Q4 Stock Market Outlook: Where We See Opportunities for Investors

The great rotation out of overvalued & overextended large-cap growth stocks has further room to run.

Key Takeaways:

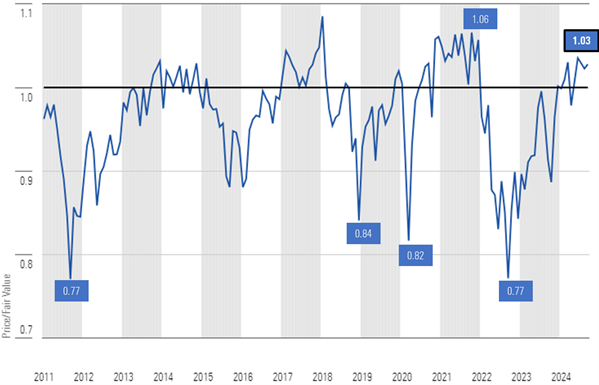

- Since 2010, only 15% of the time has the market traded at a 3% premium or more.

- Rotation into small-cap and value stocks has further room to run.

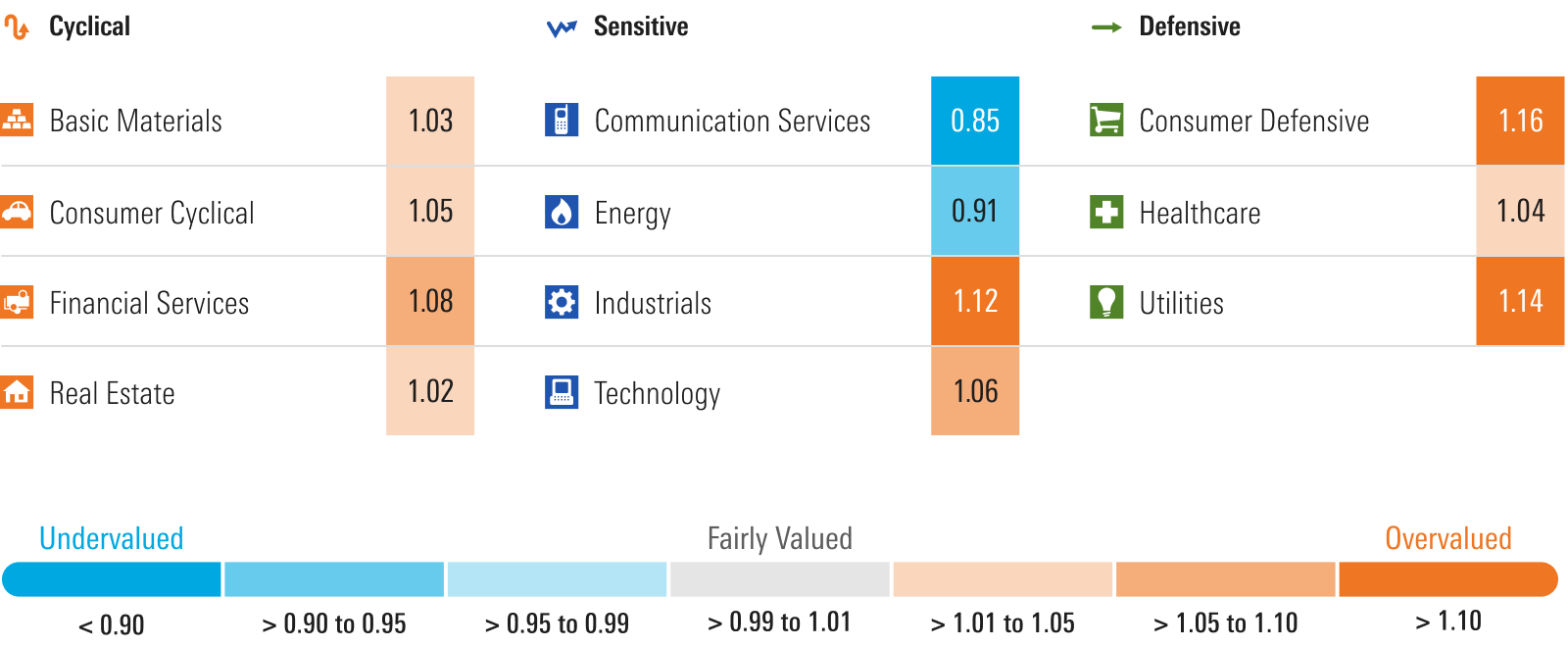

- Only the communications and energy sectors remain undervalued.

