3 Things for U.S. Utilities Investors to Watch

Valuation, growth capital expenditure, and renewable energy are top of mind.

Utilities have faced atypical volatility during the past three months. Shelter-in-place orders have driven commercial and industrial energy demand down at a stunning pace while once-stagnant residential demand has jumped. Utilities stocks have bounced like racquetballs. What will the post-pandemic world look like for utilities? We think there are three critical investment themes.

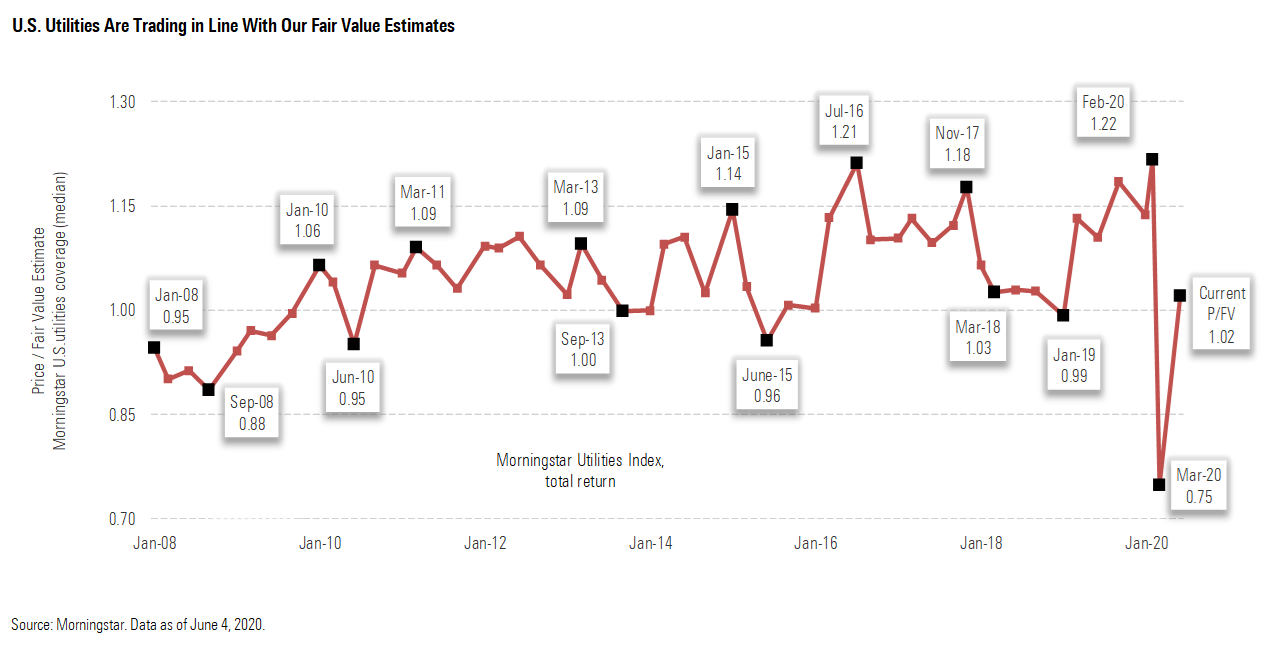

Valuation matters. The past three months prove investors should heed valuation signals, even for utilities. Since we warned of record-high utilities valuations in late February, the Morningstar U.S. Utilities Index is down 15%, trailing the S&P 500 (down 8%). U.S. utilities are now in line with our fair value estimates. With interest rates still low, investors might find dividend yields attractive.

Capital investment equals long-term growth. We forecast $656 billion of capital expenditures over the next five years for the U.S. utilities we cover, more bullish than consensus and up from $541 billion during the past five years. This capital investment supports our median 5.5% earnings growth and 6.5% dividend growth forecasts through 2024.

Renewable energy is a must-have. Growth and income investors will benefit from owning companies that invest in renewable energy and supporting infrastructure during the next 5-10 years. Utilities have substantial ground to cover to meet public policy targets and corporate demand.

U.S Utilities Are Trending in Line With Our Fair Value Estimates

Triple-Play Top Picks: Valuation, Growth, Renewable Energy Edison International's EIX focused electric business has growth opportunities and a history of regulatory support that would make most utilities envious. With plans for $5 billion of annual capital investment to support California's renewable energy and safety policies, Edison can average 6% annual earnings growth on a normalized basis, in our view. It locked up financing to support its growth through 2022 and has regulatory structures in place to protect it from coronavirus-related swings in electric demand. With an attractive combination of growth, yield, and value, Edison is one of our top utilities picks as of late early June.

