles, Louisiana, refinery and has plans in the state for a 400 million-gallon annual expansion. HollyFrontier has a project underway at its Artesia, New Mexico, facility but recently announced plans to shutter its Cheyenne, Wyoming, facility and convert it to renewable diesel production. Phillips 66 just announced plans to do the same to its Rodeo, California, refinery. Marathon Petroleum, which is converting its Dickinson, North Dakota, refinery to renewable diesel plant, is exploring the idea of doing the same with a recently shuttered Martinez, California, refinery.

Renewable diesel is attractive to petroleum refiners for several reasons. First, its production process is similar to crude oil-based fuels and it’s chemically similar to petroleum refined products, so it’s not subject to blending limits like many other renewable fuels such as biodiesel. The higher blending rates allow refiners to generate renewable identification numbers at a greater rate because of higher volumes, and also because renewable diesel has a higher RIN-equivalent rate (1.6-1.7) than other biofuels like ethanol (1.0).

The supply/demand outlook is also favorable. The Renewable Fuel Standard in the United States, low-carbon fuel standards in California and Oregon, and existing and proposed programs in Canada support growing long-term demand. Baker & O’Brien estimates combined demand from these programs will exceed supply (including announced projects) in 2025. Additionally, renewable diesel can have carbon intensity 50%-90% lower than gasoline and diesel, depending on the feedstock, which should help address refiners’ growing focus on environmental, social, and governance concerns. Finally, renewable diesel projects look returns-accretive by meeting Valero’s hurdle rate of a 25% aftertax internal rate of return, while HollyFrontier estimates a 20%-30% IRR on its projects.

Holly Frontier, Marathon Petroleum, Phillips 66, Valero Energy

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)