Markets Brief: Will the CPI Allow the Fed to Cut Rates in September?

Bargains emerge after the stock market selloff and the CPI is on deck.

Will the CPI Allow the Fed to Cut Rates in September?

Next on the docket for investors will be the July Consumer Price Index report. While expectations are solidly in the camp of the Federal Reserve starting an active campaign of lowering interest rates in September, the central bank must have a benign inflation outlook first.

Last month, the CPI proved unexpectedly soft. This month, the data might not be as good. Forecasts suggest the July CPI will pop higher from June’s reading, partly thanks to higher gas prices. Core service prices are also expected to tick up. However, it’s the trend that matters. If the CPI comes in as forecast, economists say the coast will still be clear for a September rate cut. This case was already made stronger following the surprising July jobs report released on Aug. 2, which showed a jump in the unemployment rate to 4.3% and a weaker-than-expected increase in hiring of 114,000 jobs.

In the bond futures market, odds for a Fed rate cut are seen at 100% in September, according to the CME FedWatch tool. The question has become whether the Fed will cut rates by a quarter point or by a more aggressive half of a percentage point.

Last Monday’s Market Selloff

Last Monday was stressful for investors. The Morningstar US Market Index was down 2.96% at the close, and the stock market saw its sharpest drop in nearly two years. Japanese stocks posted their biggest loss in decades. There were multiple factors in the selloff. One was the weaker-than-expected July jobs report released the previous Friday, which caused some concern that the Fed has waited too long to cut rates, increasing the threat of a recession.

The second contributor was a surprising interest rate increase from the Bank of Japan, decreasing the yen’s value (which many traders had been borrowing to buy other more expensive assets) against the dollar. The hike caused many to quickly exit their trades, leading to more panic.

The overly concentrated US market didn’t help the selloff, with big tech stocks (which normally pull up the market) falling.

Magnificent Seven Hit Drags the Market Lower

Alphabet GOOGL, Amazon.com AMZN, Apple AAPL, Meta Platforms META, Microsoft MSFT, Nvidia NVDA, and Tesla TSLA were the stocks most responsible for the decline, with nearly half the loss attributed to the group. Tesla fell 14.3% between Aug. 1 and Aug. 5, while Nvidia dropped 14.03%. More broadly, semiconductor stocks, which have been market leaders, were especially beaten. This is the kind of downside to market concentration that some analysts have been warning about.

Some stocks that were particularly pricey before the selloff now look more attractive as entry points—specifically Microsoft and Amazon, which are both now considered undervalued. Amazon went for $167.06 per share by the end of Aug. 8, well below Morningstar’s fair value estimate of $195. Microsoft ended the week at $402.02, 18% below its fair value estimate of $490. A month ago, Amazon traded at roughly $200 and Microsoft at $466.

Stocks on Sale

While it was a scary couple of days for the stock market (which had only just hit new record highs in mid-July), these kinds of pullbacks can offer opportunities for investors to put more money to work. Case in point: In just a week, 46 stocks saw their Morningstar Ratings go from 3 to 4 stars. Stocks rated 4 or 5 stars are considered undervalued, those rated 3 stars are considered fairly valued, and those rated 1 or 2 stars are considered overvalued. Big names now undervalued include Amazon, Chevron CVX, and Micron Technology MU.

Highlights of This Week’s Market and Investing Events

- Tuesday, August 13: July Producer Price Index report, earnings from Home Depot HD.

- Wednesday, August 14: July Consumer Price Index report.

- Thursday, August 15: July Retail Sales, earnings from Alibaba Group Holding BABA, Walmart WMT.

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

For the Trading Week Ended August 9

- The Morningstar US Market Index stayed the same.

- The best-performing sectors were energy, up 1.05%, and communication services, up 0.63%.

- The worst-performing sector was basic materials, down 1.39%.

- Yields on 10-year US Treasury notes rose to 3.94% from 3.80%.

- West Texas Intermediate crude prices rose 4.73% to $77 per barrel.

- Of the 701 US-listed companies covered by Morningstar, 293, or 42%, were up, 3 were unchanged, and 405, or 58%, were down.