We think Duke Energy’s DUK valuation discount to peers is unjustified, given its favorable regulation and investment opportunities that support consistent earnings and dividend growth. Florida remains one of the most constructive regulatory jurisdictions, with sector-leading allowed returns on equity, automatic rate base adjustments, and strong renewable growth investment potential. North Carolina continues to support Duke’s growth investments in electric and gas transmission and distribution infrastructure.

AES AES has narrowed its geographic and business focus by selling businesses in markets where it did not have a competitive advantage or opportunity for expansion. Today, the company has a stronger balance sheet and a rapidly growing renewable energy business supported by a well-positioned battery storage joint venture with Siemens. AES has about 2 gigawatts of renewable energy projects under construction or with signed power purchase agreements and has been adding new PPAs at the rate of almost 2 GW per year.

Although not classified as a utility, First Solar FSLR offers investors exposure to the rapidly growing solar market without the volatility of speculative clean-energy upstarts. As the world’s oldest and largest thin-film solar panel manufacturer, First Solar produces steady cash flow like a mature industrial company. We estimate free cash flow in 2020-23 will total $19.50 per share, and the company’s $1.6 billion of cash as of April is enough to cover planned growth investments. Free cash flow before growth should top $5 per share by 2023, an 11% yield as of late May.

Theme 1: Utilities' Valuations Back to the Future We think the post-COVID-19 environment will look a lot like the pre-COVID-19 environment. Utilities will continue providing essential energy sources in a mostly regulated rate structure, the foundation of our narrow moat ratings for most utilities. We also believe utilities will remain defensive investments valued for their higher-than-market dividend yields and payouts. And we believe utilities will maintain stable investment-grade credit profiles while funding growth investment.

Utilities have earned their defensive credibility by faring the least badly during market downturns, but this year proved that valuation is critical. In February, utilities reached a median 23 price/earnings multiple and 1.22 price/fair value ratio, both the highest of any month preceding a bear market during the past 40 years. This is the first bear market that utilities have underperformed the S&P 500.

Utilities' current valuations position them better to produce defensive returns if there is an extended recession. Morningstar expects a 6% drop in U.S. gross domestic product in 2020. However, we expect GDP to eventually catch up to just 1 percentage point below its pre-COVID-19 trend, which implies faster-than-normal growth in the years following 2020.

We don’t expect utilities to revisit the volatility they showed in March and April. Utilities had six of the sector’s eight largest single-day moves in at least 40 years in mid-March, including four days of 10% or larger moves. In the past 10 years, utilities had never moved more than 6% in a single week until late February, when they moved more than 6% up and down during seven consecutive weeks.

