U.S. Autos Are Not Doomed

Sales will be horrendous in the near term, but there’s value to be found.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

The market’s rapid sell-off as a result of the coronavirus pandemic is leaving carnage in its wake, creating massive uncertainty about the timing or extent of a recovery. Fear, uncertainty, and a high likelihood of a recession are a disaster for U.S. auto stocks. However, we’ve seen distress before in 2008-09, so we are not afraid to make undervalued calls in this highly cyclical sector. In auto stocks, we think you make your money in recessions. Many companies, especially dealers, generated massive returns for anyone who bought them during the depths of the Great Recession. For example, Ford F reached distressed levels of $1.01 in November 2008 and rose to nearly $19 by January 2011. Dealer Asbury Automotive Group ABG increased 77-fold by late 2019 from its March 2009 low of $1.60, and by February 2020, CarMax KMX had risen nearly 18 times from its November 2008 low of $5.76. We see spring 2020 as a buying opportunity similar to 2008-09 because we refuse to accept that the current economic environment is permanent. However, we recognize that things are likely to get worse before they get better.

This article examines several 2020 U.S. light-vehicle scenarios and offers actionable, and even defensive, high-quality ideas. Yes, autos can be high quality, but we stress that defensive in this context means names that can fall less than the market rather than companies that are immune to a recession and guaranteed to preserve capital near term. We see auto-dimming mirror supplier Gentex GNTX as the best defensive name because of its debt-free, cash-rich balance sheet, with over 90% market share, and it only gets cheap in times like this. CarMax is our runner-up for high quality because of its size and how it performed in 2009. Names like Adient ADNT, General Motors GM, and Ford are not high quality, in our view, but we think these stocks are a steal at present levels, though they will require a long-term horizon. We do not think investors need to rush to buy automotive names, because the economic damage from pausing the U.S. economy will take time to resolve, but autos should not be ignored now. The space is cyclical, but we think sell-offs are buying opportunities, and investors should take time now to research autos and make a list of names to buy when they are ready to dive into the wreckage. Only each investor can decide his or her level of risk, but we see the whole spectrum available in U.S. autos, and we stress that downturns are where one makes real money in this sector, as shown in 2008-09.

How Bad Will 2020 U.S. Auto Sales Get? According to Wards, 2020 U.S. sales through February rose 4.5% year over year, with all but three automakers (Ford, Nissan, and Tesla) showing growth. Sales had been helped by incentives, but the sales and employment climate before the coronavirus pandemic was reasonably healthy and trending above our then full-year 2020 prediction of 16.5 million-16.7 million units (about a 3% year-over-year decline). The virus-induced damage to auto sales was abrupt and severe because the United States effectively hit the pause button on life in mid-March. Per Wards, March auto sales fell 37.9% from March 2019 (down 33.0% adjusted for two fewer selling days in March 2020), and we don't expect good news in April, either. May is a big question mark because it depends on stay-at-home provisions ending and the impact of the April U.S. unemployment rate likely to hit low double digits, up from 4.4% in March. Contrary to what the stock market did in March, we do not think it's time to panic, but uncertainty will remain for a while. This uncertainty means that right now, it's impossible for us, or we think for auto executives, to have confidence in any sales forecasts for this year; this is one reason many companies like GM, Ford, and Adient have withdrawn or suspended 2020 guidance. J.D. Power said on April 3 that it forecasts 2020 sales of 12.1 million-14.8 million units, down from a pre-virus prediction of 16.8 million. We don't see that range as unreasonable and think it's more likely than sales plummeting all year long. The key will be how long consumers are either without jobs or too afraid to pull the trigger on buying a new vehicle.

