- Sustainable investing isn’t all or nothing. Advisors can consider environmental, social, and corporate governance as leading factors or as one component of a custom investment plan.

- ESG factors can help advisors personalize portfolios for their clients, building and deepening relationships.

- Financial advisor tools can help incorporate sustainability research and planning into portfolio construction.

Sustainable Investing

How Financial Advisors Use ESG Data to Build Portfolios

Key Takeaways

Read Time: 7 Minutes

Through withering heat waves, hurricanes, and wildfires, investors are already witnessing the early effects of climate change. Interest in sustainable investing is growing as people look to protect their returns and use their money to improve the world.

Sustainable investing is an umbrella term for approaches that analyze how investments treat people and the environment while pursuing competitive returns. Institutional investors might focus on environmental, social, and corporate governance as three components of sustainability. Clients might ask about socially responsible investing.

Some financial advisors are reluctant to expand their toolkit to accommodate sustainability concerns. After all, investment fads come and go, and advisors focus on long-term returns.

However, recent data shows that investor interest in sustainability is resilient. One Morningstar study found that 72% of adult respondents in the U.S. showed at least a moderate interest in sustainable investing [PDF]. While overall funds shrank by 0.4% in the first half of 2022, sustainable funds grew by 2.5%.

Integrating ESG factors into portfolio construction doesn’t mean that advisors have to reinvent their entire process. ESG factors give advisors more information about the outcomes of an investment plan, and what it means for each client’s goals and values. Sustainability data and research can help advisors give their clients the best possible service.

In this blog post, we’ll explore how financial advisors can make ESG data points part of their routine workflow.

