COVID-19 Vaccine Efficacy Solid Even as Delta Extends Pandemic

Hopes for eradication fade, further highlighting the benefits of vaccination and boosters.

With 5.5 billion doses of COVID-19 vaccines administered globally as of early September, according to Our World in Data, the immunization rate is slowing in many developed countries just as it accelerates in less-developed markets. In the United States, 53% of the population has been fully vaccinated. An apparent combination of vaccine hesitancy, waning efficacy of vaccines against infection, and the rise of the more contagious delta variant thwarted President Joe Biden’s target for returning to nearly normal by July 4.

The delta variant raises the bar to a potentially unreachable level for herd immunity, although we expect a return to nearly normal once all school-age children have access to the vaccine, likely in late 2021 in the U.S. New mandates or increased willingness to vaccinate following the Food and Drug Administration's full approval of Pfizer/BioNTech's PFE/BNTX Comirnaty on Aug. 23, uptake of third-dose booster shots beginning in September, and the potential rise of future vaccine-resistant variants will affect the speed of our return to nearly normal.

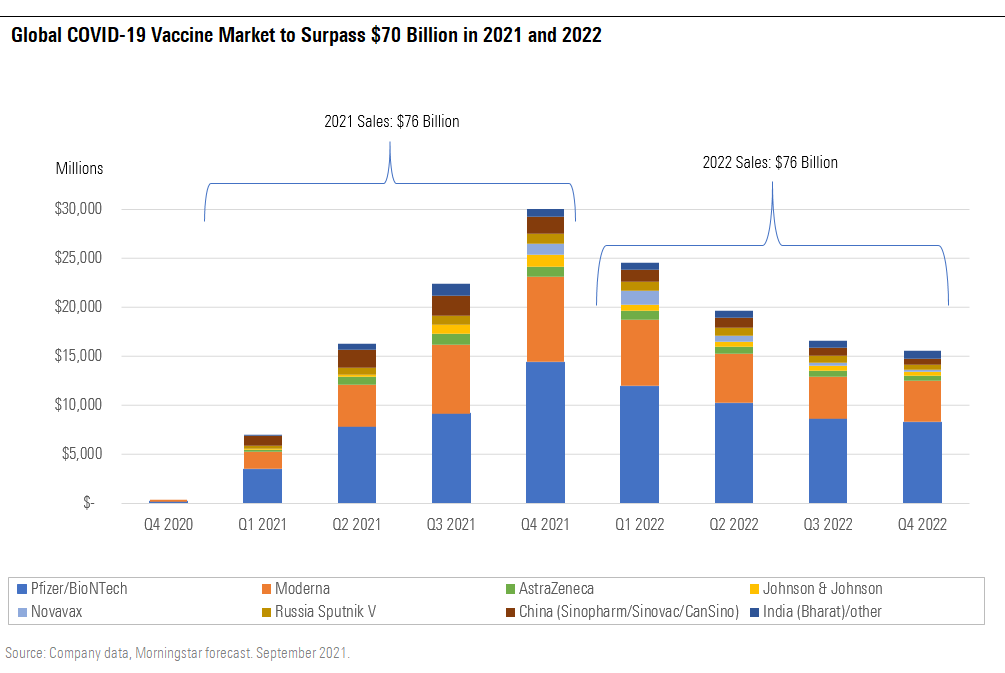

We now forecast sales of $35 billion for Comirnaty and $22 billion for Moderna's MRNA Spikevax in 2021, followed by similarly strong sales in 2022, driven by developed-market boosters and developing-market primary two-shot series. However, our long-term cash flow projections for Moderna and BioNTech rely heavily on the companies' non-COVID-19 infectious disease and oncology pipelines, where development and commercial risks remain high. We think the companies remain vulnerable to disruptive threats over the next 10 years, and we do not believe either has an economic moat. We also think Moderna and BioNTech appear overvalued. Based on DrugAnalyst consensus for Comirnaty sales that are generally in line with our forecast, we suspect that the stocks are being driven by preclinical or theoretical uses of mRNA technology.