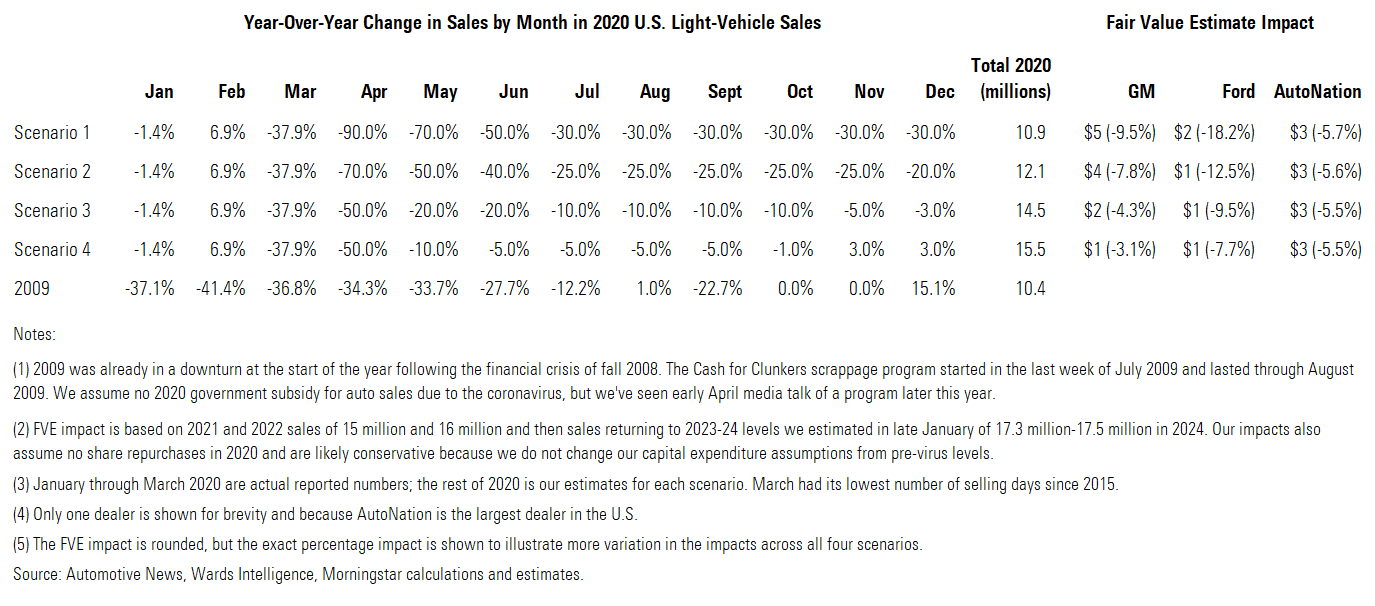

The accompanying table shows four scenarios for how 2020 U.S. light-vehicle sales may finish, with year-over-year sales changes for each month. April-December are Morningstar estimates. Scenario 1 is the most dire, similar to 2009’s severe low of 10.4 million; each following scenario is less draconian from there. We also include 2009’s monthly year-over-year change for reference. 2009 was more of a depression for the auto industry than a recession--the 10.4 million in absolute levels was about as bad as 1982’s 10.36 million, but 2009 was far worse than 1982 in per capita terms. Dividing 2009 sales by the 209.6 million licensed drivers at the time gives a per capita sales ratio of 0.050, the lowest on record back through 1951, and the per capita ratio for the total U.S. population at the time was 0.034, the lowest since 1958. The per licensed driver ratio was 0.069 in 1982, and the next-lowest ratio after that was all the way back in 1958, at 0.063. The 2019 ratio was 0.074, and since 2013, the ratio has ranged between 0.074 and 0.080. Even adjusting 2009’s ratio for the 2019 number of drivers or 2019 total U.S. population would, by our estimate, mean sales of about 11.2 million-11.5 million, which means Scenario 1 assumes 2020 ends up worse than 2009 in population-adjusted terms.

Your Over Year Change in Sales by Month in 2020 U.S Light Vehicle sales

The replacement rate of demand, equal to the scrappage rate (about 4.5%, according to our calculations from Experian data) times the light-vehicle fleet size per Experian of 279.6 million, is about 12.7 million, so scenarios 1 and 2 would mean 2020 sales are below scrappage. That has only happened two other times since World War II: 2009 and 2010. None of our scenarios assume a federal government scrappage program like Cash for Clunkers in summer 2009, but anything is possible in these times.

Another variable to consider is financing: Lenders (automakers’ captive finance arms, for example) may increase sales via lease incentives or extend loan durations to make monthly payments easier for consumers leery of taking on a new loan. According to Experian, the average new-vehicle loan term is 69.3 months, and new-vehicle loan durations between 85 and 96 months are only 1.4% of all new-vehicle loans, while 71% are between 61 and 84 months, so there’s room to expand the far right tail of the duration spectrum. Leasing is also important to 2020 demand because just over 4 million vehicles are coming off lease in the U.S. this year, which forces nearly all these customers back into the marketplace. Some may buy used, but some may again lease a new vehicle for the lower monthly payment compared with buying new, and leasing a new vehicle still counts as a sale for monthly industry sales reporting. Experian’s fourth-quarter 2019 data shows that the average U.S. new-vehicle monthly loan payment is $554 compared with $461 for a lease payment and $393 for used. Interest rates are likely to remain very low for a while, which does not hurt, but we don’t see that alone as sufficient to jump-start demand.

