How to Find Tax-Efficient Morningstar Medalist Funds

These tax efficiency data points can help narrow your search.

Taxes, like all investment costs, eat at returns. As a result, choosing a fund with a lower tax burden will help you keep more of what you earn.

Morningstar Medalist funds have good odds of beating their peers and benchmarks on a risk-adjusted basis over the long term. Screening them for tax efficiency further improves their chances of delivering strong aftertax results, too.

Here's how to find tax-efficient medalist funds by using tax efficiency data points in Morningstar Direct.

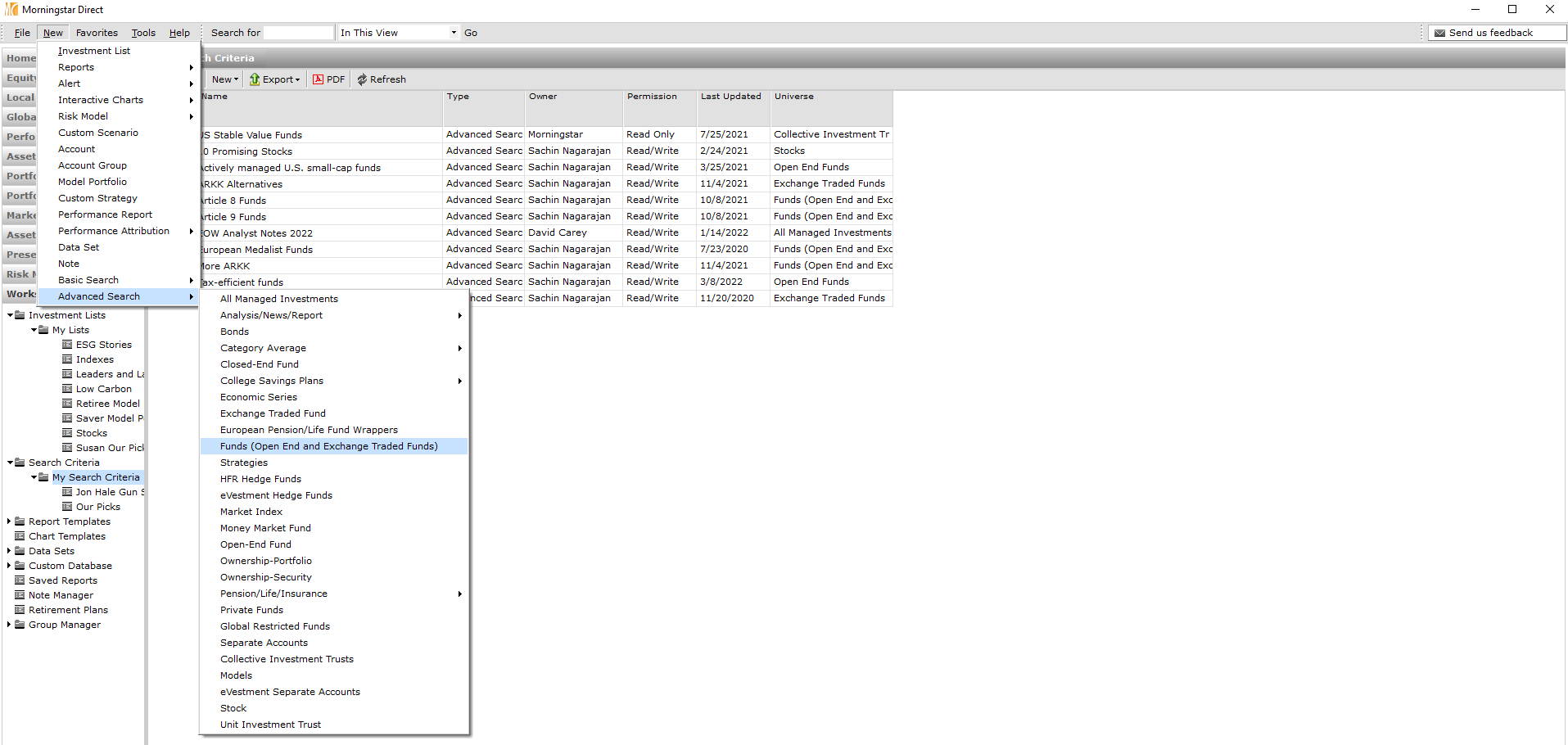

1) Create a New Advanced Search On the Direct home screen, click New in the top left corner. Select Advanced Search. From there, you can choose funds (open-end and exchange-traded funds). This lets you compare traditional mutual funds with more tax-efficient ETFs.

