Elections and Markets Are a Mixed Bag

Plus, six other charts on 2024′s second quarter.

Thinking of changing how you invest based on how the November 2024 US presidential election will pan out? Think twice. The data on postelection stock market performance is mixed and gives neither party an obvious advantage. That’s one possible conclusion from Morningstar’s Markets Observer, a quarterly publication that draws on careful research and market insights. Other takeaways: The US market is still getting more concentrated at the top, emerging-markets equities have shown some life, and agency mortgage-backed bonds have looked more attractive to many fixed-income managers. Preston Caldwell, Morningstar’s senior US economist, expects inflation to continue to normalize.

Interested readers can download the full report here. Morningstar Direct and Office clients can also access the report on Direct Compass. A summary of key findings is available below.

US Large-Cap Equities Reign Supreme

US large-cap equities once again led the way in 2024′s second quarter amid continued artificial intelligence optimism and strong earnings results. The Morningstar US Large Cap Index gained 6.1% in the second quarter, beating the Morningstar US Small Cap Index’s 3.6% decline. Outside the US, emerging-markets stocks weren’t far behind, with the Morningstar Emerging Markets Index rising 5.2% as China bounced back and India continued to rally despite local election volatility. Emerging markets’ strong showing propelled it ahead of the Morningstar Developed Markets ex US Index (which lost 0.8% in the quarter) for the trailing 12 months through June, though US stocks remained supreme over that period. Elsewhere, commodities remained up in the past year despite a selloff in June, while US bonds rose marginally.

