Rebalance a portfolio

Tips on how to approach rebalancing your portfolio using Investor.

Morningstar Investor can be a useful tool as you review your current asset allocations and adjust them toward a target allocation. The changes you choose may include increasing or decreasing the number of shares owned of any security, adding a new investment, or selling off a current investment completely.

General rebalancing considerations

- The primary reason to rebalance is to attempt to control risk, not necessarily to improve returns.

- The main factors you want to look at are your time horizon and your specific financial goals. In addition to the overall mix of stocks, bonds, and cash, also look at U.S. versus international holdings and value versus growth.

- A tax-deferred account like a 401(k) or an IRA is the best place to start because buying and selling within the same account won’t accrue capital gains taxes.

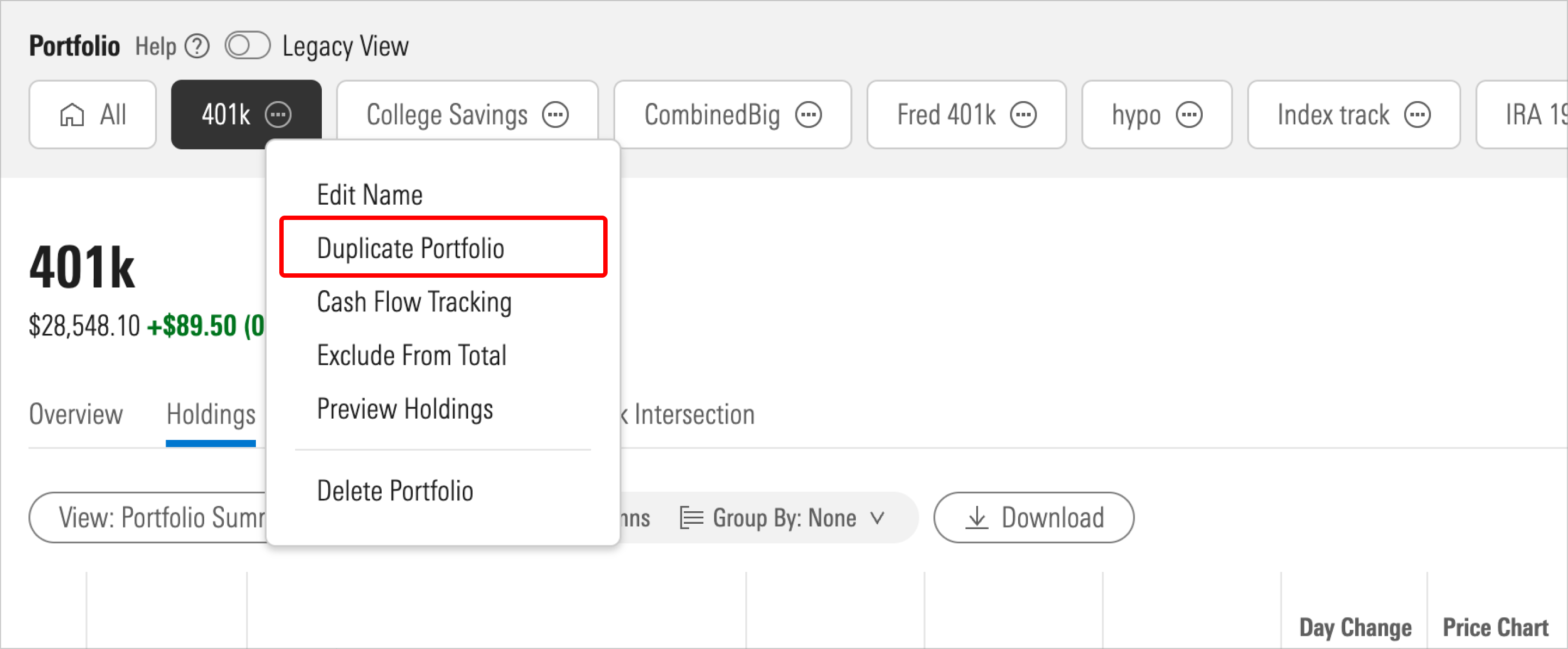

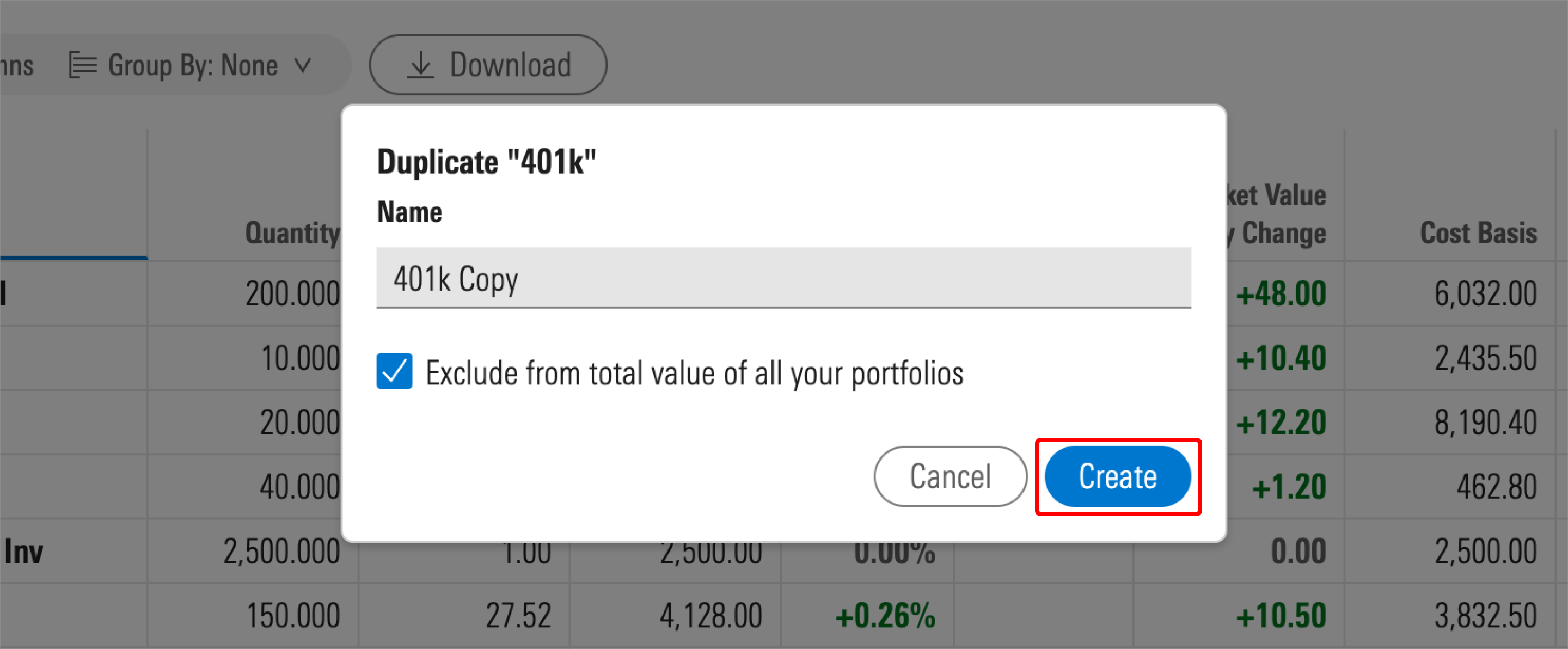

Duplicate your portfolio

To begin the rebalancing process, create duplicate copies of your portfolios to assess how buying or selling specific holdings will change the asset allocation.

