Large-Growth Funds Dominate ... Again

Funds benefited from owning tech stocks like Nvidia in Q2 2024.

In a period when Nvidia NVDA briefly became the most valuable publicly traded US company, large-cap growth funds stood out in 2024′s second quarter. The typical large-growth Morningstar Category fund rose 4.9%. Aside from large-blend funds, the seven other Morningstar Style Box categories posted declines over the period.

It’s a story that’s been familiar in recent years. Growth funds tended to outperform their value counterparts while large-cap funds held up relatively better than their small-cap peers. Small-value funds had the toughest slog, falling 4.0% over the quarter.

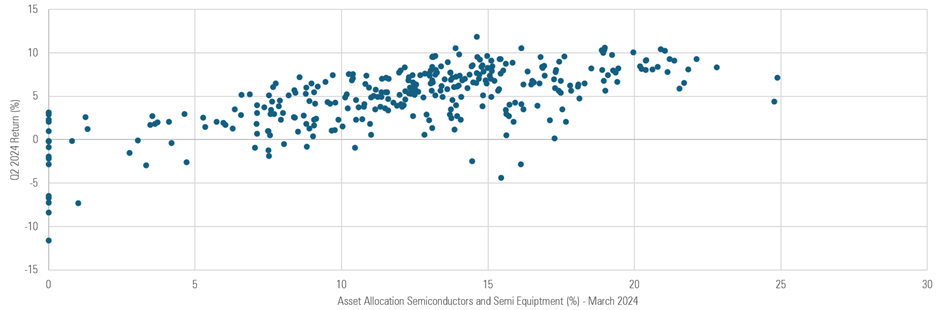

Semiconductor stocks continued their dominance throughout the quarter and were key drivers of large-growth funds’ outperformance. Nvidia and Broadcom AVGO gained 22% and 37%, respectively. As such, funds with a greater allocation to semiconductor stocks had a clear advantage over peers that owned less of them.

Large-Growth Funds' Allocation to Semiconductors and Semi Equipment Versus Q2 2024 Returns

Two Alger funds were among the biggest beneficiaries of the Nvidia boom. Alger Capital Appreciation ACAAX and Alger Spectra SPECX had 10.7% and 10.9% of assets stashed in the semiconductor giant as of March 2024. Both funds went on to beat more than 95% of their large-growth category peers in the second quarter. The returns of Fidelity OTC FOCPX also ranked in the category’s top decile during the quarter thanks to its hefty allocation to Nvidia and other mega-cap firms such as Microsoft MSFT (11.9% of April 2024 assets) and Apple AAPL (9.9%).

Large-growth funds that missed out on Nvidia tended to underperform their peers. Morgan Stanley Institutional Advantage MPAIX didn’t own Nvidia at all over the period and had a combined 18% allocation to DoorDash DASH and Cloudflare NET at the end of March 2024; both stocks declined more than 14% over the ensuing quarter. The fund’s 8.4% decline ranked among the category’s worst showings. Transamerica Capital Growth IALAX and Ave Maria Growth AVEGX also sidestepped Nvidia and finished in the cohort’s bottom decile.

While most mid- and small-cap funds declined in 2024′s second quarter, a few eked out gains. Primecap Odyssey Aggressive Growth’s POAGX 1.1% return beat 94% of its mid-growth peers. Despite its mid-cap focus, the portfolio owned Nvidia at a 1.6% weighting at the end of March 2024 and had 6.4% of its assets stashed in the GLP-1 drugmaker Eli Lilly LLY, another large-cap stock. Other mid- and small-cap funds, such as Federated Hermes Kaufmann KAUFX and Lord Abbett Developing Growth LAGWX, finished in the top quintile in their respective categories. Both portfolios owned Wingstop WING, which gained 15% this quarter.

Meanwhile, small-value funds suffered the most, partly because of their exposure to regional banks and healthcare stocks. Fidelity Small Cap Value FCPVX, for instance, fell 6.5% this quarter largely because of a 50% decline in its top holding, medical supply distributor Owens & Minor OMI. Though much smaller portions of the portfolio, biotech holdings Zentalis Pharmaceuticals ZNTL and ALX Oncology Holdings ALXO also fell 50% over the period. Meanwhile, both Ariel Appreciation CAAPX and Ariel Fund ARGFX finished in the bottom quintile in the mid-value category. Both funds owned beaten-down stocks Sphere Entertainment SPHR and Madison Square Garden Entertainment MSGE.

International Stocks

Emerging-markets stocks outpaced their developed-markets peers in 2024′s second quarter. The Morningstar Emerging Markets Index’s 5.1% gain easily beat the Morningstar Developed Markets ex-US Index’s 0.6% decline.

Unlike in the US, international value funds tended to fare better than their growth counterparts, and large-cap stocks weren’t the runaway winners. The foreign small/mid-value category’s 0.3% average gain, for example, was slightly better than the foreign large-blend category’s 0.1% gain.

India equities were among the quarter’s best performers, despite shocks around India’s election results. The Morningstar India Index’s 11.8% gain was a standout among emerging-markets countries and, as such, funds with more exposure to it tended to do well. Meanwhile, Chinese equities rebounded nicely after a disappointing stretch. The Morningstar China Index gained 6.3% over the quarter after dropping 10.4% in 2023 and 20.5% in 2022.

Davis International’s DILAX 4.9% gain topped nearly all its foreign large-blend category peers. Its January 2024 portfolio held stocks such as Coupang CPNG, Meituan, and Metro Bank Holdings MTRO, which all gained more than 10% over 2024′s second quarter. Thornburg International Equity’s TGVAX 3.1% gain also landed it in the category’s top decile. Its April 2024 portfolio had 1.4% of its assets stashed in Nvidia and 2.8% allocated to Taiwan Semiconductor TSM, both of which boosted relative performance.

Foreign small/mid-growth funds did not hold up nearly as well as their value-leaning counterparts. Invesco International Small-Mid Company’s OSMAX 5.4% decline in 2024′s second quarter was among the worst in its category. Longtime holdings such as Carl Zeiss Meditec AFX, Nice NICE, and Bruker BRKR each fell more than 30% over the quarter. Artisan International Small-Mid ARTJX, which also owned Nice, fell 3.7% in the quarter, finishing in the category’s bottom decile.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5IGQZ5PHNZAIROE5WHJLOTZ35Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VPCBITMQP5FKLIZ32POIXOV3MQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)