Trailing 12-Month Performance of Major Asset Classes

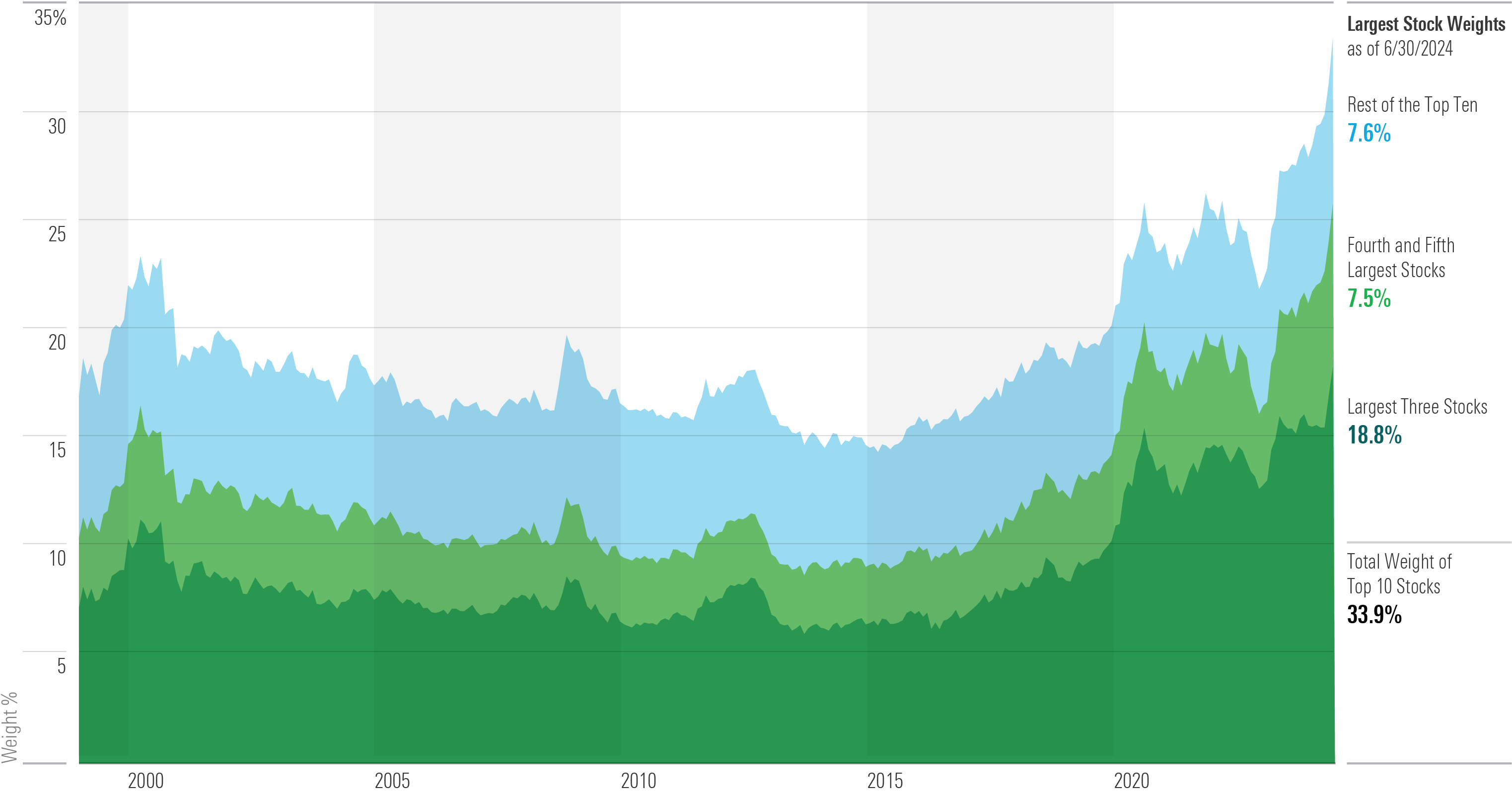

Growing US Market Concentration

The US stock market is the most concentrated it has been in the 21st century when looking at the weight of the 10 largest stocks in the Morningstar US Market Index. As of June 2024, more than half this concentration came from three stocks: Microsoft MSFT, Apple AAPL, and Nvidia NVDA. While concentration has been trending higher for years, it spiked in 2020 and continued to reach new peaks recently amid AI optimism.

