Growth Stocks Lift ESG Funds in Q2

The Magnificent Seven ran with the bulls, and these ESG funds reaped the benefits.

Large-cap sustainable funds paced conventional funds in the second quarter of 2023, despite ESG funds in outflows for the third consecutive quarter, lifted by growth stocks.

The average large-cap sustainable fund returned 7.23% during the second quarter, versus a 7.29% gain for the average traditional fund.

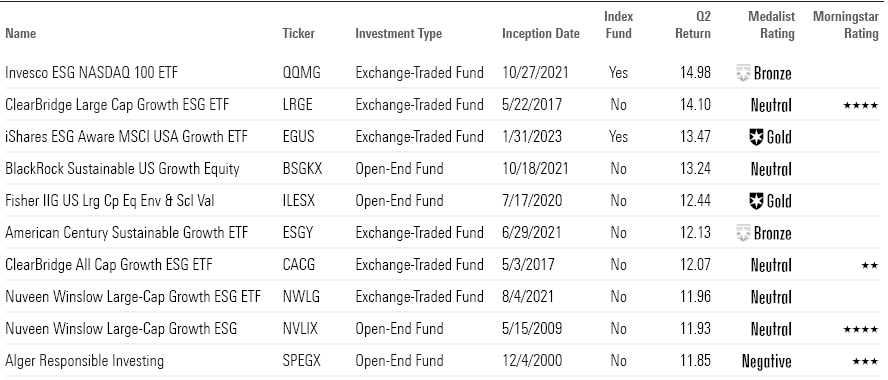

Top performers posted double-digit gains, with each fund in the top 10 outperforming both the Morningstar US Market Index and the S&P 500, which advanced 8.49% and 8.74%. Each of the top 10 performers for the second quarter are large-growth funds.

Best-Performing Large-Cap Sustainable Funds in the Second Quarter

Invesco ESG Nasdaq 100 ETF QQMG, an index fund tracking the Nasdaq-100 ESG Index, led the pack of large-cap ESG funds with nearly 15% return in the second quarter. This fund, which has a Morningstar Medalist Rating of Bronze, is expected to lag Gold or Silver offerings but still expected to outperform its Morningstar Category index, the Russell 1000 Growth Index, after fees in the long term. (Morningstar Medalist Ratings are forward-looking, not to be confused with the backward-looking Morningstar Rating, which requires a fund to have a three-year history.) The fund tracks the Nasdaq-100 ESG Index, which excludes exposure to controversial business activities.

As is the case with all our top performers, the largest contributor to the fund’s performance in the second quarter was in the technology sector. On average, nearly 59% of the fund’s holdings were in tech over the previous quarter. The top six holdings of the fund at quarter-end are part of the elite group of mega-cap stocks known as the Magnificent Seven; over 41% of the fund’s total portfolio is concentrated in Apple AAPL, Microsoft MSFT, Nvidia NVDA, Amazon.com AMZN, Tesla TSLA, and Alphabet Class C GOOG.

Communication services also had a strong showing in the second quarter; the Morningstar US Large Cap Index saw a 13.8% return in this sector alone. Netflix NFLX, Meta Platforms META, Disney DIS, and Alphabet GOOG GOOGL appeared among the holdings of many of the top performers in the ESG space, which goes to show that ESG funds, like their traditional counterparts, also enjoyed the fruits of the bull market of the second quarter.

Standouts in ESG Fund Flows

Although ESG fund flows contracted in the second quarter, our top performers managed to generate positive returns. In fact, no large-cap sustainable funds saw negative returns in the quarter. ClearBridge All Cap Growth ESG ETF CACG saw multimillion-dollar outflows in the second quarter but still managed to generate a positive return of 12.07%.

Fund Flows of Top Performers in the Second Quarter

Alyssa Stankiewicz, associate director of sustainability research at Morningstar, says that “it’s harder to manage a fund during outflows, because fund managers are pressured to sell off poor performers that they would otherwise let ride.” Stankiewicz adds that “active managers that deliver positive excess returns while in outflows overcome a more difficult challenge.”

Morningstar Manager Research assigned the ClearBridge All Cap strategy an Above Average People Pillar rating; that rating is largely credited to the more than 25 years of average manager experience.

The tiny Fisher IIG US Large Cap Equity Environment and Social Values ILESX was recently upgraded to a Gold Medalist Rating from Silver. Morningstar Manager Research cites the investment team’s longevity: “The leading factor in the rating is the firm’s five-year retention rate of 100% of the portfolio management team over the period.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FPI4DOPK5VFUNIOGY5CVTI6NCI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)