The Saver’s Match Could Be a Game Changer for Retirement Savings—Especially for Black Women

The program, which matches individuals’ contributions to 401(k) plans, could help close the racial wealth gap.

The Secure 2.0 Act of 2022 introduced the Saver’s Match, a program designed to give your retirement savings a significant boost.

In a recent study, I investigated the efficacy of this program with respect to mitigating race/gender disparities in 401(k) outcomes. Here’s what individual investors and financial advisors need to know.

What Is the Saver’s Match?

Think of the Saver’s Match as a free money program for retirement.

Starting in 2027, the Saver’s Match offers a 50% match on contributions up to $2,000 annually for eligible participants in employer-sponsored 401(k) plans. There are income thresholds, so not everyone will qualify. However, for those who do, this can be a powerful tool to accelerate retirement savings growth.

Background: Racial and Gender Disparities in 401(k) Plans

In a previous study for the Collaborative for Equitable Retirement Savings (a joint program of the Defined Contribution Institutional Investment Association, Aspen Institute Financial Security Program, and Morningstar Retirement), I highlight the concerning reality of racial and gender gaps in 401(k) balances. These disparities persist even after controlling for factors like age, salary, and job tenure.

Key contributors to this gap include:

- Contribution differences: I find that Black and Hispanic women contribute a lower percentage of their salaries to retirement accounts compared with their white counterparts, even after adjusting for differences in salary.

- Preretirement withdrawals: Black and Hispanic workers are more likely to tap into their retirement savings before reaching retirement age compared with white workers.

- Loan activity: Black participants are more likely to have outstanding loans against their 401(k) balances, reducing the amount available for long-term growth.

These factors create a compounding effect, leading to significantly lower retirement savings for Black and Hispanic workers, especially women.

Who Benefits Most From the Saver’s Match?

The program was designed by Congress to help low- and middle-income earners who may struggle to save enough for retirement. In the new study, I investigated the efficacy of the Saver’s Match with respect to mitigating race/gender disparities in 401(k) outcomes. The results suggest Black females stand to gain the most significant benefits—which could help narrow the racial wealth gap in retirement savings.

How Much Could You Gain From the Saver’s Match?

