Investors Pile Into Leveraged Loan Funds at Fastest Clip In Two Years

But after strong May inflows, trends weaken in June.

Loan fund assets under management grew by $3.69 billion in May—the highest monthly total since April 2022, according to Morningstar data—as loan secondary prices rallied and elevated income returns from higher base rates continued to draw investors.

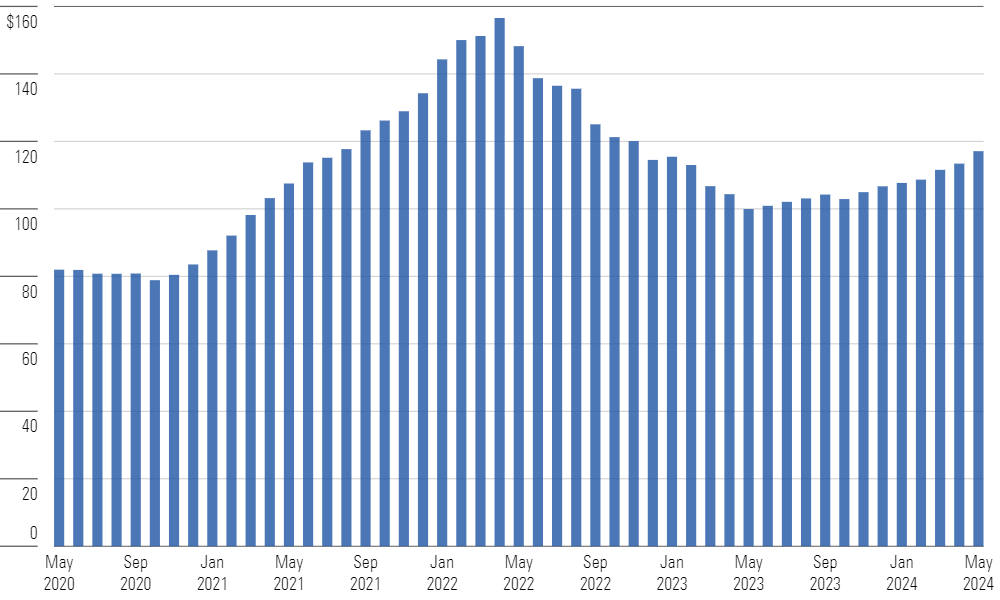

It was the 11th increase loan funds had seen in 12 months. The weighted average bid price of leveraged loans rose 29 basis points in May to 96.93—also the highest month-end mark since April 2022.

US Loan Fund Assets Under Management

Trends are mixed in June. While weekly reports show roughly $580 million of cumulative inflows in the first three weeks, an eight-week streak of inflows was snapped, and loan bids slipped to 96.67 as of June 20. Loan prices have been retreating recently amid softening economic data and rising expectations of at least one interest rate cut this year.

Monthly Prime Fund Flows

Weighted Average Loan Bid Price

At the end of May, the total AUM tracked by Morningstar was $117 billion (its highest level in 18 months), making for a roughly 9% share of the Morningstar LSTA US Leveraged Loan Index. Mutual funds account for 84% of the total AUM, while ETFs comprise 16%.

Total Net Assets of US Prime Funds ($B)

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/06-27-2024/t_128e5b2b1e35443e99302bd249d3a5d5_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)