Ultimate Stock-Pickers: Top 10 Best Performing Ideas

While the downturn in the equity markets in the back half of 2015 has been detrimental to our top managers' year-to-date performance it has also uncovered a handful of best ideas for the year ahead.

By Greggory Warren, CFA | Senior Stock Analyst

Outperforming the market on a consistent basis continues to be a challenge for most active equity managers, and our Ultimate Stock-Pickers have certainly been adherents to this trend the past few years. With most stocks trading at or above our analysts' fair value estimates from the middle of 2013 to the middle of this year, our top managers had maintained a much more cautious approach to the markets, making it difficult for more than a handful of them to make moves that would lead to outsized returns. While market corrections tend to provide active managers with an opportunity to outperform, that has yet to be the case this year, as only a fifth of the 22 fund managers represented on our Investment Manager Roster are currently beating the market, as represented by the S&P 500 TR Index, which was down 0.3% year to date at the end of last week. There has been no index hugging this year, either, as there are few managers that are within 100 basis points of the index.

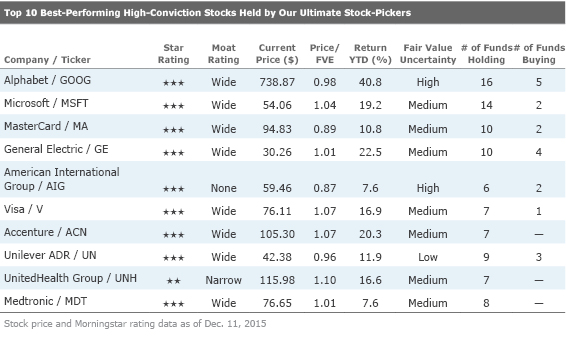

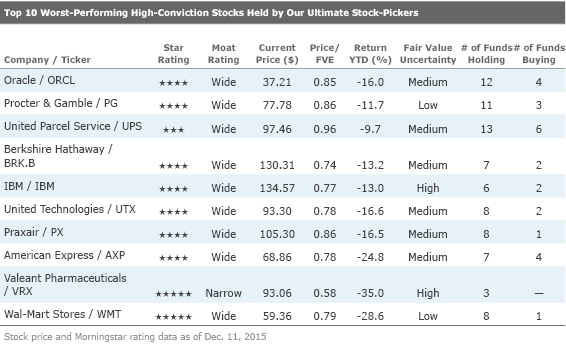

Given our top managers' penchant for taking concentrated positions, we thought we'd take a deeper look at the individual performance of some of their highest-conviction holdings this year, focusing in on the biggest contributors to and detractors from their portfolios. That said, we're not interested as much in the stocks that were generating returns close to the market's, but in those where the divergence was more than 750 basis points and where the holdings in aggregate were meaningful enough to rank among our managers' top 50 positions. In this particular case, we didn't have to dig too deep, as we were able to construct a list of top 10 best-performing high-conviction stocks, as well as a list of top-10 worst performing high-conviction stocks, within the first 35 holdings of our Ultimate Stock-Pickers. That said, the list of best-performing stocks looks nothing like what one would expect from a more defensive portfolio (despite most of the names having wide economic moats), while the list of worst-performing high-conviction holdings contains a fair number of wide moat firms--half of which are top recommendations for our analysts right now.

Before we continue, we feel it is important to once again stress the point that the Ultimate Stock-Pickers concept was put together as a stock-picking screen, not as a guide for finding fund managers to add to an investment portfolio. Our primary goal has been to identify a broad enough collection of stock pickers that have shown an ability to beat the markets over multiple time periods (with an emphasis on longer-term time frames), and cross reference the top holdings, purchases, and sales of these managers against the recommendations of our own cadre of stock analysts on a regular basis, allowing us to uncover securities that investors might want to investigate further. There will always be limitations to our process, as we are focusing only on managers that our fund analysts cover, and on companies that our stock analysts cover, which serves to reduce the universe of potential ideas that we can ultimately address in any given time period. This is also the main reason why we focus so much attention on large-cap fund managers, as they tend to be covered more broadly on the fund side of our operations, and their stock holdings tend to overlap more heavily with our active stock coverage.

Looking at the year-to-date performance of the top holdings of our Ultimate Stock-Pickers, we were kind of surprised to see only a few defensive names in the portfolio, given the increased level of market volatility this year (not to mention the market correction during the third quarter of the year). The healthcare and consumer defensive sectors have traditionally been viewed as safe havens during periods of market turmoil. While we do have three names from those sectors on the list--narrow-moat

With regards to the financial services names, AIG was the weaker performer of the three, posting a 7.6% gain through the end of last week. The results might have been higher had it not been for the fact that one of the stock's largest holders, Bruce Berkowitz at Fairholme Capital Management, sold off most of his funds' holdings (which at one time accounted for more than 40% of his total portfolio) since the start of 2015. As for Visa and MasterCard, both stocks have rallied this year as the credit card companies have posted fairly solid results, even in the face of a stronger U.S. dollar. Things may be a bit tougher in the near to medium for the credit card firms, though, as the rapid proliferation of payment options like Apple Pay and Google Wallet could threaten what has been an extremely lucrative segment of the market for these two firms. Visa also looks to have its hands full next year, with the firm's announcing at the end of its fiscal fourth quarter that it would be acquiring Visa Europe, a move that will geographically diversify Visa's business away from the mature North American market (which has historically made up more than half of volume and revenue) but also creates some integration risks as Visa Europe has been underperforming (relative to the U.S.-based business). As for MasterCard, we remain concerned about the continued increase in rebates and incentives by the card issuer, which are trending above our longer-term expectations. That's been less of a concern for General Electric, which continued to divest its financial-services assets this year, focusing much more heavily on its industrial businesses. It also hasn't hurt that the company has been fairly resilient in the face of uncertain global macroeconomic conditions, aided by the diversity of its end markets and geographic exposure.

