Where Are They Now? Funds That Got Dumped in 2008

Get caught up on that fund you hated.

I was wondering what happened to the funds that were most hated in the bear-market year of 2008. As you may recall, the sell-off was centered on the teetering financial sector as brokerages and banks were either imploding or at risk of doing so. Yet unlike in some past bear markets, the sell-off hit nearly every asset class except Treasuries. The whole Morningstar Style Box took a pounding, as did foreign equities and even bonds.

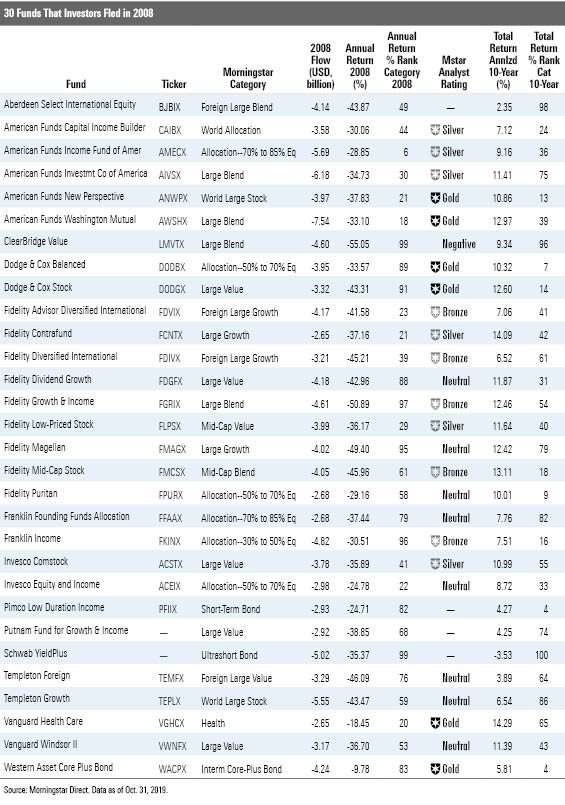

Here's a rundown of the 30 funds that had the greatest redemptions in dollar terms. Twenty were stock funds. Seven were allocation funds. Three were bond funds. Among the equity funds, seven were value, six were blend, and seven were growth. I would have guessed a heavier skew toward value given how great the pain was there.

But only two of those funds are no longer with us. That's another surprise, and it speaks to the durability of mutual funds, large ones in particular. But in general, patience was rewarded. Seventeen outperformed over the 10 years ended October 2019, while 11 underperformed their peers.

And the prospects of many are still pretty good if you go by Morningstar Analyst Ratings. A total of 17 are Morningstar Medalists. Eight are rated Neutral, and one is rated Negative. Two are not covered.

For my part, I didn't own any of these funds in 2008, but I bought American Funds Washington Mutual AWSHX in 2009 when it was added to our 401(k). American Funds Washington Mutual is a dull but dependable dividend-focused fund. It has low costs and a deep management bench. Although it lost 33% in 2008 that was actually better than most of its peers.

Since the crisis, a total of four funds produced top-decile returns, but not much on the surface links the four. Two are bond funds, and two are allocation funds. All four are cheap. One is Pimco Low Duration Income PFIIX, which changed its name and strategy and was moved from the nontraditional bond Morningstar Category to short-term bond. Given that move, I'd say there's not much to be learned here.

Among the three that kept their strategies, they have moderate costs, strong teams, and tend to be a bit more aggressive than peers. Dodge & Cox Balanced DODBX is conservative in some regards, but it generally has been around the high end of equity weightings in the allocation--50% to 70% equity category. Likewise, Fidelity Puritan FPURX has mostly been overweight equities, and its growth tilt is unusual for its peer group. However, it moderates that focus with a tame bond portfolio. Finally Western Asset Core Plus Bond WACPX has long been an astute taker of risks, as the record shows.

At the other end are the two funds that didn't make it to 2019. Schwab YieldPlus and Putnam Fund for Growth & Income. The stories here are very different. Putnam Fund for Growth and Income was just a thoroughly mediocre fund that produced disappointing performance and was eventually merged away in 2017.

Schwab YieldPlus is a long story, but I'll focus on one key element. Outflows were not much of a hindrance for most of the funds on this list because they had oodles of liquidity. A large-cap fund, or a balanced fund mixing large caps and high-quality bonds, can sell holdings without having a significant impact, barring extreme outflows. However, for Schwab YieldPlus, liquidity evaporated almost overnight, causing a brutal cycle of losses and outflows that fed on itself. This fund was trying to be a little aggressive with mortgages that boosted yields compared with other short-term bond funds, only its seemingly dependable mortgages were a disaster that no one wanted as the crisis unfolded in 2008. Schwab shut the fund down and paid to settle with investors and the SEC. You can read articles in The Wall Street Journal and The New York Times for more.

Maybe the most impressive thing about this overall group is the absolute returns you enjoyed even if your fund didn't shoot the lights out. A total of 15 funds produced double-digit returns, and two of those were allocation funds. Only Templeton Foreign TEMFX and Aberdeen Select International Equity BJBIX really had dud returns in absolute terms. They returned 3.89% and 2.35% annualized, respectively. Weaker foreign markets, a value tilt, and just poor stock selection held them back.

Patience, low costs, and skilled management generally are a winning formula even when it seems like the whole economy is burning down. The next 10 years probably won't be quite so generous to investors, so keep those principles in mind.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HRIVHHHVD5EKFATQH4SHWN44ZQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)