The COVID-19 vaccine market evolution will depend on duration of vaccine protection, how variants evolve, and how new vaccines progress. Our base case assumes a $7.5 billion postpandemic COVID-19 vaccine market focused on annual booster shots for infants and the elderly.

Global COVID-19 Vaccine Market to Surpass $70 Billion in 2021 and 2022

COVID-19 Vaccine Market Expands to $70 Billion-Plus in 2021 and 2022

Pfizer/BioNTech's and Moderna's for-profit mRNA vaccines continue to dominate the global COVID-19 vaccine market as a result of a combination of manufacturing delays and rare side effects for viral vector vaccines, delayed manufacturing scale and approval for the Novavax NVAX antigen vaccine, and disappointing data for the CureVac CVAC mRNA vaccine. Sales of the two leading mRNA vaccines account for a combined 75% of our total COVID-19 vaccine market sales estimates in 2021 and 2022. We see their first-to-market status, manufacturing success, and leading efficacy and safety securing dominant positions with relatively strong pricing power in the near term.

A booster shot is likely to raise antibody levels and secure strong Pfizer/BioNTech and Moderna sales through 2022, but in the long run, we expect more limited utilization (focused on higher-risk individuals), competition from new vaccine manufacturers (Novavax, Sanofi SNY, Glaxo GSK, and others), and the eventual waning virulence of the virus to limit long-term potential of these mRNA COVID-19 vaccine franchises.

Delta More Transmissible and Virulent, but Vaccines Support Return to Nearly Normal

Prior pandemics over the past century have had second and third waves more severe than the first, and the delta variant surge fits this pattern. The delta variant (B.1.617.2) has been classified as a variant of concern, on the heels of several other variants in this category.

The delta variant now accounts for virtually all U.S. cases. It appears to have higher transmissibility and virulence than the original strain and the highest transmissibility of all variants of concern. Vaccinated individuals who are infected with the variant can have levels of virus in their upper airways that are similar to those in unvaccinated individuals who are infected, which is different from prior variants and could be driving transmission through vaccinated individuals as well. The U.S. Centers for Disease Control and Prevention estimates that the delta variant can spread to roughly five to nine individuals for each person infected, making it nearly as contagious as chickenpox. The CDC also estimates slightly higher fatality rates than the original coronavirus. A recent U.K. study saw roughly twice the risk of hospitalization for delta variant versus alpha variant patients.

We think these characteristics of the delta variant raise the bar for herd immunity to impossible levels. We expect this will lead society to refocus on preventing severe disease and hospitalization through vaccination, rather than eradicating the virus and ending asymptomatic and mild breakthrough infections. However, nearly normal is still achievable globally, as the population gains access to vaccines, and in developed markets, as school-age children are likely to be vaccinated this fall. Vaccine efficacy against severe disease has remained strong, and we expect third-dose rollouts to help maintain these high levels of efficacy.