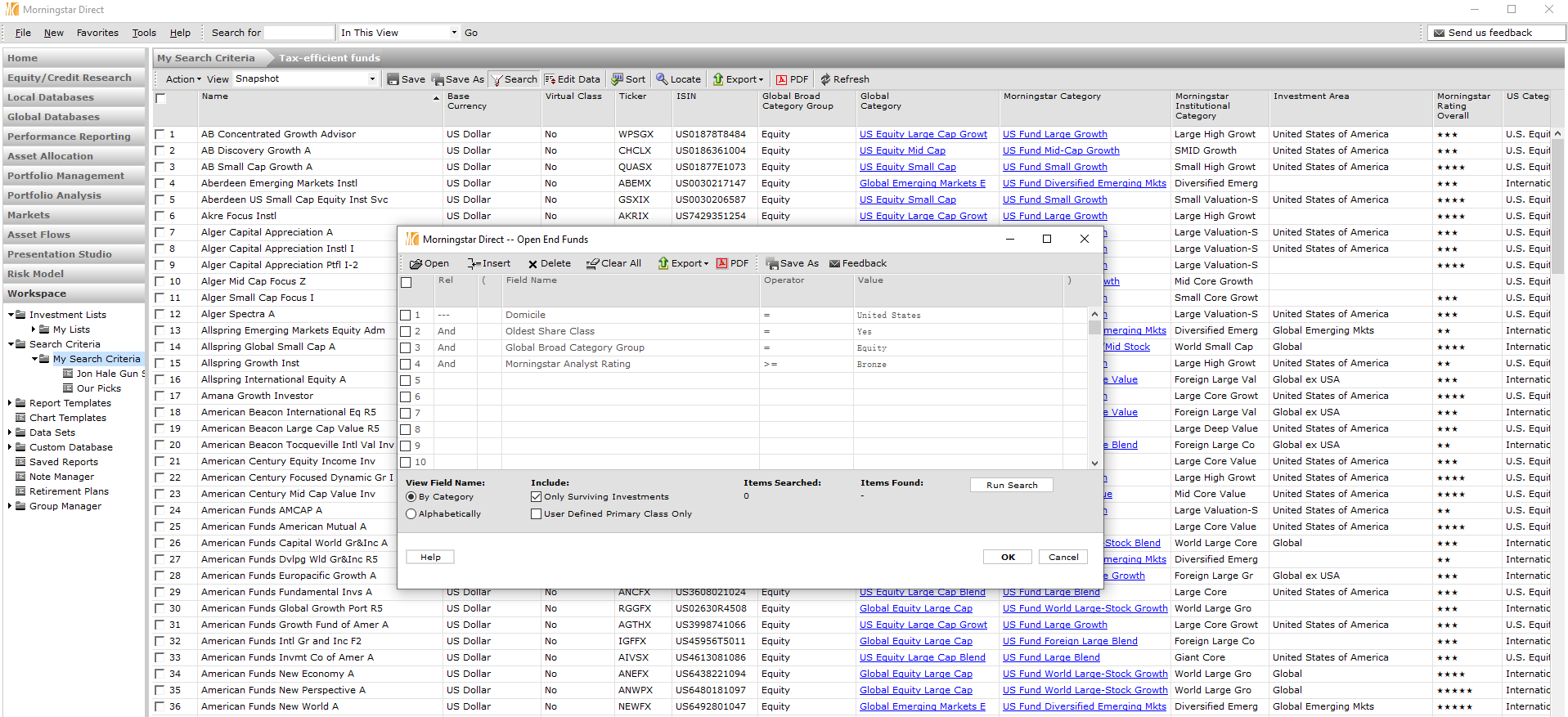

2) Select Search Criteria In the new pop-up, select Click Here to start a new search. Choose Domicile as your first criterion and make the value United States. This looks for only U.S.-domiciled funds.

