7 ‘Acorn’ Funds on Our Radar

These little funds have huge growth potential.

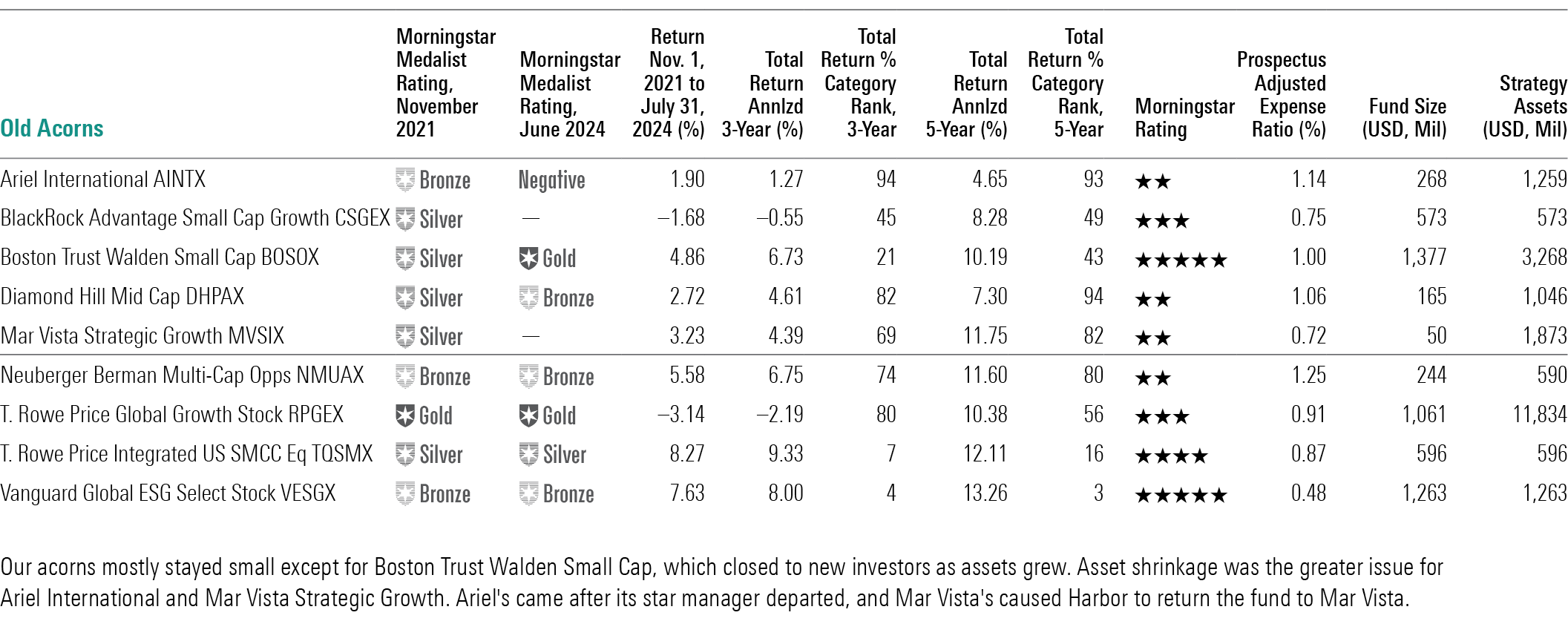

In November 2021, I wrote about fund “acorns,” which had small assets but promising fundamentals that could help them mature into greatness.

Looking back shows the rewards and perils of investing in promising funds with small asset bases. As it happened, large-growth strategies continued their run over the ensuing time period, so smaller-cap funds had relatively modest returns and didn’t attract much growth.

Fund Size

This went well. Most of the funds didn’t increase their assets much, so few struggled with asset bloat, or getting too big to optimally run money. Some even shrank, though I’m not sure that’s a good thing. Only one fund, Vanguard Global ESG Select Stock VESGX, had a big gain, nearly doubling its assets from $670 million to $1.2 billion. However, the fund easily handled the growth because of its large-cap focus.

Boston Trust Walden Small Cap BOSOX also increased in size. It was $875 million and now is $1.4 billion. But the good news is the firm closed the fund in April 2023. That’s the best outcome; the fund closed at a manageable level that should ensure it doesn’t have to compromise its strategy.