4Q 2024 US Market Outlook & Valuation

Through Sept. 23, the Morningstar US Market Index, our proxy for the broad US equity market, increased 5.31% quarter to date. By style, the greatest gains were generated in the value category, which surged 8.35%, followed by core, which increased 6.84%, and bringing up the rear was growth, which only rose 4.20%. By capitalization, mid- and small-cap stocks rose 8.15% and 7.93%, respectively, whereas large-cap only increased 4.33%.

Last quarter, we highlighted that those large-cap growth stocks most correlated with artificial intelligence had risen to the point that they were generally overvalued and overextended, and we asked the rhetorical question “Is the AI trade over?” We also noted that the value category and small-cap stocks, which have long lagged the market rally, remained significantly undervalued and advocated for an overweight position in both. Although the rotation into value and small-cap stocks has already begun, according to our valuations, we think the rotation has further room to run. Each remain undervalued on both an absolute basis as well as relative to the market valuation.

As of Sept. 23, the price/fair value of the US stock market was 1.03, representing a 3% premium to our fair value estimates. While not yet in overvalued territory, this places the market valuation near the top end of the fair value range. In fact, since the end of 2010, the market has traded at this much of a premium, or more, only 15% of the time.

Price/Fair Value of Morningstar's US Equity Research Coverage at Month-End

The combination of an economy that has held up better than expected, moderating inflation, declining interest rates, and easing monetary policy has led to stronger equity market returns than we had expected at the beginning of the year.

These conditions, in conjunction with the transformational nature of artificial intelligence and ongoing strong consumer spending, has led us to increase our fair values on 60% of the stocks under our coverage that trade on US exchanges. In fact, we increased our fair value by 10% or more on 30% of our coverage.

Yet, even after boosting our fair values across much of our coverage, the market has outpaced these increases and our composite price/fair value metric has risen to a 3% premium, whereas it was trading right at fair value coming into the year.

While the overall market appears to be priced to perfection, we continue to see some undervalued opportunities, albeit these opportunities are much fewer and far between than earlier this year and are often contrarian plays or story stocks.