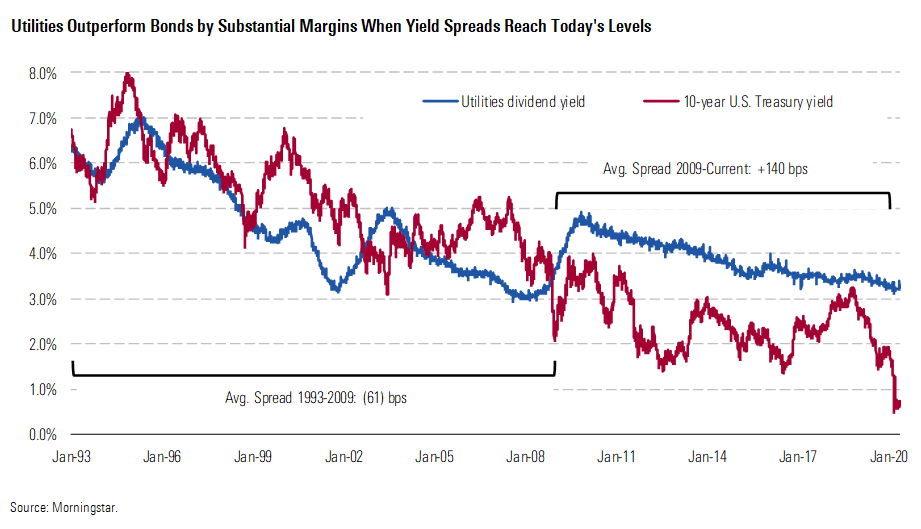

Falling Interest Rates a Double-Edge Sword The combination of still-falling interest rates and rising dividend yields has caused a historically high yield premium for utilities. In late May, the spread between 10-year U.S. Treasury yields at 0.6% and utilities' 3.2% trailing dividend yield nearly matched the sector's mid-2012 record spread when 10-year U.S. Treasury yields hit 1.5% and utilities' dividend yield was 4.2%. In 2012, utilities gained 17% while U.S. Treasury prices fell 14% during the 18 months following the peak spread. On average during the past 30 years, utilities' three-year annualized returns have topped Treasury bond returns by 10 percentage points when utilities' dividend yield premiums were at least 150 basis points.

Utilities Outperform Bonds by Substantial Margin When Yield Spreads Reach Today's Level

Low interest rates have made dividends more attractive and lowered utilities’ borrowing costs, helping earnings. However, lower interest rates could be an offsetting headwind if regulators cut utilities’ allowed returns. Heightened regulatory risk could depress valuations if customer rate changes slow earnings growth. Following are some situations to watch.

While we viewed Illinois’ move toward allowed returns tied to the 30-year Treasury as a positive, low interest rates are now a headwind for Ameren’s AEE and Exelon’s EXC utility subsidiaries. Ameren estimates a full-year allowed return on equity of just 7.3%, by far the lowest among its regulated peers.

The 9.4% allowed ROE and less favorable hypothetical capital structure settlement that Texas regulators approved for CenterPoint Energy’s CNP Houston Electric earlier this year unnerved the sector. Xcel Energy XEL, Atmos Energy ATO, and Sempra Energy SRE have sizable distribution utilities in the state.

Xcel’s Texas utility faces an allowed ROE cut after settling on an $88 million rate increase and 9.45% allowed ROE, down from its $141 million rate increase (later revised to $130 million) and 10.1% allowed ROE request. Similarly, New Mexico regulators recently approved a 9.45% allowed ROE, down from its 9.56% current rate and 10.1% request. Texas and New Mexico together represent 20% of Xcel’s earnings. Xcel also faces rate pressure in Colorado, which represents about 40% of earnings. In February, regulators approved only one third of Xcel’s electric rate increase request based on a 9.3% allowed ROE, down from its previous 9.8% allowed ROE and 10.2% request. Xcel is now requesting a 9.95% allowed ROE as part of its gas rate increase proposal. We think regulators might go below its current 9.35% ROE if interest rates are still falling. Also, rate litigation in Xcel’s largest jurisdiction, Minnesota, could be coming in 2021.

California’s three investor-owned utilities have been able to avoid ROE cuts despite the state’s annual interest-rate adjustment factor. Instead, the utilities have negotiated settlements that keep the allowed ROE at 10.3% for Edison, 10.25% for PG&E PCG, and 10.2% for Sempra, all among the highest in the country.

PPL’s PPL international delivery segment is the largest distribution utility in the United Kingdom, but it also adds shareholder risk as the U.K. regulatory environment comes under political and regulatory pressure. Investors will need to wait until the end of 2020 for the RIIO-ED2 methodology to be finalized, which should bring clarity on specific targets for revenue, allowed returns, and incentive revenue. We expect returns will be significantly lower. U.K. regulators recently suggested just 4% rates of return for gas distribution, gas transmission, and electricity transmission. If electricity distribution rates of return are subject to similar treatment, we think it will be difficult for PPL to invest significant growth capital to help offset what we expect will be materially lower returns. However, recent elections provide hope that returns for electric distributors could be higher.

Theme 2: Morningstar's Capital Expenditure Forecast Utilities continue to have robust long-term opportunities to increase earnings by investing in aging infrastructure, electric transmission, and renewable energy. While we recently revised our 2020 capital investment forecasts because of concerns about the economic and supply chain ramifications of COVID-19, we continue to see ample long-term earnings growth opportunities. Our expectation for natural gas prices at $2.80 per thousand cubic feet also provides ample room for utility investment with minimal customer bill impact.

In 2019, utilities we cover spent $120.8 billion on capital investment, well above the five-year inflation adjusted average of $113.6 billion. We expect utilities to spend $130.3 billion in 2020 and $135.0 billion in 2021. The increase from 2020 to 2021 we attribute to the slight shift in capital we incorporated to account for the supply chain disruptions and social distancing requirements we expect will have an impact on utilities’ ability to fully invest in their 2020 capital plans. Our 2020 capital forecast is in line with consensus estimates, but our 2021 capital forecast is 7% above consensus estimates. We remain confident that utilities can shift planned capital expenditures because of COVID-19 headwinds and avoid cutting spending, like we think others are assuming.