Vaccine Hesitancy and Mandates Will Determine Next Steps

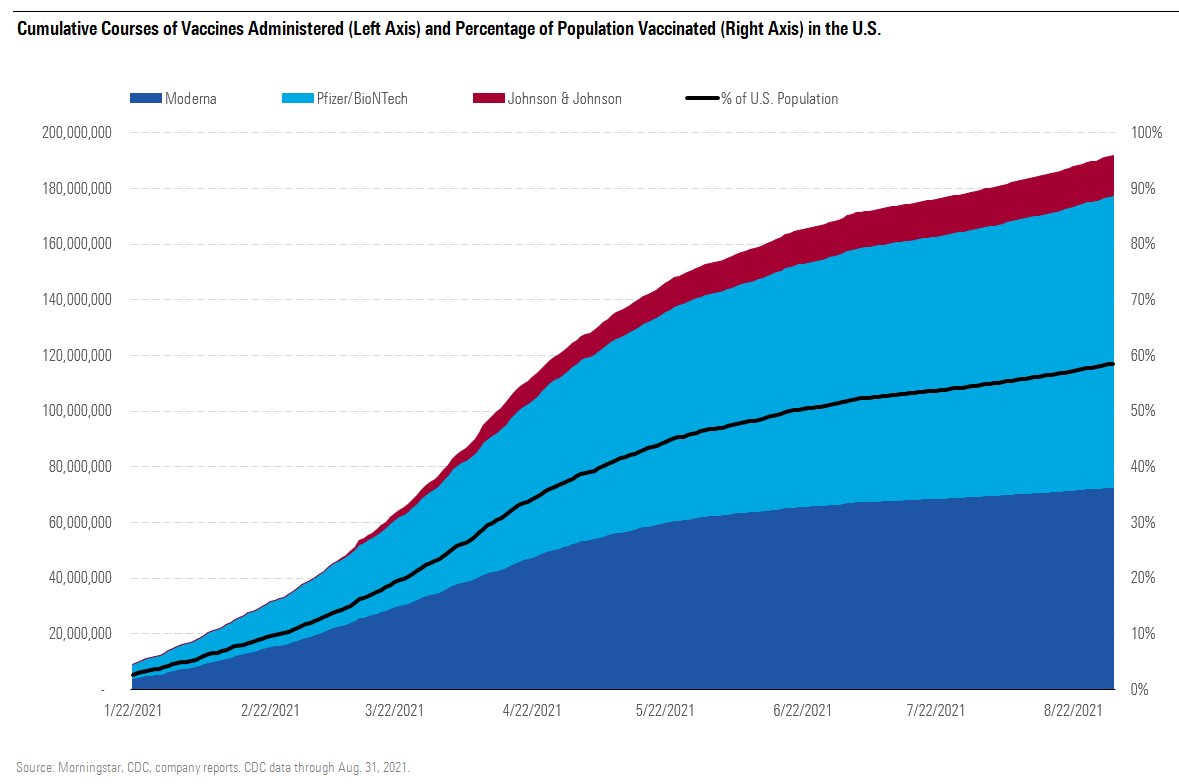

At the peak in April, more than 3 million vaccine doses were administered each day in the U.S. Levels fell rapidly, however, as the over-65 demographic was largely vaccinated (more than 80% are fully vaccinated). Rates periodically climbed again starting in May with the Pfizer/BioNTech vaccine authorization for ages 12-15, although falling rates of COVID-19 cases across the country led to the vaccination rate bottoming out around 500,000 doses per day in July. According to CDC data as of Aug. 31, 53% of Americans are fully vaccinated and 63% have received at least one dose. Data from the CDC shows that most Americans vaccinated have received mRNA vaccines, with Pfizer/BioNTech dominating.

Cumulative Courses of Vaccines Administered (Left Axis) and Percentage of Population Vaccinated in the U.S.

Cases began rising again in the U.S. in July. This was partly due to the much higher contagiousness of the delta variant as well as variability in vaccination rates in the U.S. States with lower vaccination rates have been more vulnerable and seen sharper spikes in both infections and hospitalizations. As of Aug. 30, several states continue to see less than 40% of their population fully vaccinated.

With the recent spread of the delta variant as well as the initial third doses for immunocompromised patients, daily vaccination rates are slowly increasing again. Rates for the initial series should fall as the delta surge subsides and as it becomes more difficult to find unvaccinated Americans willing to get vaccinated. We expect this to be partly countered by reduced vaccine hesitancy and increased vaccine mandates (both tied to Comirnaty's recent full FDA approval), as well as authorization in children ages 5-11.

Herd Immunity Unlikely

The CDC estimates that 120 million Americans were infected with COVID-19 through May, creating a baseline of at least 35% of the population who could be protected against further severe disease. With the delta variant surge, we estimate that 50% of the population will have been infected by the end of 2021, at which point we also expect 65% of the population to be vaccinated, with a total combined protected level of 83%.

While this is encouraging, we’ve also substantially changed our assumptions for COVID-19’s R0 (reproduction number, or rate of transmission) to account for the delta variant’s much more contagious nature. We’ve also slightly lowered our assumed rates of efficacy against disease in the U.S. for the remainder of the year, as protection could be slightly weaker ahead of and during administration of third doses. Taking these estimates together with the number of Americans who have been infected with COVID-19 over the past year, we now expect that the U.S. will not reach a level of protection (from infection and vaccination) sufficient to allow for herd immunity during 2021.