Weight of Top Constituents in the Morningstar US Market Index

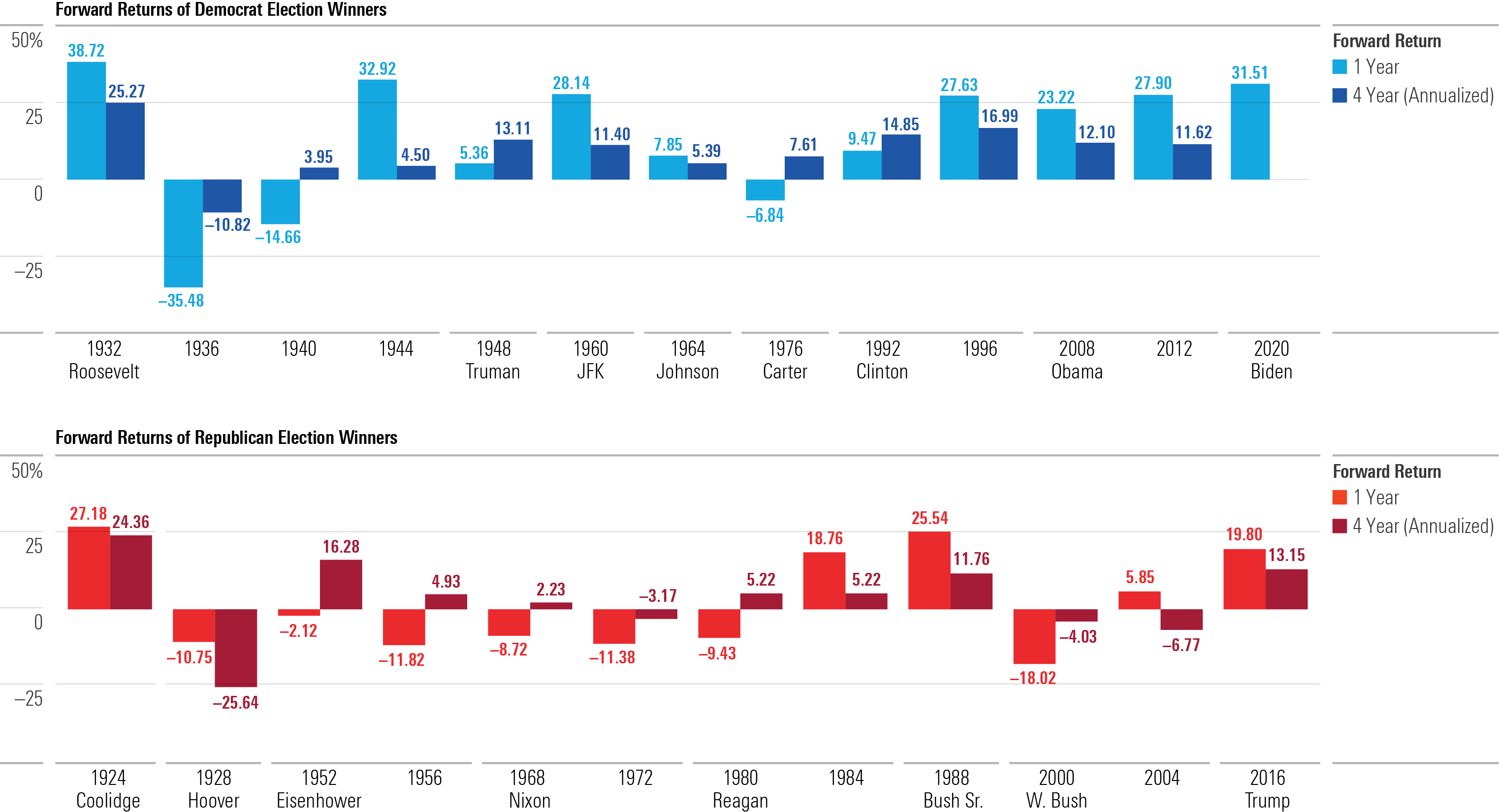

Elections and Markets: A Mixed Bag

We sorted the one-year and four-year returns for the S&P 500 index after Nov. 1 for the last 25 US presidential elections by winning party. Forward one-year returns were positive in 10 of 13 Democratic-won elections, compared with five of 12 Republican-won elections. Over forward four-year periods, returns were positive for Democrats in 11 of 12 instances; for Republicans, it was eight of 12. Since November 2020, when Democrat Joe Biden won, the index was up 16.0% annualized through June 2024 (though he is not included on the below chart since he hasn’t passed the four-year mark).