Over the next five years, we expect utilities to spend $656 billion, up from the $541 billion spent the prior five years. Across our coverage universe, our five-year capital expenditure forecasts increased a median 13.5%. Electric utilities’ capital investment tips more heavily toward generation and distribution, illustrating investment in renewable energy, natural gas generation, smart grid, and network upgrades.

Increases in Capex Plans Highlight Continued Growth Opportunities Ameren has one of the most attractive growth capital pipelines among its peers. Through 2024, Ameren plans $16 billion in investments supporting nearly 9% rate base growth, a $2.7 billion increase from its prior five-year plan. Beyond 2024, Ameren notes $20 billion in investment opportunities across its operating subsidiaries. An improving regulatory environment in Missouri has spurred investment for grid modernization and renewable generation. We expect Ameren to have additional renewable generation opportunities in Missouri beyond the planned solar and wind generation as the state progresses on its decarbonization goals. Ameren targets 6%-8% earnings growth through 2024, and we think strong execution and growth investments will put it in the top half of that range.

Avangrid’s AGR capital increase is mostly due to timing of renewable development, as the company begins to develop its backlog. Recent management execution missteps have led us to discount our expectations for capital development, particularly Avangrid’s expectations for significant offshore wind development. Continued political and industry pushback against New England Clean Energy Connect causes us to discount the program for our projections. Avangrid withdrew its long-term 8%-10% earnings growth outlook through 2022, with 2018 as its base year. We have long viewed this target as unrealistic, with our current expectations of just 5.5% growth over this period. Management said it will provide a new long-term outlook later this year at the company’s rescheduled analyst day, suggesting further revisions to its capital plan.

Dominion Energy’s D increase in capital investment is due to opportunities in offshore wind development and transmission and distribution. Recent Virginia legislation requires 5.2 GW of utility-owned offshore wind by 2035, estimated to represent capital investment of $8 billion-$17 billion. We were skeptical regulators would not approve the high cost of offshore wind, but the Virginia Clean Economy Act allows energy costs up to $125 per megawatt-hour. Given offshore wind costs in Europe, we think the large project has a decent chance of being approved. The Coastal Virginia Offshore Wind project originally proposed by Dominion is 2.6 GW. This and other renewable energy and storage projects required in the VCEA would almost double Dominion Energy Virginia’s current $24 billion rate base.

After disclosing plans to issue $2.5 billion in equity in 2019, Duke Energy management sought to ease investor concerns about earnings growth by increasing its five-year capital investment plan to $55 billion. The additional growth is focused on its three high-growth operating areas of Florida, North Carolina, and South Carolina. Duke plans to invest another $1.5 billion in Florida in grid hardening and solar investments. Investment in the Carolinas will focus on transmission and distribution investments at its electric business and integrity management and infrastructure investments at its gas distribution business. The investments should allow Duke to achieve the midpoint of its 4%-6% earnings growth guidance for 2020-24.

Our five-year capital plan assumes regulatory approval for New Jersey Resources’ NJR five-year, $507 million infrastructure investment program. The program would help keep distribution investment above $300 million per year even as NJR wraps up other projects in 2020-21. We expect NJR to invest $1.1 billion at the utility and $1.3 billion in its midstream and solar businesses in 2020-22, in line with management’s latest plan. We assume NJR completes its Southern Reliability Link project in 2021 and receives regulatory approval for the initial stages of its infrastructure investment program. We do not include the full planned investment.

Sempra management recently announced an updated $32 billion five-year capital plan, a $7 billion increase from its prior plan. In California, Sempra received a constructive final decision on its general rate case supporting a combined $17.9 billion in capital spending over the next five years. Oncor’s Texas rate base is forecast to grow nearly 7.5% over the next five years on nearly $12 billion in investments. While there has been some concern regarding the regulatory environment due to a disappointing recent rate case outcome at CenterPoint’s Houston Electric, we continue to expect constructive regulatory support for Oncor’s transmission and distribution investments that align well with the state’s renewable transition.

