4 Stocks That Benefit From Interest-Free Sources of Capital

As interest rates remain high, companies with prepaid funds are particularly well positioned.

If you’re a regular reader of Warren Buffett’s annual letter to Berkshire Hathaway BRK.B shareholders, you’ve seen reference to the company’s “float,” his term for the essentially free capital that the insurance operations gather by collecting insurance premiums up front and paying claims later.

Companies with this “collect now, pay later” business model can invest their float, and they particularly benefit when interest rates are high. But as Buffett often also points out, only those firms that can pair this capital with strong underlying businesses and predictable future revenue and costs can be expected to generate significant returns over the long term.

In the current lofty interest-rate environment, it’s natural then to screen for reasonably priced insurance stocks with narrow or wide Morningstar Economic Moat Ratings, which enjoy durable competitive advantages. And indeed, several stocks look attractive at present prices, more on that below.

But digging deeper can highlight firms with float opportunities that may be overlooked. This includes an insurance company with a unique way to take advantage of its prepaid funds—Zurich Insurance Group, as well as three stocks outside of insurance: Paycom PAYC, Computershare, and (perhaps surprisingly) Starbucks SBUX.

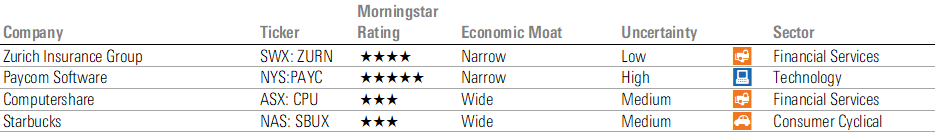

These 4 Stocks Benefit From Interest-Free Float Capital

The potential value of these four companies’ float may not be immediately obvious but can present an important part of the investment thesis. And with two trading at steep discounts to Morningstar equity analysts’ assessments of their fair values, and two trading in line, it’s worth examining further.

An Insurance Stock With a Unique Asset

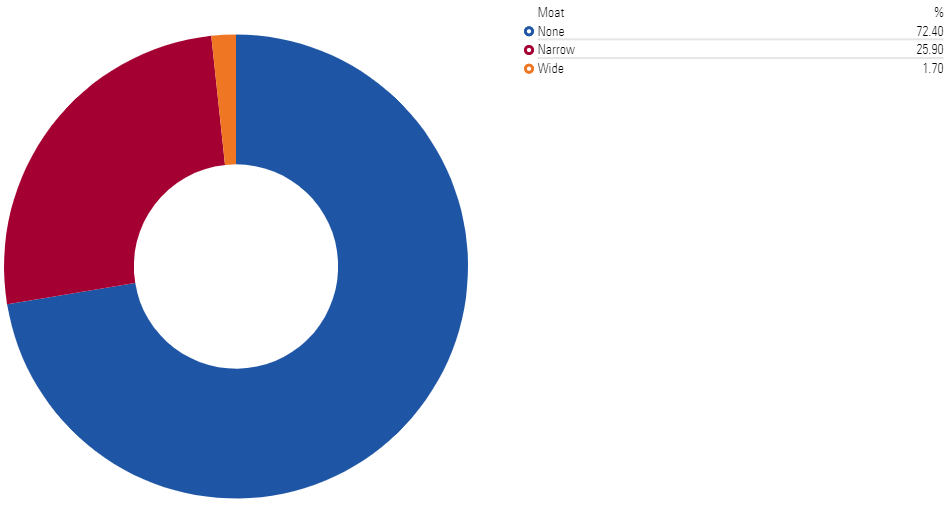

Not all insurance companies are created equal. Among insurance stocks covered by Morningstar analysts, only Berkshire has carved a wide moat, while the vast majority are assigned a no-moat rating.

Most Insurance Companies Covered by Morningstar Don't Have a Moat

But within this list are 15 narrow-moat stocks, and among these, five are currently assigned either 4- or 5-star Morningstar Ratings, including Travelers Companies TRV in the United States, Admiral Group in the United Kingdom, and AUB Group and PSC Insurance in Australia.