Massive uncertainty will remain in the auto market at least into early summer, until we get data about any demand recovery or perhaps a Cash for Clunkers-type program like the U.S. had in summer 2009. That program cost about $3 billion and took nearly 700,000 vehicles in on trade. We don’t see the coronavirus as a reason to change our midcycle U.S. sales forecast, which remains at 17.3 million-17.5 million. Most of a stock’s fair value estimate derived from an analyst’s inputs in our discounted cash flow models comes from the outer years of our projections rather than from 2020 and 2021. This is why we show the fair value estimate impact for each of the four scenarios in the table. Even in the extremely bleak Scenario 1, the hypothetical fair value estimate deductions are nowhere near as severe as how far automotive stocks declined in the back half of March. As long as current sales levels are only temporary, which we strongly believe is the case, we see sell-offs from the virus as a buying opportunity for the long-term investor.

GM's Pickup Inventory a Bit Light Due to 2019 UAW Strike The virus wreaking havoc on the entire U.S. economy is horrible for everyone, but it might be worse for GM, which has been rebuilding its inventory following a 40-day United Auto Workers strike last fall. The March-end inventory data does not suggest to us that GM is in a desperate position inventory-wise, but it could use more pickup trucks. Total company supply in terms of days' sales outstanding is identical for GM and Ford at 99, and GM has about 8,500 more units on the ground than Ford. Neither company is widely off from the industry days' supply figure of 95, but GM could use more pickups once production resumes. Pickups are the most profitable vehicles these automakers sell, so the Chevrolet Silverado and GMC Sierra levels are worth comparing with Ford's F-Series and Fiat Chrysler's Ram. It's not a major concern to us that GM's pickup inventory is the smallest days' supply of the Detroit Three but worth noting that GM's pickup inventory unit count is about 71,000 less than Ford's and nearly 30,000 higher than Ram's. At the end of February, GM's pickup count lagged Ford's by about 75,000 and exceeded Ram's by about 37,000, so there's not a large difference sequentially in terms of unit count difference. Days' supply may skyrocket for everyone after April due to likely very low monthly sales leading to a tiny daily sales rate. If there's little to no inventory replenishment in April, then dividing April-end inventory by a low daily sales rate will lead to incredibly high days' supply figures to start May.

GM’s numbers are still higher than those of some Japanese automakers, which tend to have leaner inventory than the Americans anyway (American automakers dominate pickups and try to keep lots of truck inventory to have various trims available, plus they have a UAW workforce to keep happy), so the data to us does not suggest that GM is in deep trouble once consumers return to the showroom. The key is to get factories open and start running light-truck plants (pickups, crossovers, SUVs) at three shifts a day because once the virus abates, high days’ supply figures won’t matter; unit levels will.

Plus, automakers except Tesla book revenue based on wholesales to dealers, so they need to produce to get their income statements restarted. GM also has new-generation full-size SUVs, such as the Cadillac Escalade and Chevrolet Tahoe, coming out later this year from its plant in Arlington, Texas, and these highly profitable vehicles should help GM recover once factories reopen.

GM remains on our Best Ideas list because we think it will make it through the coronavirus fallout without going bankrupt or needing a bailout. The company finished 2019 with $17.3 billion available on its credit lines; the virus forced GM to suspend its 2020 guidance and borrow about $16 billion of these funds, according to a March 24 announcement. We estimate this draw brings GM’s cash balance to about $30 billion, because on March 24, the automaker also estimated its March-end cash excluding the credit line funds borrowed would be about $15 billion-$16 billion.

GM’s now-suspended 2020 guidance given Feb. 5 called for $2 billion-$3 billion in share buybacks this year, adjusted automotive free cash flow (excluding the Cruise autonomous vehicle ride-hailing business) of $6.0 billion-$7.5 billion, and adjusted diluted earnings per share of $5.75-$6.25. Excluding the $5.4 billion of lost free cash flow from the strike, GM’s 2019 adjusted automotive free cash totaled $6.5 billion, so 2020 guidance was solid, in our view. It also indicated to us that GM’s transformation program, announced in November 2018 to reduce capital expenditures and generate net cost savings of $4.0 billion-$4.5 billion by year-end 2020, was working. We think 2020 guidance in February would have been disappointing, like Ford’s was, if not for GM making moves like closing and then selling the Lordstown, Ohio, plant that made the now-discontinued Cruze compact sedan.

