3 Stock Funds That Are Up in a Down Year

Energy and utility stocks helped lift the performance of these funds.

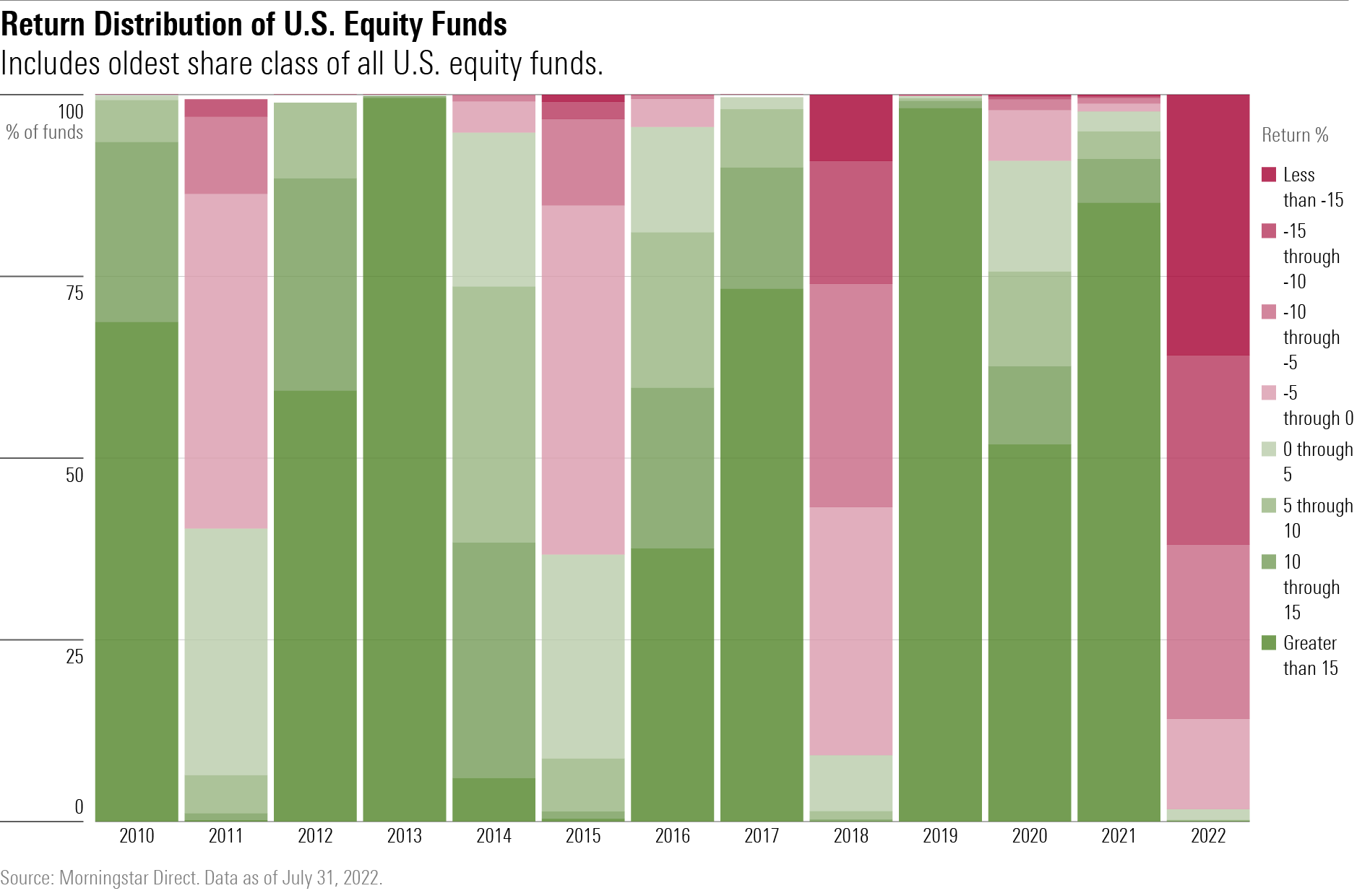

It has been an ugly and painful year for U.S. equity fund managers and their investors as the market's plunge sent stocks into bear territory. How bad has it been?

Just three of the 556 U.S. equity funds covered by Morningstar analysts, about 0.53%, were up for the year as of Aug. 1. That is the fewest number of funds to finish in positive territory since at least 2010.

Bigger weightings in some once out-of-favor sectors have helped the handful of funds squeak out positive returns.

