How to Use Small-Cap Stocks in Your Portfolio

What you need to know about the advantages and risks of investing in small-cap stocks.

While the market’s biggest names have been grabbing an even larger share of investors’ attention than usual, the smaller end of the market deserves some consideration, as well.

In this series on portfolio basics, I’ll explain some of the fundamentals of putting together sound portfolios. I’ll start with some of the most widely used types of investments and walk through what you need to know to use them effectively in a portfolio.

What Are Small-Cap Stocks?

Small-cap stocks are equities with lower market capitalizations (which reflect the stock price times the number of shares outstanding) and are typically issued by companies with relatively limited sales and business operations. Morningstar defines small-cap stocks as those that land in the bottom 10% of the overall equity market based on market capitalization. In practice, this translates into a market cap of roughly $10 billion or less.

These firms are small in size but large in number. About 3,600 out of 8,700 publicly traded companies in Morningstar’s US equity database qualify for the small designation.

What Are the Advantages and Risks of Investing in Small-Cap Stocks?

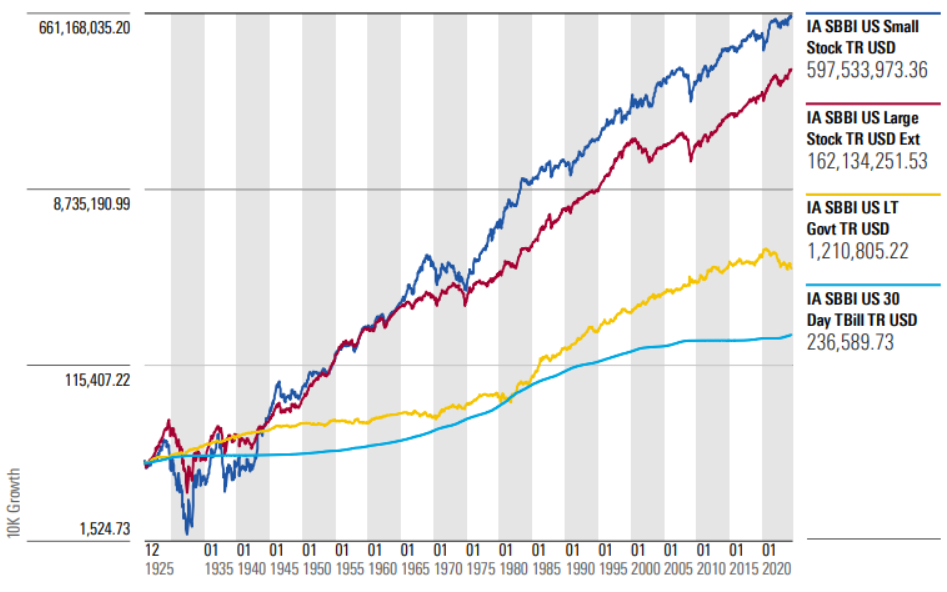

In theory, smaller companies have more room to grow because they haven’t yet reached their full potential or scale. Academic research has often highlighted the long-term performance advantage of smaller-cap stocks. As shown in the graph below, Ibbotson’s small-cap stock index has generated much higher returns compared with the large-cap benchmark over the full measurement period starting in 1926.

Long-Term Growth of Small-Cap Stocks and Other Assets

In reality, this performance advantage is probably overstated. It ignores both commission costs and bid-ask spreads, which were nontrivial over most periods shown in the graph.

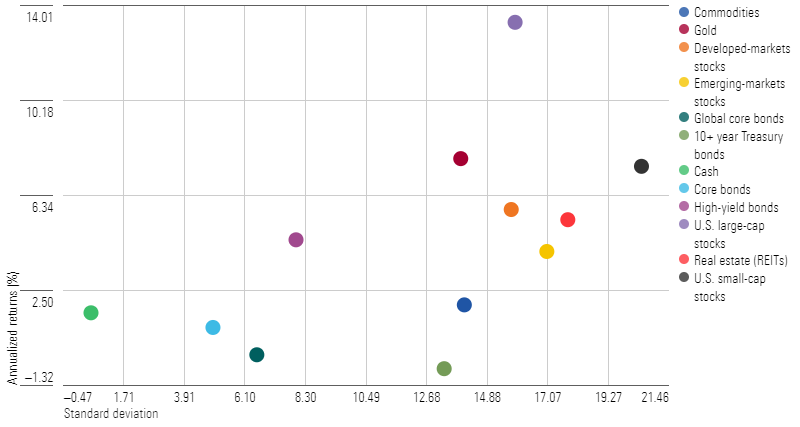

In addition, small-cap stocks haven’t had a performance advantage over the trailing 20-year period through May 2024. As shown in the scatterplot below, annualized returns on small-cap stocks have been more than 5 percentage points lower than those of the large-cap benchmark over that period. At the same time, their volatility has been much higher than that of most other major asset classes, as shown in the scatterplot below.

