These Active Funds Take the Lead on Aftertax Returns

Firms like Fidelity and DFA are raising the bar for tax efficiency.

On a recent visit to Fidelity in Boston, I was struck by how many equity portfolio managers mentioned tax management as part of their investment process.

It’s a sensible thing for them to do and not hard to guess why they are doing it. Stock exchange-traded funds are taking market share from actively managed equity open-end funds. Part of the ETFs’ appeal is they manage taxes better than the typical open-end active fund. There are two reasons. First, ETFs’ structure helps them avoid distributing capital gains. Second, most ETF money is in passive, low-turnover strategies that usually generate few capital gains.

Open-end active funds historically have been all over the map when it comes to taxes. Some managers were very aware of their funds’ tax situations and took pains to manage for maximum aftertax returns. Others paid little attention to taxes partly because their clients mostly owned their funds in tax-sheltered accounts and partly because fund managers’ bonuses were based on pretax returns versus their benchmarks.

Tax-management techniques include selling the highest-cost lots, or those with the smallest accumulated capital gains, first; holding appreciated shares for at least a year after which they qualify for the lower-tax long-term capital gains rate; and reducing turnover. Those tactics don’t help investors in tax-sheltered accounts, but there are managers who go further and factor the tax bill for selling an old holding into their estimate of the potential return of a new holding. At this point, a manager is prioritizing aftertax returns over pretax. Most managers stop short of that point, including the ones I met with at Fidelity.

There are some factors out of a manager’s control. Bull and bear markets have big impacts as they lead to big gains or big losses. Also, fund flows are crucial. Big inflows reduce the tax burden by spreading distributions across more investors. Conversely, outflows can force managers to sell to meet redemptions, realizing capital gains that their funds must distribute across fewer investors. Thus, funds’ tax profiles can change with market environments.

An investor’s bottom line is aftertax returns, not minimizing taxes. A fund that triples in 10 years will give you bigger tax bills than one that only appreciates 10% over that span, but its aftertax returns likely still will be larger. To understand the state of aftertax returns, I looked at 11 big fund companies’ equity fund returns on an aftertax basis.

To calculate aftertax returns, I took fund returns, subtracted any front loads, and calculated appropriate tax rates for income, short-term gains, and long-term gains, assuming the highest tax rate at the time of the distribution. I then calculated the remaining return, percentile rank within the Morningstar Category, and tax-cost ratio, which is like an expense ratio for taxes—an annualized figure reflecting the difference between pretax and aftertax returns.

Why factor the front load into the aftertax calculation? Well, the SEC wanted the figure to reflect the load and the tax impact, but by including the load, you are really mixing the impact of two very different things. Since Morningstar FundInvestor readers largely invest directly and most front-load funds are available without loads in fund supermarkets, I excluded A shares from the averages. I also kept out C shares because FundInvestor readers don’t buy them.