We don’t expect GM to resume its suspended 2020 guidance once virus uncertainty eases, but we think it will make it through these dark times. In addition to a deep cash hoard of about $30 billion, by our estimates, March 26 media reports indicate that GM is deferring 20% of global salaried employee pay (69,000 people, or 42% of the global head count) for potentially six months, with the amounts lost to be reimbursed in a lump-sum payment no later than March 2021. Senior leadership’s reduction will be about 30%, and directors will see pay cut by 25% and not reimbursed. It’s reasonable to assume that the deferrals equal at least $1 billion in cash saved. GM is also delaying some new vehicles, but not the new SUVs, a new Cadillac all-electric vehicle, or the new Cruise Origin AV revealed in January, provided plants can reopen. The annual dividend payout of about $2.1 billion may be cut or eliminated if GM thinks it cannot reopen plants sometime in May. The next dividend is due to be declared in late April, and we think the board will assess the pandemic at that time to make a decision. Management seems to be trying hard not to touch the dividend (it was not mentioned in GM’s March 24 announcement), which we think is the right move because elimination probably isn’t necessary if plants can restart production in May. We wrote on March 18 that we estimate the daily net income lost from all of GM’s and Ford’s North American plant shutdowns to be $92.9 million at GM, or $0.06 of EPS, and $90.0 million at Ford, or $0.02 of EPS.

Also encouraging in the March 24 news, partly related to keeping the dividend, was the disclosure that the captive finance arm, GM Financial, is still planning to pay the auto business $800 million this year, with $400 million of that already paid in the first quarter. The $800 million is double 2019’s payout, and every bit helps in trying to maintain the dividend to common stockholders. GM also said on March 24 that the captive arm had a comfortable $3.2 billion capital cushion at year-end 2019 before the auto business would be required to contribute more capital to GM Financial per its support agreement to keep the finance arm’s leverage ratio no higher than 11.5 times. In addition, GM also has about $1.3 billion in available borrowings after its March credit line draw, though that amount drops to $300 million in July 2020 when one of the lines’ credit limit falls to $2 billion from $3 billion. GM has about $1.9 billion of debt due this year, but Reuters reported April 3 that GM is seeking to extend the maturity date on a $2 billion 364-day loan and a $4 billion three-year loan.

GM disclosed in March 2015 that its minimum cash to run the business was about $8 billion. That number might be lower now, since GM has exited Europe, and if North American plants remain closed because of the virus, GM does not have to buy raw materials. The 40-day UAW strike is a useful guide for GM’s tolerance for a cash burn, though not identical to the current situation because last year only the U.S. plants closed for all 40 days and salaried workers did not defer compensation. The strike cost GM about $5.4 billion in adjusted automotive free cash flow, according to its fourth-quarter earnings presentation, which is about $135 million a day. If GM’s minimum cash to run the business in a shutdown environment is, say, $6 billion, and it has about $30 billion presently, then at a daily cash burn of $135 million, GM could survive for roughly 180 days with its plants shut down, which is around late September or early October, the height of the presidential election season. We don’t think the virus will force a shutdown that long, but if it did, GM would need new private-market funds or a government bailout. We don’t see the Trump administration letting GM die, given the election and the president’s love of American manufacturing jobs, but like the last bailout, GM may be forced to file Chapter 11 bankruptcy to receive debtor-in-possession financing from the government, which would likely mean GM’s shareholders get wiped out. We’d only expect that to happen if plants cannot reopen by the fall.

As for Ford, we can no longer say that at least you are paid to wait with a generous dividend, because the company suspended it in March. Ford was already in a large multiyear restructuring program before the pandemic, and its now-withdrawn 2020 guidance was disappointing, given that its long-stale U.S. lineup was finally getting redone. Like many Ford watchers, we are frustrated by the long wait for a turnaround, and the only thing we can say now is that the stock is very cheap and the company probably won’t go bankrupt, with about $30 billion of cash on hand as of April 9 after maxing out its credit lines in March (provided plants reopen in the spring or summer). Ford announced April 13 that it can survive through at least the third quarter even if plants do not reopen and it cannot access more capital. The stock will probably jump once virus fears abate, but we can’t find anything exciting enough in Ford’s story to say we’d buy it over GM.

Gentex Proves High Quality Can Happen in U.S. Autos Gentex is a mid-cap name that some may not even have heard of. It is the dominant supplier of auto-dimming mirrors, with 94% market share. In many years of covering it, the biggest criticism we repeatedly see levied at Gentex is that it should add some debt and stop hoarding cash. New leadership is more receptive to deploying cash, with buybacks much larger over the past few years.

However, no one ever complains about a fortress balance sheet with too much cash in times like now. In fall 2008, Gentex’s stock did fall harder than the S&P 500 and Russell 2000, but from September 2008 through the end of 2009, Gentex crushed both indexes by gaining nearly 12% versus about an 8% decline in the S&P and a 10% decline in the Russell 2000. That pattern may repeat if the U.S. does not rebound fast from the coronavirus.