Forward Returns of Democrat and Republican Election Winners

How to Position Your Investment Portfolio Before the 2024 Election

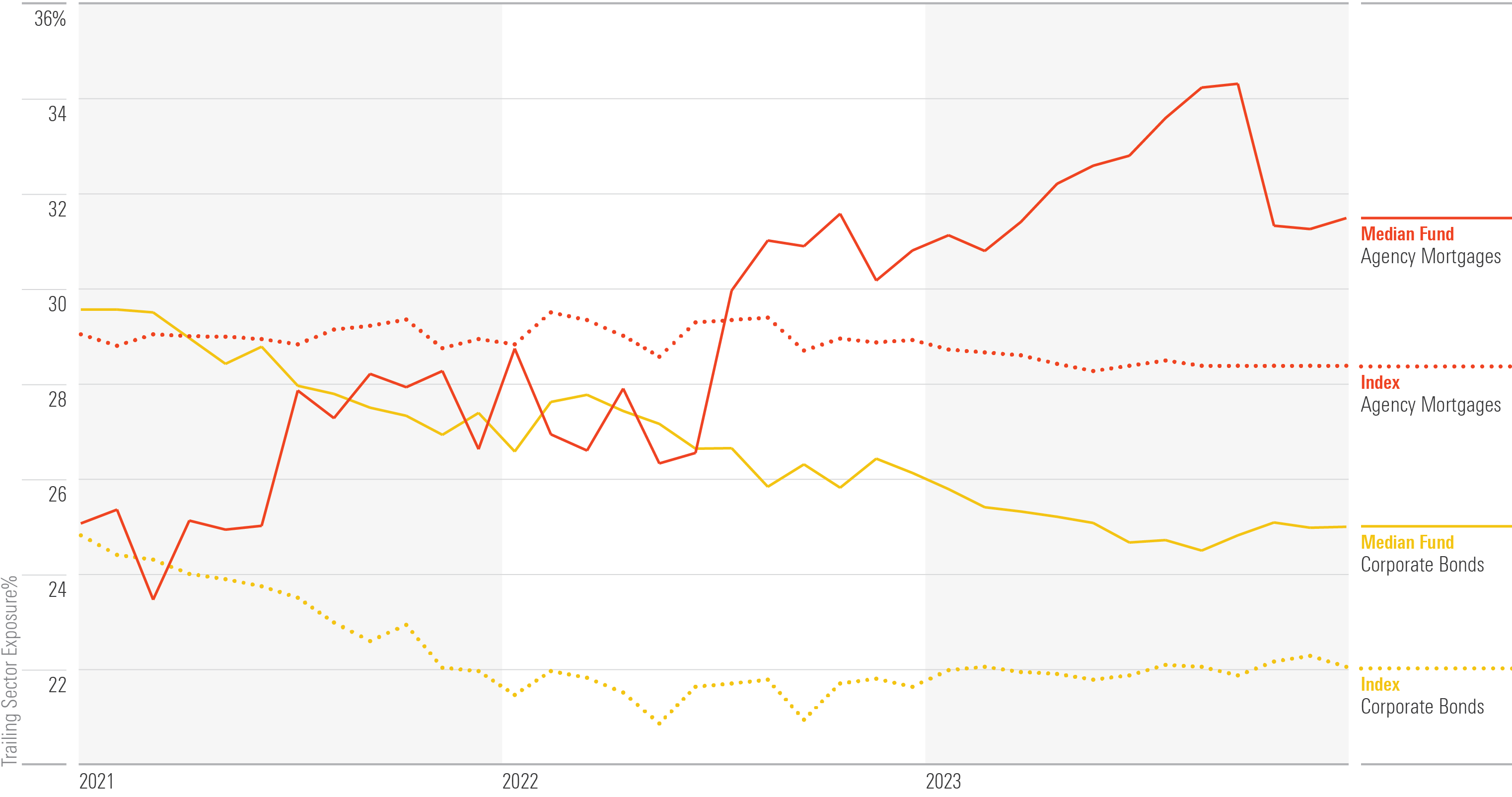

Bond Managers Find Value in Agency Mortgages

While corporate credit spreads remain tight and unattractive, bond market volatility has provided relatively attractive opportunities in high quality, and now high-yielding, agency mortgage-backed securities. These bond prices were crushed in 2022, and many active core-bond managers found opportunities to shift their agency MBS exposure to an overweighting from an underweighting by trimming their corporate bond allocation.