In practice, this could mean pockets of the U.S. are protected and others where cases continue to spread, based on the variation in vaccination rates by state. That said, we expect hospitalization rates to fall as vaccination levels rise and risks surrounding school transmission to significantly decline with authorization in the 5-11 age group later this year.

Outside of success stories in Israel and the United Kingdom, vaccination rates in the U.S. generally outpaced those in other developed countries for the first few months of 2021. However, Canada and the European Union accelerated vaccination rates and surpassed the U.S. in May. Developed-market vaccination rates continue to far outpace vaccination rates in developing markets.

Some countries (led by Canada, the U.K., and Israel) had fully vaccinated rates above 60% of their population as of mid-August. However, South America and Asia stand at only 25%, and Africa’s vaccination rate was only 2%, demonstrating the amount of work still needed to increase the average global vaccination rate, which is only 24%.

Developing Markets Just Starting to See Vaccine Supply

Large developing markets are not positioned to see herd immunity because of lower near-term supply of vaccines as well as the transmissibility and partial immune escape of the delta variant, as in other geographies. Covax aims to distribute 2 billion doses of vaccines, covering 30% of the population in low- and middle-income countries, although timing for that goal has been pushed from the end of 2021 to the first quarter of 2022. That said, vaccine donations from wealthier countries are becoming more significant; the U.S. and G7 partners have collectively committed to financing or donating a total of 2.3 billion vaccine doses globally by the end of 2022.

We still see herd immunity as tougher to achieve globally because of lower average efficacy for vaccines covering much of the population (such as AstraZeneca’s AZN and Johnson & Johnson’s JNJ vector vaccines and several Chinese inactivated-virus vaccines), logistical and financial difficulties with wide vaccination in many developing markets, continuing spread of variants that lead to lower vaccine efficacy against mild/moderate disease, and the fact that some East Asian countries have had a much lower incidence of disease, requiring even higher rates of vaccination to reach herd immunity. In addition, more contagious variants have raised the percentage of individuals who need to be protected in order to achieve herd immunity in all geographies.

Third Doses Likely to Expand Broadly This Fall

The CDC reaffirmed the efficacy of the two-shot series in early July, although a third dose has since been authorized by the FDA for immunocompromised individuals, and the Biden administration expects broad third-dose booster shots beginning in mid-September. We continue to model a third-dose booster broadly across age groups in our COVID-19 vaccine models through 2022.

Both Pfizer/BioNTech's and Moderna's vaccines appear to retain strong efficacy up to six months after a second dose. Comirnaty showed 84% efficacy against symptomatic infection after four to six months and 97% overall efficacy against severe disease through six months, and Spikevax was 93% and 98% effective on the same metrics, according to data released in Moderna's second-quarter conference call. However, these trials were conducted before the spread of the delta variant, making more-recent studies and real-world data particularly helpful. While U.S. timelines for administration of third doses look aggressive, we expect additional more-definitive data to lead to broad usage of third-dose booster shots across developed markets this fall.

Breakthrough Infections on the Rise

Vaccinated individuals have started to see more breakthrough cases and apparently lower vaccine efficacy; we expect there are multiple drivers of this trend. For example, a July outbreak in Cape Cod highlighted the risk of infection among vaccinated individuals, as 74% of diagnosed cases were among the vaccinated. In Israel, where 78% of the population over age 12 is fully vaccinated, 59% of the country's hospitalizations as of Aug. 15 were among fully vaccinated individuals.

We expect immunocompromised individuals could be a bigger driver of hospitalized cases among vaccinated individuals. For example, recent CDC data (March through July) from 21 hospitals across the U.S. pointed to 86% sustained efficacy against hospitalization, with 90% efficacy for those without compromised immune systems and only 63% for the immunocompromised. That number did not change significantly between March and July, moving from 86% to 84%.

However, beyond immunocompromised individuals, waning immunity (decreased vaccine efficacy with time) and immune escape (mutations that could allow the delta variant to more easily infect vaccinated individuals than previous strains) probably both have roles in lower observed immunity.

