Moderna Dominates COVID-19 Vaccine Manufacturers, at Least for Now

The global COVID-19 vaccine market is currently dominated by mRNA firms, but competitors are gaining strength.

The development of the COVID-19 vaccine market will depend on several tough-to-predict outcomes, like the duration of vaccine protection, how variants evolve, and how competitors progress.

Despite the early lead that Moderna MRNA and BioNTech BNTX hold, and their clear dominance in the pandemic market for COVID-19 vaccine sales, we're not yet convinced that COVID-19 will require widespread annual booster shots, and if so, whether these companies will remain dominant in the long run.

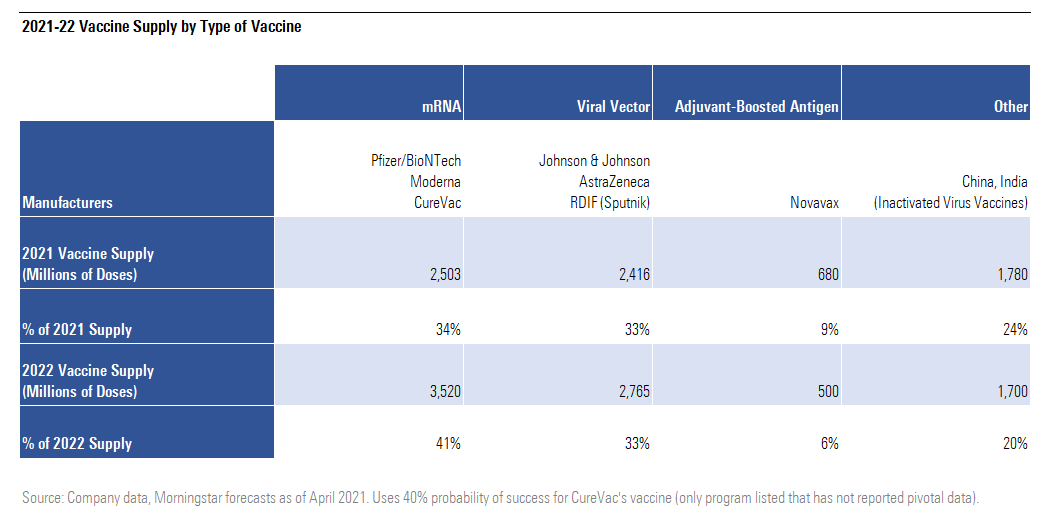

Still, we do expect these mRNA companies to dominate the global COVID-19 vaccine market in the short term, particularly as third-dose boosters become available late in 2021. We expect 41% of delivered doses in 2022 to be based on mRNA technology.

2021-22 Vaccine Supply by Type of Vaccine

Near-Term mRNA Vaccine Demand Boosted by Vector Vaccine Headwinds

Adenoviral vector vaccines from Johnson & Johnson JNJ and AstraZeneca AZN have seen slower launches due to manufacturing issues and, more recently, potential safety issues.

The manufacturing issues have cut AstraZeneca's expected output in the first half of 2021 from its original goal of 300 million doses in the European Union to only 100 million. Johnson & Johnson has lost as many as 15 million doses due to a manufacturing mix-up at a key facility in Baltimore.

And both vaccines have been linked to rare side effects. Reports of a rare combination of low platelets and dangerous blood clots in recipients of the AstraZeneca vaccine have led several European countries to limit its use to older adults; Denmark has opted to stop using it entirely. The Johnson & Johnson vaccine is back on the U.S. market following a temporary pause while the Food and Drug Administration investigated six blood clots (out of more than 6.8 million administered doses).

We continue to think the risks of COVID-19 far outweigh the potential safety risks of these vaccines, particularly in regions that do not have access to mRNA vaccines and if age restrictions are considered. That said, these fears are already boosting demand for mRNA vaccines in Europe.

COVID-19 Vaccinations Likely to Be Annual, at Least for Some Groups

So far, data indicates that vaccines last at least six months, as Pfizer PFE/BioNTech and Moderna have disclosed relatively stable six-month efficacy levels. However, we assume continuing declines will mean that COVID-19 vaccines will be needed annually for certain populations, beyond the pandemic.