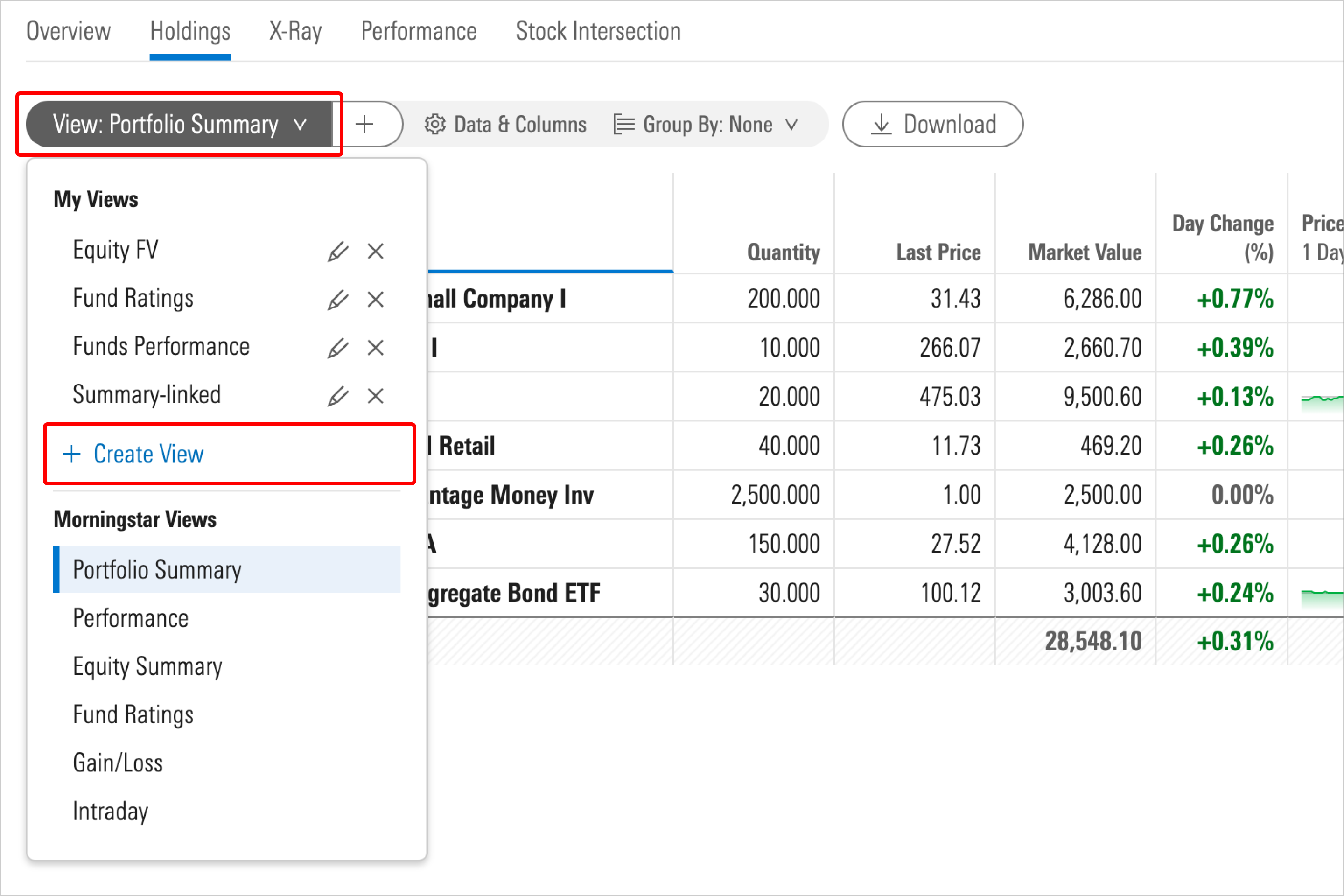

Customize your view

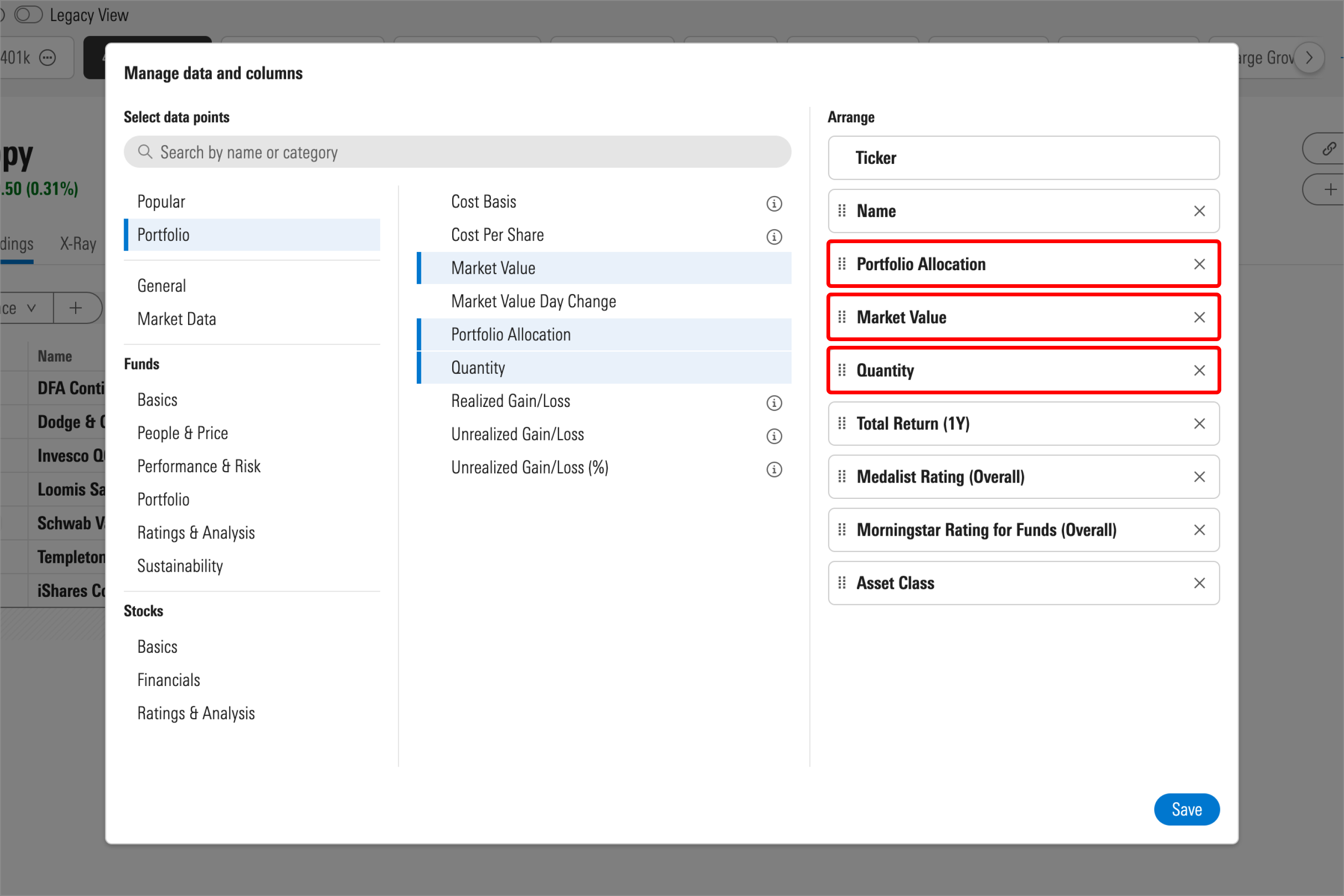

After you’ve duplicated your portfolio, create a new custom view and include the following columns:

