Porsche Shares Undervalued After Solid IPO Debut

Investors show strong demand for the high-end carmaker despite rocky markets.

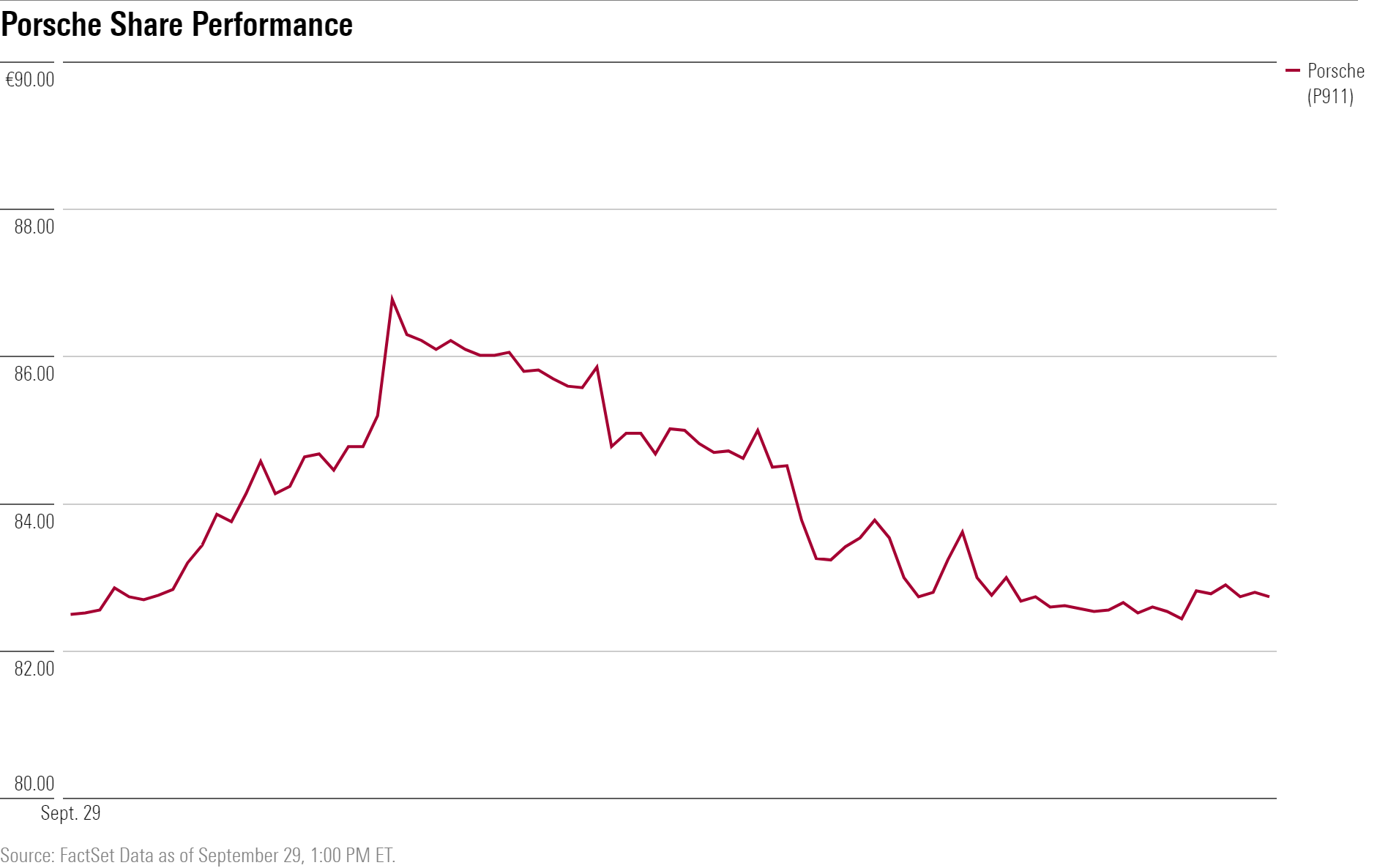

Shares of luxury car maker Porsche AG hovered just above their offer price on their first day of trading following a EUR 9.29 billion ($9.1 billion) IPO in Frankfurt on Thursday.

Amid high demand from investors, the shares were priced at EUR 82.50, the top of an initial EUR 76.50-82.50 range. After rising as much as 4.9% by midday in European trading, the stock retreated toward its offering price.

The buoyancy of Porsche’s shares contrasted with a down day in European markets, as investor confidence was battered by Russia’s imminent annexation of occupied Ukrainian regions, a suspected attack on key pipelines, and a crisis of confidence in the new U.K. government’s management of its economy.

The launch proved to be a bright spot in an otherwise dismal year for initial public offerings.

Volkswagen VWAGY will retain majority ownership of Porsche, and U.S. investors can gain exposure to the sports car maker by owning Volkswagen. Another way of gaining exposure is through Porsche Automotiv Holding POAHY, the holding company of the Porsche family, which owns a total equity stake of 25% in Porsche, including 12.5% of the voting shares. The holding company also owns a sizable stake in Volkswagen.

Foreign stocks can be bought through individual brokerage accounts, but such holdings typically have higher fees associated with them.

Porsche's choice of timing for going public had raised questions in advance.

"Automotive sector market valuations have been hit by the possibility of a recession in major markets, chip shortages, war in Ukraine, higher raw material costs, higher prices paid at the pump, and other inflationary cost pressures," says Morningstar senior equity analyst Richard Hilgert.

However, in this most challenging of environments for global automakers, Porsche has delivered on sales and profits. It had a banner year in 2021, selling more than 300,000 cars for the first time, and sales of its all-electric Taycan sedan outpaced its classic 911 model.

Porsche’s IPO is the largest in Germany since Deutsche Telekom went public in 1996.

In advance of the offering, Volkswagen revamped Porsche’s capital structure into two share classes: a 50% preferred nonvoting stock and 50% common stock with voting rights. Volkswagen also has a dual share class structure with 59% in common stock with voting rights and 41% in preferred stock that is nonvoting. Volkswagen says it will hold a December shareholder meeting to vote on a special dividend of 49% of the gross proceeds.

“We reiterate that we like Volkswagen's plan to reward shareholders with a special dividend,” says Hilgert. “In addition, we like that the remainder of the proceeds will probably be used in Volkswagen's transition to battery electric vehicles, in which the firm plans to invest more than EUR 50 billion during the next five years.”

One concern around the IPO, however, involves corporate governance. For starters, owners of the new shares have no voting rights in the company

Another concern is that Volkswagen’s new chief executive, Oliver Blume, is also in charge at Porsche. “This raises concerns about a conflict of interest,” says Hilgert.

“Even so, 5-star-rated Volkswagen ordinary and preferred shares currently trade at 41% and 58% discounts to our EUR 326 fair value estimate, respectively,” Hilgert says. “We favor the nonvoting preferred shares for the higher discount to our fair value estimate and better market float relative to voting ordinary shares.”

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UA4PJHTFYFFX3FUDUZ6ZHGQ6IY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D2LN64PPEJFUFPSWUNYVGCCDLA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)