T. Rowe Price Integrated U.S. Small-Mid Cap Core Equity TQSMX also had significant growth. The fund jumped from $200 million to $600 million, but for a diffuse portfolio like this one, that’s not enough to cause concern.

Performance

Not coincidentally, the expanding funds were also the star performers. Each one enjoyed top-quartile performance and, of course, some market appreciation helped.

On the downside, four underperformed significantly.

Diamond Hill Mid Cap DHPAX, Neuberger Berman Multi-Cap Opportunities NMUAX, T. Rowe Price Global Growth Stock RPGEX, and Ariel International AINTX all posted weak performance. The funds leaned to the smaller, more value side of their Morningstar Categories, which hurt.

The Downside of Being Small

Ariel International was the big disappointment. Rupal Bhansali, Ariel’s star manager, left the firm, and it didn’t have a replacement who could continue in her style. Thus, investors had little reason to stay, and many bolted. We took the fund’s Morningstar Medalist Rating to Negative from Bronze because of the changes.

While this case is unusual, it illustrates a challenge for smaller funds. The managers are more likely to be hired away or open their own shops. And the funds are more likely to be merged away.

Mar Vista Strategic Growth MVSIX was named Harbor Strategic Growth when I highlighted it in 2021. It failed to draw assets, so Harbor returned the fund to subadvisor Mar Vista as it wasn’t making any money for Harbor. That’s not a disaster for investors in the fund, but it’s still another odd thing that can happen to small funds. The fund has lagged a bit since 2021.

Another thing that can happen is Morningstar can drop coverage of a small fund. We dropped Mar Vista and did the same for middling performer BlackRock Advantage Small Cap Growth CSGEX. Its assets declined from $1 billion to $600 million as small-growth stocks have struggled over that period.

Are these three funds still acorns today? As I said, they haven’t gotten bloated through excessive asset growth, but Ariel International was downgraded to Negative, and Morningstar analysts no longer regularly assess the fundamentals of the Mar Vista and BlackRock funds. So, I wouldn’t consider them to be as promising anymore.

How They Measure Up

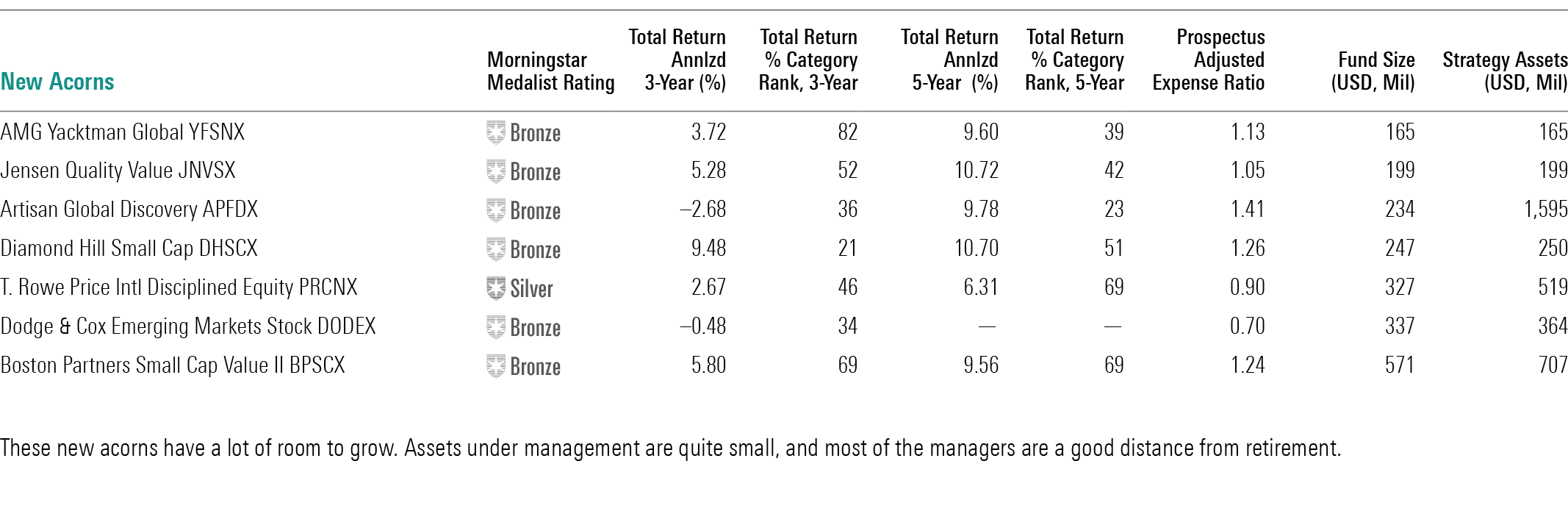

New Acorns

How about other funds that have popped up on my screens? The smallest ones naturally haven’t been hot lately, or they wouldn’t be so small, but you’d be getting in on the ground floor.

