Markets Brief: AI Leaders Excel In Earnings Season So Far

Tech stocks with an AI advantage outperform, China markets could be stirring, and investors are turning their attention to the Fed.

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

In a big week for economic data, the picture painted for investors showed slower economic growth and stickier inflation. US first-quarter GDP growth was 1.6%, compared with a forecast of 2.2%, and inflation as measured by the Personal Consumption Expenditures Price Index was 2.8% over the last 12 months, compared to an expectation of 2.7%.

While this may look like bad news for investors, they seem relieved that the situation is not worse. This reminds us of the importance of expectations in determining short-term price movements. However, the impact of these volatile expectations fades as time passes, while the fundamental returns of the asset classes we invest in become more important. This is why investment is always a long-term pursuit.

Earnings Season Winners and Losers

Approaching the midpoint of the US quarterly earnings season, we’re seeing updates from the large technology companies christened the “Magnificent Seven” last year. Microsoft MSFT, Alphabet GOOGL/GOOG, Meta Platforms META, and Tesla TSLA have reported, while Apple AAPL and Amazon AMZN are expected to report this week. (Nvidia NVDA reports later in May.) Stronger-than-expected results encouraged analysts to raise their expectations for future growth, leading to the Morningstar US Technology and Communication Services Index rising 4.52% over the week.

Artificial intelligence continues to be a key differentiator in this group. While investors appeared to welcome further investment in this area by Microsoft and Alphabet, they remain concerned about Meta’s higher spending. You can catch up on the latest earnings reports from Morningstar equity analysts on this dedicated page.

Will China’s Unloved Stocks Surprise Investors?

Expectations have also played a strong role in markets outside the United States. Concerns about economic and geopolitical challenges in China have weighed on investors’ minds, leading to a 42% decline (47% in US dollar terms) in the Morningstar China Index from the end of 2020 to the start of 2024. Most companies that dominate that index now appear attractively valued. Many are high-quality businesses that Morningstar analysts expect to deliver attractive returns for investors over the long term (as evidenced by their economic moat ratings).

However, this market appears to be gaining more attention, given the 11.19% price rise over the last three months, reminding us of the benefits of searching for value in unloved parts of the capital markets. Morningstar’s Investment Management team outlined the attractive parts of the Chinese equity market (and how to address its risks) last year. They continue to see opportunities, as evidenced by a recent Global Convictions document.

Expect No Surprises from the Federal Reserve

This week’s big event is the Federal Reserve’s latest decision on interest rates, which will be announced Wednesday. According to the CME FedWatch Tool, there is a 97.6% probability that interest rates will remain unchanged. Any other outcome would be a surprise that could create significant volatility.

As always, investors will closely scrutinize Fed chair Jerome Powell’s comments, looking for hints about the future path of interest rates. While such speculation provides work for financial commentators, it should be of limited interest to investors with well-structured portfolios, who can look a little further ahead.

Highlights of This Week’s Market and Investing Events

- Monday, April 29: Earnings from SoFi Technologies SOFI

- Tuesday, April 30: Earnings from Coca-Cola KO, Eli Lilly LLY, Amazon AMZN

- Wednesday, May 1: Earnings from Pfizer PFE, April ADP Employment Survey, March Job Openings and Labor Turnover Survey

- Thursday, May 2: Earnings from Albemarle ALB, Apple AAPL

- Friday, May 3: April Employment Situation Report

Check out our full weekly calendar of economic reports, consensus forecasts, and corporate earnings.

Stats for the Trading Week Ended April 26

- The Morningstar US Market Index rose 2.69%.

- The best-performing sectors were technology, up 5.01%, and consumer cyclical, up 3.48%.

- The worst-performing sector was basic materials, up 0.30%.

- Yields on 10-year US Treasury notes rose to 4.67% from 4.62%.

- West Texas Intermediate crude prices fell 0.14% to $83.67 per barrel.

- Of the 704 US-listed companies covered by Morningstar, 475, or 68%, were up, four were unchanged, and 225, or 32%, were down.