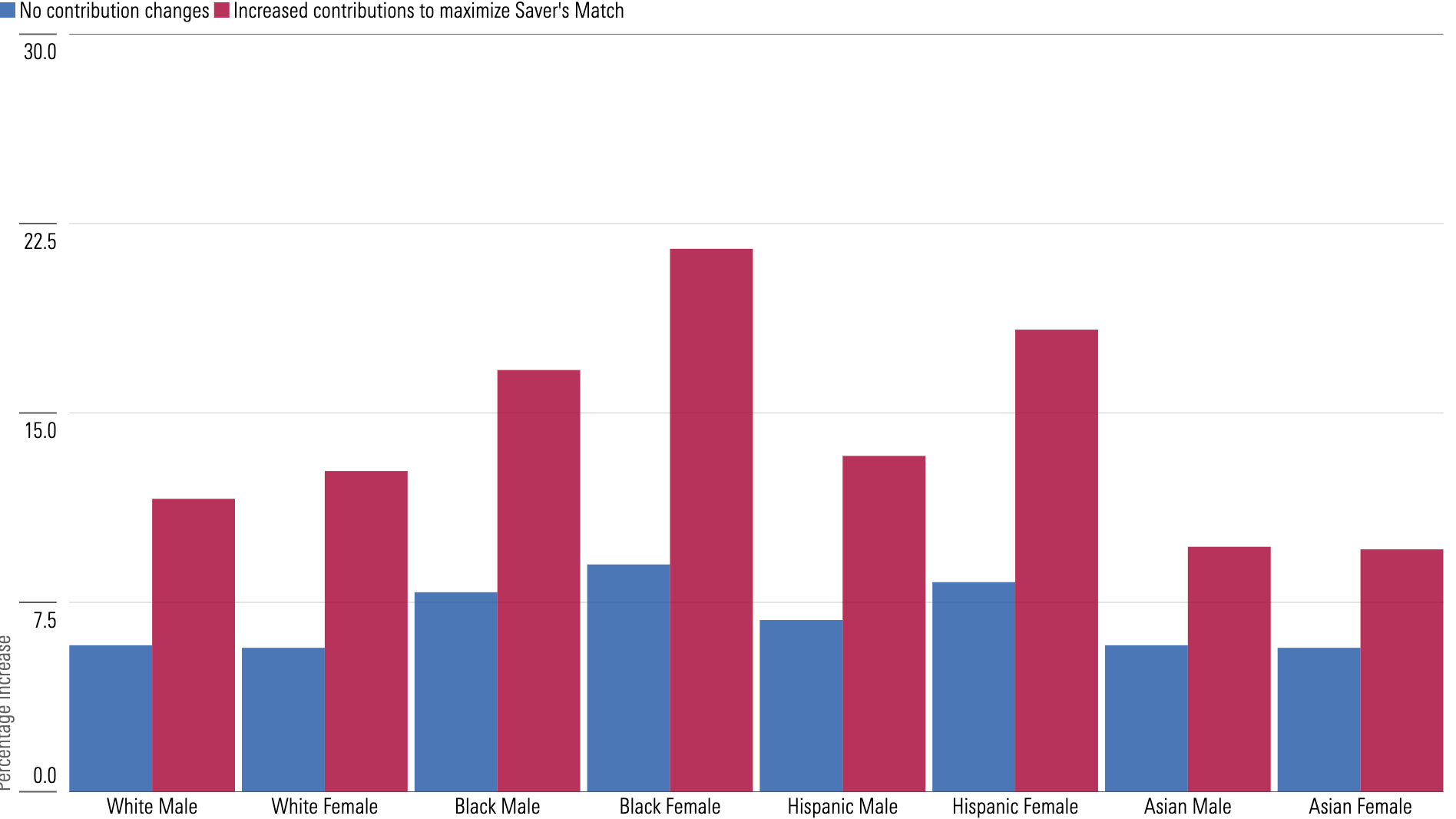

As seen in the figure below, the exact impact to the Saver’s Match depends on your specific situation and how you react to the program. Here’s a breakdown based on contribution behavior:

- No contribution changes: Even if you don’t increase your contributions, the Saver’s Match can still add a significant boost to your retirement savings. My simulations show an increase in the account balance/salary ratio at retirement by 5.7% to 9.0% for eligible participants, with Black females potentially experiencing the highest gains.

- Maximizing the match: The real magic happens if you adjust your contributions to take full advantage of the match. By increasing your contributions to $2,000 (if you’re not already contributing that much), you can see a much larger increase in your retirement savings. My simulations show potential gains ranging from 9.6% to 21.5% for eligible participants, with Black females again seeing the biggest potential benefit.

Average Increase in Account Balance/Salary Ratio at Age 65 as a Result of the Saver's Match

What the Saver’s Match Means for Investors

- Review your 401(k) eligibility: Check your plan details and income level to see if you qualify for the Saver’s Match in 2027.

- Consider contribution adjustments: If you’re not already contributing $2,000, increasing your contributions to maximize the match could significantly boost your retirement savings. Talk to your financial advisor for personalized guidance.

- Stay informed: The program is still new, and details may evolve. Stay updated on any program changes and eligibility requirements.

What the Saver’s Match Means for Financial Advisors

- Educate your clients: The Saver’s Match is a game changer for many clients, especially those in lower- and middle-income brackets. Help them understand the program’s benefits and how it can accelerate their retirement savings goals.

- Analyze client eligibility: Review your clients’ 401(k) plans and income levels to determine their Saver’s Match eligibility.

- Develop contribution strategies: Help your clients develop contribution strategies to maximize the Saver’s Match benefit.

- Stay informed: Keep yourself updated on program details and eligibility requirements to best advise your clients.

The Bottom Line

The Saver’s Match has the potential to be a transformative tool for retirement savings, particularly for those who need it most, including people of color. By understanding the program and taking advantage of its benefits, individual investors can significantly improve their retirement outlook. Financial advisors play a crucial role in educating clients and developing personalized strategies to maximize the Saver’s Match benefit.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/d10o6nnig0wrdw.cloudfront.net/06-25-2024/t_f8ae5dc770f14b3d8f21379e20cb1857_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/d10o6nnig0wrdw.cloudfront.net/06-11-2024/t_e65b384b0a014048b9688b20487ab406_name_MIC_24_Christine_Benz_Speaker_1920x1080.png)