Zurich Insurance Group is the final one of these undervalued narrow-moat insurance names. But unlike the others on the screen, Zurich offers a unique way to generate a return on its float.

The crux is Zurich’s arrangement with Farmers Insurance. The Farmers business is a uniquely crafted model, in which policyholders (rather than the insurance company) own the float associated with their policies under a business called Farmers Exchanges. The Farmers Exchanges then contract with Farmers Management Services, which is owned by Zurich, for nonclaims services, such as document administration, invoicing, and portfolio management. For this service, Zurich collects a management fee, which is targeted to be about 7% after expenses.

The result is an earnings stream that is capital-light, high-margin, and less interest-rate sensitive than typical insurance providers. And importantly, this agreement has been in place since the Farmers Exchanges were formed in the 1920s. Unwinding it would take significant effort, making it highly unlikely in the view of Morningstar’s equity analysts.

Farmers Management Services contributed about 30% of Zurich’s operating profit in fiscal 2022, while the Farmers Exchanges have continued to expand at a single-digit rate through the first nine months of fiscal 2023. Zurich’s stock trades in 4-star territory, suggesting a decent margin of safety for long-term investors.

Finding Interest-Free Capital in Noninsurance Names

Beyond insurance companies, there are three other companies to highlight that benefit from a sizable amount of float.

Paycom

As a payroll processor, this narrow-moat company collects client funds and earns interest income on tax withholdings before remitting payments to tax authorities. Morningstar equity analysts estimate the income generated on these funds will be about 17% of earnings before taxes in 2023.

Our analysts also believe Paycom has carved a narrow economic moat. Like other payroll peers, the company benefits from high customer switching costs. Human capital management software is typically deeply embedded in a business’ operations, making it a costly and time-intensive process to switch providers.

Although the company is currently facing challenges related to transitioning remaining clients to its flagship self-service payroll solution and revenue cannibalization woes, Paycom is nonetheless well placed to take further market share as it capitalizes on competitors’ shortfalls. With the stock currently trading at 5 stars, there appears to be a sizable margin of safety to account for these near-term risks.

Computershare

This leading share-registry provider is based in Australia but enjoys a global customer base. It temporarily holds money for clients related to dividend and takeover payments, buyback funds to be disbursed, IPO proceeds, and capital raisings. Like other companies with sizable float, Computershare can generate investment income from these balances.

While this business is more interest-rate-sensitive than Zurich Insurance, Morningstar’s equity analysts note that its customers and float are relatively sticky, meaning the increasing interest income is less at risk of being competed away compared with the income on the free float from insurers. This interest income is also material; it accounted for approximately two thirds of earnings before interest, taxes, depreciation, and amortization in fiscal 2023.

Computershare currently trades in 3-star territory, in line with its fair value estimate, but it is worth keeping on your watch list.

Starbucks

It’s perhaps surprising to see this wide-moat global coffee chain in this group, but Starbucks benefits from a novel source of interest-free capital: gift card balances, including customer funds that sit in its mobile app. At the end of October 2023, this balance was north of $1.5 billion. Because customers cannot redeem this balance for cash—only for future coffee or other Starbucks purchases—Starbucks is free to invest this.

Admittedly, Starbucks’s future prospects are aligned more heavily with the growth of its coffee sales than the income generated from gift card balances. While not directly reported, the interest from its float likely contributes less than 1% of total net income. But the funds essentially serve as an interest-free loan to the company by its customers. The float represented about 9% of total debt (including the funds) in fiscal 2023, and in reality, the cost is probably less than zero given a portion of the balance is assumed every year to never be redeemed (this equated to about 1.5% of card activations and reloads in fiscal 2022).

Starbucks shares currently trade in 3-star territory and are also worth keeping on your watch list.

Final Thoughts

If interest rates remain higher than historical levels, companies that gather substantial amounts of prepaid revenue, funds held for clients, or money tied up in gift card balances should benefit. But only firms with durable competitive positions can be expected to maximize this value over the long run, given their predictable revenue streams, stable cost structures, and sticky customers. For these firms, this capital is often “cheaper than free,” and when paired with reasonable valuations, these stocks offer potential opportunities for float-seeking investors outside of the typical insurance path.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)