What Policy Changes Could Mean for Biopharma

Firms may face headwinds in U.S. sales, but our fair value estimates haven't budged.

Many healthcare reforms have surfaced over the past two decades, but very few have become law as 1) the biopharma lobbying group holds significant power, 2) the government wants to avoid disrupting innovation and lifesaving medicines, 3) Republicans tend to prefer less interference with market forces, and 4) the complexity of changing drug prices makes new laws challenging to pass.

Despite these headwinds for new drug pricing laws, as well as the Biden administration's initial focus on COVID-19 relief and infrastructure, we expect new laws will emerge with more focus on targeting the out-of-pocket spending by patients versus absolute drug prices.

In particular, we expect reforms contained in the Prescription Drug Pricing Reduction Act--including the Medicare Part D redesign and Medicare inflation caps--could be among the most likely to pass.

Access to Basic Services Is an Issue That Weighs on the Industry but Not Our Fair Value Estimates

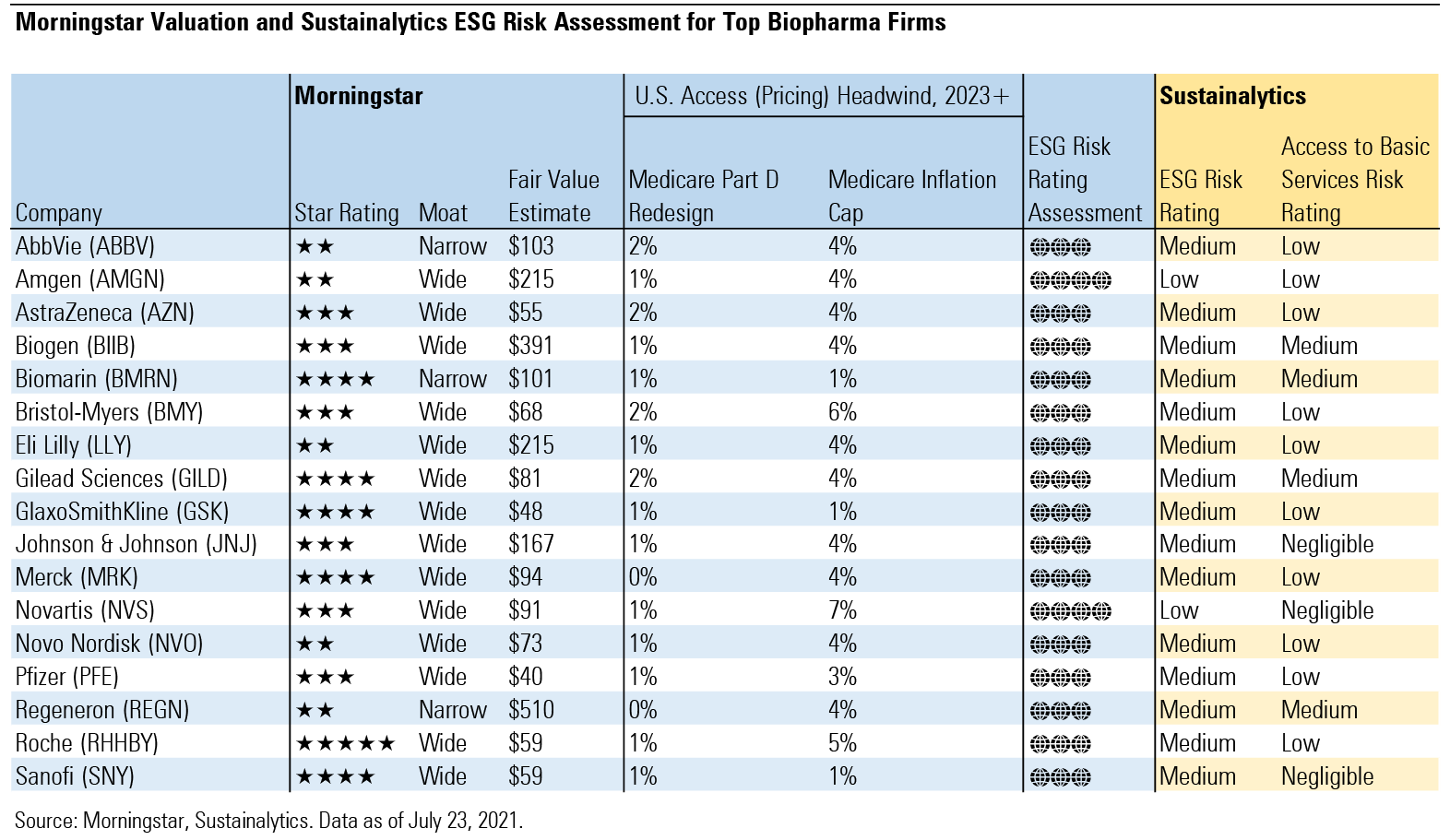

Potential U.S. policy changes aimed at increasing access to branded drugs (reducing costs to patients and the government) are likely weighing too much on biopharma valuations. Based on the political landscape and proposed reforms, we've included up to a 2% step-down in sales from a Medicare Part D redesign in our valuations for large-cap biopharma firms as well as up to a 7% step-down in sales from Medicare inflation caps in our bear-case scenarios.