Median Intermediate Core Bond Fund vs. Morningstar US Core Bond Index

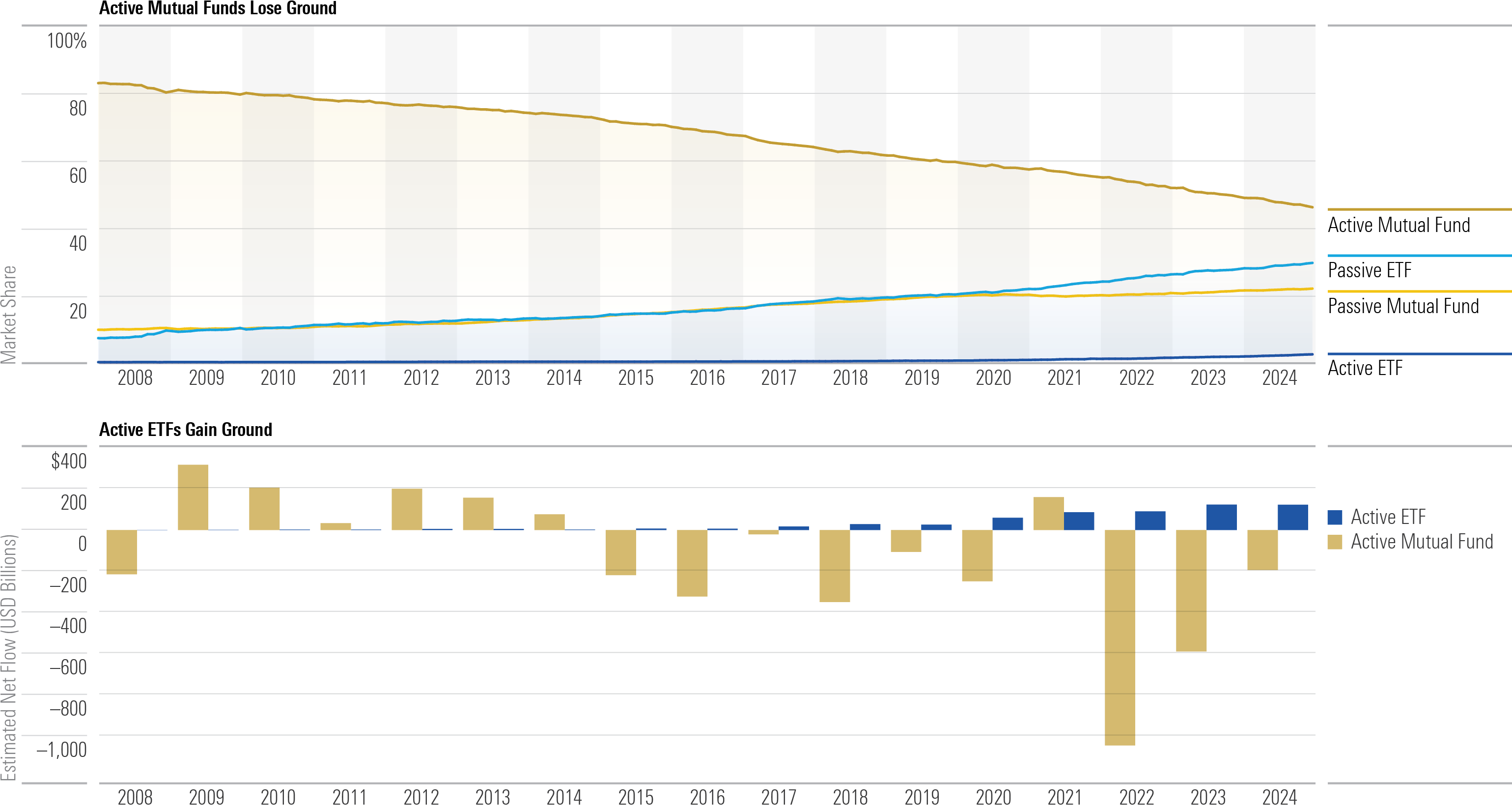

Active ETFs Slowly Gain Ground

Asset managers are launching active exchange-traded funds in droves, and investors are following. Flows into active ETFs have left active mutual funds in the dust. Since 2008, through June 2024, active ETFs collected $569 billion, while active mutual funds lost $2.1 trillion. But active ETFs still have a ways to go because active mutual funds were the dominant choice for decades. Active ETFs account for just 2.3% of all US fund assets through the second quarter of 2024, a far cry from active mutual funds’ 46.2%.