Trailing 20-Year Risk and Return: Small-Cap Stocks and Other Assets

This volatility has also been reflected in greater levels of downside risk. Small-growth stocks have been the most vulnerable to losses. In one particularly painful episode, they lost about 67% of their value when tech stocks corrected starting in March 2000.

Risk and Drawdown Stats

How to Invest in Small-Cap Stocks

There are two main ways to invest in small-cap stocks: by purchasing individual stocks or by buying a fund.

Buying individual stocks comes with additional risks. If you own one stock (or even as many as 20 different stocks), you’ll be subject to stock-specific risk—meaning that the odds of things going poorly are much higher than they would be with a diversified portfolio. In 2023, for example, more than half of all US small-cap stocks lost 10% or more, even though the overall market gained about 26% for the year.

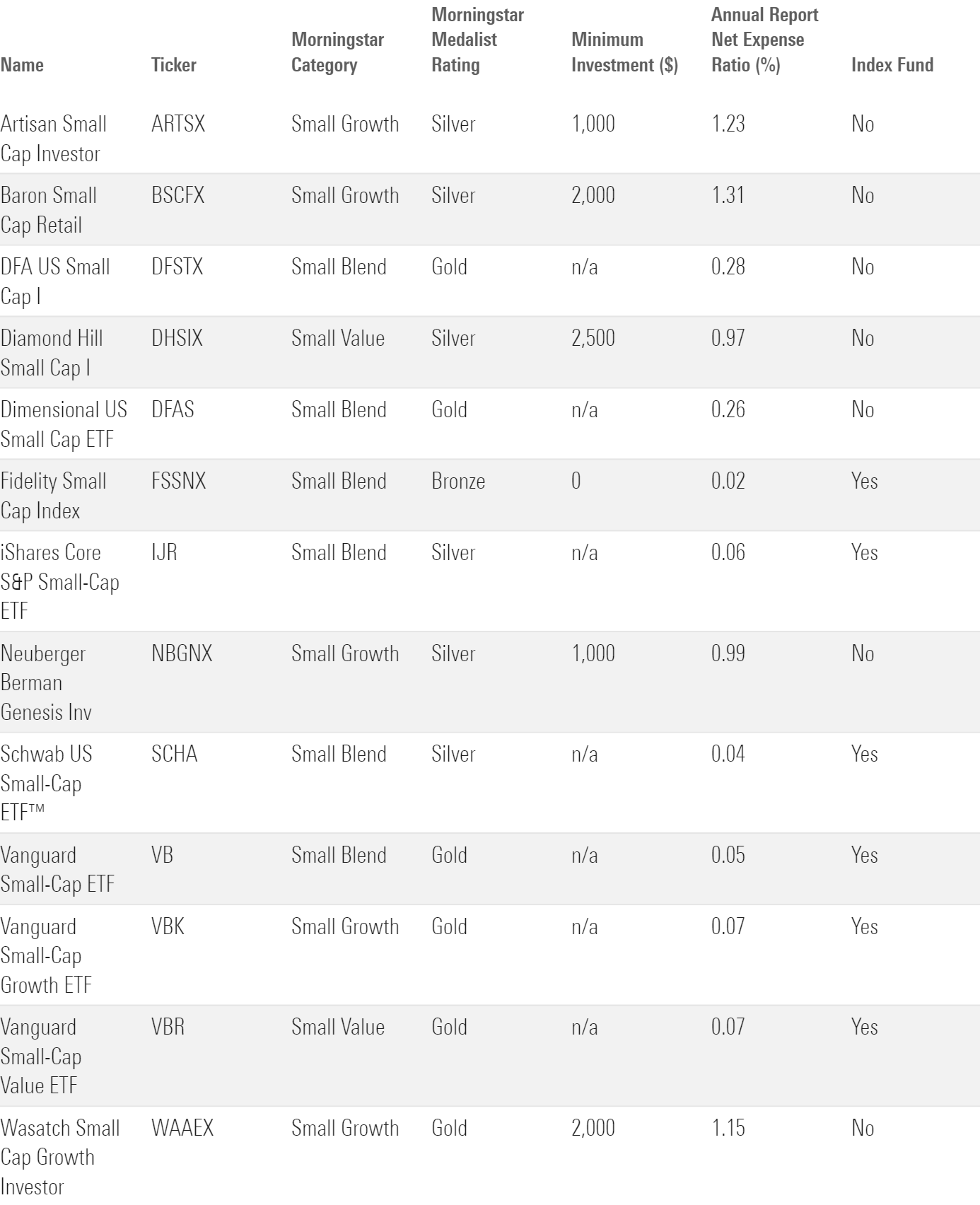

For the average investor, a broadly diversified mutual fund or exchange-traded fund is a better option. The choice then becomes active or passive. In the small-cap arena, actively managed funds have outpaced their passive counterparts more often than in other areas, such as large-cap stocks. However, the percentage of small-cap funds that beat out passively managed options declined sharply in 2023.

Index funds, on the other hand, harness the market’s collective wisdom about the relative value of each stock included in a given benchmark. They’re also cheaper: Investors in actively managed small-cap stock funds pony up annual expenses of about 100 basis points, on average, but the typical passively managed fund charges less than half of that.

The table below highlights some small-cap funds with above-average Morningstar Medalist Ratings.

Selected Small-Cap Funds

When Do Small-Cap Stocks Perform Best?

Small-cap stocks are often perceived as more economically sensitive than stocks issued by larger firms. Their business lines are often more focused on domestic markets and can be heavily dependent on trends in interest rates, consumer demand, and commodities prices. In addition, they often carry more debt than larger, more established companies.