- Portfolio Allocation

- Market Value

- Quantity

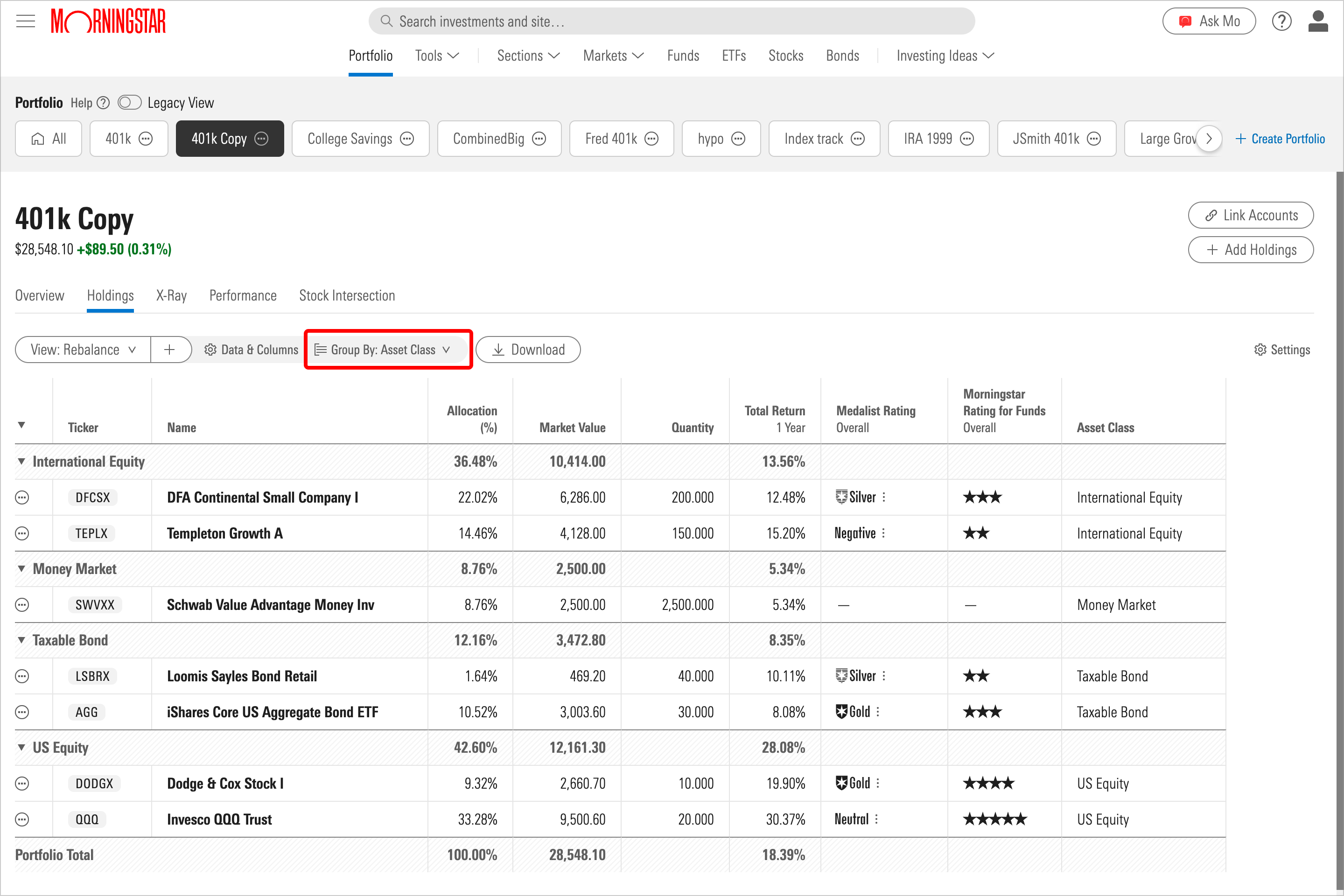

Then select the Group By button, and choose Asset Class (for portfolios of mutual funds or ETFs) or Sector (for stock portfolios).