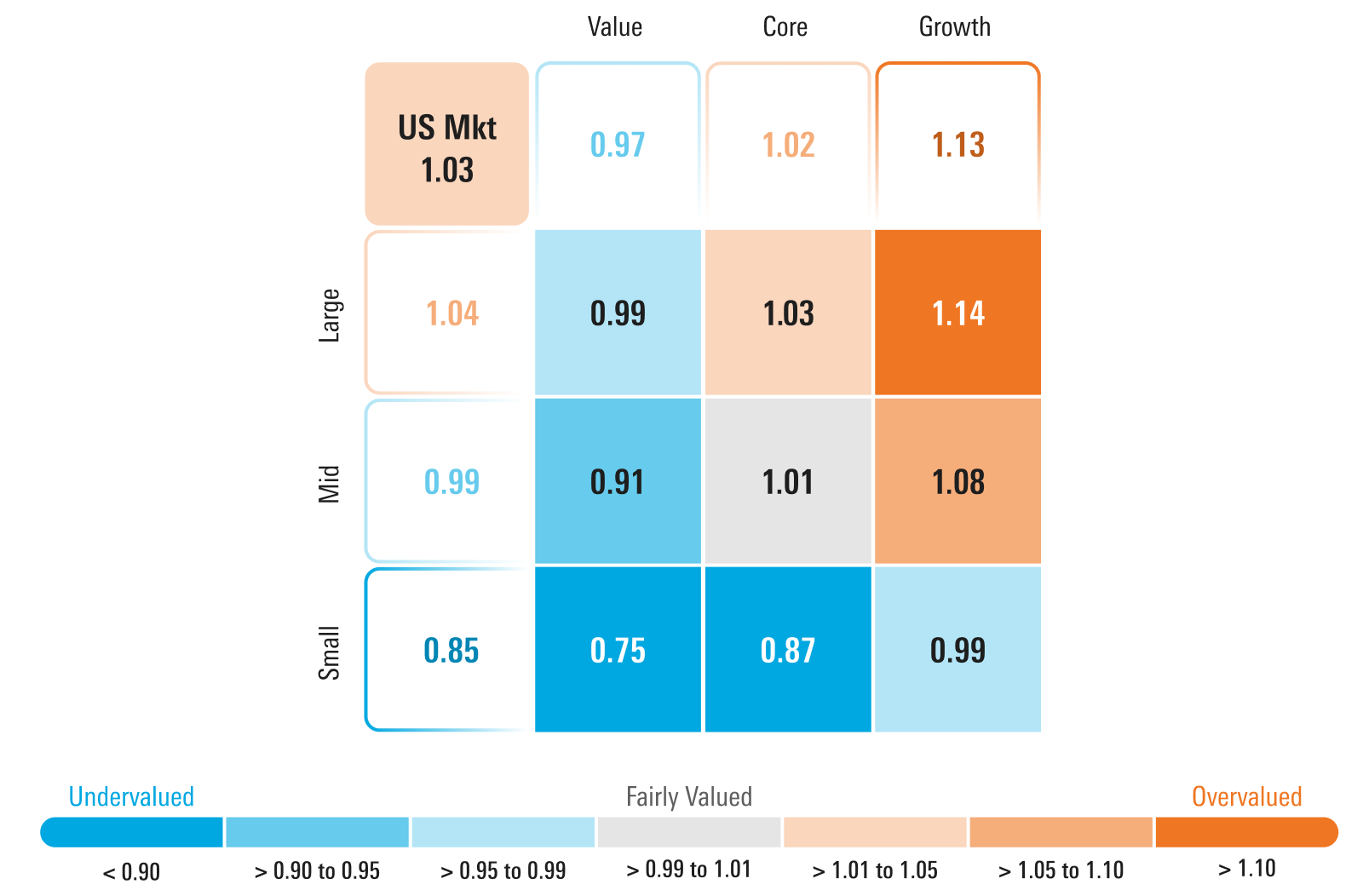

Price/Fair Value by Morningstar Style Box Category

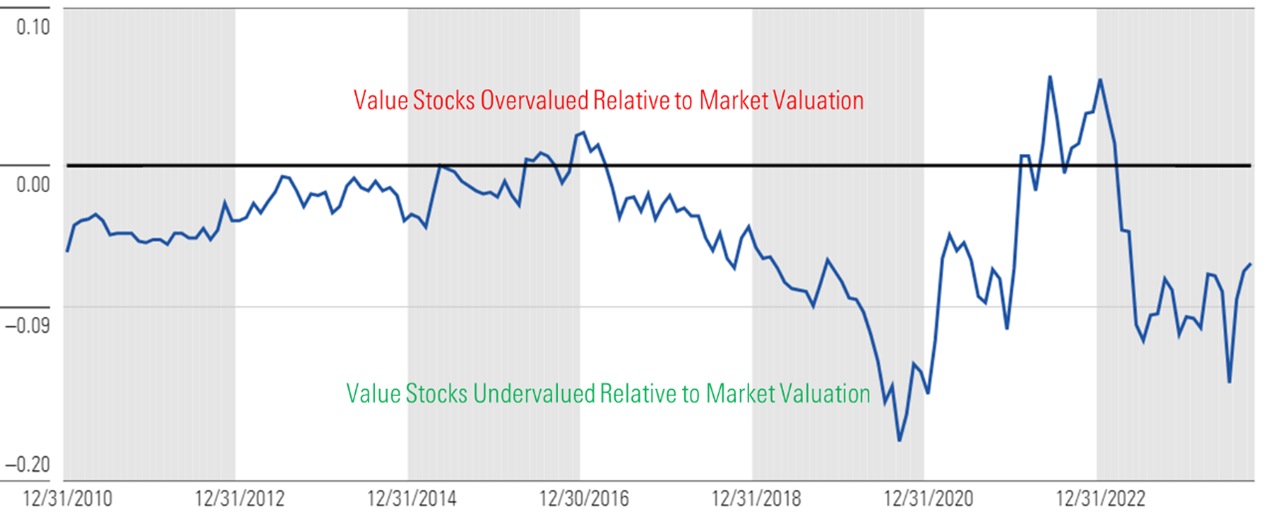

As of Sept. 23, growth stocks are trading at a 13% premium to a composite of our coverage, and core stocks are trading at only a 2% premium, whereas value stocks remain attractively priced at a 3% discount to our valuations. According to these valuations, we advocate overweighting value stocks, holding a market weight position in core stocks, and underweighting growth stocks.

