3 Challenges for Getting ESG Funds Into Retirement Plans

The new CalSavers plan wanted an ESG option but couldn't find one.

The recent decision made by the new CalSavers Retirement Savings Program not to offer an environmental, social, and governance option, despite its preference for doing so, highlights the challenges for getting ESG funds into retirement plans.

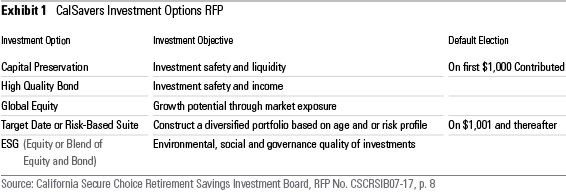

The CalSavers Retirement Savings Program is a new state-run defined-contribution plan for employees in California who work for companies that don't offer their own retirement-savings plans. CalSavers issued a request for proposal, or RFP, in May 2018 for a simple lineup of passively managed funds, consisting of money market, investment-grade bond, global-equity, and target-date options. It also wanted an ESG option.

CalSavers recently announced the selection of State Street Global Advisors to manage the investment lineup using existing SSGA funds or combinations thereof but said there won't be an ESG fund in the plan, at least not initially.

The reason? The ESG options were too expensive. "[T]he options provided through the procurement process were less than optimal with regard to fees," said the board in its report announcing the results. "The lowest-cost qualified proposal would charge 59 basis points." That compares with 2 to 12 basis points for the five SSGA investment options selected for the plan. The board recommended continuing to "research and explore … options for an ESG fund at a later date."

That's a big missed opportunity for sustainable investors. The CalSavers program is expected to draw an estimated 4.0 million participants in its first five years and an estimated $25 billion in assets by year five. Over a decade, the program is expected to have 4.7 million participants with $62 billion in assets. Given that the majority of investors in surveys typically now say they are interested in sustainable investing, it's not hard to imagine an ESG manager getting significant CalSavers assets. Even if we conservatively estimate that an ESG option would attract just 10% of assets, that amounts to $2.5 billion after five years and $6.2 billion after 10.

By not being in on the ground floor, though, any future ESG option will now have to contend with switching costs--having to convince plan participants to change their existing fund selections to the ESG option--and that will lower its long-term asset-gathering potential.

I don't know how many qualified proposals CalSavers received for an ESG investment manager, but it's disappointing, to say the least, that ESG asset managers were unable, or perhaps unwilling, to take advantage of this opportunity.

That being said, the CalSavers decision highlights some challenges facing ESG investments when it comes to retirement plans, fees being only the most obvious.

A Lack of Clarity The CalSavers RFP lacked clarity around what it wanted in an ESG option. The description in the RFP of the investment options sought for the lineup can be seen in Exhibit 1. While all sought-after investment options are described succinctly in the RFP, the conventional options are all well-enough understood to merit that level of succinctness, but the ESG option is not.

What exactly was CalSavers looking for in an ESG option? Based on the RFP, it's not clear. From my reading, CalSavers could have been seeking an equity fund with virtually any country, regional, market-cap, or style emphasis. Or it could have been seeking some type of risk-based allocation fund or perhaps a traditional balanced fund. And while elsewhere in the RFP CalSavers was clear that it was seeking passive investment options only, it should have clarified that point for ESG. (And if its lowest-cost ESG proposal was 0.59%, then I assume it did receive proposals for actively managed ESG funds.)

Based on the RFP, it doesn't appear that CalSavers had really thought through what kind of ESG option it wanted and, more importantly, how that option might work for plan participants. If, for example, it would have selected a core U.S. equity ESG option, how would CalSavers participants have used that fund in lieu of or in conjunction with other plan options? Given the existence of a conventional global-equity option (consisting of U.S. and non-U.S. stocks), participants using a core U.S. equity ESG option exclusively would forego any international-stock exposure, possibly without realizing it. Those who might allocate to the core U.S. equity ESG option alongside the non-ESG global-equity option would risk inadvertently overweighting U.S. stocks. That would also happen if participants allocated to both the ESG option and the target-date option.

Similarly, if CalSavers had selected a single ESG fund consisting of both stocks and bonds, that option might have been used by participants as a one-stop ESG alternative to the plan's other options. Yet the stock-bond allocations of that single ESG allocation fund would have only been appropriate for a subset of plan participants. The 60/40 stock-bond allocation in a traditional balanced fund, for example, is too conservative for many plan participants, especially younger ones who also tend to be more interested in ESG than older participants.