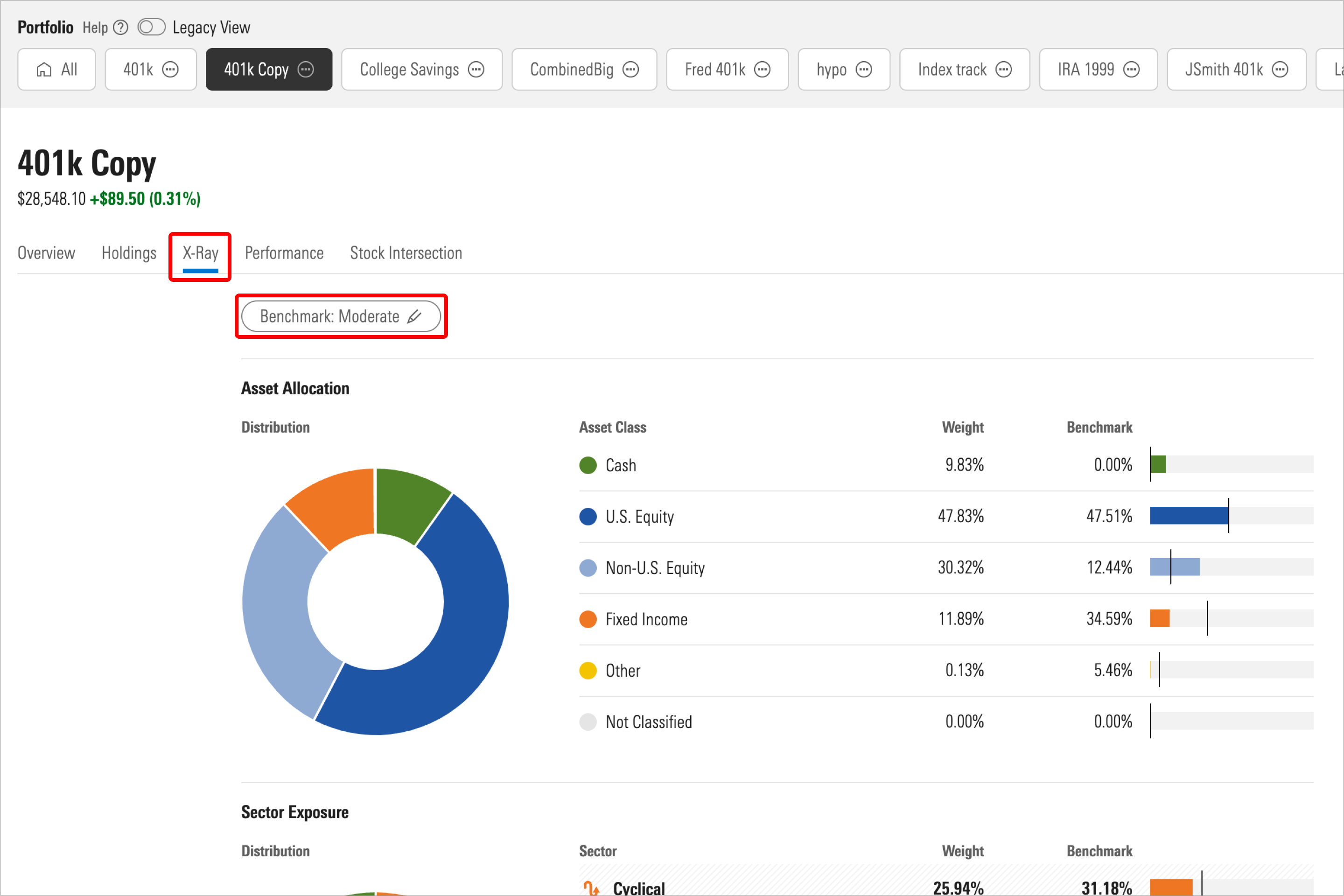

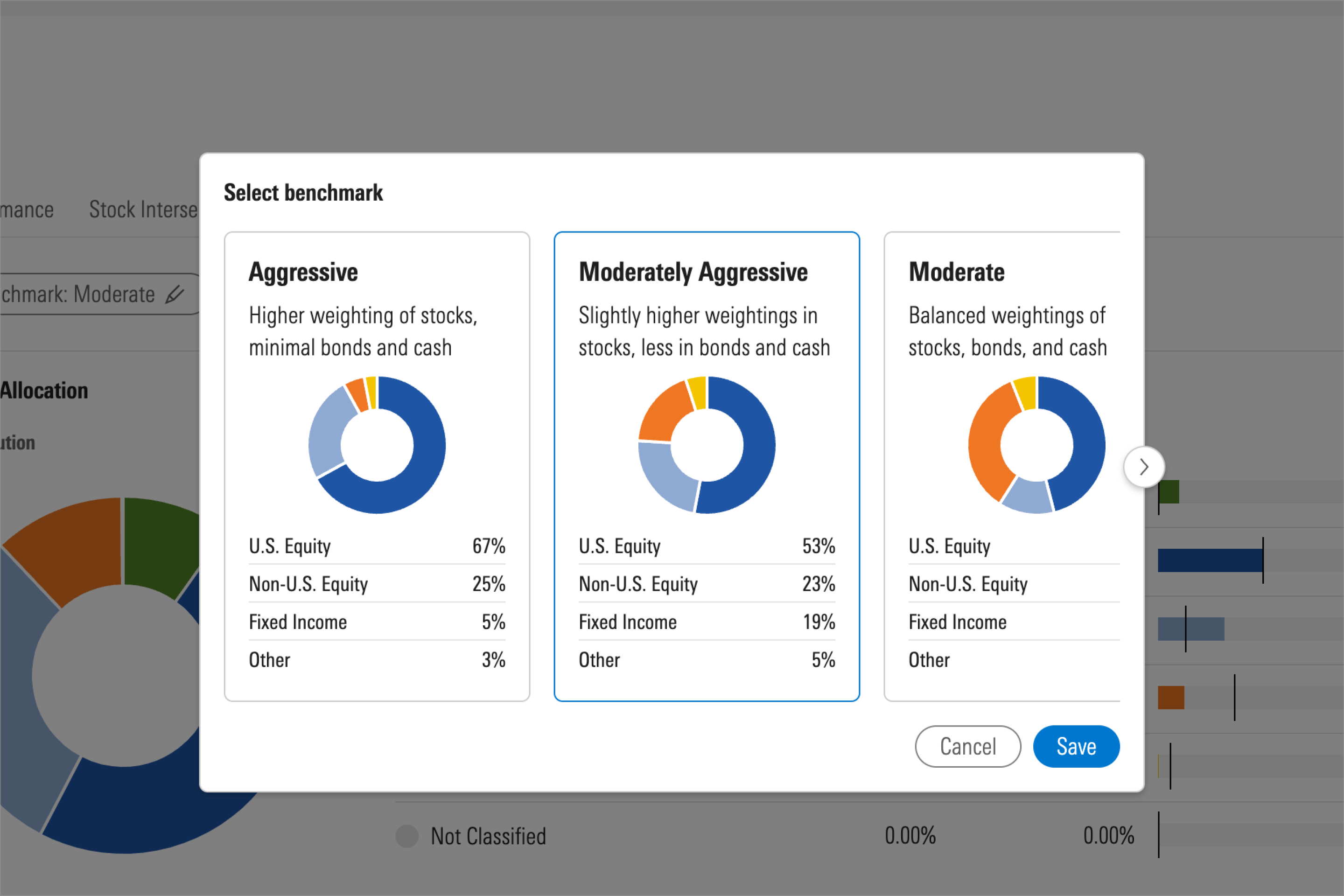

Rebalancing with X-Ray

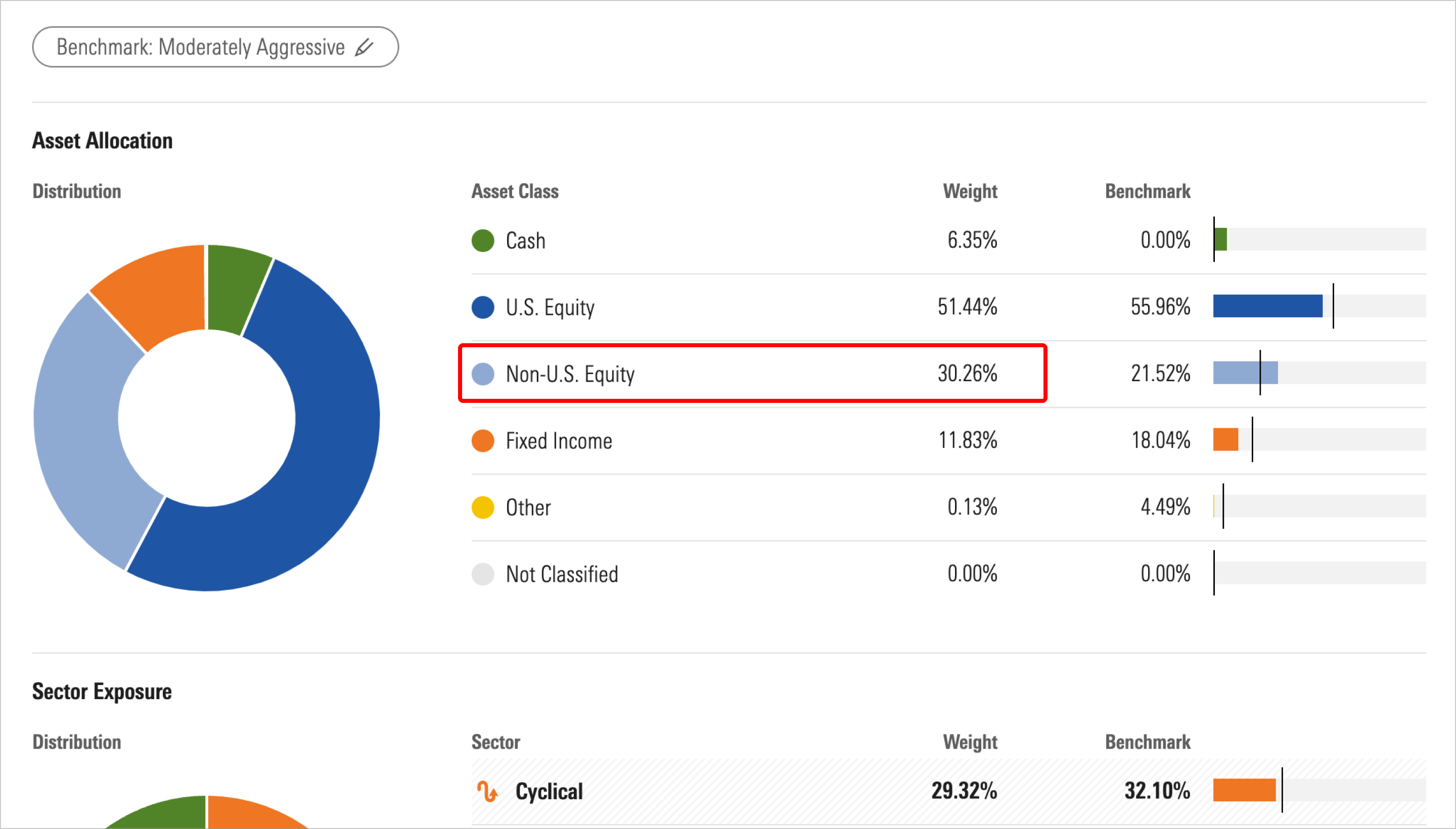

With X-Ray, you can compare your portfolio against five target benchmarks that range from aggressive to conservative. In the Weight column, you can see the values for your current portfolio, which are compared to the benchmark’s standards in the Benchmark column. Use the Benchmark drop-down menu to compare and select the benchmark that works best for your investing goals.

As you rebalance your portfolio to better meet your chosen benchmark, you will toggle between the Holdings tab, where you can record changes to your portfolio, and the X-Ray tab, where you can see how those changes match with your benchmark’s standards.

Here are some important facts to keep in mind as you rebalance with X-Ray:

- Investor analyzes the portfolio of each mutual fund to classify each stock, bond, or cash position to the appropriate asset class. Most mutual funds hold a small percentage of cash in the fund portfolio.

- The X-Ray view shows the most accurate asset class values, whereas the Holdings view does not.

- When you compare asset class breakdowns in the Holdings view to the asset class percentages in X-Ray, the values will not match.