Best Utilities to Benefit From Electric T&D Investments Electric transmission and distribution investments, combined with gas distribution investments, represent nearly 60% of total utility investments, according to the Edison Electric Institute. These investments will help facilitate the continued transition from coal generation to natural gas and renewable energy. The Energy Information Administration forecasts over 11 GW of coal retirements in the next three years alone. We don't expect the near-term effects of COVID-19 to have an impact on the transition away from coal. Furthermore, much of the current electric and natural gas infrastructure is aging and in need of repair. We expect regulators to support these investments, given the heightened focus on safety and reliability.

Below, we highlight three companies with strong growth capital opportunities that will drive healthy growth rates at reasonable valuations compared with the rest of our coverage universe.

Sempra has long maintained a diversified portfolio of traditional regulated utilities and unregulated energy operations. It has derisked its portfolio, focusing on regulated distribution and transmission utilities that are the focus of its healthy capital investment plan. This plan, which includes investments in liquefied natural gas, is focused 80% on Sempra’s regulated subsidiaries.

Sempra has wisely expanded its regulated operations with proceeds from its asset divestitures. It acquired regulated assets in Texas to pair with its regulated California utilities; it acquired Oncor for $18.8 billion and InfraREIT for $1.275 billion, combining two transmission and distribution utilities in a constructive regulatory environment. We think Texas offers numerous benefits for Sempra, particularly the increase in earnings contribution from regulated utility operations that provide more stable cash flows than the company’s unregulated businesses.

Oncor and InfraREIT offer plentiful opportunities for capital investments. Sempra has increased Oncor’s capital expenditure forecast to $12 billion from the $7.5 billion when the transaction was originally announced, driving 7.5% rate base growth. This supports our long-held belief that there are significant additional capital investment opportunities under a parent with a strong balance sheet and lower cost of capital, unlike Oncor’s previous parent, the bankrupt Energy Future Holdings.

Additionally, Sempra’s Texas subsidiaries’ transmission assets should continue to benefit from Texas’ aggressive wind generation build-out, a transition we don’t expect to alter given near-term headwinds from COVID-19. In ERCOT, there are roughly 115 GW of proposed renewable energy newbuild projects (28 GW of wind, 76 GW of solar, and 11 GW of energy storage) in the interconnection queue as of April, highlighting the continued appetite for renewable energy in the state. Rate base growth should drive earnings growth as Oncor invests in electric transmission and distribution to support renewable energy and population growth in Texas.

While there has been some concern about the regulatory environment due to a disappointing recent rate case outcome at CenterPoint’s Houston Electric, we continue to expect constructive regulatory support for Oncor’s transmission and distribution investments, since Oncor’s development program aligns with the state’s renewable transition. While allowed returns on equity are in line with the national average, forward-looking rate-setting mechanisms and trackers reduce regulatory lag, allowing Sempra to turn capital investment into cash flow with minimal lag. This bodes well for the company’s aggressive capital plan in the state.

California’s regulatory environment has remained constructive for Sempra, as its emphasis on distribution-related safety and reliability infrastructure upgrades aligns well with the state’s regulatory agenda. Sempra received a constructive final decision in its most recent general rate case. The decision positions the California utilities to increase rate base 8.5% annually at SDG&E and 12% at SoCalGas, supported by a combined $17.9 billion in capital investment over the next five years. In a separate decision, regulators approved a four-year GRC cycle with an initial five-year transitional GRC for both its California subsidiaries. Beyond 2023, the GRC will move to a four-year cycle instead of the current three years. The extended cycle brings greater regulatory certainty for capital investments and cash flow visibility. Under the cost of capital review, SoCalGas was granted an allowed return of 10.2% and SDG&E a 10.05% allowed return, both above the national average.

Edison is another California utility that has growth opportunities and a history of regulatory support that would make most utilities envious. With plans for $5 billion of annual capital investment and good regulatory support, Edison can average 6% annual earnings growth on a normalized basis, in our view. However, this growth trajectory could be lumpy as regulatory delays, wildfire issues, and California energy policy changes lead to shifts in spending and cost recovery.

Regulators have approved much of SCE’s $5 billion capital investment plan in 2020. Edison’s investment plans in 2021-23 would top $5 billion annually if it gets regulatory support for its general rate case proposal and other programs. We think state policies--including California’s 100% renewable energy by 2045 target--give Edison a good case to gain regulatory support for its investment plan. Investments to address wildfire concerns alone could top $1 billion annually during the next four years. These investments drive our 7.5% rate base growth forecast.