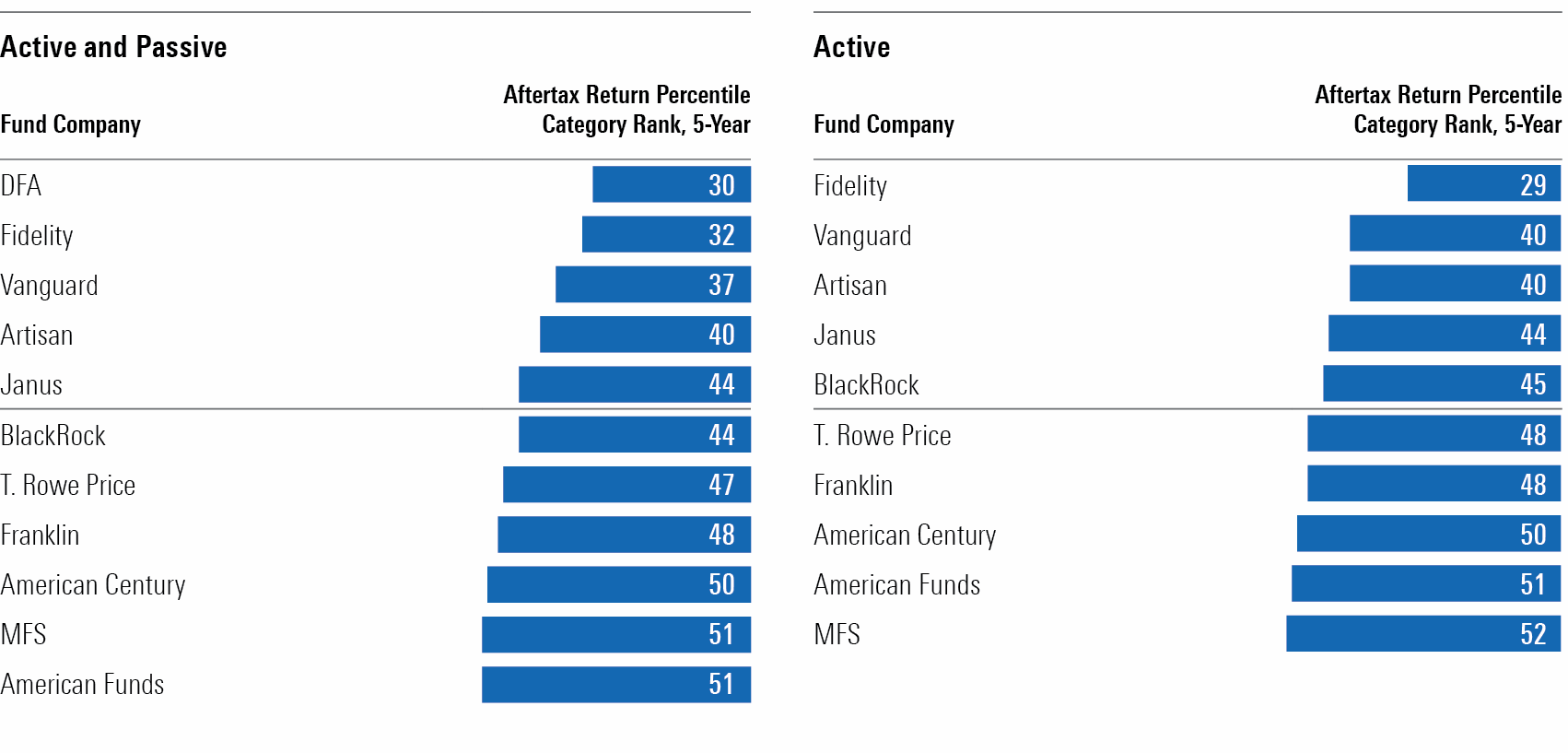

For my purposes, the aftertax percentile rank for the trailing three- and five-year periods best approximates the bottom line. Our percentile ranks make 1 the best and 100 the worst. If fund companies are raising their game here, it would show up in these figures. My first run at the data included passive and active funds to capture the big picture. My second run was just active strategies for a better apples-to-apples comparison.

Let’s look at the results.

DFA and Fidelity on Top

DFA produced truly impressive results with top 31% three-year aftertax returns and top 30% five-year aftertax returns. DFA funds are largely passive, but they aren’t index funds. The funds seek to maximize exposure to certain proven stock return factors, like value, size, or profitability, and give themselves the freedom to stray from indexes so they can take the best trades the market offers. This strategy helps boost returns and reduce taxes; DFA funds generally have low turnover. DFA funds are not as widely accessible as most fund companies’ funds, but the firm has launched many ETFs, so they are within the reach of more people than ever before.

On the flip side, American Century took last with a 59th-percentile ranking for three years and second to last with a 50th-percentile ranking for five years. Artisan and T. Rowe Price were in the 52nd percentile for three years but 40th and 47th percentile, respectively, for five years. American Funds and MFS conversely had weak five-year figures in the 51st percentile but had above-average three-year figures.

Pretax performance determined most of the successes and disappointments here, but Fidelity and DFA were able to hold on to their pretax gains while others struggled before and after taxes.

Top Active Aftertax Returns

Now we get to the heart of the matter. Passive funds have been tax-efficient for a long time, but let’s see how each firm’s active funds have fared. Screening out passive mainly affects Vanguard, BlackRock, and Fidelity as the other firms have few passive funds. All of DFA’s funds are passive, so I left them out of this table.

Fidelity’s rankings of 29th percentile for five years and 35th percentile for three years put the firm well ahead of the pack. Vanguard and Artisan were next in the 40th percentile for five years.

American Funds and MFS came in just a hair below average for five years. BlackRock and American Century were at the bottom for three years.

Fidelity’s impressive performance shows its funds are not squandering their success to taxes. I’ll watch to see if Fidelity can sustain that outperformance.

How They Stack Up

The Big Picture

It’s good to see active firms raising their tax games. However, passive funds and ETFs still look to be the most reliable routes for tax-efficient equity exposure, while munis are the best call for bond exposure for those in the top tax brackets.

However, selective use of active funds that have shown stock-selection and tax-management skills makes sense, particularly in areas where active funds have had more success, such as small caps and foreign equities.