Where others might see failure, we see opportunity. Or at least we'd like to look at it that way. While there were plenty of names that have significantly underperformed this year--especially in the energy sector--we believe it is more important to focus on where our manager have made much larger commitments of capital, because it tends to have a bigger impact on returns (both to the positive and the negative). As we noted in our last article, our Ultimate Stock-Pickers were underweight in energy, utilities, communication services, healthcare and real estate relative to the weightings of those sectors in the S&P 500 at the end of September. They also held overweight positions in the financial services, consumer defensive, technology and basic materials sectors (with their exposure to consumer cyclicals and industrials being more or less in line with the benchmark index). While one would think that this would lead to outperformance, given that more than half of the names that showed up on the list of top 10 best-performing high-conviction stocks came from the technology and financial services sector that hasn't been the case.

Part of this has been because names from the same sectors we saw in the list of best-performing stocks also showed up on our list of top 10 worst-performing high-conviction stocks. From the healthcare and consumer defensive we have three names--wide-moat-rated

As for the financial-services names--wide-moat-rated

The two industrials on the list--wide-moat

Oracle ORCL

We continue to view Oracle as one of the cheapest names in our software coverage universe, with the stock declining 16% year to date at the end of last week, primarily as a result of fears about disruption from pure-play cloud competitors, in our view. We believe that the stock has overreacted to these concerns and feel that Oracle's customer base is encumbered by high switching costs. Furthermore, we believe that Oracle has also invested heavily, and successfully, in moving its product portfolio (and customers) to the cloud. The resilience of Oracle's maintenance revenue stream (which has grown in the midsingle digits on a constant currency basis), provides a strong ballast for the company's revenue base. Maintenance and support represents about half of the company's overall revenue, and approximately 94% gross margins. We have long believed that shifting to cloud environments will take more than several years, and this growth, particularly in light of strong revenue growth from competitors such as Salesforce and Workday, gives us comfort that switching costs remain.

Procter & Gamble PG

Wide-moat Procter & Gamble strikes us as a particularly attractive investment idea, as the market's confidence in the firm's competitive edge and ability to drive accelerating sales growth (to a mid-single-digit level over the next several years) continues to wane. We stand by our contention that P&G's strategic endeavor to rightsize its brand mix is a wise course that shows the firm aims to become a more nimble and responsive operator, without sacrificing its scale and negotiating leverage with retailers. Further, we think this should enable P&G to increase its focus (from both a financial and personnel perspective) on the highest-return opportunities, which is critical in the intensely competitive environment in which it plays. However, we've long thought these initiatives would play out over the next few years rather than a couple of months, and as such, we look for it to drive profitable growth longer term, despite muted progress to date.

Berkshire Hathaway BRK.B/BRK.A

We continue to be impressed by Berkshire Hathaway's ability to generate high-single- to double-digit growth in its book value per share, believing it will take some time before the firm finally succumbs to the impediments created by the sheer size of its operations. We also believe that the ultimate departure of Warren Buffett and Charlie Munger will have less of an impact on the business than many investors believe it will. Despite its more recent deals, Berkshire continues to have plenty of cash on hand and a disciplined share-repurchase program in place, allowing it to step in and buy back meaningful levels of stock in the event that the share price drops below 1.2 times book value. With the company currently trading at around 75% of our fair value estimate of $265,000 ($177) per Class A (B) share, Berkshire is not only one of the best near-term opportunities in the financial-services sector, but is priced at one of the better entry points we've seen in quite some time for long-term investors.

American Express AXP

American Express' exceptional profitability, healthy capital levels, and pristine credit should provide the company quite a cushion to deal with temporary bumps in the road. Though the loss of the Costco cobrand relationship is a large blow, we don't think American Express is down for the count. In fact, new relationships with companies like

Wal-Mart Stores WMT

We still believe that wide-moat Wal-Mart looks attractive. As the world's largest retailer, Wal-Mart has struggled to generate meaningful sales growth recently; encouragingly, traffic trends accelerated in the second quarter, suggesting that recent investments may be gaining traction. We think that investors are struggling to reconcile positive sales growth trends with the investment needed to sustain such growth, as evidenced by margin headwinds from lower pharmacy reimbursement rates, higher shrink, and weakness in emerging markets. Combined with Wal-Mart's decision to increase wages and e-commerce investments, these headwinds have left minimal room for leverage. Still, we think that investors could realize decent risk-adjusted returns if Wal-Mart is able to generate even modest growth over the medium to long term. The company still commands scale advantages, which give it negotiating leverage over suppliers and help it to support its brand perception as a low-priced leader.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Greggory Warren own no shares of any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KXH3Z35EXJHUFKNLDATYCKICAQ.jpg)