Operating cost discipline will be critical to avoid large customer bill increases related to its investment plan. Edison will probably face more regulatory scrutiny to prove its investments are producing customer benefits. One threat to its growth is a cut in its industry-leading allowed returns on equity.

We expect Edison to retain a small share of unregulated earnings, but those are more likely to come from low-risk customer-facing or next-generation energy management businesses wrapped into Edison Energy.

Favorable regulatory frameworks and a doubling of capital expenditures have driven strong earnings growth and steady dividend increases for Atmos Energy. We expect just over $11 billion of capital expenditures during the next five years, the top end of management’s $10 billion-$11 billion target. Over 80% of the total investment is for safety and reliability. We expect this level of investment to last through the decade.

We estimate capital expenditures of $1.9 billion in 2020 increasing to over $2.5 billion by 2024, representing nearly 4 times Atmos’ depreciation and amortization expense. This should drive average annual rate base growth near 12% during this period. We estimate earnings per share will grow more slowly than the rate base, about 7.5% annually, because of the dilutive impact of almost $2 billion of equity issued over this period as the company maintains a strong balance sheet.

The majority of Atmos’ operations are regulated by the Texas Railroad Commission, which has historically been constructive to shareholders. We expect this constructive regulatory framework to continue. Atmos’ investments in infrastructure replacement are for the most part covered by favorable regulatory frameworks that include automatic formula rate mechanisms with rate trackers. The result is that about 90% of capital investments begin to earn a cash return within 12 months of the expenditure.

Atmos enjoys an average allowed ROE of approximately 10% (weighted average by rate base) for its natural gas distribution utilities, representing about two thirds of operating earnings and an allowed ROE of 11.5% for its Texas intrastate pipeline and storage. With the program to replace deficient pipe lasting another 20-30 years and the urgency recognized by the regulators, we believe these constructive regulatory frameworks allowing for economic returns will continue for at least the next two decades.

The replacement of aging natural gas infrastructure that has become unsafe provides value-accretive investment opportunities for Atmos. Over 80% of Atmos’ capital expenditures are now focused on safety and reliability, specifically replacing cast iron, bare steel, and vintage plastic pipe that the industry has identified as potentially susceptible to catastrophic failure. With the approval of regulators, Atmos has accelerated the replacement of pipes made of these materials and is currently replacing about 800-1,000 miles per year of distribution pipeline and 150-200 miles per year of transmission lines. Atmos has over 70,000 miles of pipe, with approximately 35% installed over 50 years ago before gas pipelines had established standards.

COVID-19 Shifts Some Capital Expenditure Plans We expect some utilities to shift approximately 5% of their 2020 growth investments into 2021-22 due to tight capital and labor markets as a result of the economic impacts of COVID-19. Overall, for most of the utilities under coverage, the shift of capital expenditure didn't have a material effect on our fair value estimates. We don't believe COVID-19 will affect utilities' policy-based investments in safety, clean energy, and grid modernization that support our long-term growth outlooks

However, utilities with a large share of commercial and industrial customers, usage-based rates, and less-adaptive ratemaking face potential earnings risk and capital expenditure budget cuts. We believe Consolidated Edison ED, Entergy ETR, and Evergy EVRG have the most risk, although each company’s management team recently reaffirmed its capital expenditure plans.

We believe Con Ed’s capital expenditure plan will be difficult to execute in the current environment with supply chain disruptions and staffing issues. Con Ed’s service territory includes New York City, which has been one of the areas hardest hit by COVID-19.

Our 2020-22 capital expenditure estimate is $350 million less than Con Ed’s $11.7 billion guidance. Our five-year average annual EPS growth rate is 2.8%, below the bottom of Con Ed’s 3%-5% target and among the lowest growth rates of its peer group, in part due to lower capital expenditures.

ConEd’s focus on electric and natural gas distribution combined with decoupled and forward-looking rates should produce stable earnings growth over the next five years. The regulatory framework insulates earnings from variables like weather and sales volume, resulting in less earnings and cash flow volatility than peers. This protects the company from lower C&I electricity demand. New York, the home to most of ConEd’s utility earnings, has historically allowed returns below industry averages. However, recent rate cases have allowed forward-looking estimates of capital expenditures and projected rate base, allowing Consolidated Edison Co. of New York, Con Ed’s largest subsidiary, to earn above its allowed returns.