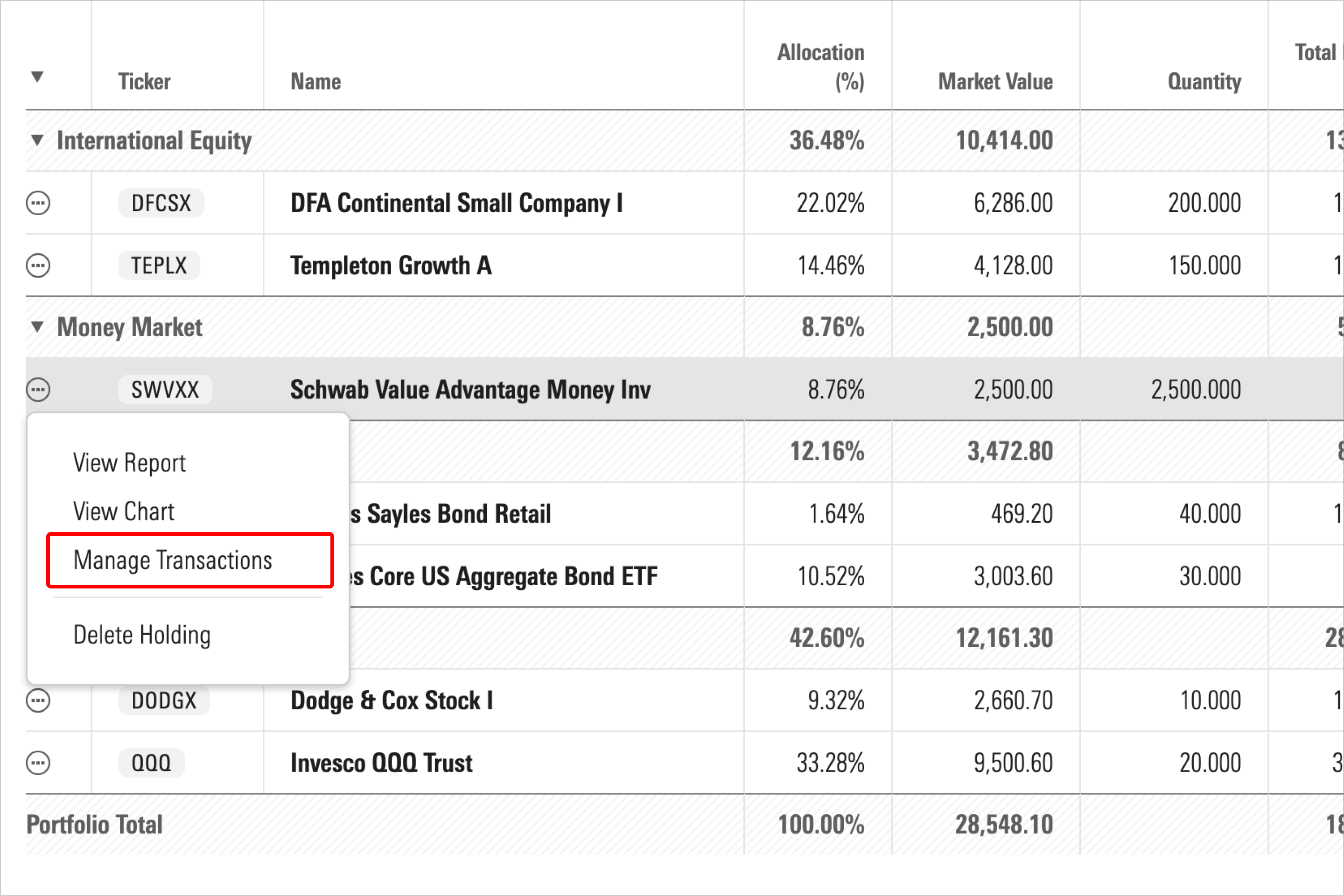

Managing transactions

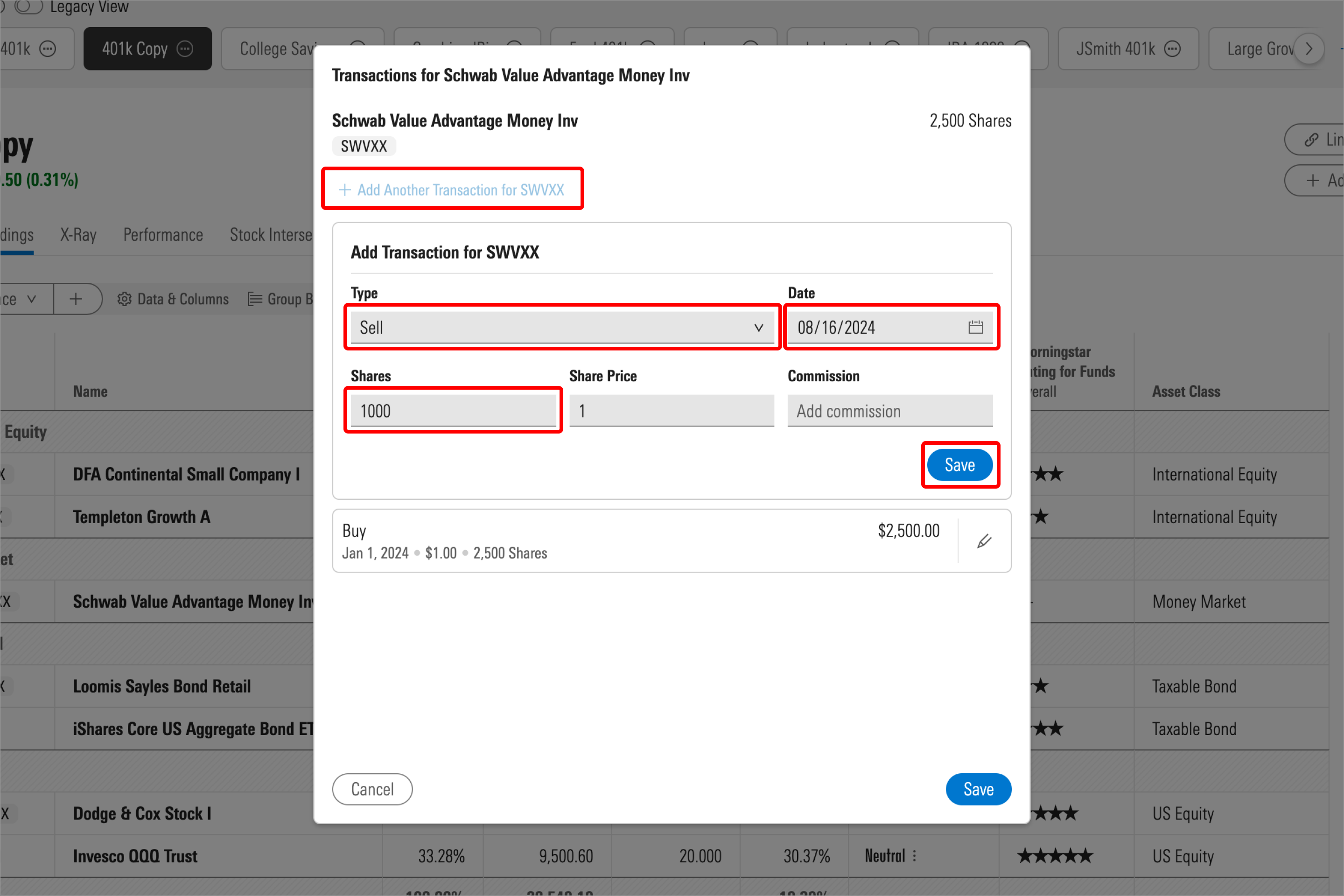

To alter your duplicated portfolio to see how sales and purchases can affect your benchmark goals, go to the Holdings tab, select the action button to the left of any security, and choose Manage Transactions.