Next, select Oldest Share Class, and make the value Yes. This narrows your search so you're not overwhelmed with multiple share classes of the same investment strategy.

Then, select an asset class. For example, if you're looking for equity funds, you can make the next criterion Global Broad Category Group and select Equity.

To include medalist funds in your search, add Morningstar Analyst Rating, make the operator greater than or equal to, and select Bronze. Click Run Search, then OK. You'll see about 630 results.

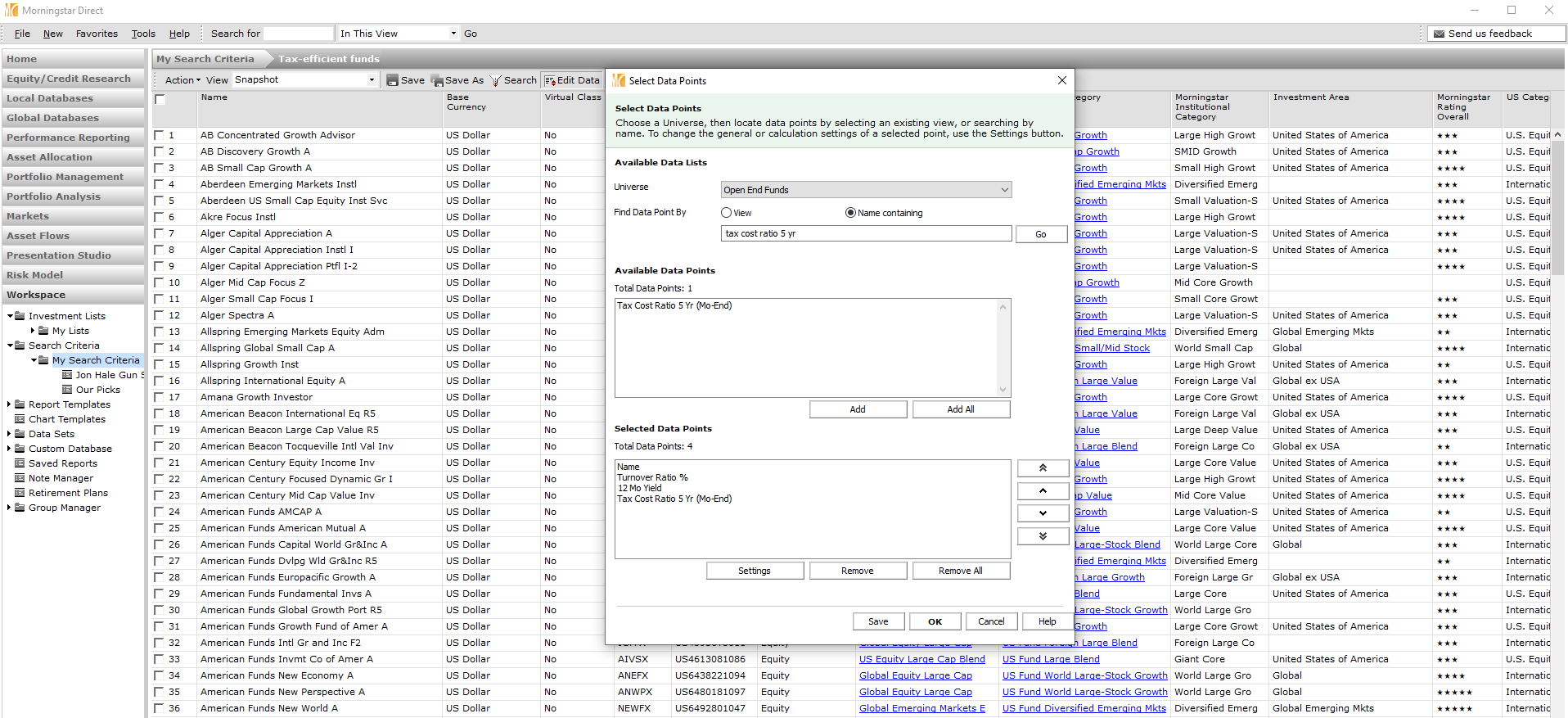

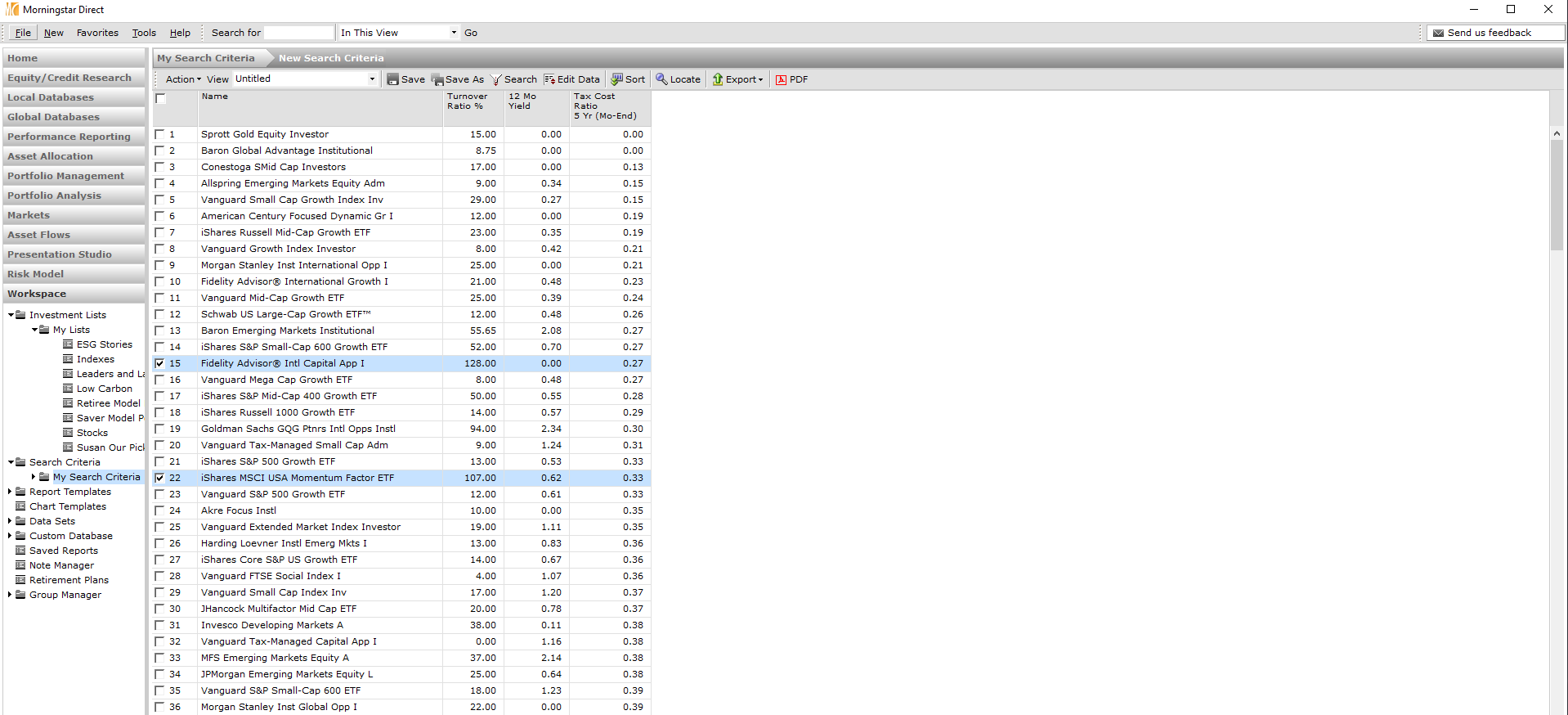

3) Edit the Data Set There are many data points that help gauge funds' tax efficiency. For this article, we'll start with portfolio turnover, 12-month yield, and tax-cost ratio.

To add these data points, click the Edit Data button in the top toolbar. In the new pop-up, click Remove All under the Selected Data Points. From there, click the Name Containing button at the top to type in a new data point.

Search for Turnover Ratio %. You'll see five results, including two identical data points for turnover ratio %. Of these two, add the second one, which covers the most recently reported period. The first is a historical time series. Portfolio turnover measures a fund's trading activity. Usually, the lower the ratio, the lower the transaction costs and capital gains distributions. Tax-efficient funds often have lower portfolio turnover.