We forecast Entergy will slow its investment plan to serve its industrial heavy power users, many in the Mississippi Delta, and have reduced our estimate of its five-year capital investment by $1 billion, to $19.9 billion. Our 2020-22 estimate is $300 million less than Entergy’s guidance. COVID-19 is masking the strong industrial sales growth in the Mississippi Delta. Although management expects industrial sales to be 7% lower than original guidance, new and expanded facilities are expected to result in industrial sales down only 1.5% versus last year. In 2019, C&I customers represented about two thirds of Entergy’s retail electric sales, highlighting the segment’s importance to not only earnings but capital plan needs.

The pressure on near-term earnings and lower investment reduced our five-year average annual EPS growth rate by about 100 basis points, to 5.5%; we are now in the lower half of management’s 5%-7% target. Beyond 2021, we expect a return of strong industrial sales in the Mississippi Delta driven by low natural gas prices, a trend we expect to continue in the long run. This growth helps support the remainder of Entergy’s capital plan. The capital plan is focused on the regulated business while Entergy continues an orderly wind-down of its once-thriving merchant nuclear business.

On March 2, Evergy announced a $1.5 billion acceleration of its five-year capital plan to $7.6 billion. However, we believe that in the current environment--with supply chain disruptions and staffing issues--the new plan will be difficult to fully execute. We estimate capital expenditure of $7.3 billion, with rate base growing at the lower end of management’s 3%-4% target.

In the near term, Evergy is likely to experience a significant reduction in usage from C&I customers, which represented 63% of electric sales in 2019. This was partially offset by our confidence that management will find additional operating and maintenance cost reductions. Beyond the near-term effects of COVID-19, Evergy has a solid balance sheet and significant investment opportunities in wind energy and transmission, investments we think regulators will continue to support. Evergy’s service territory encompasses healthy economies in Kansas and Missouri.

Theme 3: Renewable Energy Is a Must-Have Renewable energy is still a fairly small player in the U.S. energy ecosystem--just 10% of U.S. electricity sales and 7% of U.S. energy consumption, excluding hydropower. Oil, natural gas, nuclear, and coal will keep us comfortable, charged, and on the go well into the next decade.

But we think renewable energy will grow faster than consensus forecasts. We expect U.S. renewable energy-- mostly wind and solar--will climb 8% annually during the next decade, reaching 22% of total electricity generation. Tech, consumer, and even oil and gas companies are rushing into renewable energy to establish sustainability credibility, and politicians are greening up their resumes. Utilities that can harness this renewable energy growth will win big for investors; those that lack public support and struggle to execute will be left behind.

Renewable energy is also shifting the U.S. energy landscape. Natural gas is at risk. Coal and nuclear generation is reaching a bottom, and absolute energy demand is stagnant, creating a zero-sum game between renewable energy and gas. Gas has a near-term advantage, but renewable energy is gaining strength.

We forecast that U.S. renewable energy will surpass 1,000 terawatt-hours by 2030, or 22% of U.S. electricity generation, excluding hydro. State renewable energy portfolio standards and corporate purchases will fill the growth gaps. Our 8% compound annual growth rate for 2018-30 is higher than global growth rate forecasts and higher than the most recent U.S. Energy Information Administration reference case. For further information, please see "The Renewable Future."

NextEra’s NEE high-quality regulated utility in Florida and fast-growing renewable energy business gives investors the best of both worlds: a secure dividend and industry-leading growth potential. Overall, we project NextEra to spend nearly $57 billion through 2024, the largest program in our coverage universe.

NextEra’s growth in Florida will be focused on solar development, which until recently had little development. While Florida demographics are ripe for solar development, regulators wisely waited for economics to improve before encouraging the states’ investor-owned utilities to develop solar generation. By 2030, FPL aims to install more than 30 million solar panels that will allow 20% of its generation to be from solar.

With improving solar economics, Florida regulators are implementing highly constructive regulatory rate-setting mechanisms. Investors will earn an immediate return on renewable investments under automatic customer rate adjustments. FPL’s 10.6% allowed return midpoint and automatic rate base adjustments upon completion limit regulatory lag and help drive our 5.5% rate base growth estimate. NextEra consistently earns at or near the high end of its allowed ROE range of 11.6%.

