Why This ESG Fund Is Leaning Into AI Investing

Nuveen Winslow Large-Cap Growth ESG invests in Microsoft, Nvidia, and others that are driving the future of AI.

Since the fourth quarter of 2022, Nuveen Winslow Large-Cap Growth ESG NVLIX has pivoted, making a major bet on artificial intelligence. Although the fund fell 31.3% in 2022, compared with a 19.4% drop for the Morningstar US Market Index, this repositioning paid off. In the second quarter of 2023, the fund was one of the strongest performers in the sustainable fund universe.

Over the longer term, Nuveen Winslow Large-Cap Growth ESG has outperformed its peers. Over the 12 months ended Aug. 21, 2023, the fund returned 11.3%, versus 6.6% for the large-growth Morningstar Category and 6.3% for the Morningstar US Large-Mid Cap Broad Growth Index. For the five-year period, the fund returned 11.99%, versus 10.2% for the category and 11.9% for the index. Over the 10-year period, the fund gained 14.1% a year on average, versus 12.4% for the category and 13.8% for the index.

Nuveen Winslow Large-Cap Growth ESG is managed by Winslow Capital Management, a wholly-owned subsidiary of Nuveen. The team includes Stephan Petersen, Winslow Capital’s CEO Justin Kelly, Patrick Burton, and Steven Hamill. Petersen leads the environmental, social, and governance efforts for the team, serving as the team’s primary resource for ESG data collection and issue awareness while helping manage the portfolio.

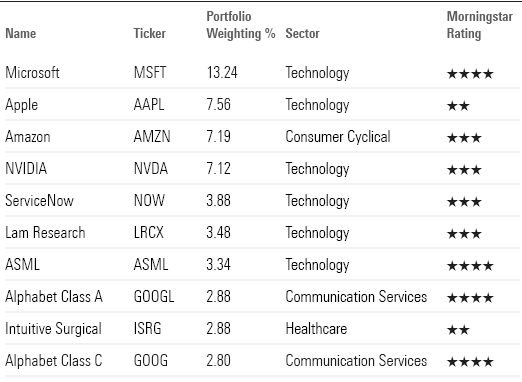

A flexible growth approach and robust integration of ESG data are key elements of the fund’s strategy. The team looks for quality management as well as signals like good capital generation, high or rising return on invested capital, and positive trends that capitalize on long-term changes in the economy or business climate. The fund has just 42 positions, and 53% of assets are tied up in the largest 10 holdings. “We are fundamental stock-pickers,” Petersen says. “There’s no alpha in macro.”

Nuveen Winslow Large-Cap Growth ESG's Top Holdings

The fund incorporates ESG data to lessen risk. For example, it evaluates how companies manage ESG risk. In addition, this fund excludes companies involved in activities such as nuclear weapons, civilian firearms, tobacco, and thermal coal.

Why AI Investing?

The AI theme was “a natural fit for our strategy” that would “play out over many years,” Petersen says. The fund manager ticked off the winners. First, semiconductors, which build “the infrastructure that needs to be developed before anything else,” according to Petersen. Next, Petersen adds, “Before you can get a firm grasp of large language modeling, you’ll need the computers and the server farms to make this whole process work.” A large language model like ChatGPT uses deep learning algorithms to analyze, process, and predict new content from large amounts of data.

“AI is going to create winners and losers,“ Petersen says. “That’s part of life, that’s part of the way the economy rolls out over time. We saw this with PCs in the 80s, the internet in the 90s, and smartphones in the 2000s.

The fund’s largest position is in wide-moat growth champion Microsoft MSFT, which accounts for 13.24% of the portfolio. With its recent investment in OpenAI, the firm behind the AI chatbot ChatGPT, Microsoft is positioned as a clear leader in the AI space, according to Dan Romanoff, senior equity analyst at Morningstar.

Petersen’s team boosted ownership in wide-moat chip processing company Nvidia NVDA. The firm’s proprietary invention of the graphics processing unit will be integral to accelerating markets like AI and automated driving.

Likewise, chip equipment companies Lam Research LRCX and ASML Holding ASML each hold market share in niche areas of semiconductor production. Lam’s advantage is in dry etching, a crucial step in chipmaking, and ASML’s lithography technology will assist chipmakers in making chips more efficient in years to come, says Morningstar analyst William Kerwin.

ServiceNow NOW, which specializes in software services for IT operations management, is a well-run organization with the ability to infuse and integrate AI with its enterprise cloud computing and organizational systems, adds Petersen.

Considering the fund’s lean into the AI opportunity, the portfolio is still well-diversified across sectors like consumer cyclical, industrials, and communication services, says Petersen.

Looking Ahead at the Future of AI

Adoption rates for AI technology are high, says Petersen. A recent Gallup poll found that 72% of Fortune 500 chief human resource officers see AI replacing jobs in the next three years. While executives are optimistic about adopting AI to increase efficiency and effectiveness, employees remain skeptical of the implications for the larger workforce.

Meanwhile, AI companies worry about reputational risk, whereas consumers criticize potential intellectual property violations, the swift pace of government regulations, and the reliability of chatbots. “As consumers, our responsibility is to focus companies on potential adverse externalities, rectify, and mitigate them,” says Petersen. He adds: “Companies should do the right thing, and if they are concerned about brand trust and attracting talent, risk mitigation will lend itself to efficiency and growth.”

Even with all those caveats, the opportunity remains strong. “The AI push has been bubbling behind the scenes for a while,” Petersen says. “Microsoft’s [investment in] ChatGPT set the stage for a new bull market and was the catalyst that got a lot of investors on board.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FPI4DOPK5VFUNIOGY5CVTI6NCI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)