While these characteristics would seemingly be a tailwind during periods of strong economic growth, that pattern hasn’t really played out in recent years. Small-cap stocks not only lagged during the pandemic-driven downturn in 2020 but also during the economic recovery that followed.

These lackluster recent showings were partly driven by differences in sector composition. Compared with the market overall, small-cap benchmarks have less exposure to technology stocks and more exposure to “old economy” sectors such as consumer cyclicals, financials, real estate, and industrials. Despite generally strong economic growth, these sectors haven’t kept pace with technology-related stocks.

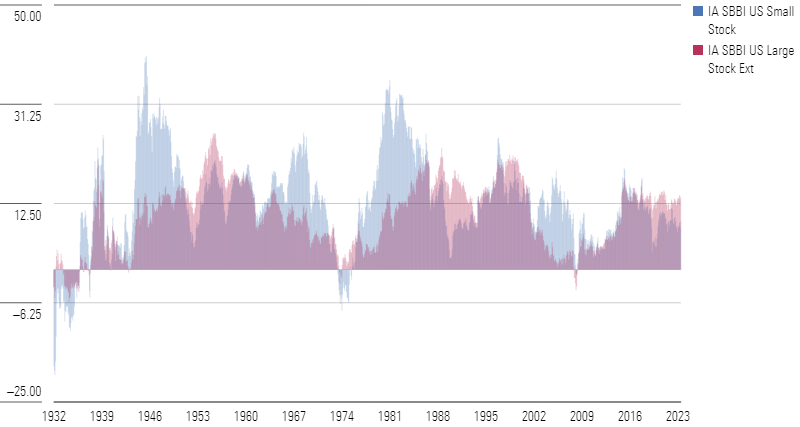

Rolling Seven-Year Returns

However, small-cap stocks pulled ahead in some previous periods, such as the stretch from 1974 through 1983, the early 1990s, and most of the period from 2000 through 2010.

How Long Should I Hold My Investments in Small-Cap Stocks?

Morningstar’s Role in Portfolio framework recommends holding small-cap stock funds for at least 10 years. We came up with this guideline partly by looking at the historical frequency of losses over various rolling time periods ranging from one year to 10 years. We also considered the maximum time to recovery, or how long it usually takes to recover after a drawdown.

How Much of My Portfolio Should Be in Small-Cap Stocks?

Small-cap stocks currently make up about 8% of the overall equity market, which is a reasonable target for the US stock portion of a portfolio. Contrarian investors might want to consider a modest overweighting as smaller-cap stocks covered by Morningstar’s equity analysts are currently trading at roughly a 10% discount to their estimated fair value, on average, compared with a 5% premium for large-cap issues.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NSVUOQPZGJF7LCEGN76XGJKQII.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BHYIMOHDUREGTCIGI46ZAN6UWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VPCBITMQP5FKLIZ32POIXOV3MQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)