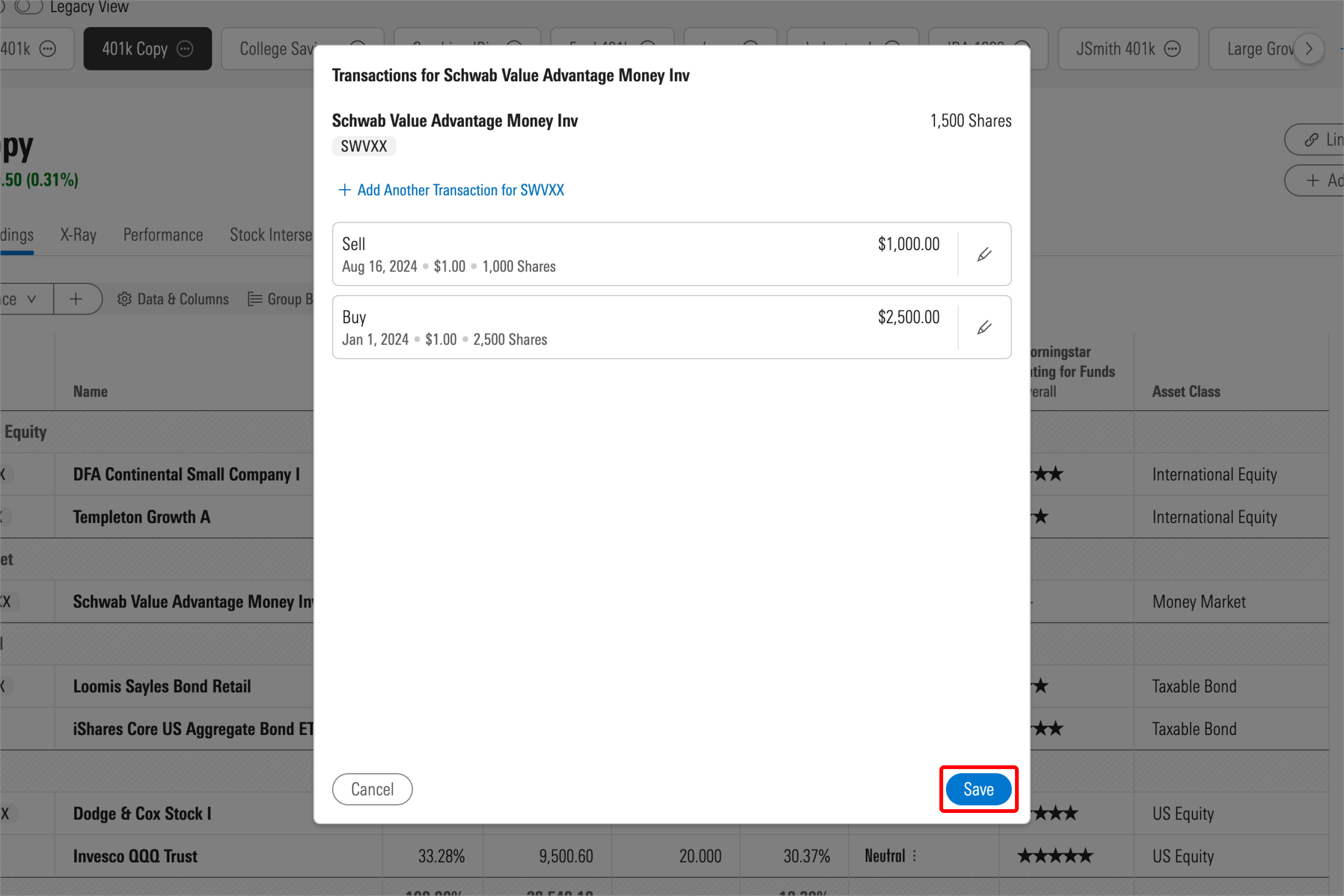

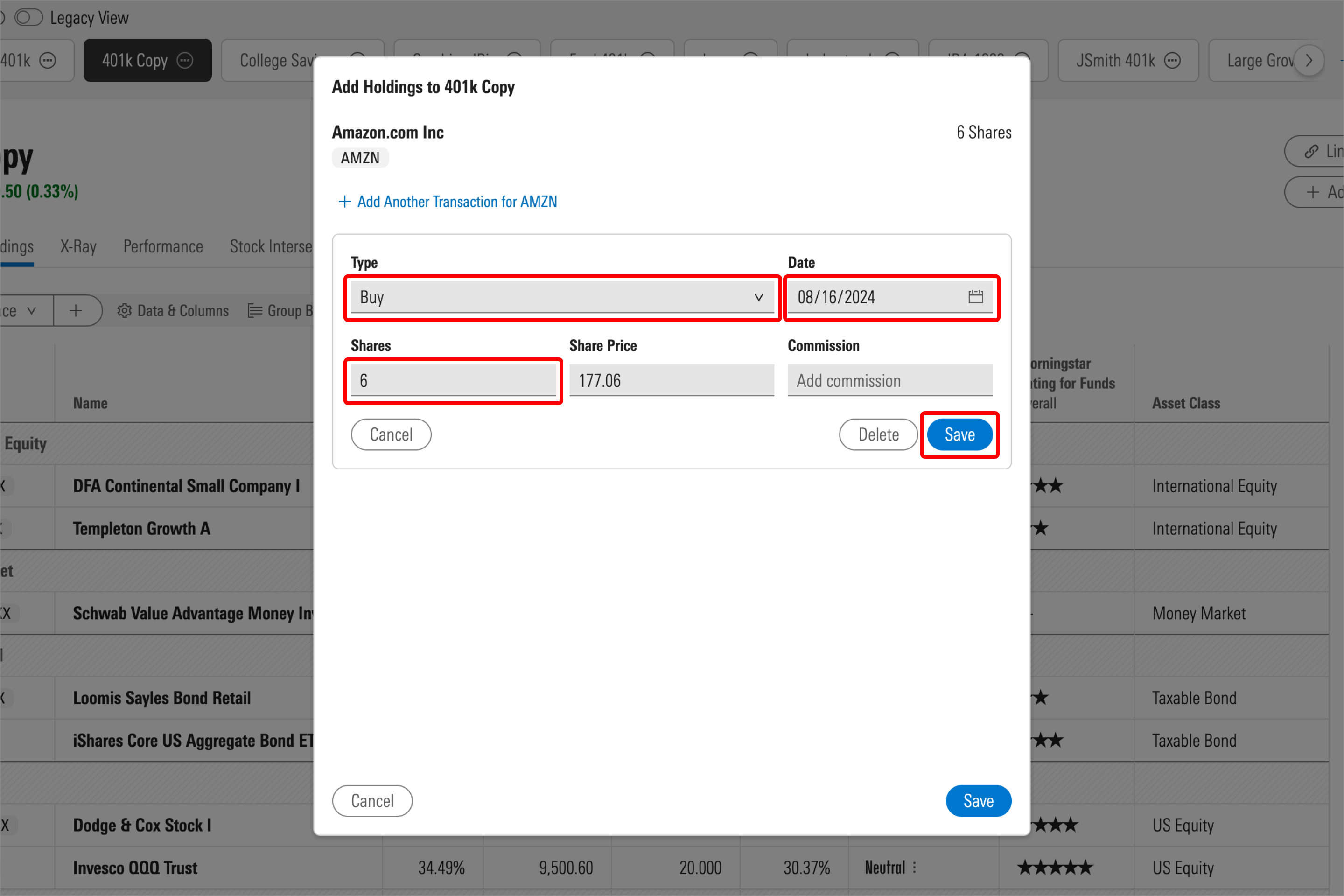

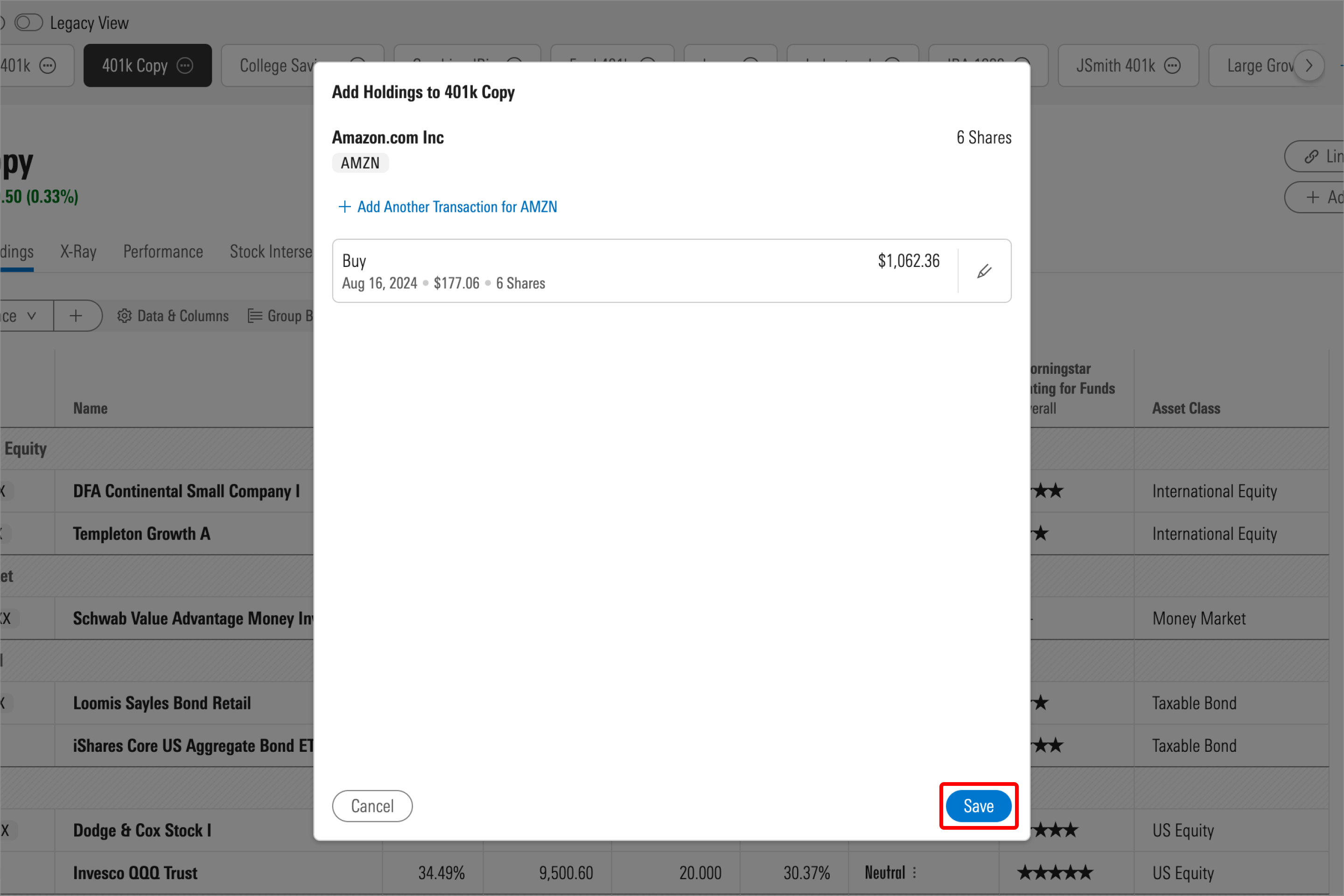

If, for example, you wished to decrease your portfolio’s cash exposure, you could add a transaction to sell 1,000 shares of a money market fund. Select Sell from the Type drop-down menu, then fill in