Gentex’s stock outperformed both indexes from March 9 to about March 20, probably due to its cash-rich balance sheet. We calculate Dec. 31 cash and investments of $2.28 per diluted share. However, from March 9 to April 13, the stock has fallen 13.1%, underperforming the S&P’s 6.1% decline but outperforming the Russell 2000’s 14% fall. The stock is only reasonably priced right now, in our view, rather than a screaming bargain, but its growth record may still make it attractive to some investors.

We also see Gentex as the best way to invest in our U.S. auto coverage for those leery of the GM/Ford story or those wanting something with an economic moat and a dividend that we think will not be touched in a recession. If this downturn is not as severe as some fear, a 3-star price may be as low as Gentex gets for a long time.

CarMax Is Our Runner-Up for High Quality in U.S. Autos CarMax's stock suffered greatly when virus panic hit the markets. The stock hit a 52-week high of $103.18 on Feb. 20 and then quickly fell 64% to a low of $37.59 (below our 5-star price of $44.40) by March 18. It then rallied by 73% in just six days to $64.90 on March 26. We found the sell-off ridiculous because we think the company's balance sheet can withstand over 30% of its stores shutting down due to stay-at-home provisions. CarMax's moat to us is quite safe because it is the largest used-vehicle retailer in the U.S. by a comfortable margin, selling several multiples of the annual used-vehicle volume of AutoNation AN, the largest franchise new-vehicle dealer. In calendar 2019, AutoNation retailed 246,113 used vehicles, while in the fiscal year ended February 2020 (fiscal 2020), CarMax retailed 832,640. We also think the moat will be fine as more competition enters the space both from franchised dealers such as Penske Automotive Group PAG, AutoNation, and Sonic Automotive SAH opening their own stand-alone used-vehicle stores, as well as from digital-only startups like Carvana and Shift, because CarMax is not standing still as e-commerce enters the automotive retailing sector. Management for several years has been building out omnichannel shopping capabilities so customers can do the researching, financing, and buying of a used vehicle online, in-store, or a combination to whatever degree they want. The company finished fiscal 2020 with omnichannel available to over 60% of customers. It will keep the rollout moving despite the virus but will focus for now on the most appropriate parts of omnichannel for these times, such as curbside pickup or home delivery.

The balance sheet looks safe to us should the U.S. enter a long recession in 2020-21. Debt has no balances due until $100 million of senior notes mature in April 2023, but major obligations are not due until June 2024. The June 2024 obligations at March 31 are $1.4 billion, with $1.1 billion coming from the credit line and $300 million from a term loan. In March, CarMax borrowed about $675 million on its revolver and has over $300 million of borrowing available plus about $700 million of cash. On the April 2 earnings call, the CFO said that the company’s two main debt covenants, a leverage ratio and a fixed-charge coverage ratio, could both “double the performance of those two ratios and still be well within the cushion”--we assume he means the fixed-charge coverage ratio could halve while the leverage ratio doubles. This cushion comes from the covenants calculated on a trailing 12-month basis, and CarMax had a strong fiscal 2020. CarMax also owns real estate at over 140 of its locations, with a book value of $1.8 billion, though that is probably understating the market value, so we think CarMax has over $2 billion of unencumbered real estate it could borrow against if things get worse. Given how well CarMax performed during the Great Recession, we’re comfortable saying it can get through the coronavirus pandemic as well.

Lehman Brothers’ September 2008 collapse occurred in CarMax’s fiscal 2009 third quarter. Despite ugly fiscal 2009 comparable-store unit sales of a 16% year-over-year decline, CarMax stayed profitable for the full year and free cash flow positive. The finance arm, CarMax Auto Finance, stayed profitable for the full year despite losing money for two quarters in fiscal 2009. It also lost money in the first quarter of fiscal 2010 and could not do an asset-backed security deal for over a year during the recession. We are not seeing the same banking system weakness that we did in 2008, so we think CAF will be fine, but it may have to delay its next securitization deal depending on how the market is handling the pandemic. On April 2, management described the ABS market as “disrupted” and does not plan a deal in the next few weeks. Securities and Exchange Commission filings indicate that CAF’s last ABS deal was in January. The warehouse facilities CAF uses to hold loan receivables before they are sold to ABS investors had $1.3 billion of unused capacity at the end of fiscal 2020. These are short-term facilities, and the next facility expires in August 2020 for $1.4 billion, but CAF did not have problems exceeding its warehouse limits after Lehman failed, partly by working out loan sales outside the securitization market, so we don’t expect problems this time around.

CarMax does not pay a dividend, so there’s nothing to maintain there, but it has bought back about 30% of its stock since the end of fiscal 2013. The buyback program is now suspended due to the virus. With March 31 cash on hand of about $700 million plus over $300 million of credit line still available, we think CarMax will weather the storm, and we see the stock as a good value for both value- and growth-minded investors. This stock is a growth stock, which means that like Gentex, the main times it’s undervalued is in downturns like now.