Active ETFs Are Gaining Market Share

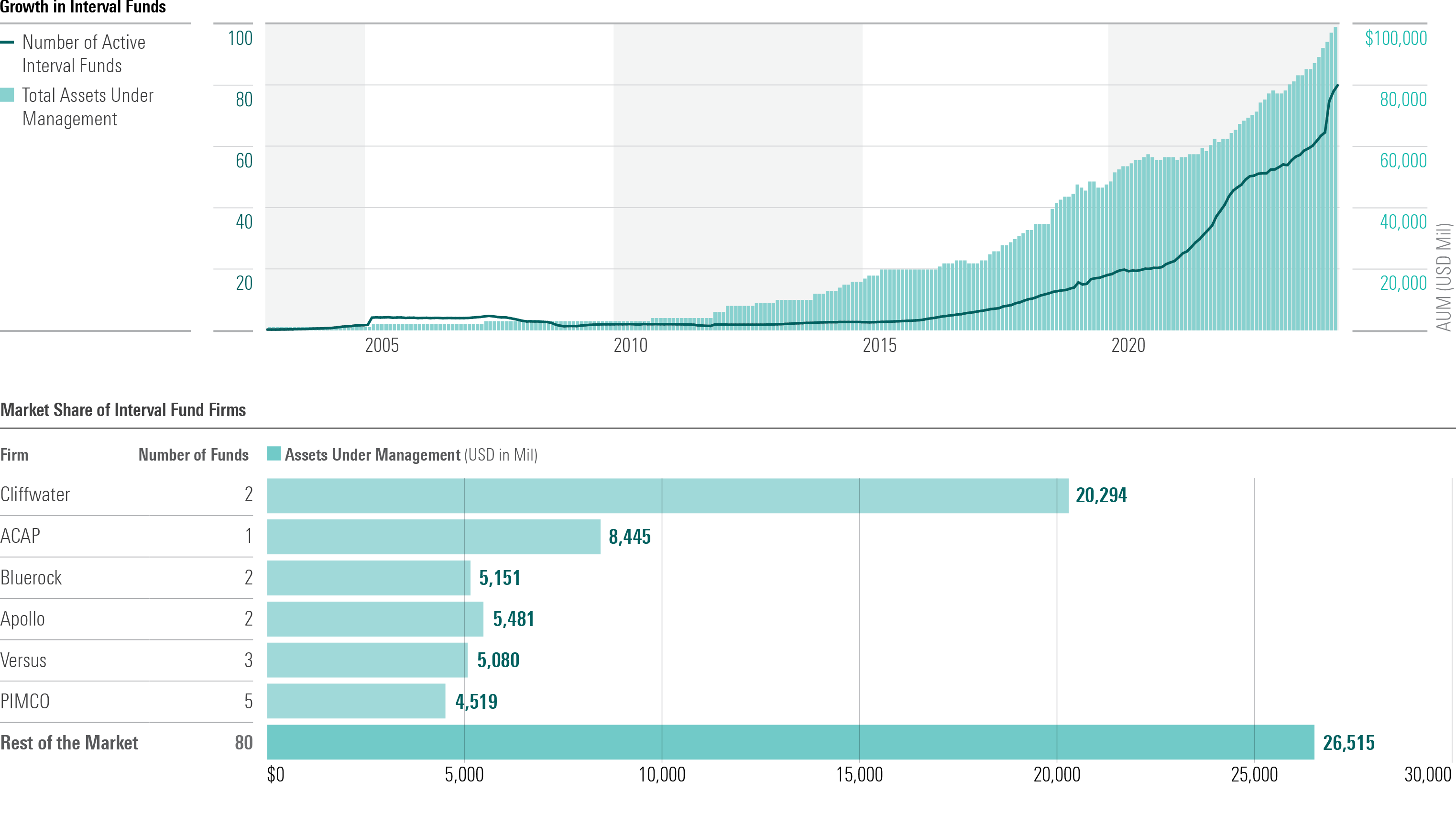

Interval Funds Have Landed

The interval fund market has surged in recent years in response to demand for products that allow regular investors ongoing access to investment strategies that historically were limited to institutional investors. Some of the world’s largest active managers have entered the market, but the market is skewed toward its biggest players and still accounts for only a small percentage of pooled investment vehicle assets. For more information on interval funds, see Morningstar’s June 2024 essential guide to interval funds.