Show Clients the Value of Professional Advice With Sustainability Conversations

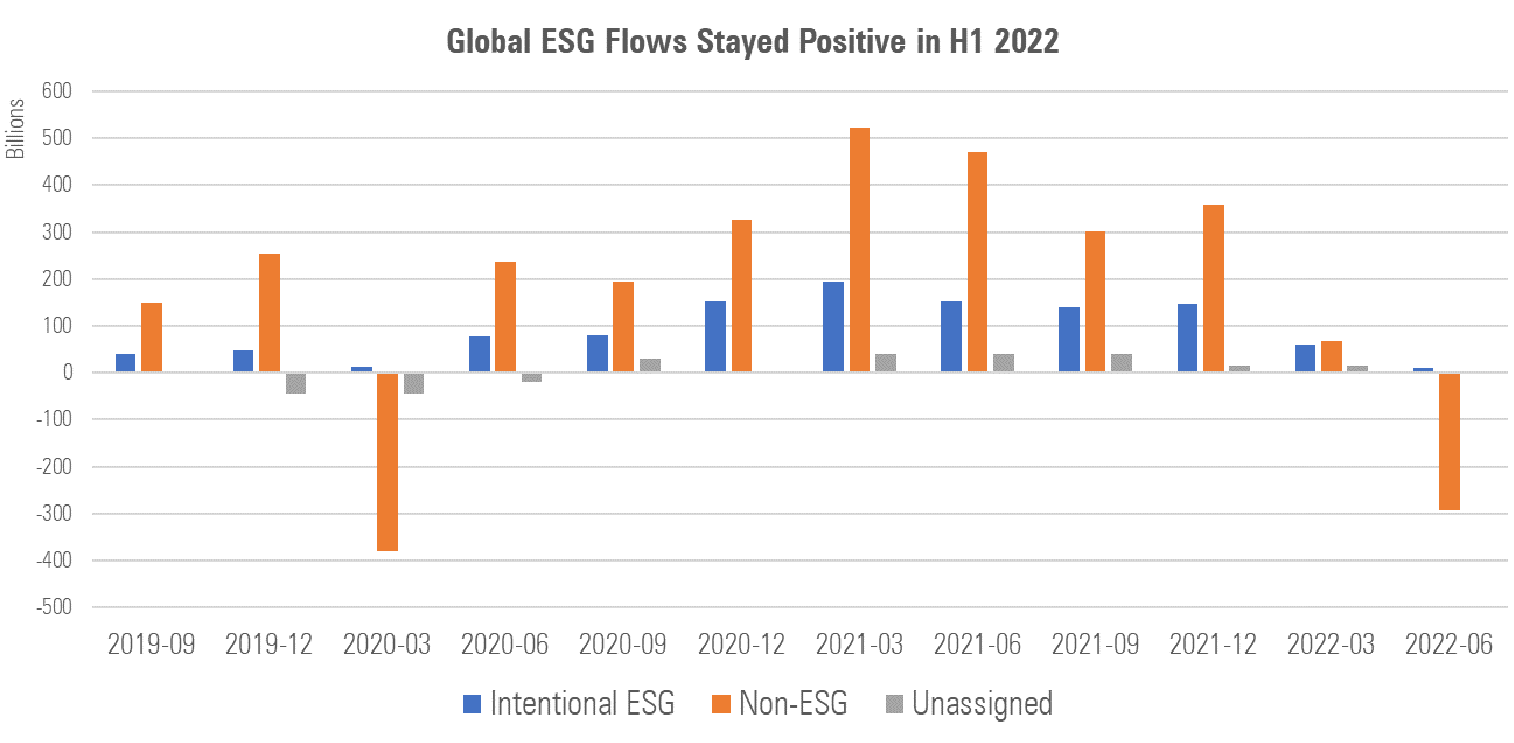

The clear, present danger of climate change has fueled interest in environmental themes like clean energy. Sustainable funds saw record-breaking inflows at the end of 2021. While other funds had outflows in the tumultuous first half of 2022, sustainable funds had modest growth [PDF].

But sustainability conversations can get tangled. Environmental, social, and governance factors cover a spectrum of considerations that can conflict. A company could sell emissions-friendly electric cars but rely on lithium mines run by child labor. Recently, the European Union sparked debate when it included nuclear power in its legal definition of clean energy.

No wonder 65% of people [PDF] said they had asked their advisor about sustainable investing, according to one Schroders survey. There’s so much data available, but with no universal definitions, people hear mixed messages.

This is where financial advisors come in. When onboarding new clients, ESG questionnaires can gather client preferences and help customize portfolios in more detail. Advisors can help cut through the snarl of information to clearly show clients how their holdings stack up against benchmarks.

Advisors should discuss questions like:

- What issues do clients care about? Advisors can coach clients through the wide world of ESG to home in on their priorities.

- What does client commitment look like in practice? Would they be willing to pay higher fees for a managed portfolio that aligns with their values?

- What is the clients’ definition of success? For some, success boils down to what generates the highest returns. Others want to measure how they’ve improved the world with their dollars.

- What level of risk can clients tolerate? Advisors who understand client risk profiles can steer them through market changes.

Sustainable-investing conversations may be harder to broach with long-time clients. An important reminder for investors is that ESG ratings don’t form a binary between “dirty” and “clean” products. Maybe clients want to start with a small investment in a clean energy fund or an incremental reduction in exposure to carbon risk. Clients look to their advisors for the performance metrics and research that inform their investments.

And clients might defy stereotypes about sustainable investors. Morningstar researchers showed comparable interest in sustainability across generation gaps [PDF], with a slight returns tilt among baby boomers. Conversations about clients’ volunteering work or board involvement could help advisors connect financial plans to their broader motivations.

Sustainable Investing Isn’t a One-Size-Fits-All Solution

How advisors build sustainable factors into their workflow can adapt based on the client and what motivates them.

If environmental or social impact is a client priority, advisors can start with sustainability as the core of a portfolio. Many model portfolios incorporate ESG ratings, with asset allocations for different comfort levels of risk. From there, advisors can adjust client preferences with an eye toward diversification across holdings.

If clients are motivated first and foremost by returns, advisors can focus on controlling ESG risks to maximize performance. And if clients don’t think sustainability is a priority, advisors can target funds that others would screen out.

The Morningstar Sustainable-Investing Framework identifies six distinct approaches along a continuum from avoiding negative outcomes to advancing positive outcomes. Any of these approaches can take a leading or a supporting role (or no role at all) in the portfolio construction process.

Six Approaches to Integrating ESG Into Portfolio Construction

1. Screen Strategies to Limit Investment Risk

Unmanaged ESG risks can endanger company value, and, in turn, shareholder returns. Two categories of climate funds focus on limiting exposure to industries that consume a lot of energy.

Low-carbon funds aim to invest in companies that emit less greenhouse gas or use less carbon to generate electricity than a benchmark. These diversified funds reduce exposure to energy-intensive industries. One example is the Morningstar US Low Carbon Risk Index, which reflects large- and mid-cap companies that align with the transition to a low-carbon economy.