Then search for 12 Mo Yield (the abbreviation for 12-month yield), which is an investment's income distributions of previous 12 months divided by its price. Since distributions are taxable, funds that distribute more income will likely have heavier tax burdens, and those with lower 12-month yields will have lighter ones. Like turnover ratio, there are two identical data points, so select the second one for the most recent figure.

For a longer-term perspective, add Tax Cost Ratio 5 Yr. This figure looks at how much taxes on distributions reduce a fund's trailing five-year annualized return. Lower tax-cost ratios equal more-tax-efficient funds.

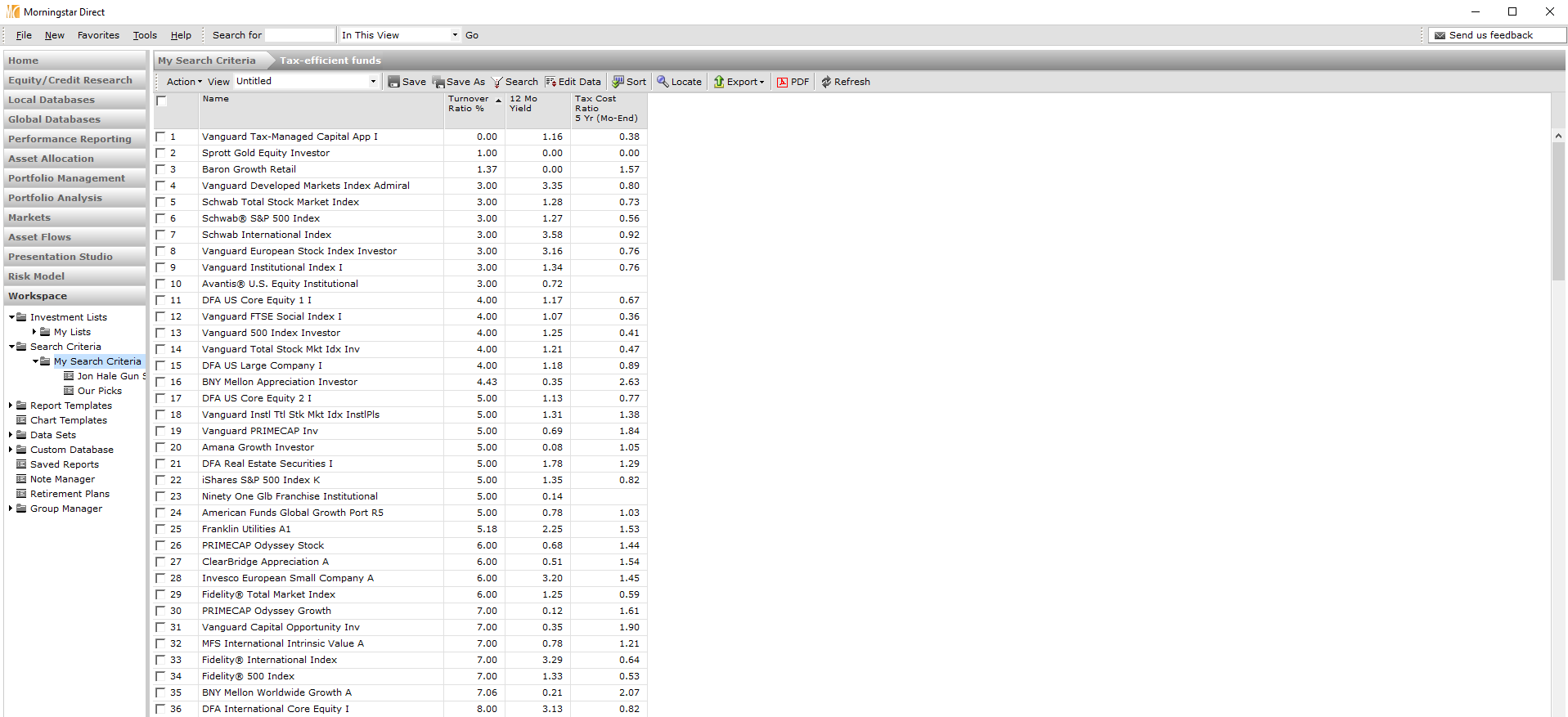

4) Sort the Tax-Efficient Data Point Columns Once these data points populate, you can double-click on the columns to sort funds by the lowest portfolio turnover, 12-month yield, or five-year tax-cost ratio. The below screenshot shows the funds ranked by lowest portfolio turnover.