Drilling Down

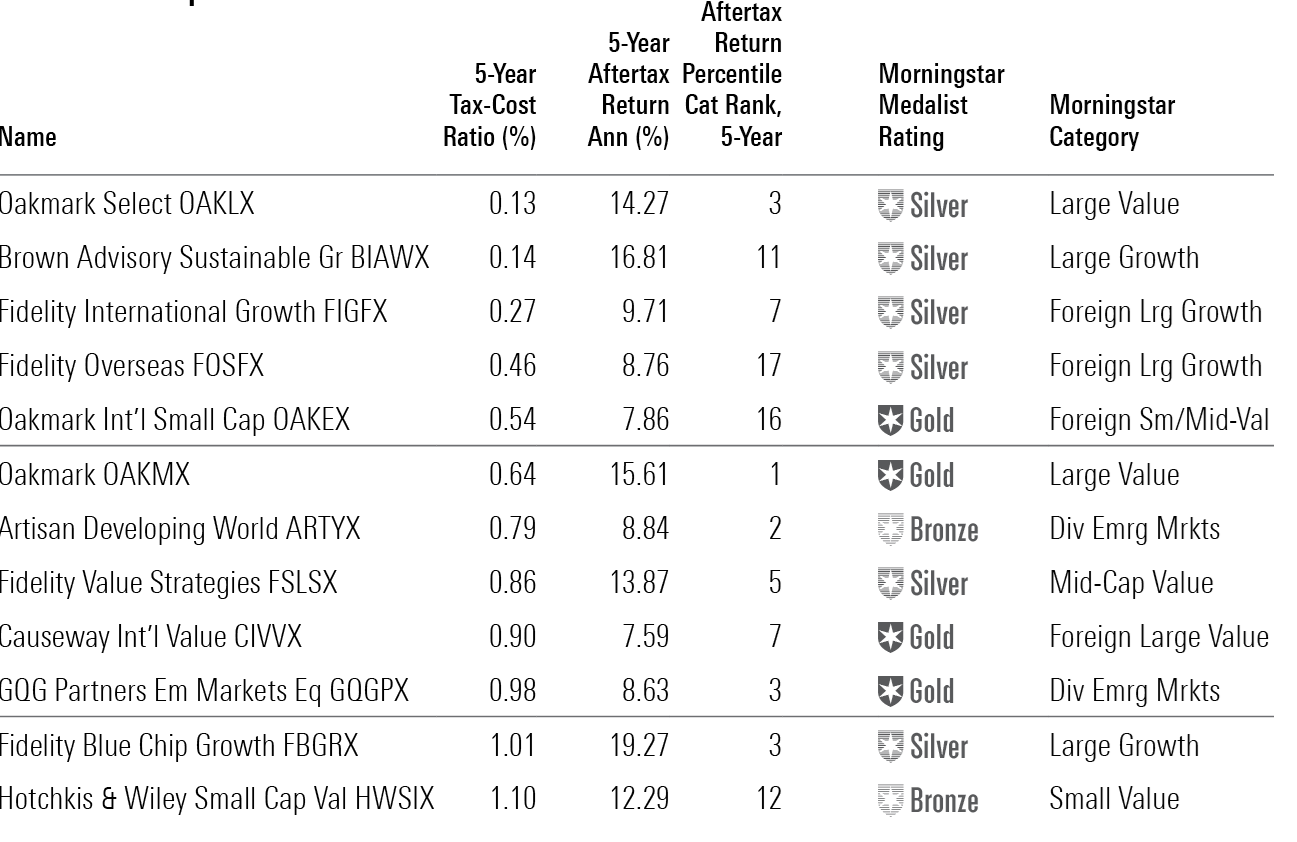

So, what funds fit that bill? I screened for funds with top-quintile five-year aftertax returns, tax-cost ratios below 1.25%, and Morningstar Medalist Ratings of Bronze or higher.

I wasn’t surprised to see Bill Nygren’s funds make the cut. At Oakmark OAKMX and Oakmark Select OAKLX, Nygren has long sought to maximize pretax and aftertax returns. He’s a patient investor who provides a bit of a bumpy ride, but when things go right, returns look very good on an aftertax basis.

Brown Advisory Sustainable Growth BIAWX takes sustainability to another level with big returns and a tiny tax bill. A patient turnover of just 13% no doubt helps to minimize the tax bill.

Fidelity International Growth FIGFX and Fidelity Overseas FOSFX are both growth funds from managers who care about quality, but Vincent Montemaggiore’s Overseas is a more eclectic fund, whereas Jed Weiss’ International Growth is comfortably in the classic growth zone.

Oakmark International Small Cap OAKEX demonstrates that David Herro is also a savvy tax-aware investor.

Artisan Developing World ARTYX and GQG Partners Emerging Markets Equity GQGPX are welcome additions to the emerging-markets sphere. The GQG fund has benefited from big inflows, and an 88% turnover rate may indicate that its tax ratio could rise if the flows stop.

Fidelity Value Strategies FSLSX was the biggest surprise on the list as manager Matt Friedman used to have triple-digit turnover. However, he’s dialed back trading as performance has improved, leading to better results for taxable investors.

Causeway International Value CIVVX is less surprising as it has always taken a patient value approach.

Fidelity Blue Chip Growth FBGRX manager Sonu Kalra runs a patient strategy with just 19% turnover but be advised that low turnover does not equate to low risk. This is a volatile fund that invests in some fast-growing names, and it can make or lose money in a big hurry.

Hotchkis & Wiley Small Cap Value HWSIX is a nice diversifier if you have a large-growth-heavy portfolio. This fund plumbs deep-value small caps at cheap multiples.

Aftertax Champs

This article first appeared in the May 2024 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-27-2024/t_128e5b2b1e35443e99302bd249d3a5d5_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AQETT7LOP5E2ZJBEHHEQLEHDQI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)