Overall, the reforms that we see as most likely to pass in the next several years are unlikely to significantly affect the intrinsic values of these firms, but cost effectiveness analysis remains a potential long-term driver of more significant policy changes in the United States.

Certain Companies Are Better Positioned to Deal With ESG Risk

Focusing on access, which is closely tied to drug pricing, we see U.S. drug pricing reform as a key area of environmental, social, and governance risk for biopharma, given U.S. premium pricing, the size of the U.S. market, the Democratic-controlled Congress, and the numerous proposals and bills that are being considered.

We focus on 17 large pharma and biotech companies under coverage at Morningstar. The exhibit below highlights the ESG risk assessments from Morningstar and Sustainalytics. Firms that appear undervalued (a Morningstar Rating of 4 stars or higher) but also have negligible or low Sustainalytics risk ratings for access to basic services, the material ESG issue related to pricing risk, include:

- GlaxoSmithKline's GSK strong entrenchment with HIV drugs combined with a robust vaccine platform should provide steady, volume-based sales growth. The firm has a history of prioritizing global access, offering adequate disclosure on price increases, and avoiding large price hikes.

- Merck's MRK immuno-oncology drug Keytruda is poised for significant gains in new indications, while the vaccine platform looks solid and the firm has adequate disclosure for U.S. price increases.

- Roche RHHBY has a solid portfolio of newer drugs and a dominant diagnostics franchise that are offsetting biosimilar headwinds. Despite its weak transparency, the firm does not have a history of unsustainable drug price increases.

- Sanofi's SNY strong launch of immunology drug Dupixent holds potential for continued gains that should further support margin increases in the backdrop of a strengthening pipeline. Sanofi also has adequate transparency on U.S. pricing as well as among the strongest commitments to low U.S. price inflation.

Morningstar Valuation and Sustainalytics ESG Risk Assessment for Top Biopharma Firms

Medicare Part D Redesign Would Cut the Industry's U.S. Sales by 1%: We Assume a 50% Probability

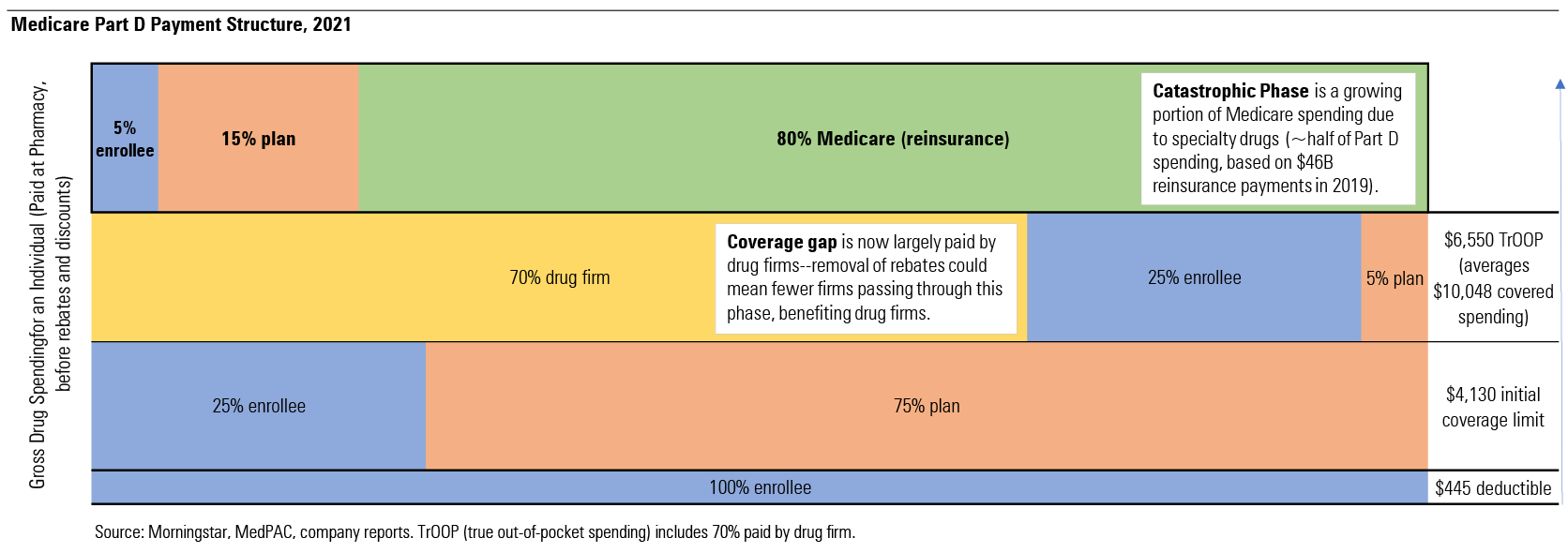

We believe the most likely change to address access is a redesign for Medicare Part D (for U.S. patients 65 or older taking medicines largely from a pharmacy, not hospital administered drugs), eliminating the 5% catastrophic cost-sharing for very expensive drugs. This would significantly reduce the cost burden for patients taking any specialty drug.

