Energy: OPEC Faces Hard Supply Decision in Latter Half of 2024

APA, Schlumberger, and Exxon Mobil are our top picks in the energy sector.

OPEC’s plans to increase supply by 2.2 million barrels per day over the next year starting in December (recently pushed back two months) reflects unwarranted optimism about the oil markets. In contrast, the Energy Information Administration, International Energy Agency, and OPEC itself are cutting oil demand estimates by varying degrees. The disappointment is largely linked to China.

On the supply side, US oil producers continue to get more efficient, and they will deliver about 250,000 bbl/d-350,000 bbl/d more in 2024 than in 2023, per Rystad—an increase of about 50,000 bbl/d from the first quarter.

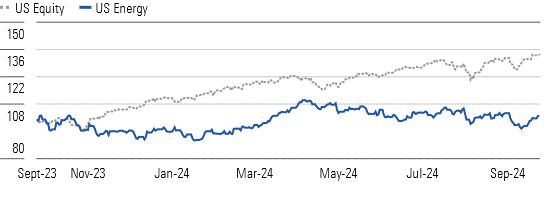

Market Weakness Dampens Energy Stock Prices

OPEC faces two likely scenarios. It can begin to add more barrels to this brittle market, trading higher volumes for lower oil prices in the $60-$70 range, or it can continue to delay the planned additions and retain prices in the $75-$85 range. We think the environment was just as fragile a few months ago, when OPEC first announced its plans, and the delay does not solve the issue. Effectively, OPEC hopes oil demand suddenly grows markedly stronger, which is unlikely.

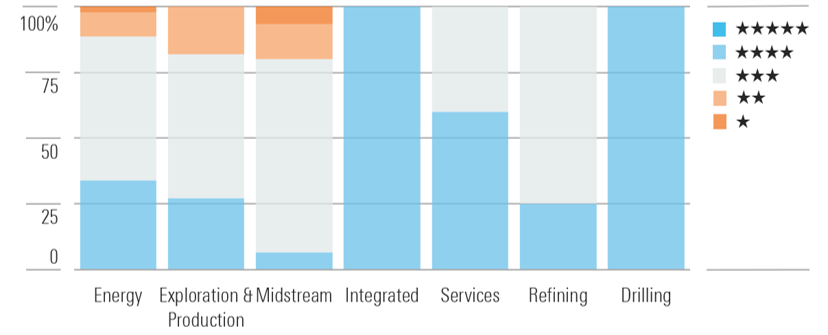

The Energy Sector Does Not Yet Have Widespread Bargains

Given the overall market’s concerns regarding oil supply, investors trimmed energy stock prices this quarter. We would require further downside before we could declare widespread industry bargains. Only 28% of our energy coverage is undervalued (4 or 5 stars). We’d be particularly interested in gas-leveraged names, given the potential for higher gas demand from AI and data center applications as a backstop for intermittent solar and wind.

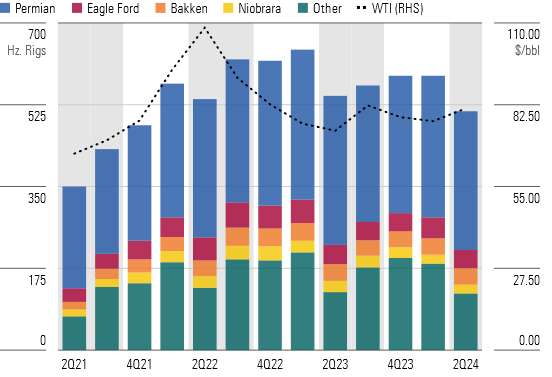

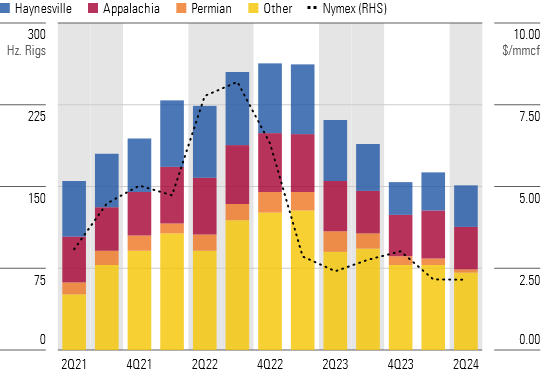

Oil Rig Activity to Remain Lower for Longer Because of Production Efficiencies

Ongoing US E&P consolidation will likely pressure oil rig activity. Public operators are culling rigs from acquired producers’ drilling programs. We favor more of a “lower for longer” approach for drilling rig activity, especially given the material efficiency improvements that US oil producers have recently reported. US gas producers faced a challenging first half in 2024, following production declines due to well shut-ins amid low gas prices. However, we think the outlook is improving. This doesn’t mean more drilling activity, though. Instead, we would expect US gas producers to focus initially on previously shut-in wells or deferred wells for near-term production gains at minimal cost.

After Challenging First Half, Gas Producers Have Better Near-Term Outlook

Top Energy Sector Picks

Exxon Mobil

- Fair Value Estimate: $135.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Exxon Mobil XOM plans to double earnings and cash flow from 2019 levels by 2027 on a combination of structural operating cost reductions, portfolio improvement, and growth across its upstream, downstream, and chemical segments. Exxon estimates that under the current plan, it will generate about $100 billion in surplus cash (after funding investments and paying its dividend) during the next five years. Combined with currently higher-than-expected commodity prices, its current repurchase program is $20 billion annually following its acquisition of Pioneer Resources.

Schlumberger

- Fair Value Estimate: $62.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: High

Schlumberger’s SLB leading-edge technological advancements continue to distinguish the firm from its peers. Its myriad innovations consistently add value for customers, preserving its ability to command premium pricing over and above the currently favorable operating environment. The impending ChampionX acquisition—expected to close by year-end—will add sizable exposure to the chemicals market, further diversifying SLB’s already-impressive product catalog.

APA

- Fair Value Estimate: $44.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

APA APA is hoping for a game-changer with its exploration assets in Suriname. The firm has announced a string of promising discoveries and may have a final investment decision in 2024. We think the project will move forward, and that the market isn’t giving it enough credit. Our fair value estimate assumes three production vehicles with 180 mb/d capacity. That pegs Suriname at a sizable percentage of APA’s equity, so we like the upside as a catalyst-driven name that might outperform in a challenging environment for oil and gas prices.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MX3XFKYTXVG2RGAL3JZKVC526Y.png)