Investor Sentiment Is Up. Here’s How to Keep Expectations in Check

Tips to help clients stay focused on their risk tolerance so that their risk perception doesn’t lead them astray.

Investors are feeling confident: Stock market returns are up, and volatility is at a multiyear low. However, good times are not without their drawbacks. Investors may be enticed to take on risk above their own needs, comfort, and capacity by behavioral biases like overconfidence and recency bias.

These kinds of biases can put a strain on financial planning. In good times, excited clients may want to chase returns by allocating more of their portfolio to the investments that are in the lead. But chasing the market is more likely to result in poor performance.

Risk Perception Is Unreliable

Our risk perception—that is, our judgment of investment risk—is easily swayed by the latest news headlines, cognitive biases, and even trivial factors like what you had for dinner last night.

New investors may not be well-informed about investment risk or the range and likelihood of possible outcomes. This lack of experience and knowledge may leave them susceptible to act on their risk perception. However, even experienced investors are not immune; they, too, can get carried away by the herd when momentum is high. Your clients, regardless of experience, are likely underestimating risk in a rising market and overestimating it in a falling market.

Note that risk perception stands distinct from risk tolerance. Our risk tolerance is a psychological trait—it’s how we feel emotionally about taking risk. Risk tolerance is relatively stable across market cycles and is a product of both nature (what we are born with) and nurture (our lived experiences). Successful financial planning is built around a client’s risk tolerance, not their risk perception.

Advisors must help clients distinguish between risk perception and risk tolerance to help them take on an appropriate level of risk that meets their needs, comfort, and capacity. In doing so, advisors can help mitigate risky behavior that can lead to disappointment. Financial education is a start but can be overridden by heightened emotions in decision-making. However, advisors can tap into how clients are perceiving risk to help them make better decisions during good and uncertain times.

Tips for Managing Changing Risk Perception

Here are some practical steps to establish expectations and keep clients’ risk perception in check. These tips can help you manage clients’ changing risk perceptions when the good times are rolling, without damping the overall mood.

Use a reliable risk tolerance tool to establish appropriate expectations. A robust risk tolerance tool will give you accurate and reliable results that can serve as a stable anchor for how much risk clients are comfortable with. Advisors can build on the assessment to create a holistic risk profile based on clients’ needs and capacity. Advisors should help clients understand their risk tolerance and set expectations of returns accordingly. This will help clients prepare for unexpected events before excitement and recency bias can sweep them away—and make it easier for them to stay the course.

Reach out to keep an eye on client’s risk perception. Clients’ risk perception may change with the headlines, but it is unlikely a client will reach out to you and share this news. Therefore, advisors should reach out to clients to gauge their risk perception regularly. It will be easier to manage creeping unrealistic expectations with check-ins before the hype sets in. However, it is especially important to touch base with clients when the market is doing exceptionally well or badly—times when clients may feel especially compelled to act.

To tap into risk perception, ask clients to reflect on the state of their finances and to identify the driving factors behind any changes. There are several things that could point to changes in clients’ risk perception, such as changes to their income or savings rate or responses that fixate on recent market trends.

Realign clients when their risk perception shifts. Clients’ shifting risk perceptions may make them want to deviate from their financial plans. In these times, advisors can serve as guardrails to encourage clients to behave in their best interest. If a client wants to change their portfolio, just listen. Often, clients can disengage from knee-jerk decisions when they slow down to articulate their thoughts. Then, advisors can refocus the conversation on the clients’ goals and values and whether their new plan would align with them. Advisors may find that some clients cannot be dissuaded from their desire to act—action bias is a powerful force! In which case, advisors may provide alternatives that can sate the client’s desire for change without taking on additional risk.

Help clients block out noise. Offer clients practical advice to help them guard against future shifts in risk perception. For example, encourage them to refrain from viewing their portfolio balances too often.

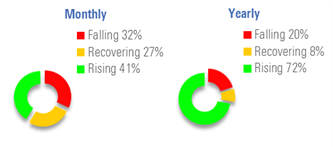

How often a portfolio is seen as falling varies depending on how often it's checked

A client who views their portfolio frequently is more likely to see the value declining than a client who doesn’t look too often. For example, as the exhibit above shows, Morningstar research indicates that a client in a representative diversified portfolio would have seen their portfolio falling in value 32% of the time over a 50-year period if they viewed it monthly. Those who checked in yearly would have seen a decline only 20% of the time.

Market cycles and changing risk perception are part of the investing journey. Setting appropriate expectations for your clients is key to keeping them on track.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2TUAYYD4PVBTFEBHVOLROKDOY4.png)

/d10o6nnig0wrdw.cloudfront.net/06-27-2024/t_2194d771c3f04756b6635f949463d5c6_name_MIC_24_Kunal_Kapoor_Speaker_1920x1080.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QJ55VWEVNNCDRHHUYR5SOVC77U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)