What You Can Expect From a Financial Advisor

Things to consider as you hire, work with, and consider parting ways with a financial advisor.

As someone who works in the finance industry, a common question I get from new acquaintances is: “So, what should I do with my finances?”

At this point, I explain that I’m not a financial advisor. Their next statement is usually some variation of the following: “I’ve been thinking about reaching out to a financial advisor, but they’re kind of a mystery to me.”

The term “mystery” here can point to many barriers that investors face when seeking professional financial advice: Who can I trust? Where to start my search? What certifications should I look out for?

But I believe one of these barriers is that many investors don’t know what to expect from a financial advisor. Investors know advisors can help with a financial plan, but is that all? And what about if you, as the investor, don’t really know what you need—can you still go to an advisor then? Is there a “minimal knowledge needed” requirement, or can you expect the advisor to teach you a thing or two as you go?

The truth is that financial advisors are a mystery to a lot of investors. Even investors who have been working with an advisor for years may not have a solid idea of what a good financial advisor should be doing.

What Should a Financial Advisor Do for You?

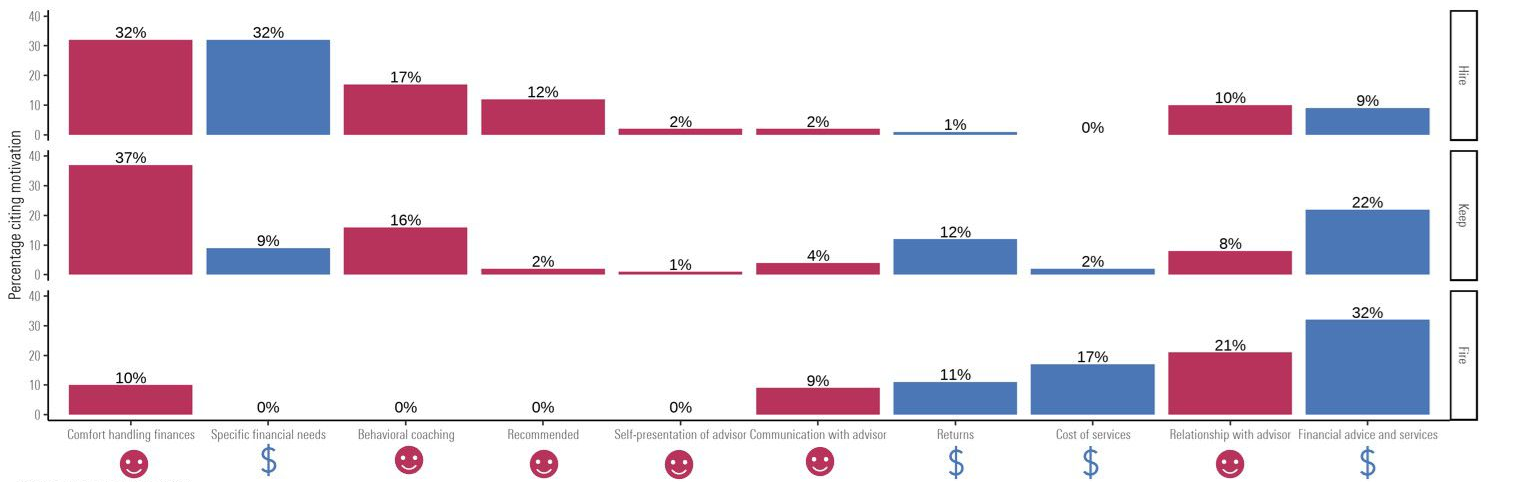

To help dismantle this mystery, we decided to look to the wisdom of crowds. We asked investors three questions: 1) Why did you hire your financial advisor? 2) Why do you keep your financial advisor? And, for those who have done so, 3) why did you fire your financial advisor?

These questions helped us understand all the services that advisors should be providing to get hired and earn their keep with existing clients. They also shed light on the reasons why investors choose to part ways with financial advisors.

In our research, we started by creating a common list of motivations behind hiring, keeping, and firing decisions, which included both financial and emotional categories. We then categorized people’s responses according to their motivations.

The graph below shows the top 10 motivations for each question, along with the proportion of responses that fit into each.

Proportion of Responses Attributed to Each Motivation Category

We consider this graph to be an expectations cheat sheet for investors.

In other words, at each of these phases, these are the services that your advisor should be providing based on what other investors are getting from their advisors. If your advisor isn’t meeting these needs, then keep searching till you find an advisor that does.

Based on our results, here’s what to look for.

When Hiring a Financial Advisor

Make sure that the advisor has the expertise and credentials to meet your financial needs.

One rule of thumb is to review the advisor’s credentials and make sure they are a fiduciary. However, an advisor’s role does not stop there. As we saw from people’s responses, many investors are also getting emotional support from their advisors. Not only do their advisors have the necessary financial expertise, but their advisors help them manage their discomfort in handling financial issues and their need for behavioral coaching.

For example, people mentioned that their advisor helped them navigate financial decisions and made them feel more confident about their financial future. They also mentioned that their advisor helped them stick to their plan during market volatility and acted as a sounding board for their decisions.

When Considering Your Current Financial Advisor

As you develop a relationship with an advisor, it’s important to consider if the relationship is still working for you.

When we asked investors why they chose to keep working with their advisors, they responded with a mix of emotional and financial reasons.

Not only were their advisors providing emotional support by acting as buffers from the “overwhelming” world of finance (discomfort handling finances), but they were also adequately addressing their financial needs by generating returns and addressing their holistic financial needs, from taxes to the costs of extended healthcare.

When Contemplating Parting Ways With Your Advisor

Breaking off a relationship is never easy, no matter the kind of relationship.

Investors in our study were convinced to take this drastic step because their advisor wasn’t meeting their expectations. The advisor wasn’t generating the value they expected, wasn’t giving them the level of personalization they needed, and didn’t seem to care about them as a person.

Even responses that mentioned cost pointed out that the services the advisor was providing weren’t making up for their cost, and not just that the service was too expensive.

Financial Advisors as Financial Partners

As investors, we should stop being daunted by financial advisors. They aren’t some mysterious black box that somehow generates returns. Instead, they can be considered a great resource to help you reach your financial goals. As you consider such a relationship, keep in mind all the things an advisor should provide—which is way more than just stock tips.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZLDA7BGZZFCDHCDRMM4AZLHG4A.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)