Proxy Voting on Sustainability: The Big Three Hold the Key

BlackRock and Vanguard cut support for shareholder resolutions again. This time, State Street joined them.

Each year I analyze the sustainability-focused shareholder resolutions that got the strongest support from shareholders. The discussion always seems to circle back to the voting decisions made by the Big Three index fund providers: BlackRock, State Street, and Vanguard.

And with good reason. There’s their sheer size: combined, the three account for over 40% of the US fund market, according to data from Morningstar Direct. But their less-tangible market influence is also a factor. To their credit, the three communicate more frequently than most US asset managers about their evolving approach to company engagement and proxy-voting on governance and sustainability issues.

Proxy-Voting Proposals: The Big Three, and Morningstar, Evolve Their Approach

And their approach certainly has evolved, as we outline in our latest research paper. Last month we acknowledged BlackRock and Vanguard’s announcements of further reductions in support for shareholder resolutions on environmental and social issues. This contributed to a further fall in market average support for E&S resolutions to 16% in the 2024 proxy year, less than half the peak reached in 2021 (33%).

It also drove a sharp reduction in the number of E&S proposals we identify as key resolutions. This prompted us to extend our analysis, using a new method to identify E&S resolutions with significant independent support. Under the new model, we now look at proposals with at least 30% support from independent shareholders, instead of the 40% threshold used previously.