today’s date and the number of shares before clicking Save.

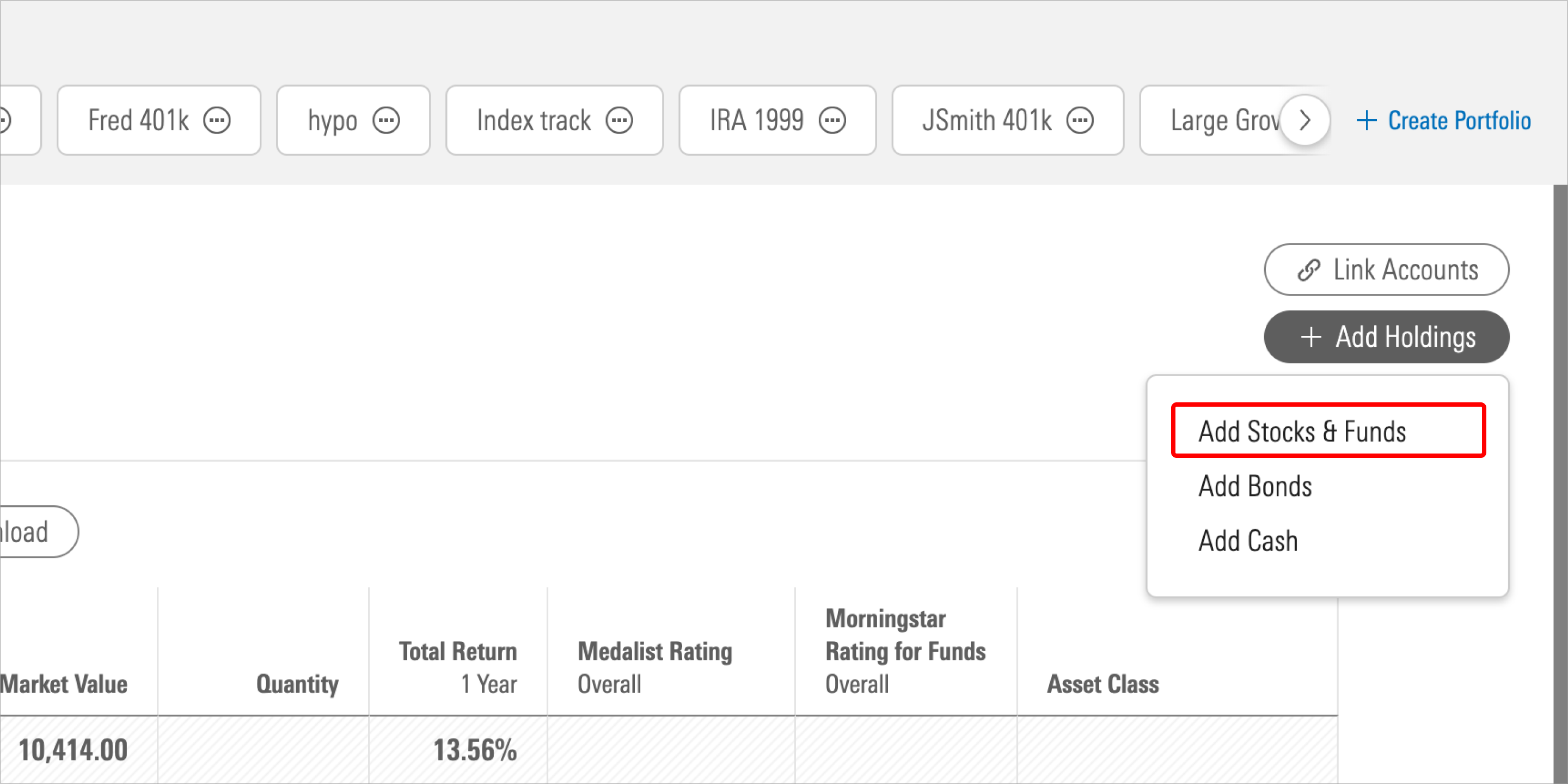

Next, you could use the Add Holdings button to invest the $1,000 from this hypothetical sale into a US equity.

After adding the transaction, you can review the overall impact to your asset allocation using the X-Ray view.

