Data from Morningstar’s Global Risk Model provides a new way to measure the risk exposure of a portfolio.

By Tom Whitelaw, Morningstar Research Services LLC

Risk

By Tom Whitelaw, Morningstar Research Services LLC

Read Time: 3 Minutes

There are several ways to assess an investment portfolio’s risk. It’s essential to understand both a portfolio’s risk exposure and how it impacts the sources of return within that portfolio to help clients answer questions like: “Is my portfolio overexposed to risk from oil fluctuations?” Or, “Is my portfolio too concentrated in small-cap stocks right now?”

The Global Risk Model provides a powerful tool for making comparisons across portfolios and benchmarks on a standardized, objective basis. Create custom market scenarios, perform what-if analyses on market movements, and gauge their portfolio exposures to as many as 36 distinct factors.

Here, we highlight how the tool can help evaluate fund exposure to certain risk factors.

The Global Risk Model uses the valuation factor to evaluate how cheap or expensive an overall portfolio is compared with our fair value estimate (which is based on the dollar amount we believe a company is worth today).

Let's look at an example.

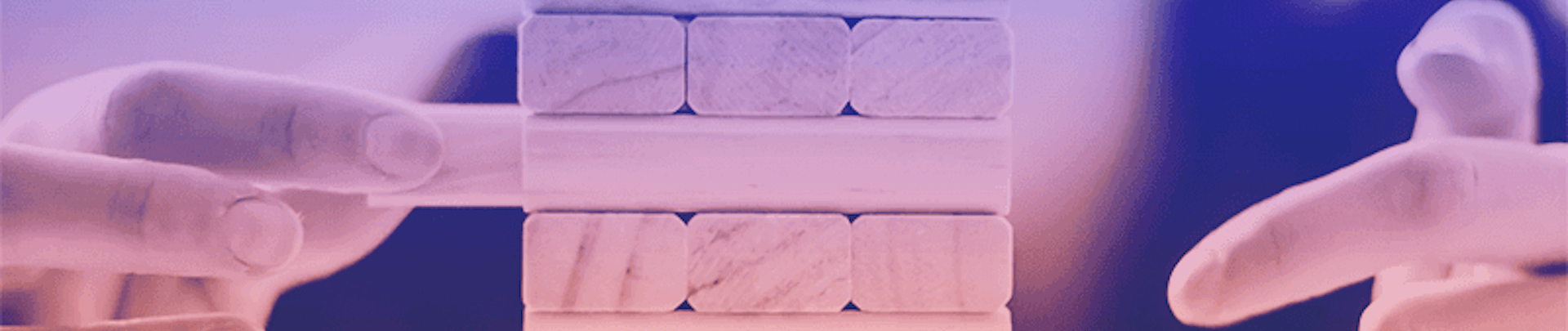

The chart below maps out a few aspects of the valuation factor exposure for Hotchkis & Wiley Large Cap Value (HWLAX):

The horizontal black lines on each bar indicate what the valuation exposure factor of the relevant Russell 1000 Value benchmark has looked like over the past five years. Note how the Russell 1000 Value Index itself moved back into overvalued territory in 2018.

Source: Morningstar Direct. Data as of May 24, 2024.

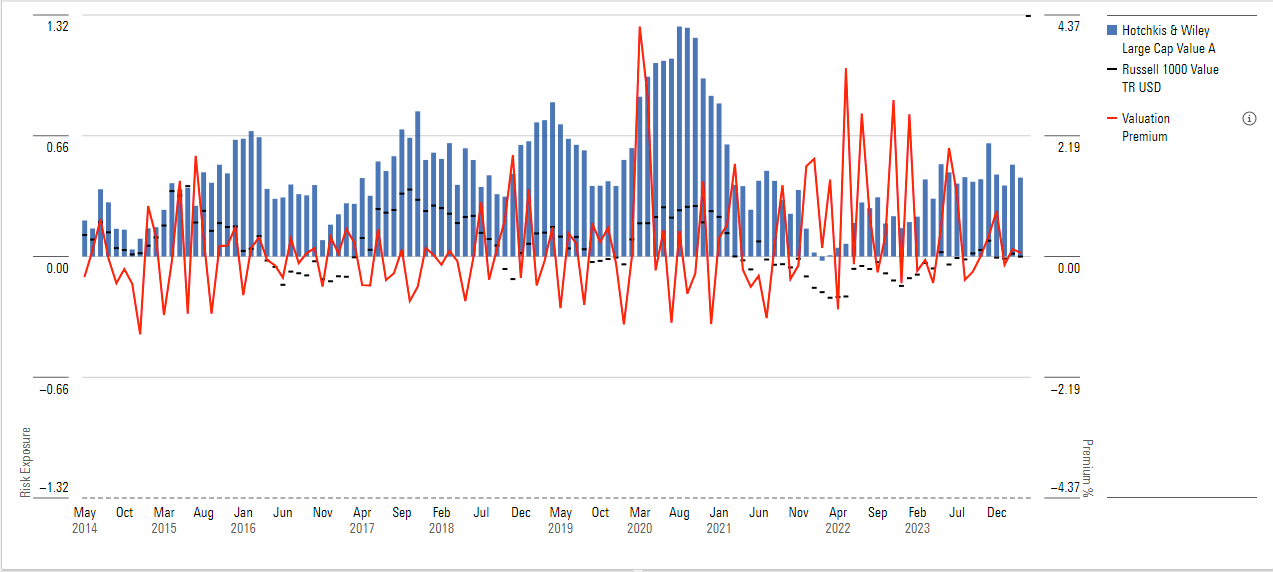

Another important factor when considering a portfolio’s risk exposure is its competitive advantages over similar companies. The Global Risk Model measures this with the economic moat rating, which assesses the strength and sustainability of a firm’s competitive advantages.

