Communication Services: Online Advertising Remains Strong, but Growth Will Likely Decelerate

Our favorite stocks in communication services include Comcast, Warner Bros. Discovery, and Crown Castle.

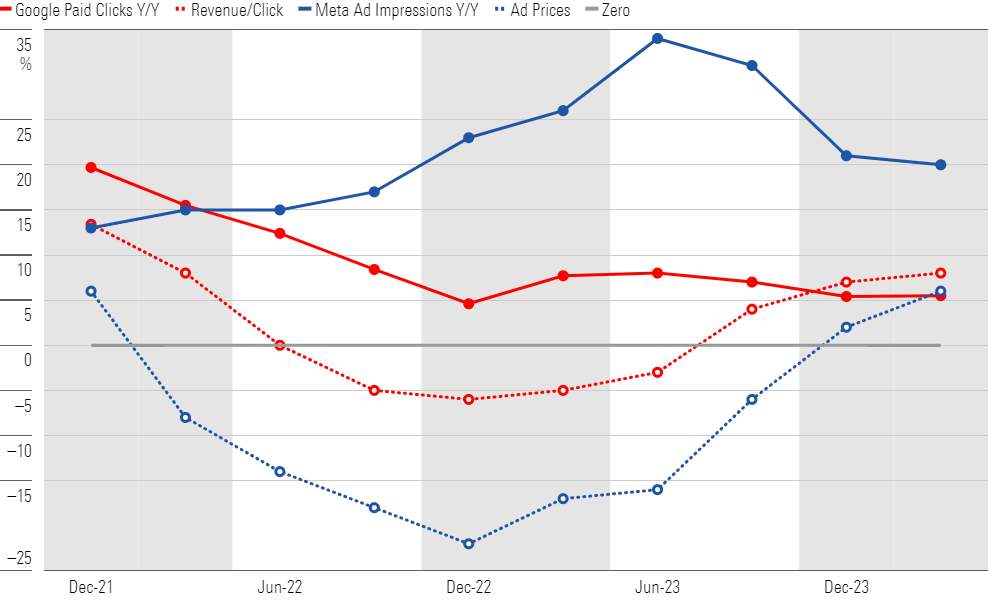

Giants Alphabet GOOGL/GOOG and Meta Platforms META continue to see strong consumer engagement, though growth is slowing. Google’s paid search volume increased 5% year over year during the first quarter, versus 7% in 2023 and 10% in 2022. Meta’s ad impressions were up 20%, down from 28% last year, on 7% daily active user growth and increased ad loads, especially on Reels. Ad pricing has been the bigger story, though. Exceptionally strong advertiser demand lifted revenue per click by 8% at Google and 6% at Meta—the best results in two years.

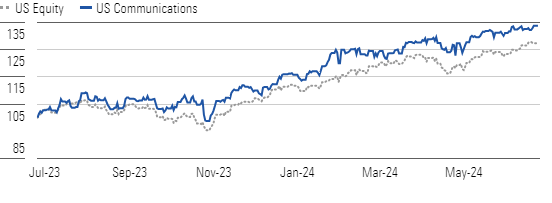

Alphabet’s Gains and Meta’s Rebound Following Earnings Have Powered the Sector

Asian advertisers have sharply ramped up spending. Meta, which discloses revenue by user and advertiser location, has seen nearly half of its growth over the past year come from Asia-based advertisers. This surge in demand could turn into a headwind as 2024 progresses, however. Research firm Tinuiti noted that the year-long surge in Google search demand from Asian retailer Temu waned late in the first quarter. In short, we expect growth for both Alphabet and Meta to slow steadily in the coming quarters.