International equity

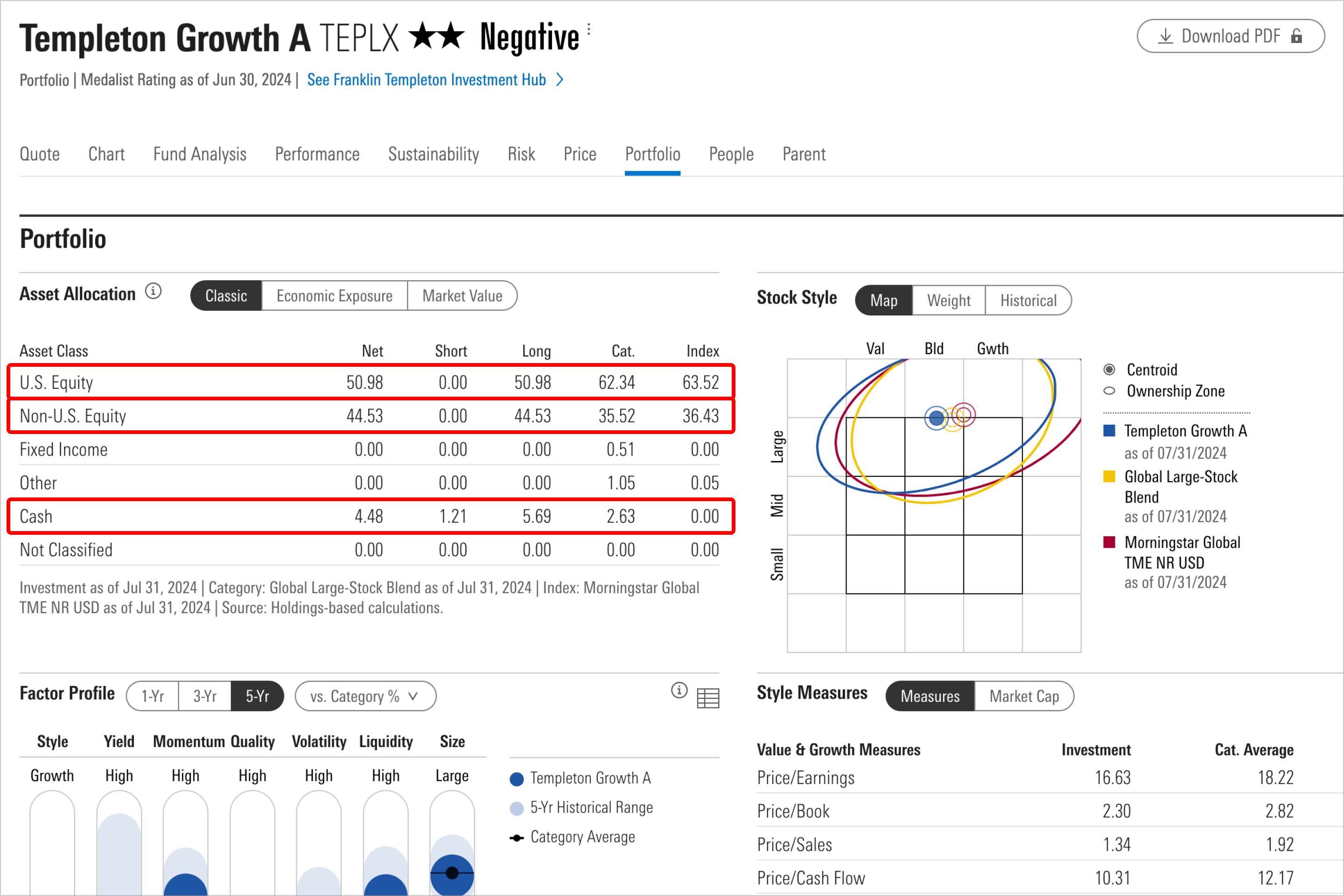

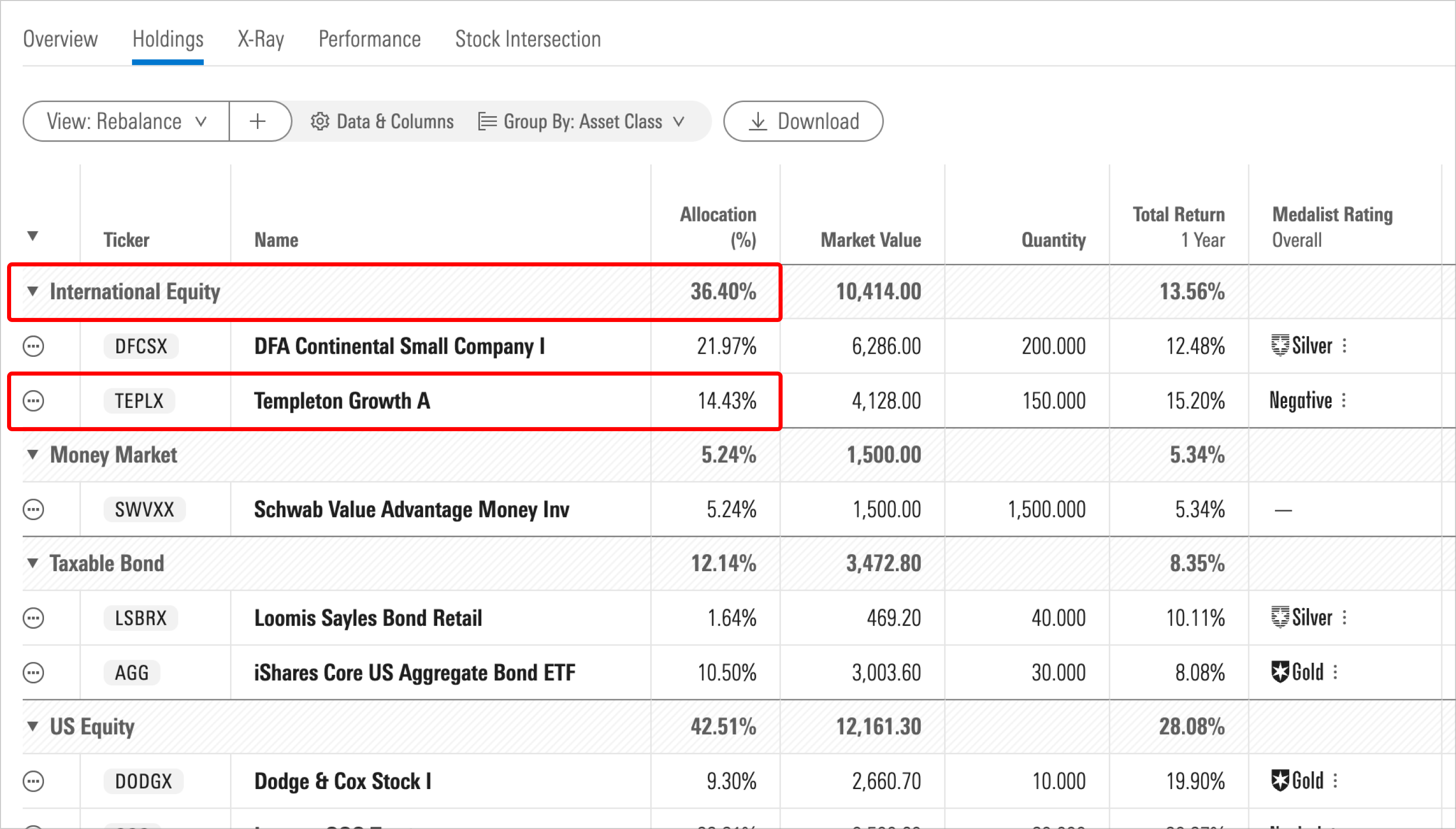

Views between X-Ray and Holdings also differ when comparing values for the international equity asset class. In the example below, the Holdings view shows about 36%, while the X-Ray shows 30% for non-U.S. equity. Part of this difference comes from the Templeton Growth mutual fund (TEPLX) in this portfolio.

The Holdings view shows that 36% of this example 401(k) portfolio is classified as international equity, yet the fund quote page for TEPLX shows it actually holds about 51% in US stocks. This is reflective of the fact that although the fund is classified as international equity, its current holdings are roughly 51% US equity, 45% non-US equity, and 4% cash.