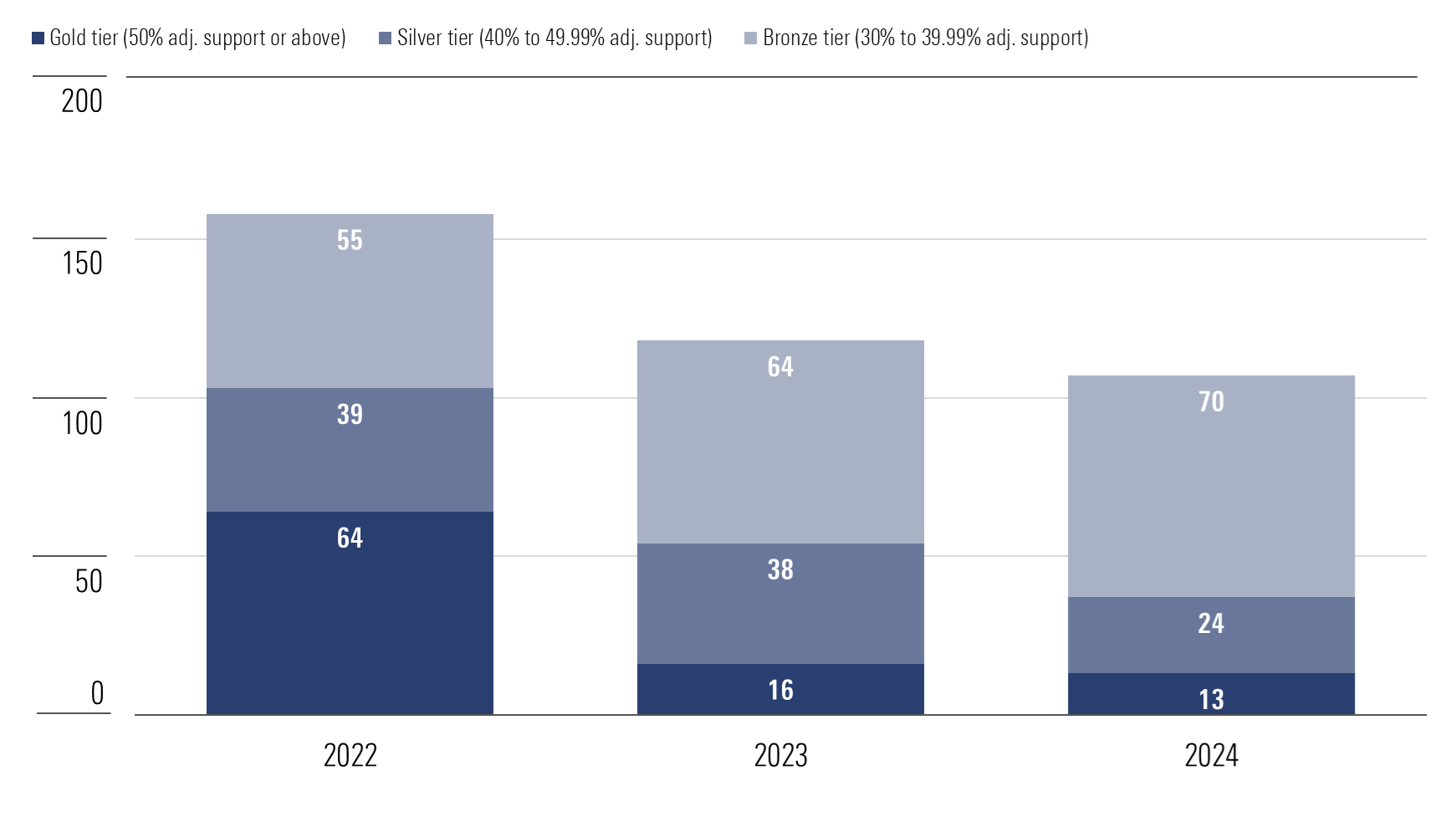

We identified 383 such resolutions in the last three proxy years. The chart below shows them, split into three tiers according to their shareholder support level.

Volume of E&S Resolutions by Tier

We see that the better-supported Gold and Silver tiers have significantly contracted, partly down to the withdrawal of support for E&S resolutions by BlackRock and Vanguard, which we foresaw in our early August analysis.

Both firms insisted that the reductions in their support for E&S resolutions is because they view too many as “prescriptive,” “redundant,” or “not material.”

State Street Joins BlackRock and Vanguard in Cutting E&S Support

What’s new this year is that State Street also significantly cut its support for even the best-backed E&S proposals.

While the firm has not so far issued any comments on this development, State Street’s recently published voting records for 2024 confirm that its support for the 383 E&S resolutions we analyzed fell sharply this year.

This is notable because prior to 2024, State Street was the Big Three firm most likely to support an environmental or social shareholder proposal. While that remains the case, the firm has cut the gap to its Big Three peers, as shown on the chart below.

E&S Resolutions With Significant Independent Support

In the 2022 and 2023 proxy years, State Street supported 46% of E&S resolutions with significant independent support. In 2024, this fell to just 22%—still considerably higher than BlackRock (12%) and Vanguard (0%), but a steep cut nonetheless.

Comparing the Big Three’s voting record with other managers usually yields some interesting insights, and this year is no different. Looking at the same 383 resolutions, we examined the voting record of four managers with a more pro-ESG voting stance: Amundi, LGIM, and Norges Bank, all based in Europe; and Chicago-headquartered Northern Trust.

We see a slight decrease in average support for the E&S resolutions among this pro-ESG peer group in 2024, but nothing as dramatic as the Big Three’s drop. Support by these four firms for the 383 resolutions was consistently high over the last three years, and the slight drop in the average in 2024 is attributable to changes in voting pattern by the only US-based firm in the group: Northern Trust. (Our research in January this year covered the growing gap between US and European institutional investors when it comes to their approach to sustainability.)

Increasingly, Fund Managers Are Letting Investors Take the Wheel

Overall, what we’re seeing is a reduction in the number of very strongly supported resolutions, in the gold and silver tiers of our analysis, driven largely by reductions in Big Three backing for such proposals. However, the bronze tier has grown in size, less affected by Big Three voting decisions, and more consistently backed by institutions with a more sustainability-conscious outlook.

And yet more changes may be on the horizon. Both BlackRock and State Street are in the early stages of implementing “multitrack” engagement and voting policies—bifurcated stewardship policies that prioritize sustainability themes for those investors who specifically opt into it. Northern Trust is also heading in a similar direction.

Meanwhile, the Big Three are also ramping up their offering of proxy-voting policy choices to investors, giving them more opportunities to align voting decisions with their own preferences.

Increasingly, managers are letting investors take the wheel. And that means bit by bit, the monolithic blocks of voting decisions we assess in our research will become increasingly fragmented.

So, in the future, it’s just possible that research like this could focus more on the most popular stewardship policies, rather than the managers with the largest market share.

As with so much in sustainability, the only constant is change.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FPI4DOPK5VFUNIOGY5CVTI6NCI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKF5TFZDABBAHA6TLTRJH2OZHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)