Oil and Water: How to Invest During an Election Year

An evidence-based approach—rather than a focus on politics—has shown its worth.

A presidential election might cause short-term turbulence in the markets, creating discomfort for investors as they watch their portfolios churn or worry about the outcome. Understanding the impact that elections have historically had on markets can serve as Pepto Bismol for investors.

Are Democrats or Republicans Better for Stocks?

Looking at 70 years of returns, a Democrat in the White House has been better for investors. Since 1953, $1,000 invested when a Democrat is president, sold to cash when a Republican takes office, then reinvested when a Democrat returns turns into $62,000. The opposite strategy—only investing when a Republican sits in the Oval Office—only grows to $27,000.

Returns Since Eisenhower's Inauguration (1953)

However, this overlooks critical context: Investors would have been better off ignoring Washington, DC entirely. The original $1,000 investment turns into nearly $1.7 million for those who never acted on their political preferences and remained invested throughout.

Returns Since Eisenhower's Inauguration (1953)

The stock market goes up and down under every president, but the path of least resistance has always been higher. There’s no reason to believe this will change because of November’s election. In short, politics can be a significant drag on a portfolio. That’s why treating the two like oil and water is essential. Obviously, that’s much easier said than done. And the next few months will be fertile ground for political implications on financial markets.

Politics and Investing

Major policy differences cited between President Joe Biden and former President Donald Trump often include healthcare spending, immigration, and business regulation. One interesting example is the regulatory landscape. Paramount Global PARA, one of the most famous media brands, has been in the news for months because of the possible sale of its business. After months of Will they or won’t they, the company recently decided it was no longer for sale.

Paramount would likely deal with expensive and time-consuming litigation to realize this move. The Federal Trade Commission has been aggressively blocking mergers, preventing four in January this year alone. The prevailing theory is that Paramount wants to do the sale, but is better off waiting until after the election. A change in leadership could usher in a friendlier FTC, whose leadership is appointed by the president.

But theory is one thing; reality is something else entirely. We can pull examples from the last two presidencies in which conventional wisdom indicated one outcome, but something else happened.

President Trump and China

After Trump won in 2016, it was widely assumed his policies would have terrible consequences for companies with exposure to China. It could be argued that no American company does more business with China than Apple AAPL. A trade war would negatively impact its business. A few headlines at the time made this case:

- CNN Business, August 2019: “Apple ‘Gut Punch’: Trade war will cut iPhone sales by 8 million, analyst says”

- BBC, September 2019: “Trump’s tariffs put Apple’s golden goose at risk”

But Apple’s business performed just fine. Its stock returned nearly 8 times the US stock market in the year after these articles were published.

Apple vs. Market Returns, Sept. 2019-Sept. 2020

President Biden and Energy Companies

To borrow from Rodney Dangerfield in Caddyshack, “Keep it fair!” There’s a similar example from the Biden presidency. The administration is often viewed as an enemy of the energy industry. One specific agenda item was to make it harder for energy companies to drill by reducing permits.

Headlines included:

- The Washington Post, December 2020: “Biden wants to make climate fight central to his presidency. What do big oil and gas firms think about that?”

- AP, October 2020: “Biden calls for ‘transition’ from oil”

But like Apple, energy companies did just fine. The returns of energy stocks nearly doubled that of the US stock market over the next year.

Energy Sector vs. Market Returns, Dec. 2020-Dec. 2021

Since Biden’s inauguration in January 2021, energy has been the best-performing US equity sector. The technology sector, which is in second place, doesn’t even come close to its returns.

Total Returns Since Biden Inauguration

These examples and others remind us that conventional wisdom can often be wrong, and that politics influence the stock market less than we might realize.

Resist Reacting to Election Volatility

Monetary decisions are full of emotions, biases, and blind spots. There’s no need to add another layer of complexity with politics. It’s been said that life is 10% what happens and 90% is how people choose to react. The next few months will be a measuring stick.

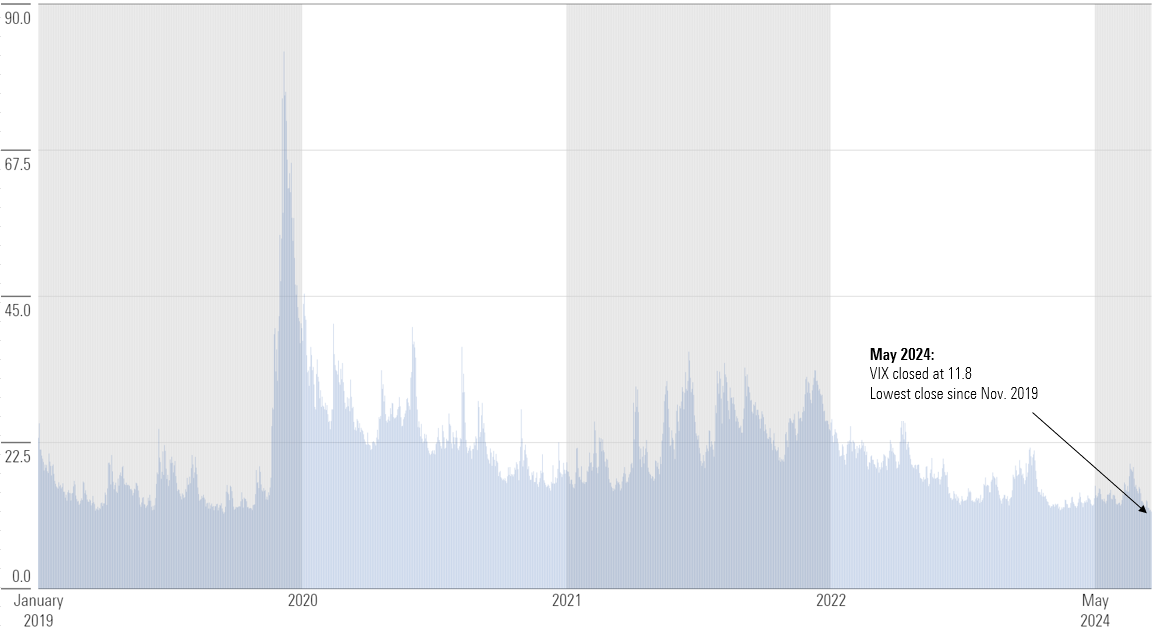

To date, markets have been calm—maybe too calm. The CBOE Volatility Index touched its lowest level in five years last month.

The VIX Over Time

The election could be a spark, as election years tend to observe more volatility than other years.

The VIX Is Higher In Election Years

There’s the additional factor that the average year tends to observe a stock market decline of 14%. To date, the largest decline has only been 5%. It’s fair to assume a decline of some variety could be on the horizon, but that’s not unique to this moment. If it occurs, media coverage will likely prioritize sensationalism over calming long-term perspectives, potentially using politics as a convenient angle to fan more flames. But remember, their fiduciary duty is not to you.

For a detailed, evidence-based presentation on navigating an election year, visit Morningstar Wealth.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2TUAYYD4PVBTFEBHVOLROKDOY4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)