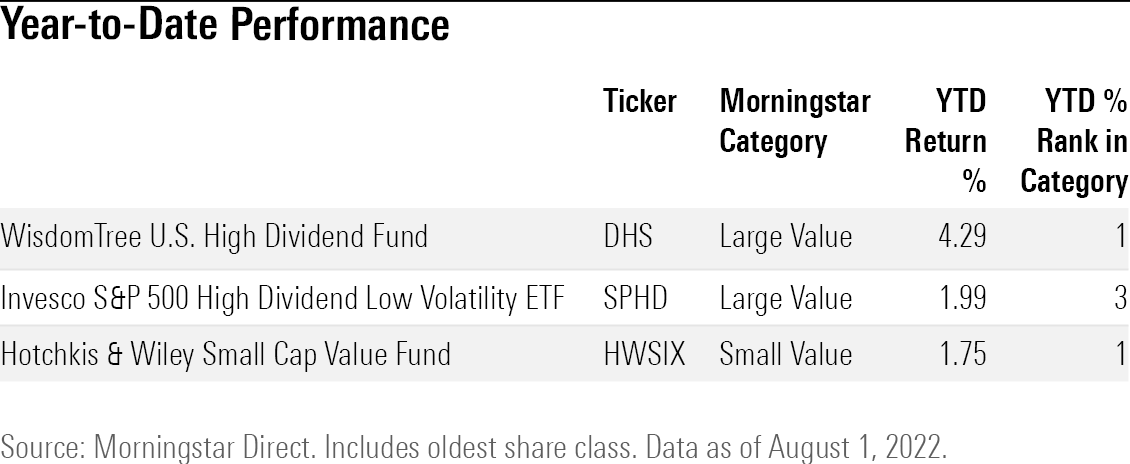

WisdomTree U.S. High Dividend Fund DHS advanced the most of any U.S. equity fund covered by Morningstar. It’s gained 4.29% while the average large-value fund is down 6.5%.

"A fair amount of the fund's outperformance is the result of its active bet on energy stocks compared with the broader market," Morningstar associate analyst Zachary Evens wrote. The fund has more than double the average large-value fund's stake in energy companies of 18.8% versus the Morningstar Category average of a decline of 7.3% as of July 31.

Return Distribution of U.S Equity Funds

The fund’s rebalance in December put it in a "perfect position" for the rally in energy this year, Evens wrote. The exchange-traded fund tracks an index that includes the highest-yielding stocks and, following the stellar year for several energy companies, many were added to the index.

For all U.S. equity funds, just 44 out of 2,600, about 1.69%, have eked out a positive return so far this year.

Year-to-Date Performance

For the Invesco S&P 500 High Dividend Low Volatility ETF SPHD, along with energy, utilities stocks have boosted performance. Energy represents 18.6% of the fund's holding versus the category index's 5.4%. Sempra Energy SRE, which surged 23.6%, Consolidated Edison ED, up 18.4%, and Southern Co SO, which has rallied 14.3%, have all helped the fund.

The fund’s high dividend yield and low-volatility mandate "results in regular and sizable sector bets,” according to Morningstar associate manager research analyst Lan Anh Tran.

"Since the fund uses yield to select and weight stocks, it will lean toward high-paying stocks with cheaper valuations," Tran says. "These have done well this year as the market flees toward sturdier defensive stocks plus the recent value rally."

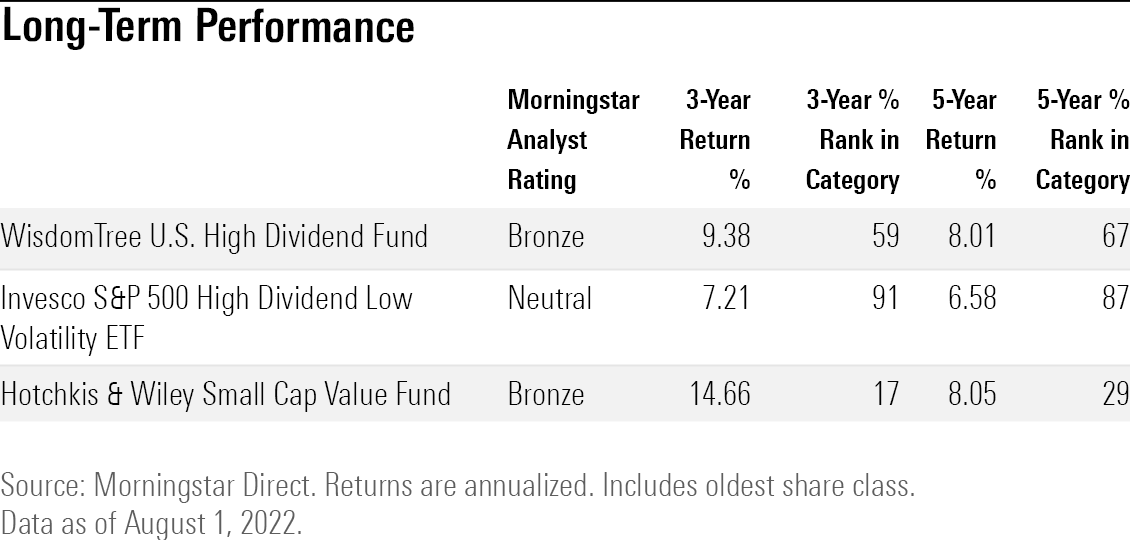

Hotchkis & Wiley Small Cap Value’s HWSIX comparatively positive performance, up 1.75%, isn’t exclusive to this year. Over the past five- and 10-year periods it ranks in the top quartile of the small-value category.

"The fund's contrarian positioning has fueled the fund as of late," according to a Morningstar analyst report from April. The managers had 15.7% of their holdings in energy, compared with the category index's 7.1%, as of July 31. The fund was able to "rocket back from a prolonged performance slump" because of its large energy holdings.

"This type of strong performance," the analyst wrote, "should be expected given the fund’s high-beta, deep-value profile."

Long term Performance

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)