AMG Yacktman Global YFSNX has excellent managers and just $165 million in assets. The managers do run billions in a US value strategy but going global gives them a lot of room to grow. The fund’s absolute return strategy is out of favor in this hypergrowth market, but the US strategy has often bounced back from such periods. If you wait for it to get hot, though, you may miss the turnaround, so there’s no need to wait. Managers Stephen Yacktman, Jason Subotky, and Adam Sues have proved adept at this focused, defensive strategy that tends to hold up well in down markets, though its loss in 2022 was slightly worse than the returns of peers and the benchmark. We rate the fund Bronze.

Jensen Quality Value JNVSX has just $199 million in assets as the torch has been passed to the next generation of managers. Eric Schoenstein is handing off responsibility to Adam Calamar and Kurt Havnaer, who will continue to run this Bronze-rated fund, which invests in smaller and cheaper companies than does flagship Jensen Quality Growth JENSX. Fundamental analysis and the pursuit of stocks trading below their intrinsic values remain, but this is a concentrated mid-blend fund.

Artisan Global Discovery APFDX is another promising global fund that investors have missed. It resides in the mid-growth area of the Morningstar Style Box and is run by the team that runs several growth funds for Artisan. Jason White leads the fund with four comanagers. The fund has thumped the competition under White, yet it has just $234 million in assets. White looks for growth with catalysts, and technology soaks up 36% of the portfolio. The fund owns more than 80 names, so one dud won’t sink the ship.

Diamond Hill Small Cap DHSCX recently had a manager transition as Aaron Monroe took over for Chris Welch last year. Monroe has been a comanager here since 2017, so he seems ready for the assignment. Diamond Hill is a fundamental value shop, and its style has been out of favor. As a result, the fund has just $247 million in assets. That should give the fund plenty of runway to maintain its strategy when small-value rebounds. The fund has been a strong performer the past year and a half thanks to some big winners like FTAI Aviation FTAI and First Advantage FA. At some point, investors will take note.

T. Rowe Price International Disciplined Equity PRCNX is small but definitely not a high-risk/high-reward fund. Manager Federico Santilli looks for compellingly priced companies with superior competitive positions, strong returns, and skilled leadership. He invests across the style spectrum and allows his stock picks to determine sector and country weightings. The $327 million fund shines at defense, so if things go well, you’ll get marketlike returns with less volatility. It’s good to have a couple of funds like that.

Dodge & Cox Emerging Markets Stock DODEX marks a departure for the firm in one way, but fortunately, Dodge & Cox’s appealing traits are still very much on display. The fund sports a strong fundamentals-driven value portfolio and low fees despite a small asset base. However, it leans on a little more quantitative work than other Dodge & Cox funds to narrow the field of stocks, so it has a more diversified portfolio. The fund has performed well in the three years since its inception and has a small $337 million asset base. It boasts a strong five-person management team, though one manager is set to leave at year-end.

Boston Partners Small Cap Value II BPSCX represents an elusive target: a well-run actively managed small-value fund that is still open with a manageable asset base of about $571 million. George Gumpert, David Hinton, and Volkan Gulen have done a fine job looking for financially sound companies with catalysts for improvement. This isn’t a deep-value fund. The team favors the smaller end of small caps’ market range, which means it invests in companies that have very little Wall Street following. That’s great, but it also can mean a fairly bumpy ride, so a modest weighting in this fund is prudent.

Plenty of Room to Grow

Conclusion

Buying acorns like these probably requires a little more monitoring than established big names like Vanguard Primecap VPMAX or T. Rowe Price Capital Appreciation PRWCX. But you get the benefit of a small, nimble portfolio that may last a long time in your portfolio.

This article first appeared in the August 2024 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-24-2024/t_c34615412a994d3494385dd68d74e4aa_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)