Remember to put these results into context. Just because a fund has a low 12-month yield or five-year tax-cost ratio doesn't mean it will have low portfolio turnover. The following results are sorted by the lowest five-year tax-cost ratio, but top-ranking funds like Fidelity Advisor International Capital Appreciation FCPIX and iShares MSCI USA Momentum Factor ETF MTUM have high portfolio turnover.

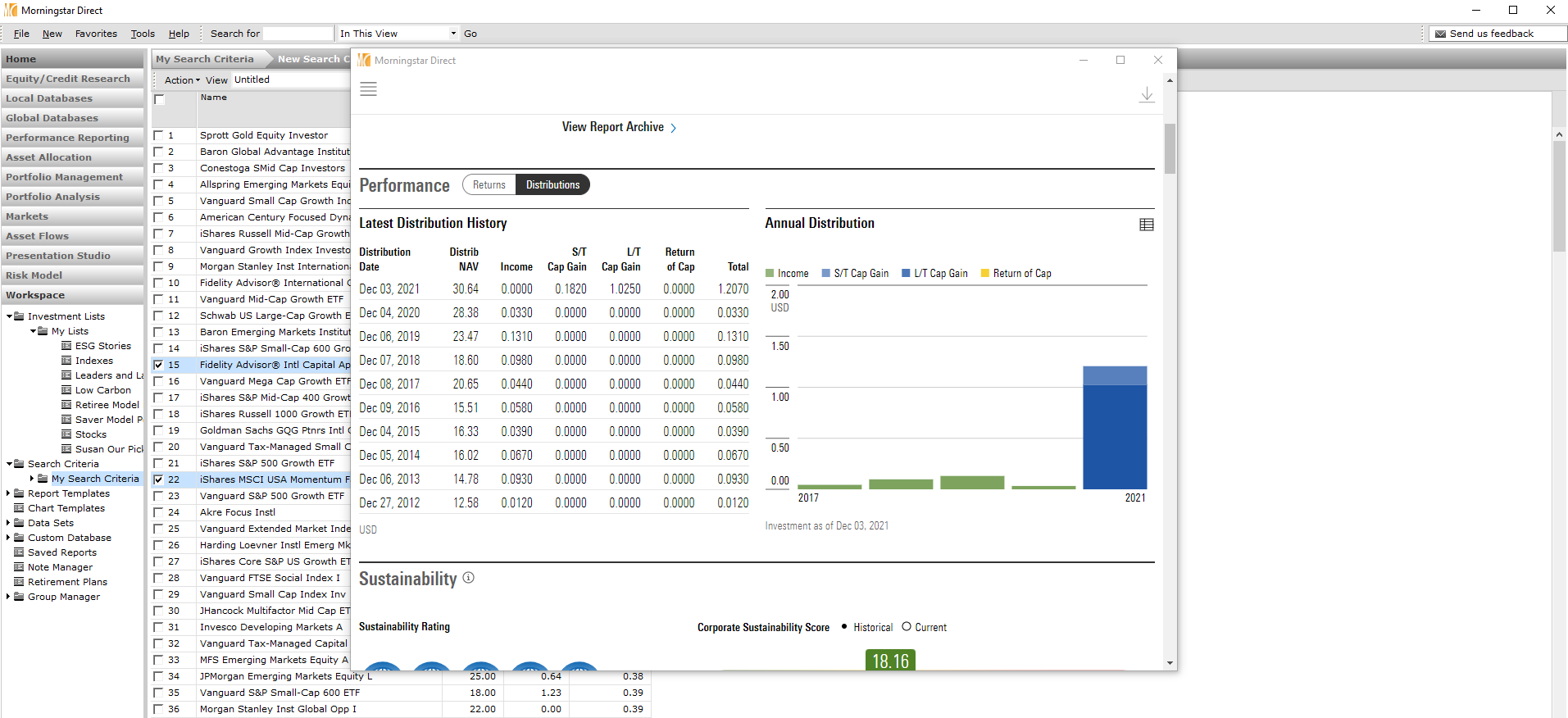

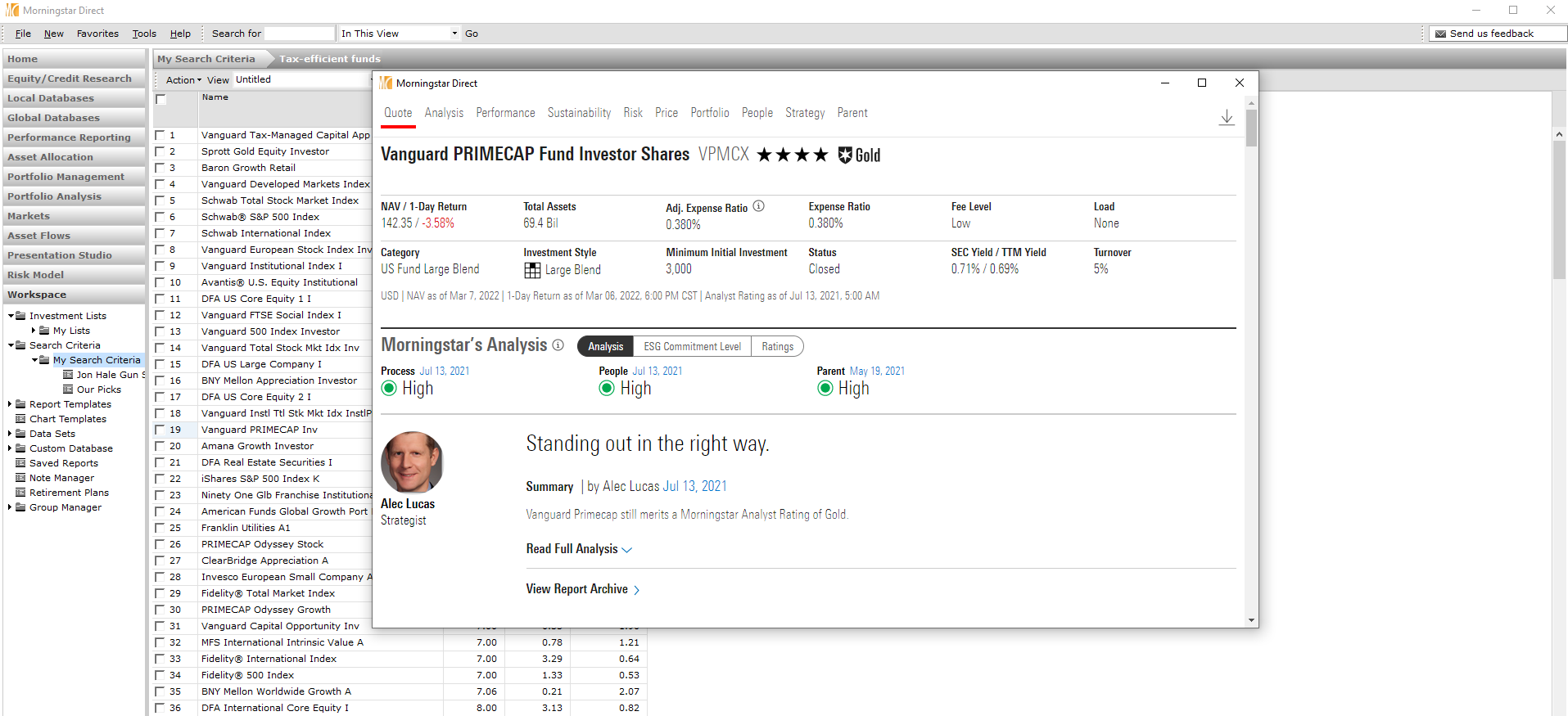

5) Double-Click on a Fund Another method when considering tax efficiency is to look at a fund's distribution history. To do this, double-click the fund to view the Morningstar Analyst Report, and click Distributions under the Performance tab.

The report also gives you a basic overview of the fund, what our analysts think of it, and how it has performed against its benchmark. You can also explore other tabs in the report to learn more about the fund.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)