What Stocks Are Up?

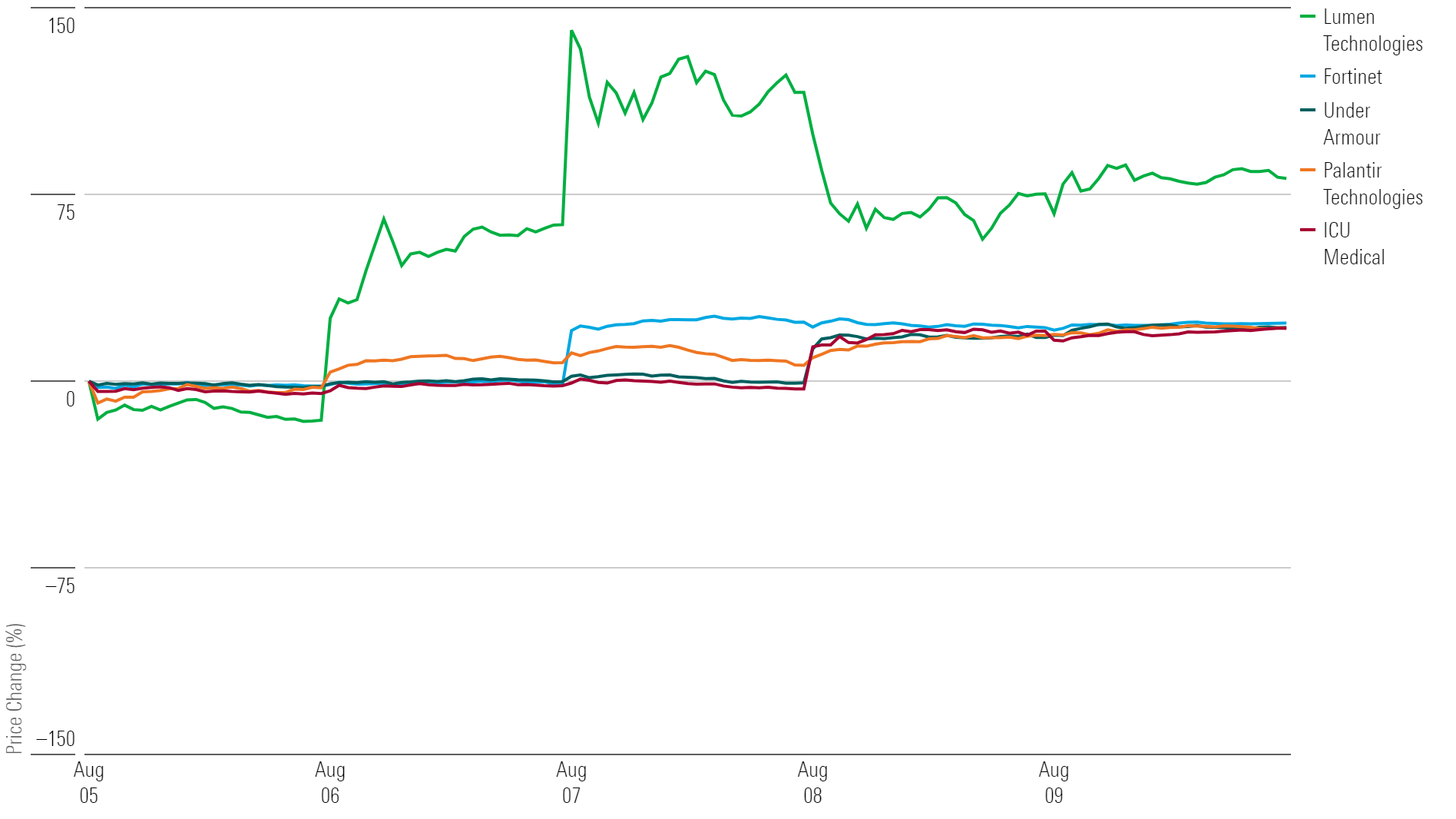

Lumen Technologies LUMN, Fortinet FTNT, Under Armour UA, Palantir Technologies PLTR, ICU Medical ICUI

Best-Performing Stocks of the Week

What Stocks Are Down?