Here's a simple suggestion: Rather than thinking of ESG as a single option, plan providers should think of ESG as an additional set of options that should mirror the conventional options in a plan. This can be done without overly complicating the lineup. CalSavers, for example, could have simply asked for conventional and ESG choices for global equity and high-quality bonds. Having those two options would have put participants who prefer ESG on the same footing as other participants when it comes to allocating across asset classes.

The same may be said for target-date series. CalSavers could offer an ESG target-date series alongside the conventional target-date series. The ESG version would not necessarily be the default option for participants, but they could still use their estimated retirement date to allocate properly, just as participants could do for the conventional target-date option. At present, Natixis Sustainable Future is the only ESG-oriented target-date mutual fund series and it is not quite two years old, but larger plans can create their own collective-trust target-date options.

A lack of clarity in the CalSavers RFP on what it wanted in an ESG option was a recipe for failure. A simple fix in this case would have been to seek proposals for two ESG options (high-quality bond and global-equity growth) rather than one and also to consider an ESG target-date or risk-based series that would serve as an alternative to the conventional target-date series.

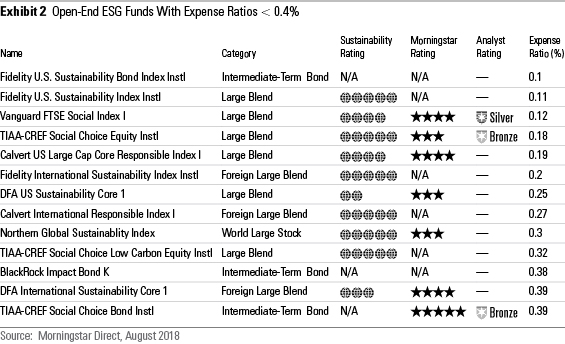

Fees That being said, what to do about fees? It costs less than ever to invest in a passive ESG open-end fund. But it costs next to nothing to invest in a conventional market-cap-weighted index fund. While it does seem unreasonable to charge 0.59% for an ESG fund when the conventional funds selected by CalSavers cost between 0.02% and 0.12% (those are fund expense ratios, not overall plan costs), more than 40 ESG open-end funds have expense ratios less than 0.59%.

As shown in Exhibit 2, several ESG equity index funds charge 0.20% or less. Investors can now get a passive ESG bond fund for 0.10%, although that's a brand-new offering from Fidelity. The actively managed

So with regard to fees, passive ESG equity funds are getting cheaper, and there is no reason they shouldn't be even cheaper for retirement plans, but plan providers should keep in mind that 0.20% to 0.40% is itself a low and reasonable range of fees to pay for an investment.

Longevity The CalSavers report didn't say, but it likely had longevity issues with its ESG proposals. The number of ESG funds available in the United States with even a three-year track record is relatively small--about 170, by my count. I say "relatively small" because that's a tiny fraction of the 8,000 or so open-end mutual funds out there, but on the other hand, how big of an ESG universe does a plan provider really need? My answer is that 170 is probably enough. In any event, the number of ESG funds with at least three-year track records will nearly double over the next three years, giving plan providers more than enough options to consider.

In the meantime, there are two things that can be done to evaluate younger ESG strategies. For passive strategies, take a look at the track record of the index being tracked and its provider. The index itself may have a longer track record and the provider a reputation for creating successful indexes. In other cases, a strategy may have a longer track record as a private separate account or as a fund available outside the U.S. When choosing from the thousands of conventional funds, there may be no need to go beyond a fund's track record, but in the current ESG environment, if 170 funds is not enough, it seems reasonable to do so.

In the end, two recommendations: One is that ESG funds have to become more cost-competitive in order to get into retirement-savings plans. It's not that they're more expensive than funds in general, it's that they cost more than practically nothing, so it's a tall order for ESG funds to make it into plans that insist on having cheap passive investment options. But 0.59% is not going to cut it--even if an ESG fund makes it into a plan and performs on par or better than the other dirt-cheap options, it's unlikely to garner the assets it would at half that price. The second is for plan providers to clarify what they want in an ESG option and to give participants a realistic way to allocate to ESG. Don't set up plan participants to fail at ESG. This means, at minimum, offering an equity and bond fund or a range of allocation funds that mirror the conventional options in the plan.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FPI4DOPK5VFUNIOGY5CVTI6NCI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EOGIPTUNFNBS3HYL7IIABFUB5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)