Beyond the passage of time and the rise of the delta variant, there could be other factors contributing to changing vaccine efficacy. The comparison between risk in vaccinated and unvaccinated groups isn’t quite the same as it was before. Vaccinated individuals have likely taken more risks than they would have before vaccination, and unvaccinated people are more likely to have had an asymptomatic infection that might be protecting them against hospitalization and are also partly protected by being surrounded by an increasing percentage of vaccinated people. Also, the way data is presented can make vaccines appear less effective than they are.

Rollout of Booster Shots Based on Time Since Second Dose

Regardless of the exact timing of additional data and rollouts in various developed markets, we expect broad use of booster shots across approved age groups this fall, with emphasis on time since the second dose is the most important qualifier.

Third doses are already rolling out in some countries and in varying groups of higher-risk individuals. Israel began recommending third doses for individuals over age 60 in July, and countries including the U.K., France, and Germany will begin giving third doses to elderly and immunocompromised populations in September, despite World Health Organization guidelines to continue to focus supply on primary two-dose series. The European CDC said on Sept. 1 that booster shots are appropriate in immunocompromised patients who did not respond to the initial series, but that there is not enough data yet to recommend booster shots on a wider basis. On Aug. 13, the FDA updated the emergency use authorization for mRNA vaccines to allow a third dose for immunocompromised individuals, which encompasses roughly 7 million Americans or 2.7% of the adult population, according to the CDC.

Pfizer submitted phase 3 booster data to the FDA in August; this serves as the basis of a supplemental biologics license applications filing, coming on the heels of the Aug. 23 full regulatory approval of the two-dose initial series. Similar data was filed with European regulators in early September. Based on the data, which tested boosters 4.8-8 months after a second dose, we think regulators could recommend booster shots after six months. Other vaccines are also likely to be authorized as boosters, although timelines are slightly behind Pfizer’s, particularly for J&J’s booster shot.

COVID-19 Vaccinations Likely to Be Annual Only for Vulnerable Groups

Beyond a third dose, the need for continued vaccination becomes even less certain. In our base case, we assume higher-risk populations (infants and the elderly) require annual vaccination. One recent paper indicated that if infections in children remain mild and similar to the common cold, we may not need annual vaccination in this age group. That said, Moderna presented data in April showing that human coronaviruses (key pathogens involved in many common colds) are not harmless, with $1.4 billion in annual costs from human coronavirus infections among U.S. adults over the age of 65 out of the roughly $15 billion in annual respiratory virus costs.

Assuming 60%-80% of this more vulnerable population receives annual vaccination (with three shots for infants and one shot for adults), this would require roughly 700 million doses annually. At a price of $25 per dose in the U.S. and $8 per dose in developing markets (or $11 a dose on average globally, with 75% of assumed volume going to developing markets), this creates a $7.5 billion annual market. We assume Moderna and Pfizer/BioNTech could each take 25%-30% of this market, or $2 billion in annual sales each.

Virus Evolution Uncertain, but Vaccine Protection Should Remain High

How the virus will mutate and evolve is uncertain. Some theorize that SARS-CoV-2 will evolve to become less virulent, supported by the fact that seasonal coronaviruses like OC43 have low mortality rates, as well as the expectation that immunity against severe disease could be long-lasting and could build over time as younger individuals retain strong protection as they age.

However, it is not clear that the virus will itself evolve to become less virulent. Typically, less virulent viruses can have an advantage as they make it easier for the virus to spread between individuals. However, with COVID-19, the virus is most contagious before the emergence of significant symptoms, so even patients with severe disease can spread the virus early in their infection before symptoms arise. That said, the virus may be constrained in the number of mutations that can allow immune escape and still result in viability; previous coronaviruses have not mutated to cause additional pandemics, for example.

Even if future variants start to erode protection from three doses of the original mRNA vaccines, we expect protection against severe disease and hospitalization should still remain high. For example, even when the flu vaccine is only 30%-50% effective against infection, it is typically more than 80% effective against hospitalization.

/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)

/d10o6nnig0wrdw.cloudfront.net/10-04-2024/t_e6175f671cee439d9180e460f6081183_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/morningstar/558ccc7b-2d37-4a8c-babf-feca8e10da32.jpg)