We believe the three most important factors are in alignment for the passage of this proposal: support by Democrats, Republicans, and the biopharma group. We believe the overall negative impact to industry sales would be close to 1% as drug firms would pick up more of the cost of drugs in the catastrophic phase of patient payments. One potential secondary concern for drug companies would be increased coverage of drug costs by insurance companies, which may decide to increase pricing pressure against drug companies.

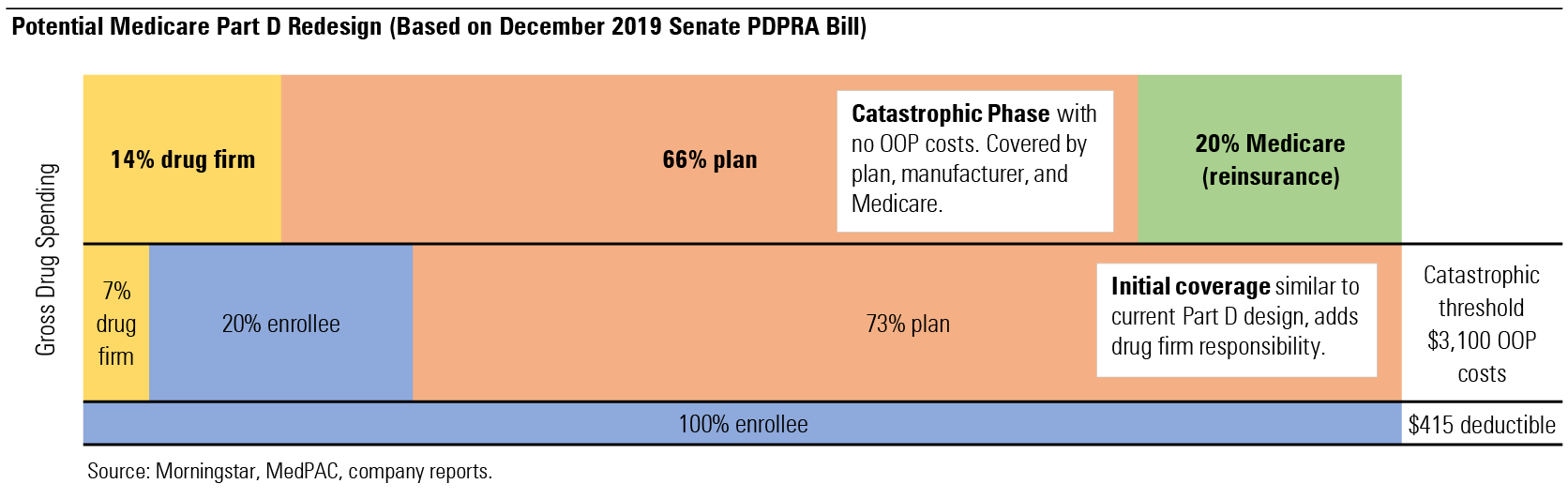

The exhibits below show the before and after of the Medicare Part D redesign.

Medicare Part D Payment Structure. 2021

Potential Medicare Part D Redesign (Based on December 2019 Senate PDPRA Bill)

Medicare Inflation Capping Would Likely Cut U.S. Industry Sales by 4%: We Assume a 25% Probability

While overall net brand drug pricing inflation has fallen dramatically over the past decade to a level fairly close to current inflation, certain drug prices are still increasing well above inflation rates. The media's attention on list price (cash pay) increases versus net price (insurance pay) confuses the issue, since few people pay list price in the U.S. Increasing prices have driven calls for the U.S. government to limit future price increases to only inflationary levels.

We view this proposal with a 25% chance of passing, as there is mixed support from Republicans and less support from the biopharma group. The complexity within the pricing channel for drugs between list prices and net prices (after rebates) makes this proposal potentially prone to manipulation by drug firms. Nevertheless, capping Medicare drug price increases at inflation would likely cut industry sales by 4%.

What Happens if Both Medicare Part D Redesign and Medicare Inflation Caps Are Enacted?

Overall, we assume a 1% headwind to U.S. sales for the industry from the Medicare Part D redesign in 2023 (resetting to the new payment structure) and a 4% additional headwind in 2023 in our bear case from potential Medicare inflation caps. We distribute these hits across our coverage based on each firm's exposure to Medicare and price characteristics for key drugs.

Adding the Medicare Part D redesign to our base case does not have a significant impact on our global growth outlook. However, when combined with potential Medicare inflation caps, we think U.S. growth could dip below zero in 2023, with global growth of roughly 3.8% annually through 2025 (to $644 billion).

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/d10o6nnig0wrdw.cloudfront.net/10-04-2024/t_e6175f671cee439d9180e460f6081183_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)