The Interval Fund Market Is Surging

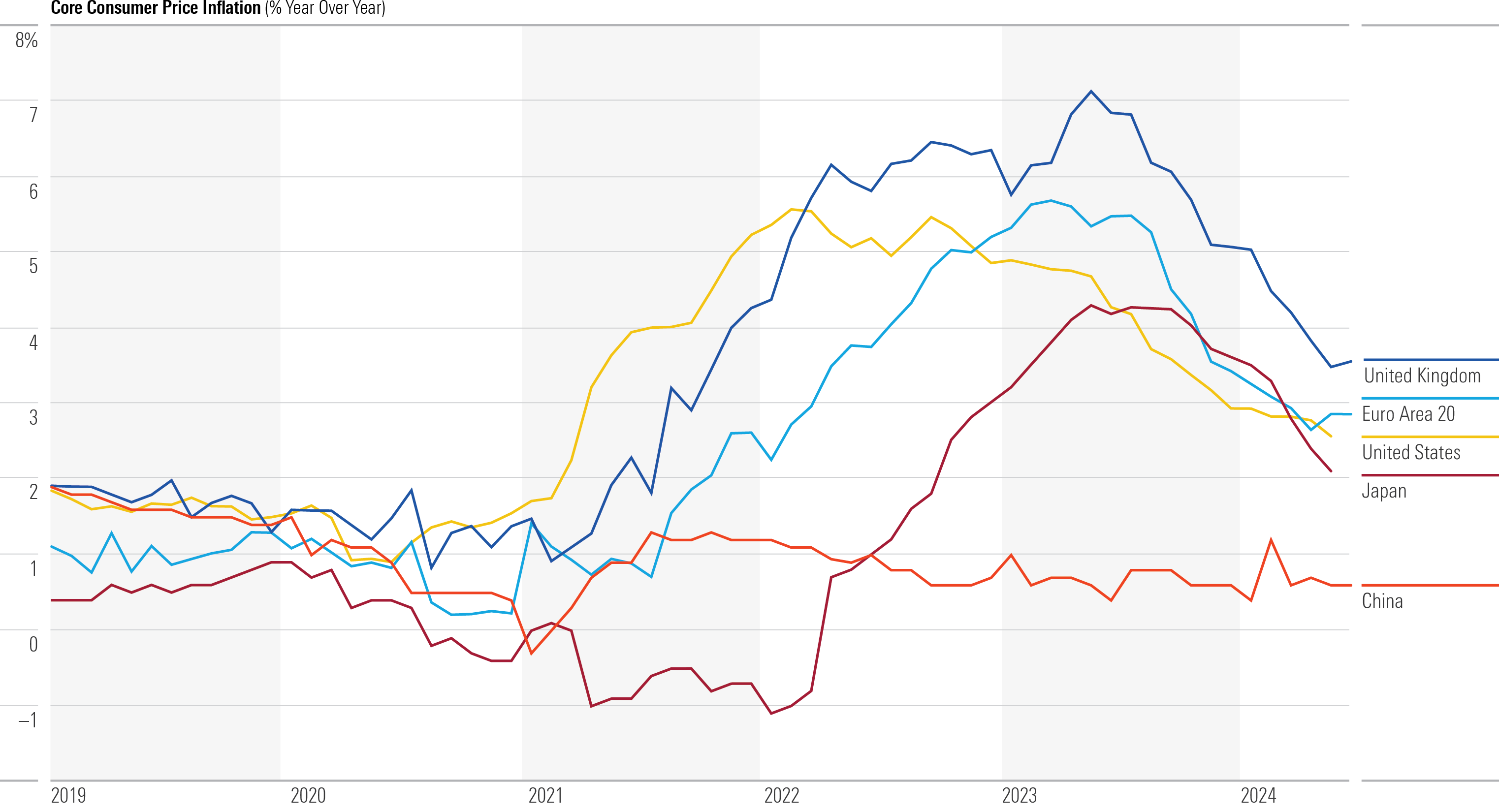

Inflation Marching Back to Normal

Core inflation peaked for most major economies in 2022 or early 2023 but has trended down in the year through June 2024. It’s too early to declare victory, says Preston Caldwell, Morningstar’s senior US economist, with core inflation still above central banks’ 2% targets and progress having slowed somewhat in 2024. Still, Caldwell expects inflation to normalize as supply disruptions are resolved and demand cools off. China could also transmit its low inflation to the rest of the world via expanded exports, but this could run afoul of protectionist backlash.

Inflation Rates Are Normalizing Across the World

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UUSODIGU4REULCOR35PTDS7HW4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HBAEAVIJHFEBTPMEK2UMVQ3NFQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/aa946852-e4a7-438e-a67b-ded2358a0f40.jpg)