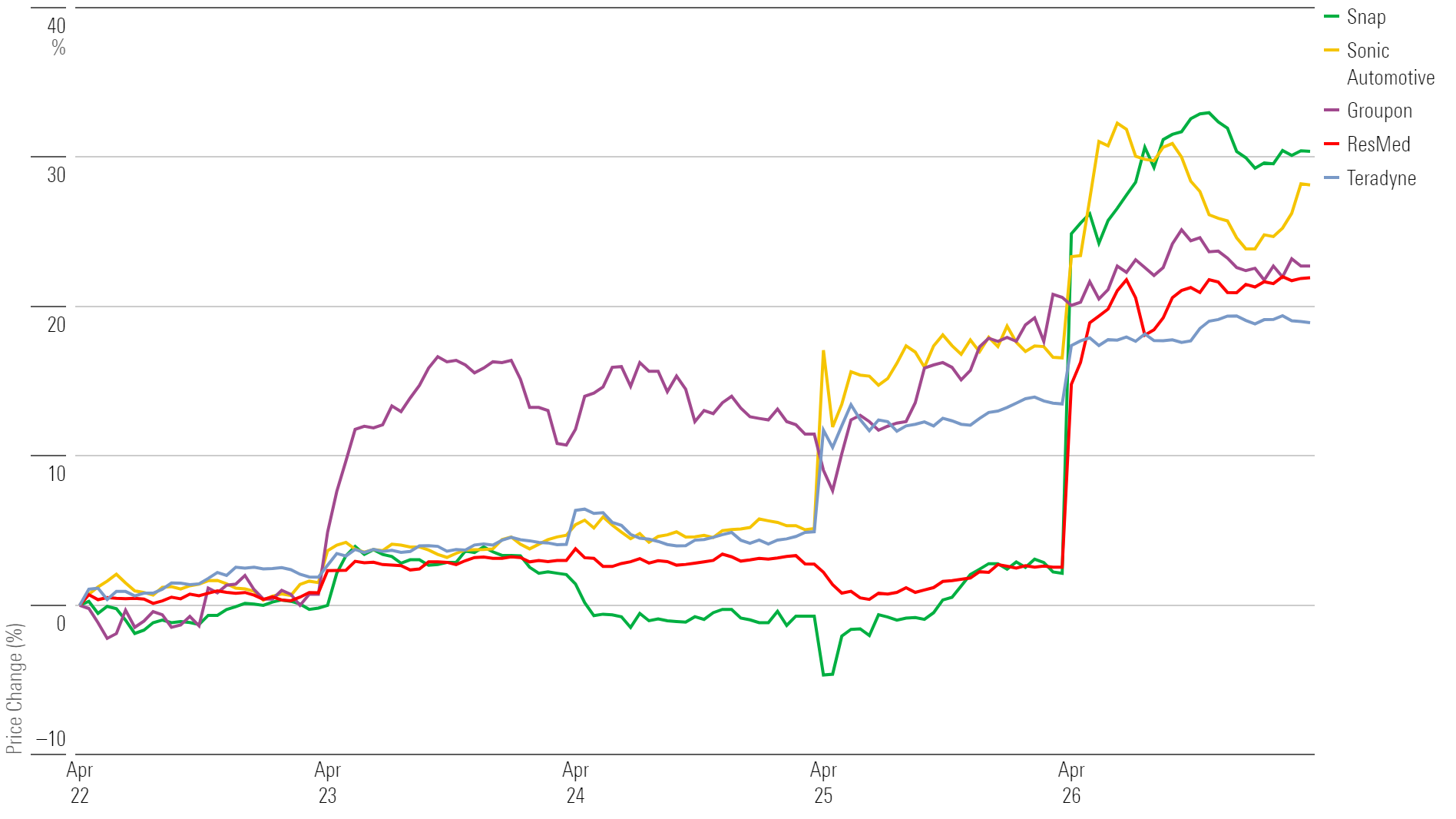

What Stocks Are Up?

Snap SNAP, Sonic Automotive SAH, Groupon GRPN, ResMed RMD, and Teradyne TER.