Franchise Auto Dealers Shouldn't Be Ignored in a Recession We have found over the years that many investors are not familiar with the six publicly traded franchise auto dealers: AutoNation, Asbury, Group 1 GPI, Lithia LAD, Penske, and Sonic. These are all narrow-moat businesses that in 2008-09 fell to levels that subsequently led to massive stock price appreciation in the 2010s. We think the market often assumes that a fall in new-vehicle demand means doom for the dealers, but that is not true. Dealers enjoy massive profits from their parts and service business, which they call fixed ops, and from their finance and insurance business. The dealers are not lenders, so F&I is a 100% gross profit segment due to its commission-based nature for arranging loans with banks and automakers' captive finance arms. F&I also gets commissions from selling third-party extended warranty products and other products, such as guaranteed asset protection, which covers the gap should an insurance check after an accident not cover the owner's loan balance.

Although some of the six public dealers were in financial distress in 2008-09, particularly Sonic, none of them went bankrupt. This is because we think lenders did not want to own a dealership company, dealers had credit lines to draw on and in some cases, especially Lithia, unencumbered real estate to borrow against, but also because dealers do more than sell new vehicles. They have four segments: new vehicles, used vehicles, parts and service, and F&I. However, new vehicles are the basis for the other three segments because new vehicles bring a used vehicle on trade-in to possibly retail, a possible F&I sale with the vehicle sale (according to Experian, 85% of U.S. new-vehicle sales are financed, as are 55% of used vehicles), and service work for at least several years while the vehicle is under warranty. In a downturn, dealers actually report higher gross margins due to a mix shift toward service work and also used vehicles, but then experience deleveraging of selling, general, and administrative expenses and lower EBIT margins. This dynamic can enable a dealer to remain profitable, at least excluding noncash impairment charges for franchise rights impairments, or goodwill write-offs, and stay free cash flow positive in a recession. Service gross margins from warranty or customer pay work are generally in the mid-40s to mid-50s, which creates a stark contrast between revenue and gross profit mix.

The virus sell-off has made all six of our dealers attractively priced, and we think it’s hard to go wrong buying one at present prices over the long run. There are some differences in strategy, particularly around embracing stand-alone used-vehicle stores, where Sonic is most aggressive with its EchoPark stores, but AutoNation (with AutoNation USA) and Penske (with its U.K. and U.S. acquisitions of CarShop and CarSense) have also embraced this strategy. We don’t think a dealer has to have stand-alone used-vehicle stores to be a success; the main company differences tend to be around brand mix, debt on the balance sheet, and store geography. All six companies benefit from the industry gradually consolidating in favor of larger operators. This trend is happening, albeit very slowly over decades, because of automakers’ new-vehicle volume bonus payouts making it very hard to make good money in new-vehicle sales, succession issues with smaller dealers, automakers’ preference to give new stores (called open points) to the large dealers, and constant expensive store imaging rules put in place by automakers.

All six have narrow moat ratings as a result of the intangible asset and cost advantage sources in our moat framework, but Lithia, to us, is the most unique because its moat story also has a third source: efficient scale. Lithia is the only one of the six dealers that has a sizable presence in small cities in addition to metro areas. For example, it owns nearly all Chevrolet stores in Alaska, five stores of various brands in Hawaii, and stores in small Texas cities, such as Odessa and Midland. This strategy often leads to Lithia having the only dealership for a brand within 100 miles, helping its pricing power and market share. Lithia announced on March 27 that it currently has over $1 billion in potential liquidity from a combination of cash on hand, credit lines, and unencumbered real estate. The last was particularly helpful to the company in 2008-09.

If international exposure is attractive, then Group 1 and Penske Automotive are the only two with business outside the U.S. Both are active in the United Kingdom, and Group 1 is the only one of the six with stores in Brazil. Group 1 may struggle in 2020 as low oil prices will hurt its Texas and Oklahoma dealerships, which combined made up 43.1% of new-vehicle unit volume last year (Texas was 36.3%). The U.K. made up 22.2% and Brazil 5.6%. We think the company’s balance sheet can get it through these bad times, though, and the stock offers value here. It has no major debt due until a $550 million bond maturity in June 2022, and the company announced on April 2 that it redeemed all of its 5.25% $300 million bonds due in 2023 via credit lines, mortgage borrowings, and excess cash. The net impact moved the maturity to 2027 while lowering annual interest expense by $8.5 million. The company also said on April 2 that it will obtain new mortgage debt during the second quarter to supplement its liquidity. This type of move suggests to us that the company will not have a liquidity crunch and can get more credit if needed. The company also freed up about $20 million on an annual basis by announcing a dividend suspension on April 7.

