5G Isn’t Enough to Justify Tower Companies’ Valuations

We think the best of times for U.S. tower spending has already occurred.

The arrival of 5G has fueled investors’ appetites for seemingly any company they perceive will be affected by the new technology. A notable exception, which we think is correct, is the lack of exuberance for U.S. wireless carriers, especially AT&T and Verizon. In what we expect to be a repeat of the experience with 4G, wireless carriers will not be the companies to extract greater profits from these more advanced networks. Competition has restrained pricing power for them. We think investors have failed to extend this logic to the next step. If carriers aren’t seeing boons to their businesses, they are unlikely to ramp up spending on their wireless towers to much higher levels than they’ve been recently.

Unlike the carriers, however, tower stocks’ upward trajectories took a big step higher over the past year, and valuations reached unprecedented levels. We think 5G mobile networks are a primary rationale for the excitement. Usage of 5G networks is now in its infancy, but investment in towers in preparation for it has been happening for years. In many cases, carriers can now turn on their 5G networks without any further increase to their tower payments. More important, tower spending is less dependent on the wireless technology being used than the amount of mobile data traffic that the networks must handle. These factors lead us to believe that spending on towers will remain robust, but it is unlikely to reach new levels.

Looking closely at the wireless carriers supports our view. AT&T T, which has spent aggressively on towers in the past two years, and Verizon VZ, which plans to spend heavily on small cells for 5G rather than towers, have both said they expect to slow their pace of new tower spending. T-Mobile TMUS, which is now integrating Sprint’s network, is likely to ramp up tower spending in the next two to three years, but it will then be able to decommission Sprint’s tower sites, leading to lease cancellations on towers. Dish Network DISH needs to build a wireless network and may pick up many of those leases, but financial restraints and specifics of its promises to the U.S. government as part of the T-Mobile/Sprint merger cause us to question whether it will do any more than make up for the loss of Sprint.

We think the best of times for U.S. tower spending has already occurred. The advent of 4G caused mobile data traffic to grow at rates that are unlikely to be repeated with 5G, as many of the “Internet of Things” functions that 5G is likely to enable should take much less bandwidth than things like mobile video, which exploded with 4G. We expect traffic growth to remain high and significant network investment by carriers to continue, but we don’t expect a different environment from what we’ve experienced in recent years. The economic and technological realities lead us to believe that continuing deployment of 5G equipment as the networks mature will look remarkably similar to what 4G has required.

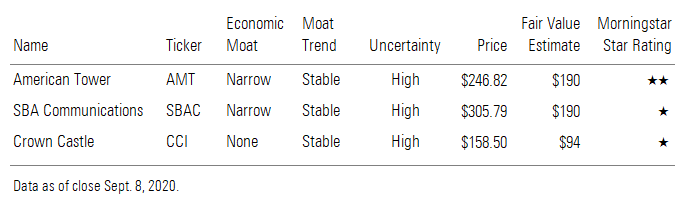

With the U.S. market unlikely to be a catalyst for tower stocks, we look to their other businesses. In that regard, American Tower AMT is our favorite, as it has exposure to fast-growing emerging markets in India, Africa, and Latin America. SBA SBAC has less geographic diversification, while Crown Castle CCI operates exclusively in the United States. Crown Castle is the only company that has a prominent business apart from towers: its U.S. fiber business, where it also offers small cells. However, despite the critical factor that small cells are likely to be in 5G networks, we don’t think Crown Castle’s fiber business will be highly profitable. Building out the fiber and small cell network is extremely expensive, and we think the carriers have too many alternative providers--including the ability to do it themselves, in many cases--for the investment to earn sufficient returns.

Against the backdrop of the current environment, valuations for all the tower companies have moved to extreme heights, but we don’t expect revenue growth to materially accelerate from already high levels. We believe the stocks have risk to the downside if interest rates rise or if the market is disappointed with steady to decelerating rates of revenue growth. We believe all tower companies are expensive and at risk of seeing material stock price declines, but we continue to favor American Tower on a relative basis. If we had to own a tower company, it would undoubtedly be American Tower, and that’s the one we’d enthusiastically recommend on a pullback in what remains a great albeit seemingly overheated industry.