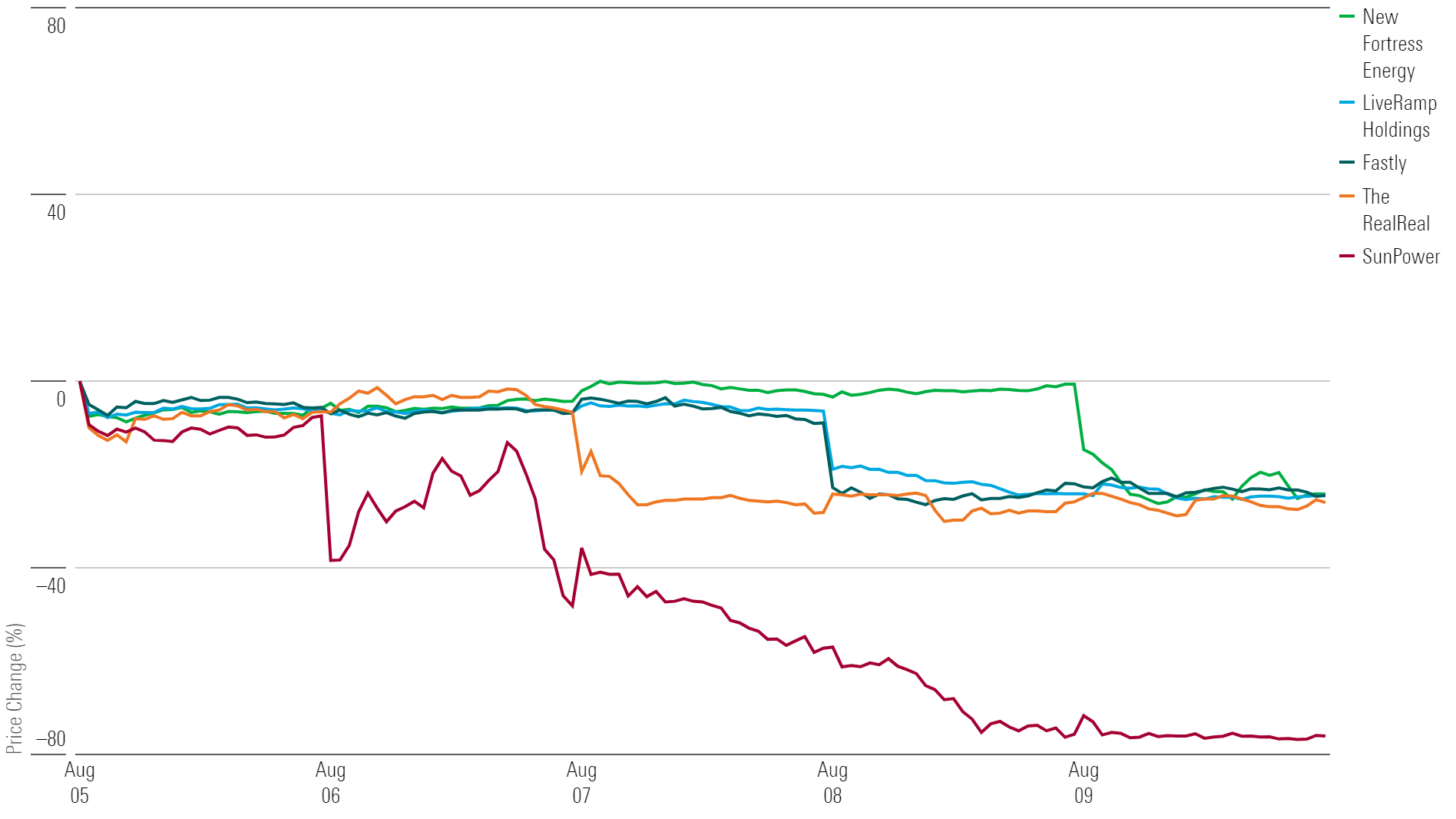

SunPower Corporation SPWR, RealReal REAL, Fastly FSLY, LiveRamp Holdings RAMP, New Fortress Energy NFE

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)