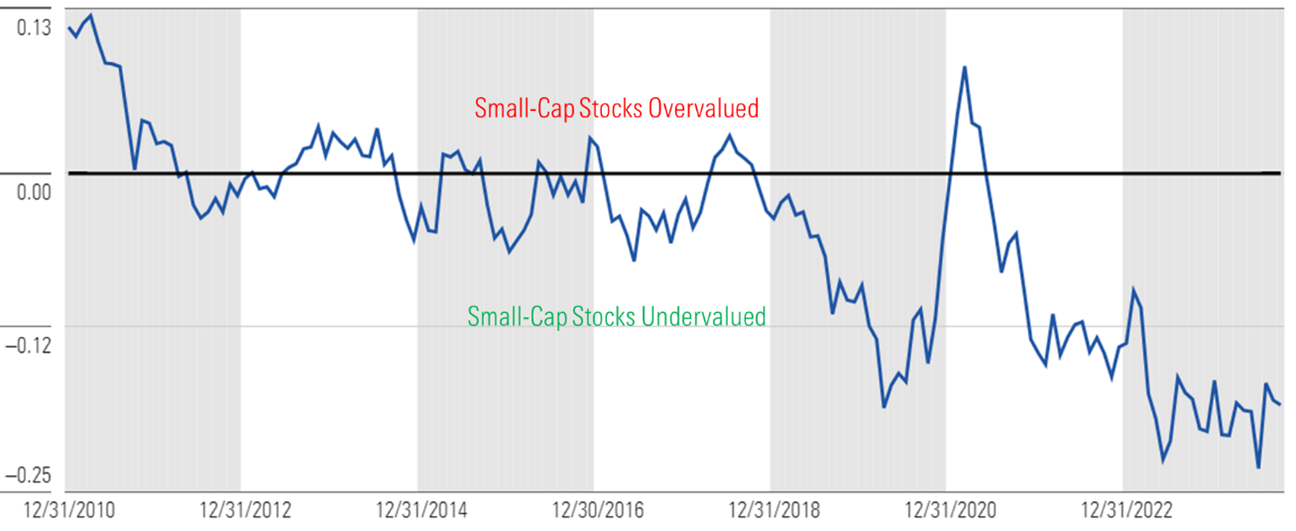

By capitalization, small-cap stocks remain attractive, trading at a 15% discount to fair value. Mid-cap stocks trade near fair value at only a 1% discount, and large-cap stocks are at a 4% premium. According to these valuations, we advocate an overweight in small-cap stocks, market weight in mid-cap stocks, and underweight in large-cap stocks.

Rotation Into Small-Cap and Value Stocks Have Room to Run

According to our valuations, we think the rotation into small-cap and value stocks has further room to run as each remain undervalued on both an absolute basis as well as relative to the market valuation.

Small-Caps Near Lowest Relative Valuation to Market Valuation Over Past 14 Years

Value Stocks Continue to Trade at a Deep Discount Relative to Broad Market Valuation

Opportunities Across Undervalued Sectors and Stocks

The rally across the value category has brought sector valuations up among those sectors that contain a high number of value stocks. At this point, only the communications and energy sectors are undervalued at the sector level. Looking forward, we expect that individual stock selection will play an increasingly greater role in being able to outperform the broad market.

Morningstar Price/Fair Value by Sector

Communications

Communications is the most undervalued sector, trading at a 15% discount to fair value. Within the sector, following its recent earnings report, we boosted our fair value on Alphabet GOOGL by 15% to $209. Much of the fair value increase was driven by raising our growth expectations for its cloud computing arm. We also recently took a fresh look at Meta Platforms META and increased our fair value to $560. The fair value increase incorporates a more optimistic outlook on the firm’s investments in artificial intelligence, especially as they relate to Meta’s ability to improve its ad-targeting business. We also continue to see value in many traditional communications companies such as 4-star-rated Verizon VZ.