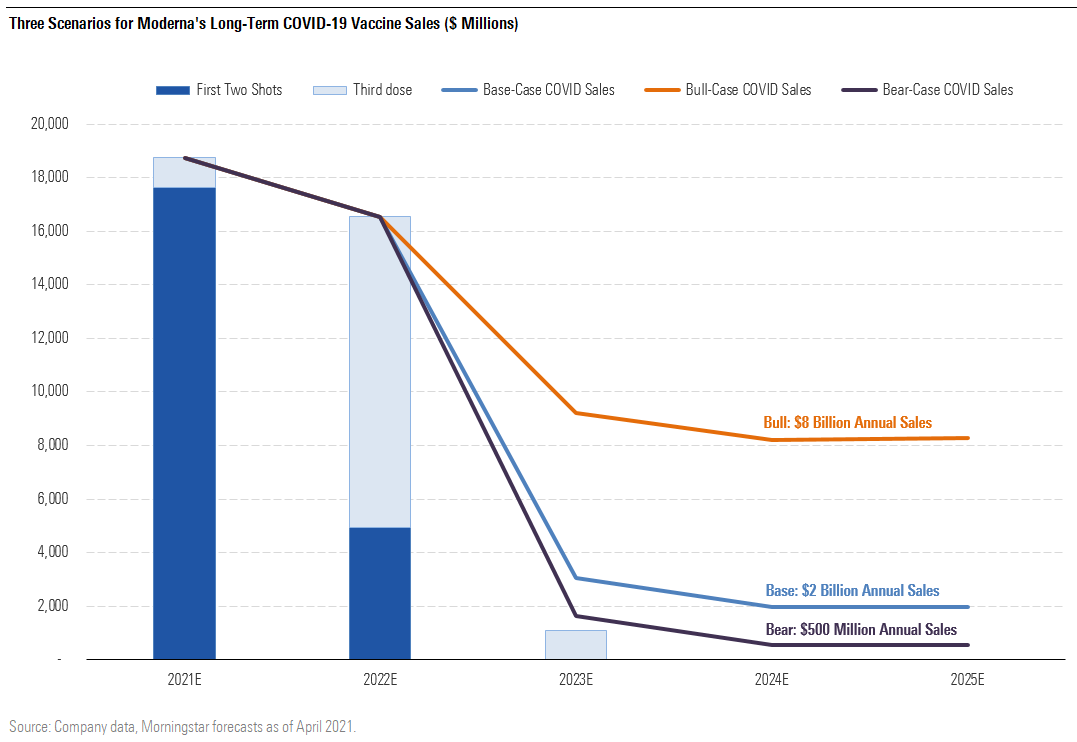

- In our base case, we assume that higher-risk populations (infants and the elderly) require annual vaccination and that prices rise slightly due to demand for higher-efficacy vaccines (although we assume some new competition from other mRNA and antigen vaccine players). Our base-case assumptions create a roughly $8 billion annual market, of which we assume Moderna could see $2 billion annually. (We provide our detailed analysis of Moderna in this article.)

- In our bull case, we assume broad recommendations for annual vaccination at a price roughly double that of pandemic prices. This assumes limited competition, continued high mutation rates, and waning immunity from pandemic shots (vaccines appear to remain effective for at least six months, but additional mutations could erode this protection further). Our Moderna bull-case assumptions imply market demand for 1.6 billion vaccine doses annually; at a premium price around $16 a dose globally ($30 in the United States), this would create a $26 billion annual market.

- In our bear case, we assume that only infants require annual shots, due to slowing mutation rates and longer-lived protection from pandemic shots, which levels the playing field for older technologies that take longer to modify and therefore prevents any price increases from pandemic levels. Our Moderna bear-case assumptions imply market demand for 250 million doses annually; at roughly pandemic-level pricing ($8 globally, $15 in the U.S.), this would create a $2 billion annual market.

Three Scenarios for Moderna's Long-Term COVID-19 Vaccine Sales

One of the reasons we see Moderna so well positioned in the booster (third-dose) market is that Pfizer/BioNTech and Moderna appear to be leading the way in the design of slightly modified vaccines to specifically target the 20H/501Y.V2 variant (B.1.351) that has become dominant in South Africa. Current vaccines appear to have reduced efficacy against this variant, to varying degrees. But Pfizer/BioNTech and Moderna are testing third doses of the current vaccine as well as new variant-designed vaccines, with these potential booster doses beginning as early as the fourth quarter.

Specifically at Moderna, phase 2 is ongoing for a third dose of the authorized vaccine, a third dose using variant vaccine mRNA-1273.351, or multivalent vaccine mRNA-1273.211 containing both versions. Preclinical top-line data indicates that the two new vaccines provide broad immunity. Next-generation vaccine mRNA-1283 (in phase 1) could be more stable at refrigerated temperatures and effective at a lower dose. This is another testament to the flexibility and speed that mRNA technology affords these two leading firms.

We do not yet model booster shot sales for either AstraZeneca or Johnson & Johnson vaccines, as they remain significantly behind mRNA leaders in clinical development for booster doses of existing or new variant vaccines.