Penske is run by business mogul Roger Penske and gets $9.7 billion, or about 42% of its 2019 revenue, from outside the U.S. It also has aggressively moved into heavy-truck dealerships in the U.S. and Canada, with 25 dealerships, and is the largest U.S. retailer of Daimler’s Freightliner and Western Star brands. Although all the dealers before COVID-19 paid a dividend except AutoNation and Asbury, Penske is likely the best dividend payer of the group in the long term, probably because of Roger Penske wanting to monetize his work. Penske Corp., which Roger is the CEO of, owns 42.3% of Penske Automotive’s stock. In February, the company increased its quarterly dividend to $0.42, about a 5% annual yield, which was the 35th straight quarter of increases. This streak may be in jeopardy due to the coronavirus, but the company does not have to make a decision on the next dividend for about another month. Liquidity is management’s key focus now, along with employee safety, so any action, including suspending the dividend, is possible. The company also has a commercial vehicle and commercial vehicle parts distribution business in Australia and New Zealand and owns joint venture stakes in light-vehicle dealer groups in continental Europe and Japan. The company announced on March 30 that it has access to $1.3 billion of liquidity, including $850 million from cash and credit lines plus approximately $450 million from financeable real estate.

Over the past few years, Asbury has led the sector in expense efficiency, with the lowest SG&A as a percentage of gross profit. In December, it announced a $1 billion deal to buy Dallas’ Park Place, a 10-store luxury dealer group, but then terminated the deal just before closing in March because of the impact of the virus on auto sales. We think management took the responsible approach by avoiding leveraging up at the start of a possible U.S. recession, but we think Asbury will seek another luxury deal once the virus impact is over. The company is looking for a CFO after the last one left for the same job at AMC Entertainment last year, and it’s not ideal to lack a finance chief in difficult times. Still, net debt/EBITDA was in the low 2s at the end of last year, and there’s no major debt due until September 2024, when $284 million on the credit line comes due. The company maxed out its credit line in March because of the virus and said its cash on March 23 is about $566 million.

Sonic and AutoNation both have large geographic exposure to the largest U.S. auto markets. Sonic in 2019 generated 55.4% of total revenue from California and Texas, with that amount split roughly evenly. Florida-headquartered AutoNation generated 63% of its revenue from Florida, Texas, and California, in that order. These markets can suffer from a hurricane or a housing bubble, but we think that over the long run, being a large dealer in the largest markets leads to scale and good profits. Sonic’s management decided about a decade ago that CarMax was doing something right and built its EchoPark used-vehicle business in a similar manner using algorithmic vehicle pricing, and an obsession with reinventing the used-vehicle buying experience to be customer-friendly. EchoPark has nine stores now, and AutoNation USA is holding at five while it gets its playbook right and now likely will wait for the virus and any recession to pass. EchoPark’s playbook is further along, and we expect the business to one day be a meaningful part of Sonic’s valuation. EchoPark is still small relative to CarMax, but in 2019 it sold nearly 50,000 vehicles on revenue just under $1.2 billion and had planned before the virus to open at least three more stores this year. It was also profitable before impairment charges. Management told us on April 3 that some of its franchise dealer stores, such as in the Southeast, have not been hit as hard by the coronavirus as Northern cities and will still grow for the first quarter, though not in March.

AutoNation is the best dealer for leveraging its brand because, as the largest dealer, it decided several years ago to drop regional brand names and consolidate all branding under the AutoNation name (when allowed by the automaker), so a Honda store is now AutoNation Honda, for example. The company’s size also has led to management creating AutoNation-branded parts and branded financial-service products, such as extended service and maintenance plans, which complement AutoNation’s auctions and its AutoNation-branded stand-alone used-vehicle stores, AutoNation USA. The company’s size also enabled it to land a service agreement for Waymo’s autonomous vehicles because the Alphabet subsidiary wants to have a service partner it can count on nationwide as it grows its ride-hailing business. AutoNation in late March announced an extension of its credit line to March 2025 and the release of subsidiaries as guarantors for its senior unsecured notes and commercial paper program. We think getting these terms from lenders in the thick of the coronavirus pandemic is a good sign for the company’s long-term health and shows that lenders are willing to help dealers get through bad times. On April 3, AutoNation announced that it has March 31 liquidity of $1.1 billion, including over $400 million of cash and about $700 million available on its credit line. On April 13, it said CEO and president Cheryl Miller is taking a medical leave for an undisclosed illness. Her interim replacement is Mike Jackson, who led AutoNation for about 20 years before his 2019 retirement and is an outstanding dealer CEO, so we think the company remains in good hands.