American Tower, SBA Communications, and Crown Castle

Key Takeaways

- The arrival of 5G in the U.S. has fueled enthusiasm for many companies with a feasible tie to the technology. Investors seem to expect 5G to cause a revolution that requires wholesale upgrade cycles and a resulting spike in revenue. In some cases, this may make sense, but in others it doesn't.

- Investors have (rightly, in our view) perceived that telecom carriers will suffer the same fate with 5G as they did with 4G, seeing only a relatively modest uptick in profit after years of heavy investment. We suspect a lack of significant incremental profit potential will restrain network and tower spending habits, which are already robust.

- On the other hand, we hypothesize that 5G is propelling investor expectations for the tower companies that we cover on the belief that growth will continue to accelerate from the stellar business performance seen recently. We think that's unlikely for two reasons: Carriers won't increase spending at significantly higher rates than historically, and 5G won't require radical changes to how networks are built.

- The optimal scenario for tower companies would emerge if 5G unfailingly required tower densification (if wireless carriers were forced to deploy their equipment on a greater number of towers). We don't believe this is the case. Carriers have a variety of options to increase capacity, including through the use of small cells. Only Crown Castle is aggressively pursuing small cells, but we don't believe its small cell business is positioned to thrive.

- We expect carriers to continue adding new spectrum to existing towers, which is certainly lucrative for tower companies. However, we believe this is merely a continuation of what towers have been doing the past several years.

- In preparation for 5G in recent years, T-Mobile has blanketed the U.S. with 600 MHz spectrum, and AT&T and Verizon have bulked up midband deployments on towers. AT&T has also been widely deploying spectrum for the FirstNet government project. These carriers have already begun turning on 5G networks with simple software updates or radio upgrades that are mostly independent from tower spending.

- In the near term, we expect T-Mobile to accelerate U.S. tower spending as it works feverishly to integrate Sprint's network into its own, but we think spending by Verizon and AT&T will hit a lull following their more aggressive recent deployments (AT&T) and heavy emphasis on fiber deployment (Verizon).

- We think the CBRS and C-Band spectrum auctions will propel Verizon and AT&T to pick up tower spending again in a couple of years, but we don't think that will result in any greater tailwind for tower companies than they've had recently.

- Eventually, T-Mobile will be able to cut tower spending significantly as it realizes synergies with Sprint. Spending by Dish Network should mitigate that headwind, but Dish remains a wild card, with unconventional network ambitions and a weak financial position.

- Ultimately, tower spending is likely to remain capped by the financial motivation and resources of wireless carriers, and we don't expect more pressure or ability to further expedite network enhancements.

- With U.S. towers a less likely catalyst for future growth, the other components of each tower company's business drive our opinions of the companies. Crown Castle operates only in the U.S. but has a significant focus on its fiber and small cells, while American Tower and SBA have remained committed to the tower business, expanding outside the U.S.

- We are highly skeptical of Crown Castle's fiber segment. It requires a tremendous amount of capital investment today and faces major questions concerning future demand. We think it will be difficult for Crown Castle to see a payoff on that investment, especially because potential customers such as Verizon and AT&T should be able to meet a significant portion of their small-cell needs internally.

- American Tower is our favorite tower company. We like the opportunities it has in several emerging markets where 4G has not been fully built and many residents rely on mobile networks as their primary means of accessing the Internet.

- The tower companies are overvalued. On virtually any metric, tower companies are trading at historically high valuations. A sensitivity analysis that considers a very low-interest-rate environment, a continuation of growth near record levels in the near term, and valuation multiples permanently higher than historical averages shows the extreme assumptions one must make for tower stocks to look attractive at today's stock prices.

This information was published Aug. 10 as part of a Communication Services Observer, which is available to Morningstar’s institutional clients.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)

/d10o6nnig0wrdw.cloudfront.net/10-04-2024/t_e6175f671cee439d9180e460f6081183_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LE5DFBLC5VACTMC7JWTRIYVU5M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)