The chart below shows how two US large-cap blend funds can take shape differently based on this metric.

The chart also includes DFA International Small Cap Value (DISVX), which demonstrates how a fund with very few moat stocks would look.

Source: Morningstar Direct. Data as of May 24, 2024.

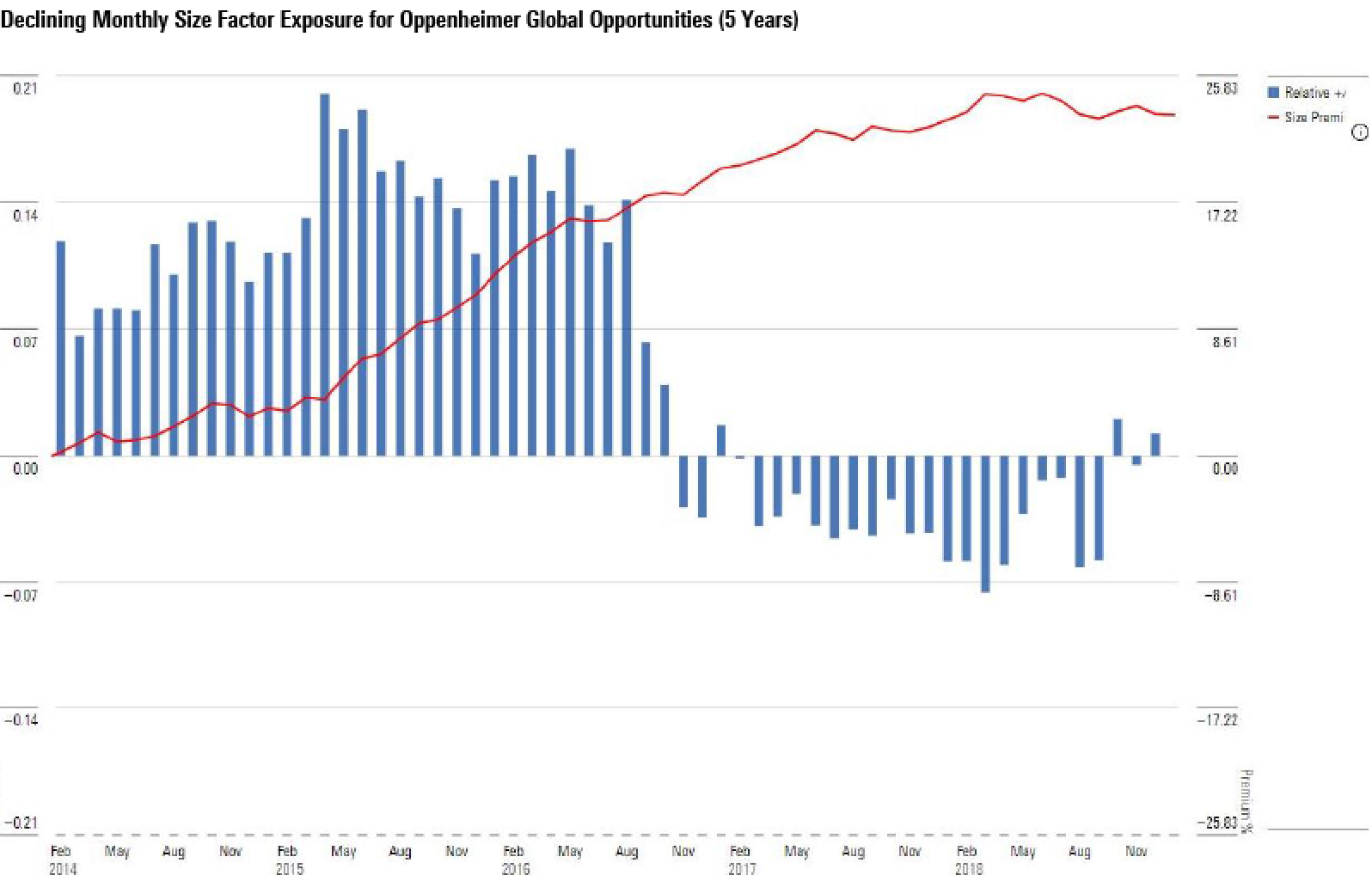

The size factor measures the market capitalization of stocks in a fund’s portfolio to identify where they fall in the market-cap ladder. Take Oppenheimer Global Opportunities (OPGIX), for example, which has historically had significant exposure to the small-cap factor relative to US small- and mid-cap funds.

As shown on the chart below, this started to change in 2017 when it moved into larger stocks following a period of strong performance that led to rapid asset growth. Assets under management ballooned from around $5 billion in early 2017 to almost $10 billion at the end of June 2018.

Source: Morningstar Direct℠ for Wealth Management. Data as of Dec. 31, 2018.

Researching funds requires understanding management’s resources, experience, financial incentives, strategy, and long-term track record, in addition to costs and the strengths of the investment organization. It serves as a key way that asset managers can help increase their value to clients.

By understanding this data and its implications, portfolio managers can make strategic decisions about their investment.

The Global Risk Model is a tool available in Morningstar Direct. If you’re a user, you have access.