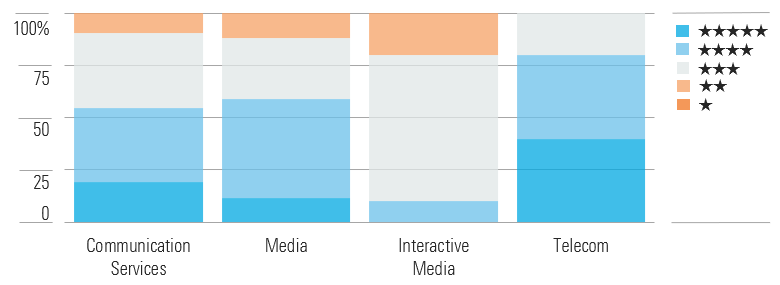

Telecom Still Offers the Most Opportunity; Traditional Media Is Also Cheap

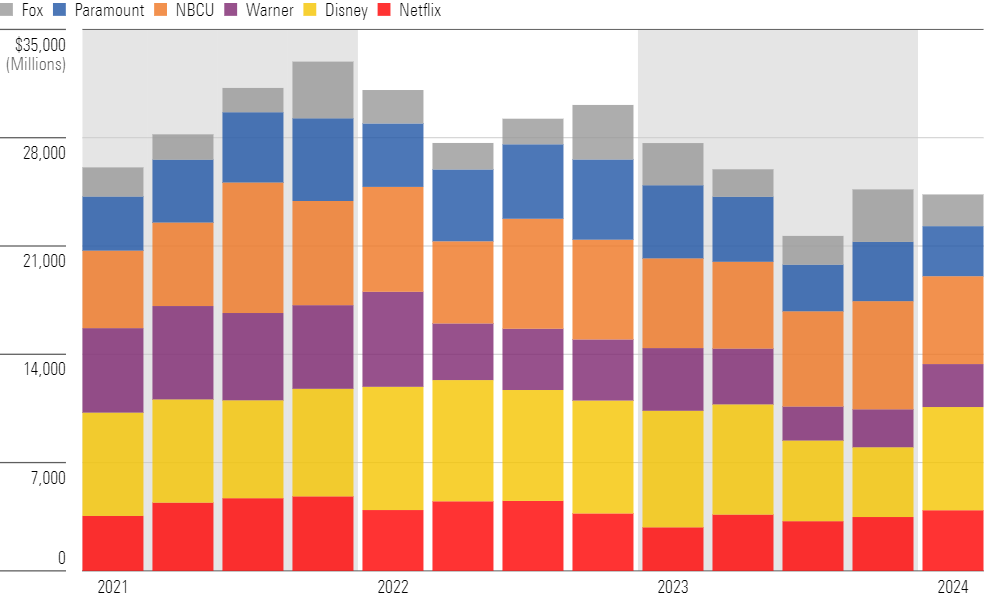

In traditional media, content spending continues to decline, reflecting an emphasis on profitability and the impact of the Hollywood strikes. Reduced production hasn’t had a noticeable impact on the traditional television business, where the pace of net customer losses has remained fairly constant. This makes sense, given the greater importance of sports and news (rather than general entertainment) to the traditional television bundle. Lower content spending has lifted profitability recently, but with cord-cutting showing no sign of abating, we expect that traditional media firms will struggle to post meaningful revenue growth and maintain margins in the coming quarters.

Volume and Price Growth: Consistent Engagement and Strong Advertiser Demand

Traditional media companies still need to make much more progress in streaming to offset the decline of television. Disney DIS posted strong Disney+ customer additions in the first quarter thanks to its new agreement with cable provider Charter, but it hasn’t struck similar deals with other distributors. The bundling of Disney+/Hulu with Warner Bros. Discovery’s WBD Max also has promise, but we’d like to see these services offered to traditional television customers at a sizable discount to enhance the value of a traditional pay-TV subscription.

Cash Content Spending: Increased Discipline and Strikes Curtail Investment

Top Communication Services Sector Picks

Warner Bros. Discovery

- Fair Value Estimate: $20.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

While some pessimism is warranted, we don’t believe investor sentiment around Warner can get much worse. The firm’s traditional TV business remains in steep secular decline, and its direct-to-consumer business, which revolves around the Max streaming service, has stagnated just below 100 million global subscribers over the past year. While we don’t expect a major turn imminently, the streaming business is entering many new markets. Warner also has a premier studio business that continues to generate profits despite a recent lull. We expect linear to continue declining, but that fate is more than priced in, and we think discipline in considering the renewal of NBA rights is prudent.

Crown Castle

- Fair Value Estimate: $130.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

We continue to believe value is being overlooked in US towers, and our current favorite is Crown Castle CCI. We previously shied away from Crown because of its fiber and small-cell business. However, new capital investment in fiber is coming down, and Crown is increasingly co-locating new tenants on existing fiber, so we don’t think fiber will destroy value. Towers drive the value we see. Unlike its peers, Crown operates exclusively in the United States. Within towers, this may result in lower relative top-line growth. However, it will also result in significantly less new investment required for towers and superior operating margins, so its returns on invested capital within towers should lead the industry.

Comcast

- Fair Value Estimate: $56.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

While Charter Communications CHTR and Altice ATUS trade at bigger discounts to our fair value estimate than Comcast CMCSA, differences in debt leverage account for these gaps. Thus, we would still favor Comcast for its stronger balance sheet. We expect Comcast’s network will enable it to maintain the size of its broadband customer base over time while a rational competitive environment allows broadband prices to rise. The cable companies, including Comcast, will need to increase network spending in the coming years to keep pace with the phone companies’ fiber network capabilities, but we expect cable cash flow to grow modestly. In our view, the NBCUniversal business isn’t as strong, but it remains an important media asset.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z34F22E3RZCQRDSGXVDDKA7FGQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)