Adient Is Extremely Undervalued, but It's Not for All Investors Adient is the largest automotive seating company in the world, with roughly 33% market share, which includes a 45% share in the world's largest vehicle market, China. The stock enjoyed initial success after an October 2016 spin-off from Johnson Controls, rising to the mid-$80s, but then fell to the low $12 range in March 2019 after a series of operational execution problems came to light. The stock has fallen to as low as $5.90 during the coronavirus crisis but has bounced off that low to the low double digits. We think the stock is ridiculously cheap, and new leadership, led by Lear and TRW veteran Doug Del Grosso, who took over in October 2018, brings Adient the operational expertise it sorely lacked when it spun off. Del Grosso has replaced nearly every legacy Johnson Controls executive, and the company was starting to move in the right direction operationally before the virus hit.

Adient’s problem is too much debt as a result of the spin-off so it could pay Johnson Controls a $3 billion dividend. In May 2019, Adient refinanced its debt to give it time to restructure its manufacturing operations. At Dec. 31, total debt was $3.7 billion, with no maturities until a EUR 165 million European Investment Bank loan in 2022 followed by a $796 million term loan in May 2024 and EUR 1 billion of notes due in 2024. Another $1.7 billion across two bonds comes due in 2026. The coronavirus in late March forced Adient to draw another $825 million on its credit line due in May 2024, leaving $175 million left to borrow and bringing debt to about $4.6 billion. Adient reported Dec. 31 cash of $965 million. On Jan. 31, 2020, Adient announced that it was selling its 30% stake in the largest automotive interiors business, Yanfeng Automotive Interiors, along with some other assets to raise about $400 million. In early March, it announced a $175 million sale of its fabrics business to Sage Automotive Interiors.

As long as these deals still go through, Adient will likely use this roughly $575 million to pay down debt. We’ll look for an update on the status of the two deals and the company’s financial health on May 5, when Adient reports fiscal second-quarter earnings. Over time, we expect that its leaders will bring cost improvements to manufacturing and that the company can keep paying down debt, though we expect some of the above maturities to be refinanced as well in a few years. As more of the enterprise value pie moves to equityholders from debtholders, we expect Adient’s stock price to massively rise from early 2020 levels.

Adient’s stock is severely mispriced, in our view. The company’s roughly 20 Chinese joint ventures are accounted for under the equity method. We take Adient’s midcycle equity income and look at the joint ventures’ value under several reasonable aftertax earnings multiples ranging between 6 and 10 times, both for 2019 equity income excluding the coming interiors joint venture sale and using our midcycle equity income projected for fiscal 2024 (Adient’s fiscal year ends Sept. 30), and then compare that product with Adient’s current market capitalization. The results show that the total market value of Adient is less than just the joint ventures’ value in all scenarios. This means that investors get Adient’s operations outside China, which is a $15 billion-$16 billion revenue business, for free.

The mispricing is probably only happening because the market fears Adient’s debt load will force a bankruptcy filing. The company, to our knowledge, does not have financial ratio covenants, such as a leverage or coverage ratio (it does have restrictive covenants for actions like paying a dividend or taking on more debt, but the latter does not seem to be an issue given the March credit line draw), that could force it to file bankruptcy, but history shows a scenario where our stock call would be wrong.

Rival seatmaker Lear filed a prepackaged bankruptcy in July 2009 shortly after reporting a quarter in which it held about $1.1 billion in cash against about $3.5 billion of debt, with our research indicating that the only large looming maturity was $467.5 million in March 2010. Lear’s senior executives kept their jobs and started with a fresh balance sheet in November 2009 when it exited bankruptcy. We don’t know if Lear’s management gave up too easily or if its lenders were unreasonable to force bankruptcy. We do have reservations about Adient’s leadership taking a similar path to clean up the balance sheet but note that Adient CEO Del Grosso left Lear nearly two years before it went bankrupt.

We don’t think Adient must take this path, but we warn investors that it might if management is willing to endure the short-term pain of having its own equity wiped out. Management would likely get equity awards over time in a new Adient to make up for that loss, but current Adient stockholders would not see their basis recovered. Even if our 5-star call is correct, we don’t expect Adient’s stock to get close to our fair value estimate for several years. This is a stock that will require immense patience and tolerance for large up and down stock price moves. We believe in the company’s moat and management team, but the debt load is high, and bankruptcy is a risk, as reflected in our bear-case scenario fair value estimate of $0.

/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)

/d10o6nnig0wrdw.cloudfront.net/10-04-2024/t_e6175f671cee439d9180e460f6081183_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/222a1c0d-911c-4064-ac93-f9d4516d0a06.jpg)