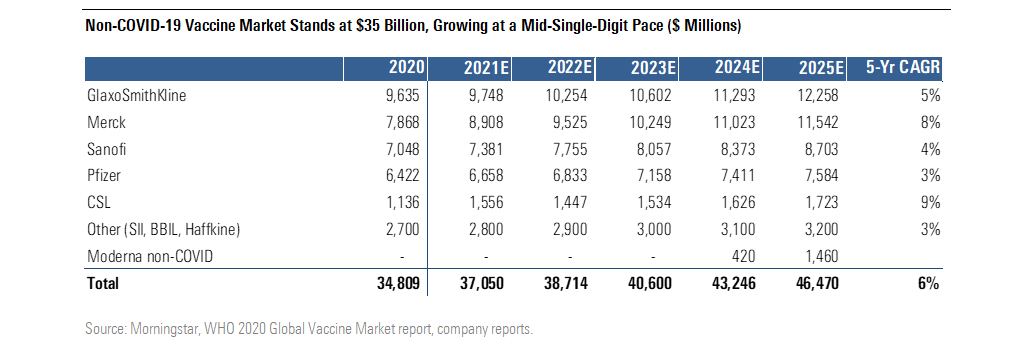

$35 Billion Non-COVID-19 Vaccine Market Growing at Mid-Single-Digit Pace

The vaccine market outside of COVID-19 is dominated by Glaxo GSK, Merck MRK, Sanofi SNY, and Pfizer in value terms. However, the top five volume providers (Glaxo, BBIL, Sanofi, Haffkine, and SII) are only 60% of the global market, showing the extent to which local vaccine makers serve the market for older, less innovative vaccines. We expect Moderna to begin to contribute to this broader market in 2024 with influenza and cytomegalovirus vaccines, and to build significantly beyond.

Non-COVID-19 Vaccine Market Stands at $35 Billion, Growing at a Mid-Single-Digit Pace

Multiple approved vaccines--such as those for HPV, meningitis, and pneumonia--are priced at more than $100 per series. These prices provide important benchmarks for the future pricing of Moderna’s innovative vaccines. We expect vaccine prices to rise from pandemic levels, but we expect several factors will limit COVID-19 vaccine price increases, including our expectation that the vaccine will be required annually (like flu shots) as well as government and public scrutiny of drug and vaccine pricing. In addition, pricing could vary based on the size of the recommended vaccination group.

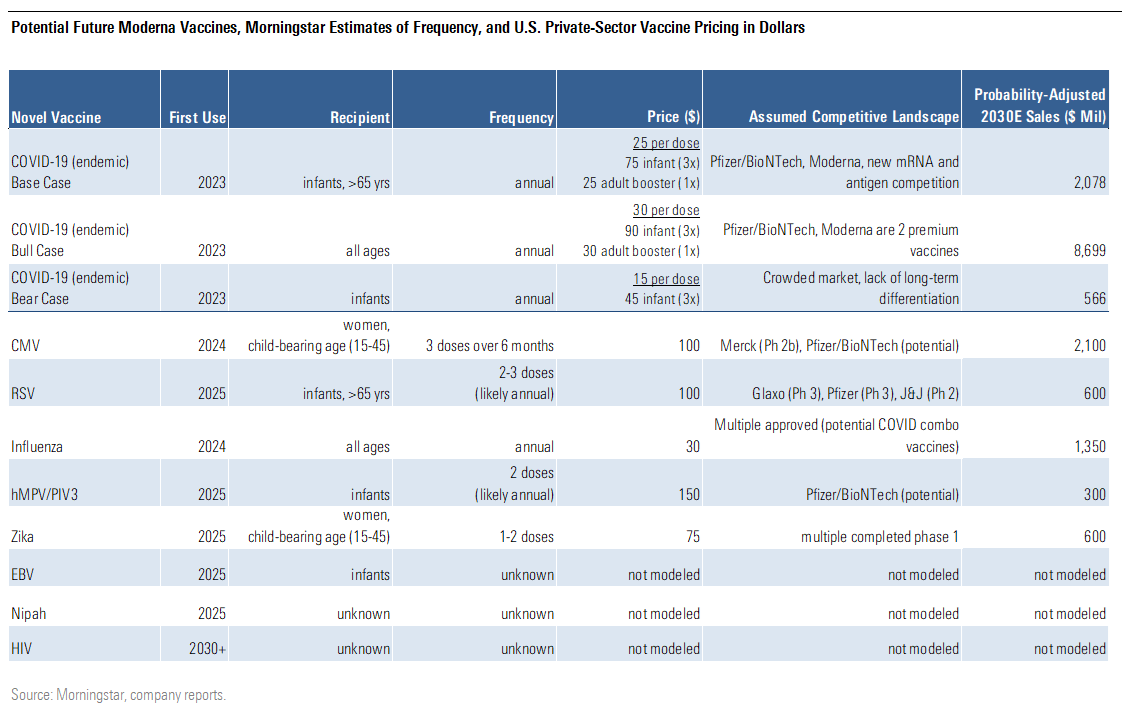

We've used the market for currently approved vaccines to help us predict the sales potential of Moderna's vaccine pipeline, with our key assumptions and probability-adjusted 2030 sales estimates shown below.