Climate-conscious funds lean, in whole or in part, toward companies that plan for climate change as part of their long-term business strategy. These funds target companies that mitigate risk by transitioning to more sustainable ways of doing business.

As sustainable investing blossoms, so has greenwashing among funds hoping to capitalize on the trend. Advisors often have little information on a fund’s commitments or risks beyond its marketing materials.

Financial business intelligence can help advisors make decisions based on accurate financial data. Morningstar Sustainalytics considers 20 material ESG issues in its risk ratings.

Environmental and social impact refers to the risks and opportunities of a product’s creation. How are companies affected by growing regulations on consumption and disposal? What about consumer trends toward more-sustainable products and packaging?

Sustainalytics also considers how companies manage emissions during their operations and product use. A company that burns oil on-site, for example, could lose value if regulations impose emissions fees.

Other material ESG issues include community relations, data privacy, and business ethics.

2. Exclude Strategies That Don’t Reflect Client Preferences

When clients feel strongly about certain issues, advisors can omit stocks by product category or industry. Exclusion criteria are another opportunity for a more client-specific approach.

What level of product involvement would be acceptable to a client—total elimination or a small percentage of their portfolio?

If investors are especially concerned about climate change, for example, advisors can omit funds that hold thermal coal, oil, and gas. Morningstar’s Portfolio Fossil Fuel Involvement™ measures the percentage of a portfolio exposed to risk from the oil and gas industry. It ranks holdings by top contributors and detractors to overall carbon risk. Morningstar also scores the risk that funds would face with the shift to a low-carbon economy.

Financial advisor tools can help select funds that align with client sustainability preferences for planning, client reports, and proposals.

3. Seek Opportunities with Sustainability-Forward Companies

Early “socially responsible” investing focused on excluding targeted products, like guns or tobacco. Now investors have more flexibility to affect issues like climate change. Advisors can help clients invest in sustainable industry leaders and improving companies.

Climate tech is generating buzz in the venture capital market as startups explore sustainable mining, food systems, and power grids. Advisors can also evaluate opportunities in clean energy firms, green bonds, and renewable energy.

4. Target Environmental Initiatives With Themed Funds and Indexes

With a targeted approach, advisors choose investments that would benefit from market shifts to more-sustainable ways of living. This includes making investments in clean energy tech. Energy transition is the second most popular themed investment [PDF], with $98 billion in global assets.

Morningstar analysts* group climate funds into several mutually exclusive categories:

- Climate solutions funds solely target companies with products or services that help transition to a low-carbon economy. That could include investments in electric vehicles, solar lighting, and recycling tech, for example.

- Clean energy/tech funds invest in renewable energy or companies that support the move to clean energy.

- Green-bond funds invest in debt instruments that finance climate and environmental projects.

5. Choose Managers Based on Their Sustainability Commitment

Asset managers have discretion over what goes into a themed fund. Their research on a company’s ethos, business decisions, and risk mitigation determines what gets included in a portfolio.

Asset managers can leave their fingerprints on both public policy and shareholder meetings. Through active ownership, asset managers who embrace sustainability can nudge companies toward net-zero policies.

Through Morningstar’s ESG Commitment Level, our analysts* assess how dedicated firms are to adding ESG factors into their investment processes and organizations. The four-tier scale grades strategies on their sustainable-investing resources, processes, and asset manager expertise. The asset manager rating also reflects how engaged firms are in proxy voting.

6. Help Clients Assess the Impact of Their Investment Dollars

Regular impact assessments showcase the value of professional advice. Investors often don’t know how (or if) their personal decisions, from taking public transportation to choosing securities, make a difference on climate change.

With ESG reporting, financial advisors can show clients how their investments compare to a goal or industry benchmark. Morningstar grades funds with Portfolio Corporate Sustainability Ratings from low to severe risk in relation to their Global Category peers. Advisors can also illuminate how client holdings stack up to benchmarks on carbon risk, fossil fuel involvement, and corporate carbon emissions.

Through clear charts and visuals, impact assessments can help clients understand if their portfolios support their sustainability goals.

Embrace the Investable World

Climate change is a material threat, and today’s investors understand its magnitude and urgency.

Armed with unbiased data, advisors can guide clients through the glut of opinions to build a long-term plan. Trustworthy research can illuminate the right approach for each client and their unique priorities, goals, and ambitions.

*Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission.