5 Undervalued Chinese Stocks With Moats

With worries about China’s economy dragging its market down, these high-quality stocks are trading at a discount.

China’s stock market has taken a hit on fears around the country’s sluggish economy and troubles in its property market. On the bright side for long-term investors, a handful of high-quality Chinese stocks are now deeply undervalued, including tech and e-commerce giant Alibaba BABA and entertainment and social media conglomerate Tencent TCEHY.

To look for undervalued stocks, we turned to the Morningstar China Index, which tracks the total performance of China’s equity markets, covering the top 97% of stocks by market capitalization. The index lost 8.95% for the trailing 12-month period as of Aug. 22, while U.S. stocks gained 5.21% as measured by the Morningstar US Market Index. For the calendar year 2023, the US Market Index has risen 16.35% while the China Index has lost 7.69%.

China Stock Market Performance

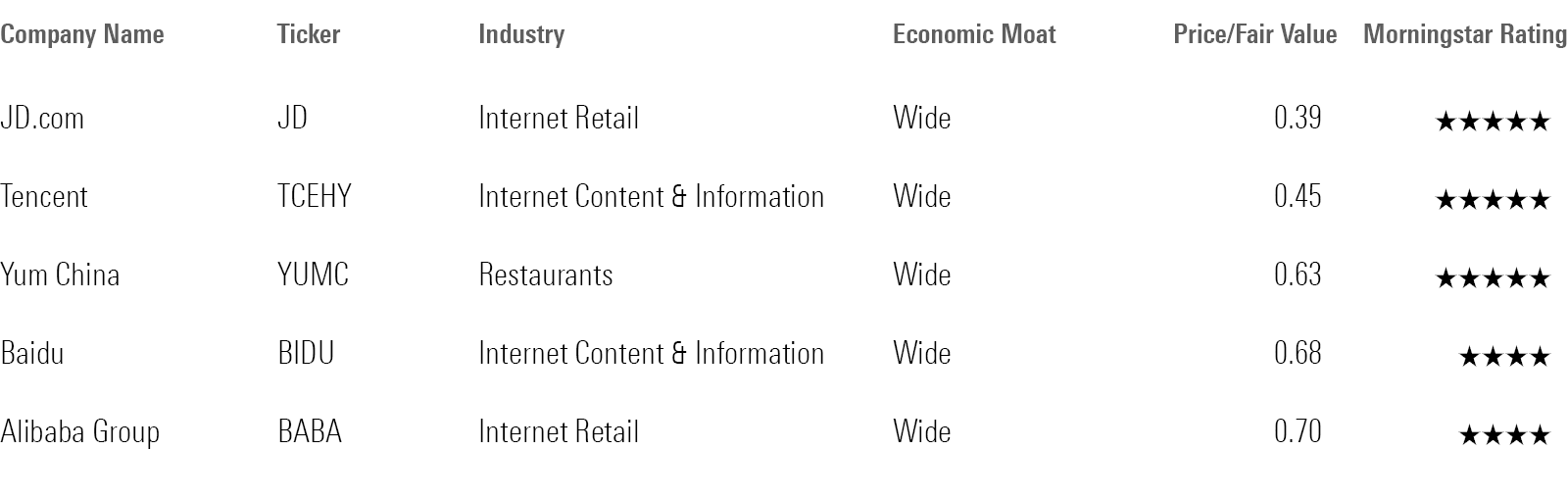

5 Undervalued High-Quality Chinese Stocks

We looked for the most undervalued stocks in the China Index by screening for those with a Morningstar Rating of 4 or 5 stars. We also looked for stocks with wide economic moats, meaning they have durable competitive advantages that are expected to last at least 20 years. Historically, stocks with moats and low valuations tend to outperform over the long term.

Of the 1,426 stocks in this index, these were the most undervalued wide-moat names as of Aug. 22, 2023:

The most undervalued stock is JD, trading at almost a 61% discount to its analyst-assessed fair value estimate. The least undervalued is Alibaba, trading at a 30% discount. The stocks are based in China, but U.S. investors can buy them as American depositary receipts, or ADRs.

Undervalued Chinese Stocks

JD.com

- Fair Value Estimate: $88.00

“JD.com offers authentic products from its online first-party business with a speedy and high-quality delivery service. It adopts an asset-heavy model with self-owned inventory and largely self-built logistics, complemented by an asset-light third-party model. By comparison, competitor Alibaba relies mostly on a third-party model.

“Underperforming Pinduoduo and Douyin, JD’s GMV/online retail sales of goods have decreased from 30.7% in 2021 to 29.2% in 2022. To reinvigorate growth, the firm wants to change customers’ mindshare of JD as an everyday low-price platform. To this end, it has launched a CNY 10 billion subsidy program to attract price-sensitive customers. It is removing sales of nonstrategic low-margin products from the first-party business and is allowing third-party merchants and business partners to provide these products instead. JD is also streamlining its organization to increase its ability to respond to quickly changing market dynamics.

“We think JD has a wide moat based on an intangible asset of high reliability and assurance (on-hand inventory, quality, fast proprietary logistics services) and a cost advantage resulting from its growing economies of scale in its first-party business. We believe the website and JD Logistics create synergies, and that a moat cannot be assessed by segment. Adjusted return on invested capital reached 9.9% in 2019 and 15.6% in 2020, but reverted to 4.5% in 2021 due to investments in new businesses. ROIC has tipped back up to 15.3% in 2022 amid cost-cutting, and we expect it to reach 26% by 2027, supporting our wide moat rating.

“JD’s intangible asset is derived from its fast, efficient, and high-quality proprietary logistics services. To a lesser extent, the company is known for higher assurance of authentic products on its first-party platform in a country where knocks-off are easy to find.”

—Chelsey Tam, analyst

Tencent Holdings

- Fair Value Estimate: $90.00

“Over the past decade, Tencent has capitalized on the industry shift toward mobile gaming. The firm owns some of the world’s most popular titles, like Honor of Kings and PUBG Mobile. To date, games remain Tencent’s primary monetization model; we estimate more than 40% of its operating income comes from this segment. Tencent should continue to leverage its unrivaled access to user data and financial capital to create innovative, high-quality, and long-cycle games with a mobile-first approach.

“Other key businesses include WeChat, QQ, WePay, music streaming, on-demand cloud, and a host of other ventures. We see a tremendous amount of untapped value in WeChat, as it continues to increase monetization through advertising and acts as a major gateway for other internet services (payment, delivery, insurance, and so on) that are looking to access its 1.2 billion-plus users.

“Tencent’s wide moat is primarily based on network effects around its massive user base. We also believe the firm possesses secondary moat sources like intangible assets, a cost advantage, and switching costs. Given Tencent’s ability to profitably monetize its network via games, music, advertising, fintech, and other services, we think it is more likely than not that the business will generate excess returns on capital over the next 20 years.”

—Ivan Su, analyst

Yum China Holdings

- Fair Value Estimate: $84.00

“The COVID-19 pandemic provided Yum China the opportunity to accelerate store openings at more favorable lease terms. The company added more than 3,700 locations from 2020 to 2022—a 36% increase from 2019. Now that China’s zero-COVID policy is in the rearview mirror, we expect these new restaurants to not only deliver significant incremental revenue but also be accretive to the firm’s overall margins.

“Over the next several years, we expect Yum China to speed up new unit openings. We share management’s view that there remain plenty of expansion opportunities in lower-tier cities in China—evidenced by the nearly 1,200 cities that still have no KFC presence.

“Our wide moat rating is predicated on Yum China’s intangible assets—a well-known brand name, consistent menu innovations, and digital capabilities—as well as cost advantages stemming from its buying scale and sourcing through its industry-leading supply chain infrastructure. Historical adjusted returns on invested capital (including goodwill) support this thesis, averaging 36% over the past six years, noticeably outpacing our 8.8% cost of capital estimate. Additionally, we forecast the company’s average annual adjusted ROICs will exceed its weighted average cost of capital over the next 20 years. "

—Ivan Su

Baidu

- Fair Value Estimate: $183.00

“Baidu’s online advertising business accounted for 73% of core revenue in 2022 and will also be the main source of revenue in the medium term, given the firm’s dominant market share for search engines. However, we believe that unless it can develop another industry-leading business, Baidu could face long-term challenges for advertising dollars from growing competitors such as Tencent and ByteDance.

“Baidu is increasingly shifting its focus toward its cloud business and artificial intelligence, with its Ernie generative AI model becoming its flagship product. We believe the company is an early mover and should benefit from China’s AI development, but whether Ernie will be the long-term leader will depend on execution, as we believe other resource-heavy companies could potentially catch up if Baidu missteps.

“Baidu’s wide economic moat is created by its network effect stemming from a dominant share of the user base, as well as intangible assets stemming from years of research and development. As one of the earliest internet companies in China, Baidu has built an ecosystem around search, and it successfully shifted to mobile internet by releasing various well-received apps, such as its flagship Baidu app, which had 580 million monthly active users as of the second quarter of 2021. According to web analytics firm Statcounter, Baidu’s market share as of September 2021 was 82.5%, compared with the 7.6% held by its closest Chinese competitor, Sogou.”

—Kai Wang, analyst

Alibaba Group

- Fair Value Estimate: $128.00

“Alibaba is a Big Data-centric conglomerate, with transaction data from its marketplaces and logistics businesses allowing it to move into omnichannel retail, cloud computing, media and entertainment, and online-to-offline services. We think a strong network effect allows leading e-commerce players to extend into other growth avenues, and nowhere is that more evident than with Alibaba.

“Despite increasing competition, we’re maintaining Alibaba’s wide economic moat rating based on its strong network effect, whereby the value of the platform to consumers increases with a greater number of sellers, and vice-versa.

“Alibaba is monetizing its network effect better than any other e-commerce platform in China. None of its new competitors—mainly third-party e-commerce platform Pinduoduo and short video platforms Douyin and Kuaishou—have proved they can monetize the physical goods e-commerce market with a durable profit margin. Meanwhile, Alibaba has been profitable for a decade, and we believe it will remain profitable for the next 20 years.”

—Chelsey Tam

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MMHQLYAKXBAGNG7XEYXPX4Y4S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)