Best-Performing Stocks of the Week

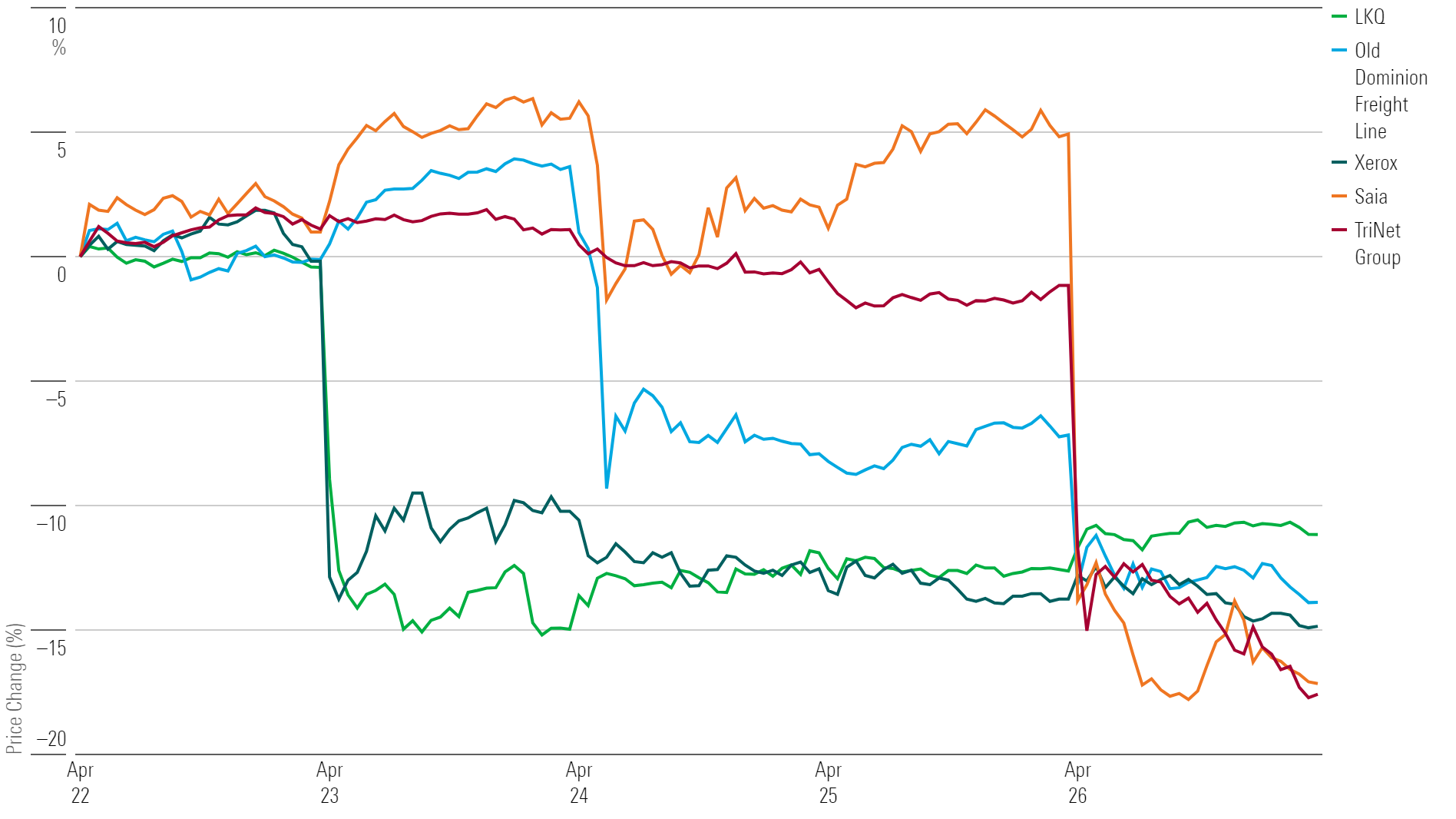

What Stocks Are Down?

TriNet Group TNET, Saia SAIA, Xerox Holdings XRX, Old Dominion Freight Line ODFL, and LKQ LKQ.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JYGMFDSZ6ZCJJKNOD2CMBUGOOM.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_4b82c3dc40354f6f812c5eab796cbf3e_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)