FPL’s growth opportunities extend beyond renewable investments. Recent Florida legislation supports ongoing storm hardening investments. Battery storage, transmission, and gas generation round out the unit’s regulated growth opportunities. We expect another constructive outcome in its planned January 2021 regulatory filing, effective 2022.

Further boosting growth in Florida is the recent $6.475 billion acquisition of Southern’s Gulf Power. As at FPL, NextEra aims to streamline operations, reduce carbon emissions, improve customer satisfaction, and invest in new infrastructure at recently acquired Gulf Power. We expect 10% annual asset base growth and 16% earnings growth through 2024 after incorporating efficiency improvements.

NextEra’s other unit is its renewable energy development business, NextEra Energy Resources. NextEra is the largest wind power producer in the U.S., proving to be a best-in-class renewable energy operator and developer. NextEra aimed to be a leader in renewable energy in the early 2000s. While the technology was still economically unfeasible in many areas, NextEra developed early know-how and relationships that have allowed it to continue to be the largest domestic renewable energy developer. Although these renewable energy developments are not subject to regulated rates, the investments tend to have regulatedlike returns. Management enters into long-term contracts to sell the power from its projects, significantly mitigating cash flow volatility relative to uncontracted generation projects that are exposed to volatile commodity prices.

Management’s continued execution on its Energy Resources development program leaves us confident that NextEra will deliver at the high end of its 11.5-18.5 GW development target. We forecast NextEra will add approximately 9.0 GW of wind capacity through 2024, with an additional 9.3 GW of new solar capacity through 2024. NextEra’s early entry into battery storage will enhance its competitive positioning in the market. Energy Resources already has 1 GW of battery storage in its backlog.

For solar skeptics, First Solar offers investors a conservative toe-dipping opportunity with a wide margin of safety. Stop thinking clean-tech startup and start thinking disciplined industrial manufacturer. Since its founding in 1999 and initial public offering in 2006, First Solar has used a slow and steady approach to become an industry leader. First Solar’s $3 billion of annual revenue and $5 billion market cap make it the largest U.S.-based solar company and the second-largest solar manufacturer in the world. It continues to grow by doing right for investors: focusing on manufacturing efficiency, financial strength, and a cost-advantaged product.

We think First Solar is a cheap way to serve three purposes for investors: Gain exposure to solar’s secular growth; add a U.S.-based industrial manufacturer with steady free cash flow growth potential; and green up a portfolio’s environmental profile.

First Solar’s combination of contracted future sales and production expansion gives us confidence in its ability to generate positive free cash flow while growing. First Solar’s 12.3 GW backlog as of April supports our estimate that it can generate more than $19.50 per share of cash in 2020-23. We estimate this cash and First Solar’s $1.6 billion cash on hand through March are enough to cover fixed costs and investments in new production capacity. Our $5 per share free cash flow estimate on a discounted basis in 2023 represents an 11% yield at the current stock price.

First Solar’s relationships with utilities, U.S. state clean-energy goals, and a low overall cost profile should support high returns on capital for at least the next five years. Longer term, First Solar faces threats from fast-developing clean-energy technologies and other solar manufacturers. But even after incorporating higher levels of investment and weaker margins, we still think First Solar offers a compelling value.

In 2011, Andres Gluski was appointed CEO of AES and began transitioning a company with operations in 28 countries and a strategy based on owning as many merchant power plants and utilities across the globe as it could acquire or develop. Gluski narrowed the company’s geographic and business focus by selling businesses in markets where AES did not have a competitive advantage or strong platform with an opportunity for expansion. Today, with a stronger balance sheet, the company has operations in 13 countries and a rapidly growing renewable energy business supported by a well-positioned battery storage joint venture with Siemens.

The Virginia-based company is also returning home. When Gluski took the helm, only 10% of pretax contribution to the parent was from the U.S. strategic business unit. In 2019, the share of earnings from the U.S. had climbed to over 35%. We estimate U.S. businesses will generate roughly 50% of pretax contribution and over one half of strategic business unit distributions to the parent by 2024. Returning home provides more stable cash flow from moaty U.S. businesses that should experience a tailwind, given our bullish view of renewable energy growth over the next decade.

AES is dramatically transforming its generation fleet. We expect renewable energy generation capacity to more than double between 2015 and 2022. AES has a total renewable project backlog of 5.3 GW under construction or with signed PPAs as of March 31. In 2018, AES completed the 49%-owned OPGC 2 coal plant in India. We expect this to be the last new coal plant developed and owned by AES.

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)