Potential Future Moderna Vaccine, Morningstar Estimates of Frequency, and U.S Private-Sector Vaccine Pricing in Dollars

Beyond COVID-19, we think most of Moderna's vaccines will be targeted at infants, including vaccines for respiratory syncytial virus, human metapneumovirus, and parainfluenza virus type 3. Other vaccines target women of child-bearing age (CMV, Zika) or the elderly (another RSV target). We assume prices for these innovative vaccine to be around $100-$150 per person, below current innovative vaccine levels, as we expect an increasingly competitive environment.

Competitive Landscape in COVID-19 and Beyond Could Be Challenging, Even for Moderna

According to recent data from the World Health Organization, there are 86 COVID-19 vaccines either authorized or in clinical trials around the world. Among the most promising competitors in the remaining pipeline are mRNA vaccines and antigen-based vaccines, many of which are in late-stage development.

CureVac CVAC and Arcturus ARCT both had slightly disappointing data in phase 1 that could mean lower potency than authorized mRNA vaccines from Pfizer/BioNTech and Moderna, although differences in convalescent serum comparisons make it hard to draw strong conclusions. Translate's program has seen manufacturing delays that reduced its potential to affect the pandemic, although the partnership with Sanofi could make this a viable program for third doses or annual boosters.

Moderna's IP Position Looks Strong, Although Multiple Competitors Could Emerge Quickly

While Moderna, CureVac, BioNTech, and GlaxoSmithKline own nearly half of mRNA vaccine patent applications, several other companies, large and small, have patents in the field, making it a highly fragmented segment.

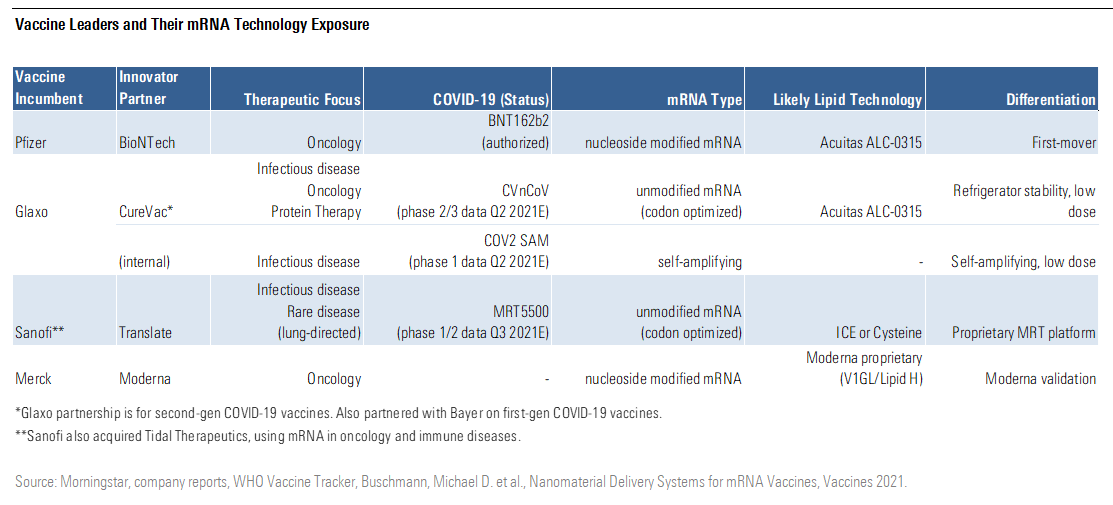

The chart below shows the mRNA exposure of the leading global vaccine makers, as well as their specific approaches by mRNA type and lipid technology. Pfizer is the only one of the four historically dominant vaccine players to have a large role in COVID-19 vaccine supply so far, but the success of COVID-19 vaccines is probably already leading to an explosion in patent applications for innovations in the segment.

Vaccine Leaders and Their mRNA Technology Exposure

Vaccine Manufacturing Field Could Grow Still More Crowded

Though Moderna is still dominating the vaccine market--and should continue to in the short term--we do not have enough certainty around future demand and capabilities to assert that this position will persist.

Multiple competitors are emerging as potential threats to Moderna's leadership among mRNA entrants over the next 10 years. This may potentially inhibit the company's ability to see the monopoly pricing power enjoyed by other innovative vaccines (Glaxo's Shingrix, Pfizer's Prevnar) launched in recent years.

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/d10o6nnig0wrdw.cloudfront.net/10-04-2024/t_e6175f671cee439d9180e460f6081183_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)