Energy

Over the long term, we expect oil prices to decline as our midcycle forecast for West Texas Intermediate WTI crude is $55/barrel. Yet, even with that bearish forecast compared with today’s $70/barrel price, we see value among much of the energy sector, which trades at a 9% discount to our fair valuations. We also think exposure to the energy sector provides a good, natural hedge to portfolios to hedge against rising geopolitical risk or if inflation were to stage a rebound.

Among the global major oil producers, 4-star-rated Exxon XOM is our preferred integrated oil company, given its earnings growth potential from a combination of high-quality asset additions and cost savings. For investors looking for domestic producers, we highlight 4-star-rated Devon DVN. For investors with a higher risk tolerance, we suggest looking at APA APA, which could have significant upside from a potential play in Suriname. The evidence to date suggests a very large petroleum system that could be transformative for the company. At this point, we think it is very likely that one or more of the discoveries will progress to the development stage, though none have been officially sanctioned yet. A final investment decision for Suriname is planned by the end of 2024 with first oil in 2028.

Real Estate

Over the past 18 months, no sector was hated as much by Wall Street than real estate, which was why it was also the most undervalued sector in last quarter’s outlook. However, in anticipation of the Fed’s shift to begin easing monetary policy and the markets’ rotation into value stocks, real estate surged in the third quarter, rising 17.50%. From a sector perspective, it’s now fairly valued. Yet, we continue to see idiosyncratic situations that remain undervalued. For example, we recently added 4-star-rated Sun Communities SUI to our quarterly Best Picks. We believe that SUI will produce same-store net operating income above the residential REIT average, and investors will recognize the strong internal growth story when interest rates stabilize. We also continue to see value in 4-star-rated Healthpeak DOC. In our opinion, its portfolio of medical office and life sciences assets should provide steady and recession-resistant revenue growth.

Overvalued Sectors to Consider Taking Profits Off the Table

Utilities

In just under one year, the historically staid utility sector has gone from significantly undervalued to overvalued. In fact, in our 4Q 2023 US Market Outlook, we highlighted that the utility sector was trading at valuation levels that were near their lowest levels over the past decade, yet we noted that fundamentally the outlook for the sector was as strong as we had ever seen it. Since the utility sector bottomed out on Oct. 2, the Morningstar US Utility Index has risen 49% through Sept. 23. The utility sector is currently trading at a 14% premium to our fair values.

With valuations at elevated levels, we advocate to swap out of overvalued utility stocks such as 2-star-rated Southern Co SO and Dominion Energy D, which trade at premiums of 28% and 19%, respectively. Evergy EVRG is one of the few utility stocks rated 4-stars, as it trades at a 5% discount to fair value.

Consumer Defensive

As the rate of economic growth is forecast to slow over the next few quarters, many investors are seeking refuge among traditionally defensive sectors. This sector is now trading at a 16% premium over our fair values, the most overvalued of any sector. Many of the large-cap stocks in this sector have been bid up to levels well above our long-term intrinsic valuations. For example, 1-star-rated Costco COST trades at an approximate 75% premium over our fair value. To put that in perspective, the company’s stock is currently trading at over 50 times our fiscal 2025 EPS forecast. Similarly, 1-star-rated Walmart WMT trades at an approximate 40% premium over our fair value as it trades at 33 times our earnings forecast.

What’s an Investor to Do?

Although the broad market is trading at a premium to fair value, we continue to advocate for a market weight position within your portfolio. When evaluating market dynamics, we think the tailwinds from declining interest rates, moderating inflation, easing monetary policy, and recent barrage of stimulus measures announced by the Chinese government will overwhelm the headwind from slowing the rate of economic growth. Within an equity portfolio, we see the best value for investors today in the value category and small-cap stocks.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6JNXNDYK3RH73MZK3IZ6UTSIAY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KVRQ726W7RFHLPM2IY7EGD7SQU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)